Global Tarpaulin Sheets Market

Market Size in USD Billion

CAGR :

%

USD

7.55 Billion

USD

10.76 Billion

2021

2029

USD

7.55 Billion

USD

10.76 Billion

2021

2029

| 2022 –2029 | |

| USD 7.55 Billion | |

| USD 10.76 Billion | |

|

|

|

|

Market Analysis and Size

A tarpaulin is referred to as a large sheet of waterproof material that is available in numerous sizes. In the 17th century, seafaring communities, sailors made waterproof clothing from tarpaulins used to defy the officers wear. Sailors used to cover canvas sheets in tar to protect things from water damage and salt spray during transit. Moreover, In Second World War, the British tarpaulin was delivered to the Soviet army as a part of the allied war and the soldiers were trained to use the tarpaulin over their tent to protect against the nuclear radiations and blast. Tarpaulin sheets were extensively used for covering things on ships in previous days. These could be found in numerous materials and their thicknesses depending on the types of applications like polyethylene, urethane-coated polyester, and canvas among others. Nowadays they are produced from woven polyethylene.

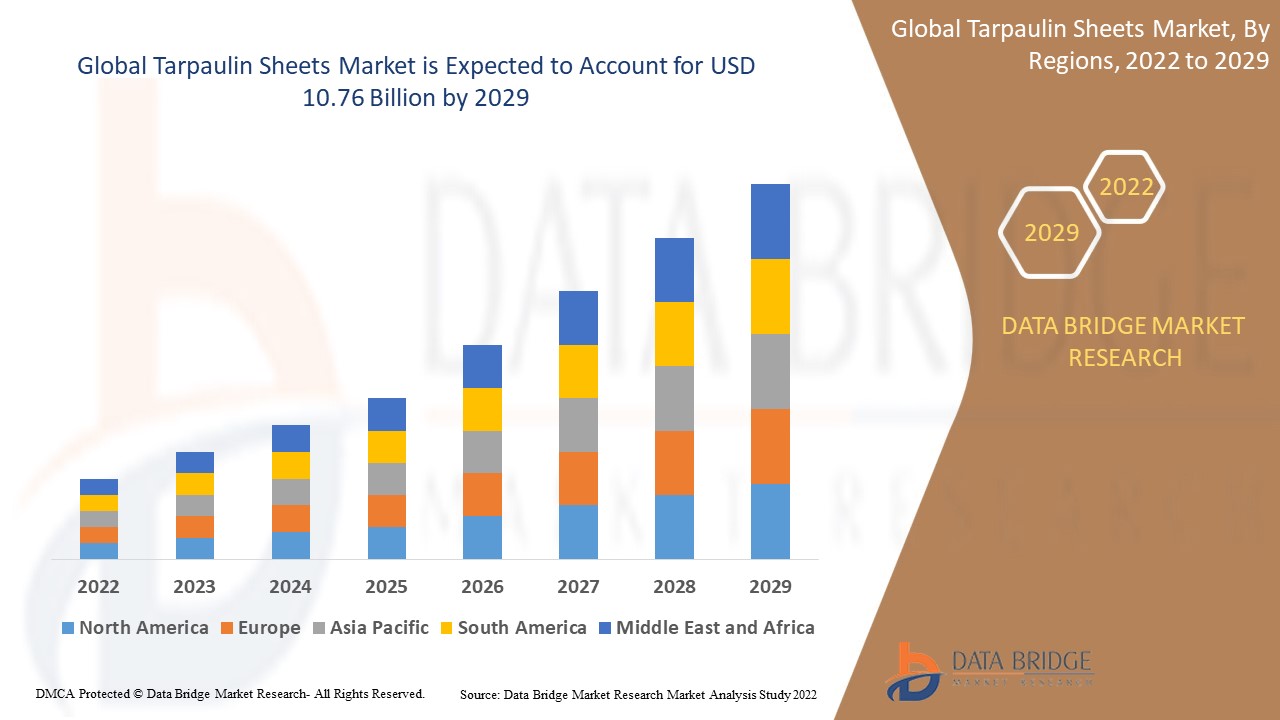

Data Bridge Market Research analyses that tarpaulin sheets market was valued at USD 7.55 billion in 2021 and is expected to reach USD 10.76 billion by 2029, registering a CAGR of 4.53% during the forecast period of 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Insulated Tarps, Hoarding Tarps, Truck Tarps, UV Protected Tarps, Sports Tarps, Mesh Tarps, Others), Material (Polyethylene (PE), Poly Vinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polyamide (PA), Canvas), Product Weight (Less than 100 GSM, Between 100 to 300 GSM, Between 300 to 600 GSM, Above 600 GSM), Lamination (Up to 2 Layers, 3 Layers Laminate, 4 Layers Laminate, Above 4 Layers), End User (Agriculture; Building and Construction; Automobiles; Storage, Warehousing and Logistics; Consumer Goods; Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

A & B Canvas Australia (Australia), Bag Poly International Pvt Ltd (India), C&H Vina Co., Ltd. (South Korea), Canadian Tarpaulin Manufacturers LTD (Canada), Cunningham Covers (UK), Darling Downs Tarpaulins (Australia), Del Tarpaulins (UK), Dolphin Impex (India), Fulin Plastic Industry (Vietnam), Gia Loi JSC (Vietnam), J Clemishaw 1870 Ltd (UK), JK Plastopack Pvt Ltd. (India), KSA Polymer USA (US), K-TARP VINA (Vietnam), Mahashakti Polycoat (India), Marson Industries Pty Ltd (Australia), Polytex S.A (US), Rainproof In (India), Rhino Sensory UK Ltd. (UK), Tan Dai Hung Co (Vietnam), Tara Tradelink Pvt Ltd (India) |

|

Market Opportunities |

|

Market Definition

Tarpaulin sheet is a waterproof and flexible sheet which is made from strong materials like plastic, H.D.P.E, polyester, canvas and many other materials. A tarpaulin sheet is a type of protecting cover for the cargo. It generally comes in the form of a large sheet which is usually polyethylene or plastic. These sheets can be made from plastic, cloth, paper, and canvas. Tarpaulin Sheet is normally used for protecting products from environmental factors like rain and dust or dirt while unloading and loading cargo.

Tarpaulin Sheets Market Dynamics

Drivers

- Rise the demand in agriculture

Tarpaulin sheets are mainly used in agriculture because they are commonly made from Poly Vinyl Chloride (PVC) with the extra properties of anti-static and anti-fungal agents, which increase the use of tarpaulin sheets in the agricultural applications. These sheets are used to cover the crops from the environmental changes and weather such as extreme heat or extreme rains that can destroy the crops. Furthermore, apart from the safety to the crops, these sheets are also used to protect the agricultural equipment in the farm.

- Increase the demand in construction sector

Increase the demand of tarpaulin sheets in growing construction and building sector is set to impact the overall growth of the tarpaulin sheets market because it is used to cover both the building materials and other materials are expected to drive the growth rate of the tarpaulin market.

- Use in transportation and logistics

Tarpaulin sheet is also used in logistics and transportation. It is also set to contribute to the growth in tarpaulin sheets market. It is mainly used to protect goods from adverse climate conditions because tarpaulin is easy to manage and uses little space to go massively in its favor. This is mainly helpful for the truckers because they need a good protective shield for their load.

Opportunities

The rise in demand from the agricultural and construction sector across the globe will act as one of the major factors driving the growth of the tarpaulin sheets market. These sheets are rise in demand because they assist in protecting the goods, cost-effective, use little space, and easy to manage and rise in the number of outdoor activities like treks and hikes further effect the market. Moreover, industrialization, expansion of construction sector and rise in infrastructural developments, growth of transportation and logistics, and rapid urbanization positively affect the tarpaulin sheets market for the market's growth rate.

Restraints/ Challenges

Limited strength of tarps and their vulnerability to damage in case of penetration may affect the sheet and form holes in these tarps. E-commerce disruption reducing the usage of tarpaulin sheets which is expected to hinder the market growth. These factors, thus, negatively affect the growth of the tarpaulin sheets market. Partial shutdowns overall the globe are expected to challenge the tarpaulin sheets market during forecast period.

This tarpaulin sheets market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the tarpaulin sheets market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Tarpaulin Sheets Market Scope

The tarpaulin sheets market is segmented on the basis of products, material, product weight, lamination type, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Insulated Tarps

- Hoarding Tarps

- Truck Tarps

- UV Protected Tarps

- Sports Tarps

- Mesh Tarps

- Others

Material

- Polyethylene (PE)

- Poly Vinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polyamide (PA)

- Canvas

Product Weight

- Less than 100 GSM

- Between 100 to 300 GSM

- Between 300 to 600 GSM

- Above 600 GSM

Lamination Type

- Up to 2 Layers

- 3 Layers Laminate

- 4 Layers Laminate

- Above 4 Layers

End User

- Agriculture

- Building and Construction

- Automobiles

- Storage

- Warehousing and Logistics

- Consumer Goods

- Others

Tarpaulin Sheets Market Regional Analysis/Insights

The tarpaulin sheets market is analysed and market size insights and trends are provided by country, products, material, product weight, lamination type and end-user as referenced above.

The countries covered in the tarpaulin sheets market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the tarpaulin sheets market in terms of revenue and market share during the forecast period. This is due to the growing demand for tarpaulin sheets in this region. North America dominates the tarpaulin sheets market due to the increase in demand from the automotive and construction industry and the presence of prominent market players in this region.

During the projected period, Asia-Pacific is expected to be the fastest developing region due to growth in construction sector and rise in population in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Tarpaulin Sheets Market Share Analysis

The tarpaulin sheets market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to tarpaulin sheets market.

Some of the major players operating in the tarpaulin sheets market are:

- A & B Canvas Australia (Australia)

- Bag Poly International Pvt Ltd (India)

- C&H Vina Co., Ltd. (South Korea)

- Canadian Tarpaulin Manufacturers LTD (Canada)

- Cunningham Covers (UK)

- Darling Downs Tarpaulins (Australia)

- Del Tarpaulins (UK)

- Dolphin Impex (India)

- Fulin Plastic Industry (Vietnam)

- Gia Loi JSC (Vietnam)

- J Clemishaw 1870 Ltd (UK)

- JK Plastopack Pvt Ltd. (India)

- KSA Polymer USA (US)

- K-TARP VINA (Vietnam)

- Mahashakti Polycoat (India)

- Marson Industries Pty Ltd (Australia)

- Polytex S.A (US)

- Rainproof In (India)

- Rhino Sensory UK Ltd. (UK)

- Tan Dai Hung Co (Vietnam)

- Tara Tradelink Pvt Ltd (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TARPAULIN SHEETS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TARPAULIN SHEETS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL TARPAULIN SHEETS MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES

5.2 VENDOR SELECTION CRITERIA

5.3 PESTEL ANALYSIS

5.4 REGULATION COVERAGE

5.5 IMPORT EXPORT ANALYSIS

6 GLOBAL TARPAULIN SHEETS MARKET, BY PRODUCT, 2020 -2029 (USD MILLION), (METER)

6.1 OVERVIEW

6.2 INSULATED TARPS

6.3 HOARDING TARPS

6.4 TRUCK TARPS

6.5 UV PROTECTED TARPS

6.6 SPORTS TARPS

6.7 MESH TARPS

6.8 OTHERS

7 GLOBAL TARPAULIN SHEETS MARKET, BY MATERIAL , 2020 -2029 (USD MILLION)

7.1 OVERVIEW

7.2 PLASTIC

7.2.1 POLYETHYLENE (PE)

7.2.1.1. HDPE

7.2.1.2. LDPE

7.2.2 POLY VINYL CHLORIDE (PVC)

7.2.3 POLYETHYLENE TEREPHTHALATE (PET)

7.2.4 POLYAMIDE (PA)

7.3 CANVAS

7.4 NYLON

7.5 OTHER

8 GLOBAL TARPAULIN SHEETS MARKET, BY LAMINATION LAYERS, 2020 -2029 (USD MILLION)

8.1 OVERVIEW

8.2 UP TO 2 LAYERS

8.3 3 LAYERS LAMINATE

8.4 4 LAYERS LAMINATE

8.5 ABOVE 4 LAYERS

9 GLOBAL TARPAULIN SHEETS MARKET, BY COLOR , 2020 -2029 (USD MILLION)

9.1 OVERVIEW

9.2 BLUE

9.3 ORANGE

9.4 WHITE

9.5 GREEN

9.6 RED

9.7 SILVER

9.8 BLACK

9.9 YELLOW

9.1 OTHERS

10 GLOBAL TARPAULIN SHEETS MARKET, BY THICKNESS , 2020 -2029 (USD MILLION)

10.1 OVERVIEW

10.2 LESS THAN 100 GSM

10.3 BETWEEN 100 TO 300 GSM

10.4 BETWEEN 300 TO 600 GSM

10.5 ABOVE 600 GSM

11 GLOBAL TARPAULIN SHEETS MARKET, BY APPLICATION , 2020 -2029 (USD MILLION)

11.1 OVERVIEW

11.2 AGRICULTURE

11.3 BUILDING & CONSTRUCTION

11.4 AUTOMOBILES

11.5 STORAGE

11.6 WAREHOUSING & LOGISTICS

11.7 CONSUMER GOODS

11.8 SPORTS GROUNDS

11.9 OTHERS

12 GLOBAL TARPAULIN SHEETS MARKET, BY REGION

GLOBAL TARPAULIN SHEETS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 U.K.

12.2.3 ITALY

12.2.4 FRANCE

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 SWITZERLAND

12.2.8 TURKEY

12.2.9 BELGIUM

12.2.10 NETHERLANDS

12.2.11 REST OF EUROPE

12.3 ASIA-PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 SINGAPORE

12.3.6 THAILAND

12.3.7 INDONESIA

12.3.8 MALAYSIA

12.3.9 PHILIPPINES

12.3.10 AUSTRALIA & NEW ZEALAND

12.3.11 REST OF ASIA-PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 ISRAEL

12.5.6 REST OF MIDDLE EAST AND AFRICA

13 GLOBAL TARPAULIN SHEETS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13.5 MERGERS AND ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 GLOBAL TARPAULIN SHEETS MARKET - COMPANY PROFILES

15.1 GIA LOI COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 TU PHUONG TARPAULIN

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 MAHASHAKTI POLYCOAT

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 CTM - CANADIAN TARPAULIN MANUFACTURERS LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 CUNNINGHAM COVERS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 J CLEMISHAW

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 TARPAULINS DIRECT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 RHINO TEXTILE PRODUCTS

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 KSAPOLYMER

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 K-TARP VINA CO., LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 FULIN PLASTIC INDUSTRY CO., LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 C&H VINA CO., LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 DEL TARPAULINS LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 TELFORD TARPAULINS

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 POLYTEX PLASTICS CO., LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 A & B CANVAS AUSTRALIA

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 DARLING DOWNS TARPAULINS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT UPDATES

15.18 MARSON INDUSTRIES PTY LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT UPDATES

15.19 DOLPHIN IMPEX

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 BAG POLY INTERNATIONAL PVT. LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 QUESTIONNAIRE

18 CONCLUSION

19 ABOUT DATA BRIDGE MARKET RESEARCH

Global Tarpaulin Sheets Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tarpaulin Sheets Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tarpaulin Sheets Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.