Global Talc Market

Market Size in USD Million

CAGR :

%

USD

8.10 Million

USD

11.48 Million

2024

2032

USD

8.10 Million

USD

11.48 Million

2024

2032

| 2025 –2032 | |

| USD 8.10 Million | |

| USD 11.48 Million | |

|

|

|

|

Talc Market Size

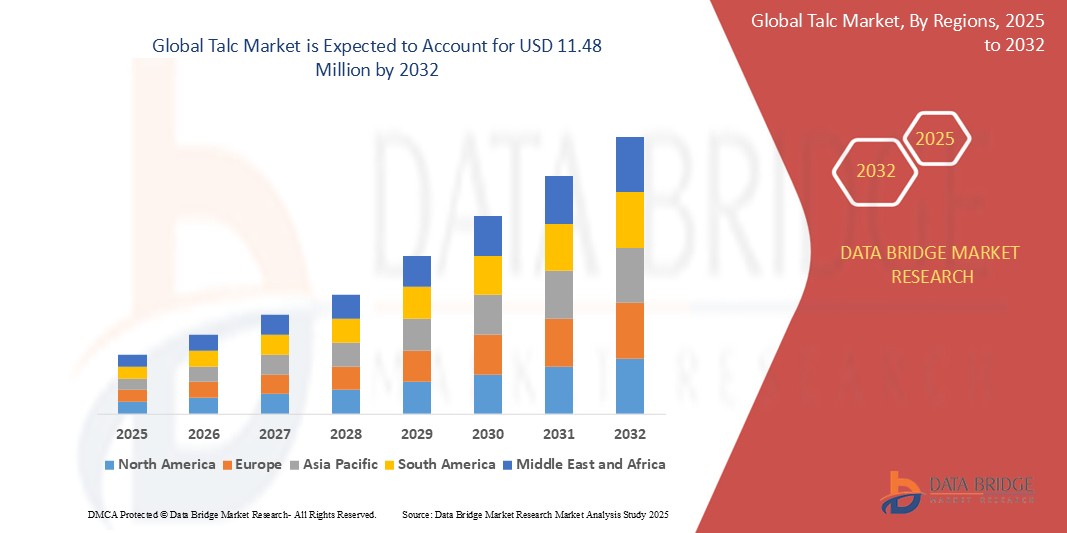

- The global talc market size was valued at USD 8.10 million in 2024 and is expected to reach USD 11.48 million by 2032, at a CAGR of 4.45% during the forecast period

- The market growth is largely fueled by rising demand for talc in the plastics, automotive, ceramics, and paints & coatings industries, where talc is valued for its excellent properties such as heat resistance, chemical inertness, and lubricity

- Furthermore, increasing usage of talc in the pharmaceutical and cosmetics sectors—owing to its purity, softness, and ability to absorb moisture—is contributing significantly to market expansion. These industrial applications, combined with growing construction activities and infrastructure development globally, are strengthening demand for talc across both developed and emerging markets

Talc Market Analysis

- Talc, a naturally occurring mineral used in a variety of industrial applications, is becoming an increasingly vital material in sectors such as plastics, paints & coatings, ceramics, paper, cosmetics, and pharmaceuticals due to its excellent thermal resistance, chemical inertness, and lamellar structure

- The escalating demand for talc is primarily driven by its growing usage in automotive light weighting applications, where it enhances polymer strength and reduces weight, as well as in the paints & coatings industry for improving durability and anti-corrosion performance

- Asia-Pacific dominates the talc market with the largest revenue share of over 45% in 2024, attributed to high talc production in countries such as China and India, and rising consumption across plastics, construction, and consumer goods industries. China, in particular, is a major exporter and end-user, fueling regional growth

- Europe is expected to be the fastest-growing region in the talc market during the forecast period, driven by rising demand in cosmetics, pharmaceuticals, and food processing industries, coupled with increasing regulatory focus on high-purity and ultrafine talc products

- The plastics and rubber segment is expected to dominate the talc market with a market share of over 30% in 2025, driven by the increasing adoption of talc-reinforced polypropylene and polyethylene in automotive components, appliances, and packaging

Report Scope and Talc Market Segmentation

|

Attributes |

Talc Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Talc Market Trends

“Sustainability-Driven Demand for Ultrafine and High-Purity Talc”

- A significant and accelerating trend in the global talc market is the rising demand for ultrafine and high-purity talc, especially in pharmaceutical, cosmetic, and food-grade applications, where product safety and regulatory compliance are paramount. Manufacturers are increasingly investing in refining and purification technologies to meet stringent industry standards

- For instance, in June 2023, IMI Fabi launched a new grade of ultrafine talc for the food packaging and hygiene markets, aligning with growing consumer awareness around product safety and sustainability. These enhanced grades offer improved barrier properties, greater purity, and superior performance in sensitive applications

- Sustainability is also influencing the plastics and coatings industries, where talc is being used to enhance recyclability and reduce carbon footprint. In automotive applications, talc-reinforced polypropylene is enabling lighter, more fuel-efficient vehicle parts.

- In addition, technological advancements in talc milling and processing are supporting the trend toward nano-talc and ultrafine particle sizes, which enhance the functionality of talc in polymer compounding, coatings, and battery separators. Companies are leveraging these innovations to expand into next-gen materials and energy storage application

- The talc industry is also witnessing a shift toward regional sourcing and local processing, particularly in Europe and North America, in response to rising supply chain transparency requirements. In September 2023, Minerali Industriali Group expanded its talc processing facility in Italy to meet the growing demand for locally sourced, high-performance talc

- This trend toward sustainable, safe, and advanced talc solutions is reshaping customer expectations across industries. Consequently, global players are developing specialized talc grades for niche applications such as electric vehicle components, biodegradable packaging, and personal care products

Talc Market Dynamics

Driver

“Growing Need Due to Rising Industrial Demand and Regulatory Shifts Toward Purity”

- The increasing demand from automotive, plastics, paints & coatings, cosmetics, and pharmaceutical industries is a significant driver for the global talc market, owing to talc’s multifunctional properties such as heat resistance, softness, and ability to improve product performance

- For instance, in May 2024, Imerys announced a strategic focus on high-purity talc production at its U.S. and European sites to meet the rising demand from pharmaceutical and food-processing clients, aligning with stricter regulatory frameworks such as FDA and EU REACH standards. These efforts by key players are expected to drive market expansion across regulated industries

- As industries shift toward sustainable and high-performance materials, talc is being increasingly used in lightweight automotive components, especially in talc-reinforced polypropylene used to reduce vehicle weight and enhance fuel efficiency—supporting automotive industry goals for lower emissions

- Furthermore, the rising use of talc in personal care and cosmetic products—due to its ability to absorb moisture, smooth skin, and act as a bulking agent—is fueling steady market demand, particularly in emerging economies experiencing rapid urbanization and lifestyle changes

- The paper and pulp industry, though mature, continues to utilize talc for pitch control and improved paper quality. In March 2024, Liaoning Aihai Talc Co., Ltd. announced an expansion in capacity to support growing demand from Southeast Asian countries.

- The push for regulatory compliance, combined with advancements in talc processing and the growing need for sustainable, functional materials across key sectors, is significantly propelling the global talc market forward

Restraint/Challenge

“Health Concerns and Regulatory Scrutiny Over Talc Composition”

- Concerns regarding the potential contamination of talc with asbestos and the resulting health implications have become a significant challenge for the global talc market. These concerns have led to growing regulatory scrutiny and consumer hesitancy, especially in applications such as cosmetics, pharmaceuticals, and food additives, where product purity is critical

- For instance, in October 2023, Johnson & Johnson officially discontinued the global sale of its talc-based baby powder due to ongoing litigation and public concerns over alleged links between talc use and cancer. This high-profile case has intensified awareness and regulatory monitoring, particularly in North America and Europe

- Addressing these safety concerns through strict quality control, asbestos-free certification, and transparent sourcing practices is essential for restoring trust in talc-based products. Leading suppliers such as Imerys and Minerali Industriali have emphasized their compliance with international standards and asbestos-free guarantees to reassure industrial buyers and end users

- In addition, the increasing regulatory complexity in regions such as the European Union—where materials used in consumer goods are subject to REACH regulation—poses a challenge for market players needing to invest heavily in product testing, compliance, and documentation to avoid restrictions or bans

- Another hurdle includes volatile raw material costs and environmental concerns associated with talc mining, which can affect profitability and limit expansion efforts in sensitive regions. Environmental opposition to mining activities has also led to delays or cancellations of talc mining projects in countries such as the U.S. and France

- Overcoming these challenges through the development of certified, high-purity talc, improved environmental mining practices, and proactive regulatory engagement will be crucial for long-term market sustainability and global acceptance of talc across diverse industries

Talc Market Scope

The market is segmented on the basis of deposit type and end-use application.

- By Deposit Type

On the basis of deposit type, the market is segmented into talc carbonate, talc chlorite, and others. The talc carbonate segment is expected to dominate the market revenue share in 2025, driven by its superior purity and versatility across multiple industrial applications. Talc Carbonate deposits are highly favored for their softness, chemical inertness, and ability to enhance product quality, making them a preferred choice for ceramics and plastics industries

The talc chlorite segment is anticipated to witness the fastest growth rate from 2025 to 2032. This growth is fueled by the increasing demand in applications requiring thermal stability and lubricity, such as paints and coatings, and certain specialty personal care products. The unique mineral structure of Talc Chlorite offers enhanced performance characteristics, encouraging its adoption in emerging markets

- By End-Use

On the basis of end-use, the market is segmented into ceramic, food and beverage, paints and coatings, personal care, plastics and rubber, pulp and paper, and other end-user industries. The ceramic segment accounts for the largest market revenue share in 2024, driven by talc's role as a flux and filler that improves whiteness, thermal shock resistance, and strength in ceramic tiles and sanitaryware. The rapid urbanization and infrastructure development worldwide continue to boost talc consumption in this sector

The food and beverage segment is projected to register significant growth over the forecast period due to the increasing use of talc as an anti-caking agent, carrier, and processing aid in powdered food products and pharmaceuticals. Rising health awareness and stringent quality standards in food manufacturing further propel this trend

Talc Market Regional Analysis

- Asia-Pacific dominates the global talc market with the largest revenue share of 45% in 2024, driven by extensive demand across end-use industries such as ceramics, plastics, paints and coatings, and personal care. The region's growing industrial base, especially in China, India, and Southeast Asia, fuels consistent consumption of talc across multiple sectors

- The presence of major talc reserves in countries such as China and India supports local production and export capabilities, making the region a key global supplier. Additionally, the increasing construction activities and automotive manufacturing in Asia-Pacific significantly bolster the demand for talc in ceramics and polymer applications

- Rapid urbanization, a booming middle class, and expanding personal care markets in countries such as Indonesia and Vietnam further contribute to regional market growth. These dynamics, coupled with government support for domestic manufacturing, firmly position Asia-Pacific as the leading region in the global talc market

Japan Talc Market Insight

The Japan talc market captured the largest revenue share within East Asia in 2025, driven by strong demand from the ceramics and personal care industries. High-purity talc is widely used in automotive parts, premium cosmetics, and engineered materials due to Japan’s advanced manufacturing standards. The country's thriving skincare and beauty sector further fuels consumption in personal care formulations. Additionally, the push for lightweight automotive components and sustainable packaging supports steady talc demand across industrial applications.

China Talc Market Insight

The China talc market is projected to grow at a substantial CAGR during the forecast period, supported by its position as the world’s leading talc producer and consumer. Abundant reserves and cost-efficient mining operations enable China to dominate both domestic and global supply chains. Rapid industrial growth and rising demand from sectors such as plastics, ceramics, and personal care drive consistent talc consumption. Additionally, investments in infrastructure and the focus on high-grade talc for exports and cosmetics manufacturing further strengthen market growth.

Europe Talc Market Insight

The Europe talc market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand from the plastics, pharmaceuticals, and personal care industries. Rising focus on lightweight automotive components and the use of talc as a reinforcing filler in polymers support market growth across Germany, France, and Italy. Additionally, the region’s stringent regulations on product safety and environmental compliance encourage the adoption of high-purity, processed talc. Growing usage of talc in food-grade and cosmetic applications also contributes to the expanding market landscape.

U.K. Talc Market Insight

The U.K. talc market is expected to expand at a considerable CAGR during the forecast period, driven by growing demand in the personal care, pharmaceuticals, and plastics sectors. The country's strong cosmetics industry fuels talc usage in skincare and hygiene products, while pharmaceutical applications benefit from talc's role as a glidant and excipient. Additionally, increased focus on product safety and regulatory compliance encourages the use of high-purity talc. The push for sustainable materials in packaging and automotive applications also supports market growth.

Germany Talc Market Insight

The Germany talc market is poised to grow steadily during the forecast period, supported by strong demand from the automotive, plastics, and coatings industries. Talc is widely used as a reinforcing filler in lightweight automotive parts, aligning with Germany’s emphasis on energy efficiency and emission reduction. The country’s advanced manufacturing sector and strict quality standards drive the use of high-performance, processed talc. Additionally, demand for talc in personal care and pharmaceutical applications remains robust, supported by consumer preference for safe and effective ingredients.

North America Talc Market Insight

The North America talc market is gaining momentum, driven by stable demand across industries such as plastics, paints and coatings, personal care, and paper. The U.S. leads the region’s market, supported by consistent use of talc in automotive plastics and cosmetic formulations. Rising consumer preference for natural ingredients in personal care products is boosting the demand for high-purity talc. Additionally, regulatory scrutiny on product safety is driving investments in quality control and refined processing techniques across the region.

U.S. Talc Market Insight

The U.S. talc market accounted for the largest revenue share in North America in 2025, driven by strong demand from the plastics, paints and coatings, and personal care industries. The country’s advanced manufacturing infrastructure and emphasis on product quality support the widespread use of high-grade talc in industrial applications. Rising consumer preference for natural and safe ingredients is boosting talc usage in cosmetics and pharmaceuticals. Additionally, regulatory focus on product safety and purity continues to shape market dynamics, encouraging innovation in processing and application.

Talc Market Share

The talc industry is primarily led by well-established companies, including:

- Minerals Technologies Inc. (U.S.)

- IMI Fabi SpA (Italy)

- GOLCHA GROUP (India)

- Nippon Talc Co.,Ltd. (Japan)

- Guangxi Longsheng Huamei Talc Development Co., Ltd. (China)

- Sibelco (Belgium)

- Xilolite (Brazil)

- LAIZHOU YUDONG TALCUM POWDER CO., LTD. (China)

- Qingdao ECHEMI Digital Technology Co., Ltd. (China)

- Jai Group Udaipur (India)

- Omargroup (Turkey)

- SEKYUNG CORPORATION (South Korea)

- HAYASHI-KASEI (Japan)

- Magnesita Refratários S.A. (Brazil)

- LITHOS Industrial Minerals GmbH (Germany)

Latest Developments in Global Talc Market

- In August 2024, Cuticura launched a talc offering 8-hour freshness, accompanied by a branding campaign on Kochi Metro trains. This initiative strategically targets Onam festival-goers, leveraging the metro’s extensive reach to showcase the product’s benefits and boost visibility. The campaign aims to engage commuters and potential customers, reinforcing the brand's promise of long-lasting freshness in the festive season. By utilizing high-traffic metro routes, Cuticura maximizes exposure and strengthens consumer connections, positioning the talc as an essential companion during Onam celebrations

- In June 2024, Dabur India introduced Cool King Icy Perfume Talc, featuring a double-burst cooling formula and 12-hour icy freshness. Designed to combat hot and humid weather, the talc offers a refreshing and fragrant experience. Bollywood actor Ranbir Kapoor endorsed the product, adding star power to its launch. This initiative aims to enhance consumer comfort and freshness, making it a go-to choice for summer skincare

- In April 2024, Golchha Group and Indian Oil Mauritius Limited signed a joint venture agreement to establish a state-of-the-art lube blending plant in Nepal for the local production of SERVO lubricants. This collaboration aims to enhance Nepal’s industrial capabilities and promote self-reliance in lubricant manufacturing. The plant is expected to be operational by the end of 2024, marking a significant milestone in the country's energy sector

- In April 2024, Imerys established a new business area, Solutions for Energy Transition, to highlight the growing importance of critical minerals in the global energy shift. This division focuses on materials such as high-purity quartz and graphite, essential for industries such as solar energy and semiconductors. The initiative underscores Imerys' commitment to supporting sustainable energy solutions and advancing mineral-based technologies

- In April 2023, Minerals Technologies Inc. entered three long-term precipitated calcium carbonate (PCC) supply agreements to expand its specialty additives product line in China and India. The agreements involve major paper companies, including Andhra Paper Limited in India and Nine Dragons Paper and Zhejiang Zhefeng New Materials Company in China. These partnerships will establish on-site PCC satellite plants, adding a combined 180,000 metric tons per year of PCC production capacity. The sites are expected to be operational by late 2023 and early 2024, reinforcing Minerals Technologies' leadership in paper and packaging filler technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TALC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TALC MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL TALC MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL TALC MARKET, BY DEPOSIT TYPE, (2022-2031), (USD MILLION) (TONS)

11 (VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

11.1 OVERVIEW

11.2 TALC CARBONATE

11.3 TALC CHLORITE

11.4 OTHERS

12 GLOBAL TALC MARKET, BY TYPE, (2022-2031), (USD MILLION)

12.1 OVERVIEW

12.2 FINE GRADE

12.2.1 FINE GRADE, BY TYPE

12.2.1.1. 3-5 MICRON TALC

12.2.1.2. 6-15 MICRON TALC

12.2.1.3. 20-25 MICRON TALC

12.3 OTHER

13 GLOBAL TALC MARKET, BY END USE, (2022-2031), (USD MILLION)

13.1 OVERVIEW

13.2 COSMETICS & PERSONAL CARE

13.2.1 COSMETICS & PERSONAL CARE, BY END USE

13.2.1.1. TALCUM POWDER

13.2.1.2. BABY POWDER

13.2.1.3. BLUSH

13.2.1.4. EYESHADOW

13.2.1.5. PRESSED POWDER

13.2.1.6. LIQUID MAKEUP

13.2.1.7. OTHERS

13.2.2 COSMETICS & PERSONAL CARE, BY DEPOSIT TYPE

13.2.2.1. TALC CARBONATE

13.2.2.2. TALC CHLORITE

13.2.2.3. OTHERS

13.3 PULP & PAPER

13.3.1 PULP & PAPER, BY DEPOSIT TYPE

13.3.1.1. TALC CARBONATE

13.3.1.2. TALC CHLORITE

13.3.1.3. OTHERS

13.4 PLASTIC INDUSTRY

13.4.1 PLASTIC INDUSTRY, BY DEPOSIT TYPE

13.4.1.1. TALC CARBONATE

13.4.1.2. TALC CHLORITE

13.4.1.3. OTHERS

13.5 PAINTS & COATINGS

13.5.1 PAINTS & COATINGS, BY DEPOSIT TYPE

13.5.1.1. TALC CARBONATE

13.5.1.2. TALC CHLORITE

13.5.1.3. OTHERS

13.6 CERAMICS

13.6.1 CERAMICS, BY DEPOSIT TYPE

13.6.1.1. TALC CARBONATE

13.6.1.2. TALC CHLORITE

13.6.1.3. OTHERS

13.7 RUBBER INDUSTRY

13.7.1 RUBBER INDUSTRY, BY DEPOSIT TYPE

13.7.1.1. TALC CARBONATE

13.7.1.2. TALC CHLORITE

13.7.1.3. OTHERS

13.8 FOOD AND BEVERAGES

13.8.1 FOOD AND BEVERAGES, BY END USE

13.8.1.1. STARCH

13.8.1.2. STARCH MIXTURES

13.8.1.3. CHOCOLATES

13.8.1.4. BAKED GOODS

13.8.1.5. POWDERED DRIED FRUITS

13.8.1.6. RICE

13.8.1.7. CHEESE

13.8.1.8. SEASONING

13.8.1.9. TABLE SALT

13.8.1.10. OTHERS

13.8.2 FOOD AND BEVERAGESS, BY DEPOSIT TYPE

13.8.2.1. TALC CARBONATE

13.8.2.2. TALC CHLORITE

13.8.2.3. OTHERS

13.9 PHARMACEUTICALS

13.9.1 PHARMACEUTICALS, BY DEPOSIT TYPE

13.9.1.1. TALC CARBONATE

13.9.1.2. TALC CHLORITE

13.9.1.3. OTHERS

13.1 OTHERS

13.10.1 OTHERS, BY DEPOSIT TYPE

13.10.1.1. TALC CARBONATE

13.10.1.2. TALC CHLORITE

13.10.1.3. OTHERS

14 GLOBAL TALC MARKET, BY REGION, (2022-2031), (USD MILLION) (TONS)

14.1 GLOBAL TALC MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

14.3 EUROPE

14.3.1 GERMANY

14.3.2 U.K.

14.3.3 ITALY

14.3.4 FRANCE

14.3.5 SPAIN

14.3.6 RUSSIA

14.3.7 SWITZERLAND

14.3.8 TURKEY

14.3.9 BELGIUM

14.3.10 NETHERLANDS

14.3.11 REST OF EUROPE

14.4 ASIA-PACIFIC

14.4.1 JAPAN

14.4.2 CHINA

14.4.3 SOUTH KOREA

14.4.4 INDIA

14.4.5 SINGAPORE

14.4.6 GLOBAL

14.4.7 INDONESIA

14.4.8 MALAYSIA

14.4.9 PHILIPPINES

14.4.10 AUSTRALIA & NEW ZEALAND

14.4.11 REST OF ASIA-PACIFIC

14.5 SOUTH AMERICA

14.5.1 BRAZIL

14.5.2 ARGENTINA

14.5.3 REST OF SOUTH AMERICA

14.6 MIDDLE EAST AND AFRICA

14.6.1 SOUTH AFRICA

14.6.2 EGYPT

14.6.3 SAUDI ARABIA

14.6.4 UNITED ARAB EMIRATES

14.6.5 ISRAEL

14.6.6 REST OF MIDDLE EAST AND AFRICA

15 GLOBAL TALC MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS AND ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

17 GLOBAL TALC MARKET - COMPANY PROFILES

17.1 GOLCHAGROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 REVENUE ANALYSIS

17.1.4 RECENT DEVELOPMENTS

17.2 IMERYS

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 REVENUE ANALYSIS

17.2.4 RECENT DEVELOPMENTS

17.3 HAYASHI-KASEI

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 REVENUE ANALYSIS

17.3.4 RECENT DEVELOPMENTS

17.4 FUJIKASEI CO LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 REVENUE ANALYSIS

17.4.4 RECENT DEVELOPMENTS

17.5 WINSTONE TECHNOLOGY CO

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 REVENUE ANALYSIS

17.5.4 RECENT DEVELOPMENTS

17.6 CHOKO CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 REVENUE ANALYSIS

17.6.4 RECENT DEVELOPMENTS

17.7 NIPPON TALC CO.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 REVENUE ANALYSIS

17.7.4 RECENT DEVELOPMENTS

17.8 ELEMENTIS PLC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 REVENUE ANALYSIS

17.8.4 RECENT DEVELOPMENTS

17.9 MINERALS TECHNOLOGIES INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 REVENUE ANALYSIS

17.9.4 RECENT DEVELOPMENTS

17.1 MIKRONS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 REVENUE ANALYSIS

17.10.4 RECENT DEVELOPMENTS

17.11 EXPAC (PRESTON) LTD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 REVENUE ANALYSIS

17.11.4 RECENT DEVELOPMENTS

17.12 IMI FABI SPA

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 REVENUE ANALYSIS

17.12.4 RECENT DEVELOPMENTS

17.13 LITHOS INDUSTRIAL MINERALS GMBH

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 REVENUE ANALYSIS

17.13.4 RECENT DEVELOPMENTS

17.14 NORDIC TALC OY

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 REVENUE ANALYSIS

17.14.4 RECENT DEVELOPMENTS

17.15 SIBELCO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 REVENUE ANALYSIS

17.15.4 RECENT DEVELOPMENTS

17.16 TALC U.S.A.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 REVENUE ANALYSIS

17.16.4 RECENT DEVELOPMENTS

17.17 YAMAGUCHI MICA CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 REVENUE ANALYSIS

17.17.4 RECENT DEVELOPMENTS

17.18 FLEXICON CORPORATION

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 REVENUE ANALYSIS

17.18.4 RECENT DEVELOPMENTS

17.19 FUKUOKA TALC CO. , LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 REVENUE ANALYSIS

17.19.4 RECENT DEVELOPMENTS

17.2 ANAND TALC

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 REVENUE ANALYSIS

17.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 CONCLUSION

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Talc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Talc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Talc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.