Global Synthetic Aperture Radar Market

Market Size in USD Billion

CAGR :

%

USD

3.57 Billion

USD

6.67 Billion

2025

2033

USD

3.57 Billion

USD

6.67 Billion

2025

2033

| 2026 –2033 | |

| USD 3.57 Billion | |

| USD 6.67 Billion | |

|

|

|

|

Synthetic Aperture Radar Market Size

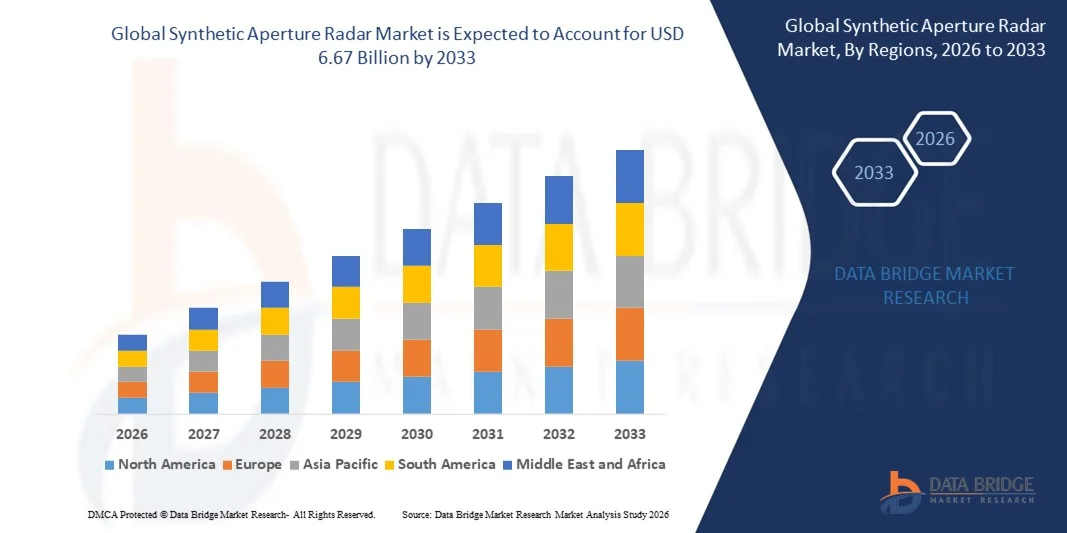

- The global synthetic aperture radar market size was valued at USD 3.57 billion in 2025 and is expected to reach USD 6.67 billion by 2033, at a CAGR of 8.10% during the forecast period

- The market growth is largely fueled by increasing demand for high-resolution, all-weather, day-and-night Earth observation and surveillance capabilities, driving investments in both government and commercial SAR systems

- Furthermore, rising adoption of satellite- and UAV-based SAR platforms for defense, environmental monitoring, natural resource exploration, and disaster management is establishing SAR technology as an essential solution for real-time imaging and intelligence applications. These converging factors are accelerating the deployment of SAR solutions, thereby significantly boosting the industry’s growth

Synthetic Aperture Radar Market Analysis

- Synthetic aperture radar systems, providing high-resolution imaging and data acquisition under all weather and lighting conditions, are increasingly vital for defense, research, and commercial applications due to their enhanced surveillance, monitoring, and mapping capabilities

- The escalating demand for SAR technology is primarily fueled by growing defense modernization programs, expansion of Earth observation initiatives, and the need for precise environmental and infrastructure monitoring across diverse geographies

- North America dominated the synthetic aperture radar market with a share of 34.3% in 2025, due to significant investments in defense, space, and environmental monitoring technologies

- Asia-Pacific is expected to be the fastest growing region in the synthetic aperture radar market during the forecast period due to rising investments in defense, space research, and environmental monitoring in countries such as China, Japan, and India

- Receiver segment dominated the market with a market share of 38.1% in 2025, due to its critical role in capturing and processing signals for high-resolution imaging and reliable data acquisition. Receivers are essential for enhancing signal sensitivity, ensuring accurate image reconstruction, and supporting a wide range of applications such as defense, environmental monitoring, and natural resource exploration

Report Scope and Synthetic Aperture Radar Market Segmentation

|

Attributes |

Synthetic Aperture Radar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Synthetic Aperture Radar Market Trends

Rising Adoption of UAV- and Satellite-Based SAR Systems

- A significant trend in the synthetic aperture radar market is the increasing deployment of UAV- and satellite-based SAR platforms, driven by the growing need for high-resolution, all-weather Earth observation and reconnaissance. These systems enable continuous monitoring of remote or inaccessible areas, enhancing capabilities in defense, disaster management, and environmental monitoring

- For instance, Northrop Grumman and Capella Space provide advanced SAR payloads for small satellites and UAVs that deliver high-resolution imagery under all weather conditions. Such solutions are widely adopted by governments and commercial operators for surveillance, mapping, and maritime tracking

- The use of SAR in agriculture and forestry is expanding, as it enables precise monitoring of crop health, soil moisture, and deforestation patterns regardless of cloud cover or daylight availability. This positions SAR as a critical tool for sustainable resource management and precision farming initiatives

- The defense sector is leveraging UAV- and satellite-based SAR systems for intelligence, surveillance, and reconnaissance (ISR) missions, where rapid, reliable imaging is crucial for situational awareness and strategic planning. This trend strengthens SAR adoption as a vital component in modern military operations

- Environmental monitoring applications are increasingly relying on SAR to track natural disasters such as floods, earthquakes, and landslides, providing real-time data to aid response and recovery efforts. This capability reinforces the importance of SAR for disaster mitigation and public safety

- The market is witnessing growth in commercial applications including infrastructure monitoring, oil and gas exploration, and maritime domain awareness, where SAR supports accurate asset tracking and risk assessment. The rising integration of SAR into multi-modal sensing platforms is further driving market expansion

Synthetic Aperture Radar Market Dynamics

Driver

Increasing Demand for High-Resolution, All-Weather Imaging

- The growing need for precise imaging that is unaffected by weather or lighting conditions is driving demand for SAR solutions across defense, commercial, and environmental applications. SAR systems provide high-resolution, consistent data, enabling operators to monitor terrain, infrastructure, and maritime activity under all conditions

- For instance, MDA (MacDonald, Dettwiler and Associates) delivers high-resolution SAR imagery through its RADARSAT satellites, supporting applications in ice monitoring, maritime surveillance, and land use mapping. These capabilities demonstrate the operational advantage and reliability SAR offers in challenging conditions

- Governments and defense agencies are investing heavily in SAR platforms to strengthen ISR and border surveillance capabilities, ensuring persistent monitoring capabilities over vast and remote regions

- Commercial sectors, including agriculture and forestry, are adopting SAR to enhance precision monitoring and resource management, benefiting from its ability to penetrate cloud cover and provide timely insights

- The increasing integration of SAR data with AI and geospatial analytics platforms is enhancing predictive modeling and decision-making processes. This integration amplifies the utility of SAR imagery for both operational efficiency and strategic planning

Restraint/Challenge

High Development and Deployment Costs

- The synthetic aperture radar market faces challenges due to the substantial costs associated with developing, manufacturing, and deploying high-performance SAR systems. These costs encompass satellite construction, UAV integration, launch services, and ongoing operational expenses, making SAR investments significant

- For instance, Airbus and Lockheed Martin invest heavily in SAR satellite programs and advanced UAV payloads, where development and deployment require significant capital and technological expertise. Such expenditures can limit adoption among smaller commercial operators or emerging markets

- The complexity of designing SAR sensors that achieve high resolution and wide coverage adds to research and manufacturing expenses, requiring precision engineering and advanced materials

- Maintenance and operational management of SAR platforms, particularly satellites, incur ongoing costs that include data processing, transmission infrastructure, and system upgrades, further impacting overall affordability

- These financial challenges constrain rapid market expansion in cost-sensitive regions and necessitate collaborative efforts between governments, commercial operators, and technology providers to optimize ROI and broaden access to SAR capabilities

Synthetic Aperture Radar Market Scope

The market is segmented on the basis of frequency band, component, application, and end-use.

- By Frequency Band

On the basis of frequency band, the SAR market is segmented into single-frequency band and multi-frequency band. The single-frequency band segment dominated the market with the largest revenue share in 2025, driven by its established reliability and simpler system design. This segment is widely adopted in applications requiring consistent performance and lower system complexity, such as standard Earth observation missions. Single-frequency SAR systems are often preferred due to their cost-effectiveness and ease of integration into existing satellite platforms. Moreover, the technology offers high-quality imaging for monitoring land, ocean, and urban areas, supporting both research and commercial operations. Its widespread adoption is further supported by extensive availability of compatible data processing tools and established industry standards.

The multi-frequency band segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for enhanced imaging capabilities and improved target detection. Multi-frequency SAR allows simultaneous operation across multiple bands, providing higher resolution and better penetration through vegetation, soil, and urban structures. For instance, companies such as Airbus Defence and Space have been developing multi-frequency SAR systems for advanced surveillance and environmental monitoring. This versatility makes multi-frequency SAR particularly attractive for defense, natural resource exploration, and disaster monitoring applications. In addition, ongoing advancements in sensor technology and data analytics further drive the adoption of multi-frequency SAR globally.

- By Component

On the basis of component, the SAR market is segmented into receiver, transmitter, and antenna. The receiver segment dominated the market with the largest revenue share of 38.1% in 2025, owing to its critical role in capturing and processing signals for high-resolution imaging and reliable data acquisition. Receivers are essential for enhancing signal sensitivity, ensuring accurate image reconstruction, and supporting a wide range of applications such as defense, environmental monitoring, and natural resource exploration. The segment’s dominance is further supported by continuous advancements in receiver technology, including multi-channel processing and noise reduction capabilities, which improve overall system performance.

The antenna segment is projected to witness the fastest growth during 2026–2033, driven by increasing demand for advanced signal transmission and reception capabilities in both airborne and spaceborne SAR systems. Antennas enable higher spatial resolution, longer range, and better coverage, which are critical for applications such as UAV surveillance, disaster management, and commercial mapping. For instance, companies such as Northrop Grumman and Airbus Defence and Space are developing next-generation SAR antennas with phased-array and adaptive beamforming technologies.

- By Application

On the basis of application, the SAR market is segmented into spacecraft, aircraft, and UAV. The spacecraft segment dominated the market with the largest revenue share in 2025, driven by extensive use in Earth observation, mapping, and environmental monitoring missions. Spaceborne SAR systems provide continuous, high-resolution imaging over large geographic areas and under all-weather conditions, making them essential for scientific and commercial studies. Agencies such as NASA and ESA heavily rely on spacecraft SAR platforms for oceanography, forestry, and urban development monitoring. The segment benefits from government and private investments in satellite launches and space infrastructure. Space-based SAR also offers superior coverage and repeatability compared to airborne and UAV systems, supporting global surveillance and research programs.

The UAV segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing deployment of compact, lightweight SAR payloads for tactical reconnaissance, disaster response, and environmental assessment. UAV-based SAR provides flexible, rapid-deployment imaging solutions at lower costs compared to manned aircraft or satellites. For instance, Lockheed Martin has been advancing UAV SAR systems with real-time imaging capabilities for defense and emergency management operations. The ability to integrate with AI-based data analytics enhances mission efficiency and target detection accuracy. In addition, growing adoption in commercial sectors for agriculture, forestry, and infrastructure inspection drives the expansion of UAV SAR applications.

- By End-Use

On the basis of end-use, the SAR market is segmented into research & commercial application, public safety, environment monitoring, natural resource exploration, and defense. The defense segment dominated the market with the largest revenue share in 2025, owing to the strategic importance of SAR for surveillance, reconnaissance, and battlefield intelligence. Defense applications leverage SAR’s all-weather, day-and-night imaging capabilities to monitor hostile regions, track movements, and detect concealed objects. For instance, Northrop Grumman develops advanced SAR systems for defense applications with high-resolution imaging and target recognition features. Governments worldwide prioritize investment in SAR technologies for national security and strategic planning. This dominance is further supported by continuous upgrades in sensor technology, data processing algorithms, and integration with other defense systems.

The natural resource exploration segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing need for efficient mapping and monitoring of minerals, oil, gas, and forestry resources. SAR systems provide high-resolution subsurface imaging and terrain analysis, making them vital for exploration planning and sustainable resource management. For instance, Airbus Defence and Space offers SAR-based solutions for monitoring oil fields and mining activities globally. The ability to operate in remote and harsh environments enhances SAR’s applicability for natural resource assessment. In addition, rising investments in energy and mining sectors worldwide support the growth of SAR applications in resource exploration.

Synthetic Aperture Radar Market Regional Analysis

- North America dominated the synthetic aperture radar market with the largest revenue share of 34.3% in 2025, driven by significant investments in defense, space, and environmental monitoring technologies

- Governments and private organizations in the region prioritize advanced imaging and surveillance solutions for national security, disaster management, and research applications

- The widespread adoption is further supported by high technological infrastructure, strong R&D initiatives, and a growing emphasis on UAV and satellite-based SAR systems, establishing the region as a hub for innovation and deployment of cutting-edge SAR solutions

U.S. Synthetic Aperture Radar Market Insight

The U.S. SAR market captured the largest revenue share within North America in 2025, fueled by increased defense budgets and the rapid advancement of satellite and UAV-based imaging technologies. Agencies such as NASA, the Department of Defense, and NOAA are heavily investing in SAR platforms for Earth observation, environmental monitoring, and disaster management. The rising adoption of commercial SAR services for infrastructure planning, resource management, and precision agriculture further supports market growth. In addition, the integration of AI and advanced analytics into SAR data processing enhances imaging capabilities, driving broader adoption across public and private sectors.

Europe Synthetic Aperture Radar Market Insight

The Europe SAR market is projected to expand at a substantial CAGR during the forecast period, driven by increasing government initiatives for Earth observation, environmental monitoring, and defense modernization. The region is witnessing growing investments in satellite and airborne SAR platforms to support natural resource exploration, climate monitoring, and security applications. European countries also focus on research collaborations and technology development in SAR systems, promoting adoption across both government and commercial segments. Advanced imaging requirements for urban planning, agriculture, and disaster response further bolster the region’s market growth.

U.K. Synthetic Aperture Radar Market Insight

The U.K. SAR market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by defense modernization programs, smart city initiatives, and increasing interest in satellite-based Earth observation. The government and private organizations are investing in UAV and small satellite SAR platforms for environmental monitoring, public safety, and infrastructure management. The strong emphasis on R&D, integration with AI-based analytics, and adoption of advanced SAR technologies for commercial applications are expected to continue driving market expansion.

Germany Synthetic Aperture Radar Market Insight

The Germany SAR market is expected to expand at a considerable CAGR during the forecast period, driven by increasing defense budgets, industrial adoption, and the demand for high-resolution imaging solutions. The country’s focus on technological innovation, environmental monitoring, and infrastructure development supports SAR system deployment across multiple sectors. Germany’s investment in advanced satellite and airborne SAR platforms, combined with integration into research and industrial applications, further strengthens market growth. The emphasis on precision data acquisition and national security contributes to the adoption of cutting-edge SAR solutions.

Asia-Pacific Synthetic Aperture Radar Market Insight

The Asia-Pacific SAR market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising investments in defense, space research, and environmental monitoring in countries such as China, Japan, and India. Rapid urbanization, technological advancements, and government initiatives promoting satellite deployment and UAV operations are fueling SAR adoption. The region’s growing focus on disaster management, resource exploration, and precision agriculture is further boosting demand. In addition, the increasing number of domestic SAR manufacturers and service providers is improving affordability and accessibility, enabling broader adoption across both commercial and governmental sectors.

Japan Synthetic Aperture Radar Market Insight

The Japan SAR market is gaining momentum due to the country’s strong emphasis on technological innovation, defense applications, and space-based Earth observation. Japanese organizations are increasingly deploying UAV and satellite SAR systems for disaster monitoring, infrastructure planning, and environmental surveillance. Integration with AI and IoT-based analytics enhances operational efficiency, making SAR solutions more effective for both public safety and commercial applications. The focus on precision imaging and high-resolution data collection is expected to sustain market growth during the forecast period.

China Synthetic Aperture Radar Market Insight

The China SAR market accounted for the largest revenue share in Asia-Pacific in 2025, driven by government investments in satellite-based surveillance, natural resource exploration, and disaster management. China’s rapid urbanization, expanding defense capabilities, and growing adoption of UAV-based SAR platforms support the widespread deployment of SAR technologies. The push toward smart city initiatives and advanced environmental monitoring projects further fuels market growth. Strong domestic manufacturers and competitive pricing of SAR solutions enhance market penetration across research, commercial, and defense segments.

Synthetic Aperture Radar Market Share

The synthetic aperture radar industry is primarily led by well-established companies, including:

- EarthDaily Analytics (U.S.)

- Thales Group (France)

- SkyGeo (U.K.)

- Saab AB (Sweden)

- Raytheon Technologies Corporation (U.S.)

- OHB System AG (Germany)

- Northrop Grumman (U.S.)

- Lockheed Martin Corporation (U.S.)

- Leonardo S.p.A (Italy)

- ICEYE (Finland)

- General Atomics (U.S.)

- Cobham Limited (U.K.)

- Capella Space (U.S.)

- BAE Systems (U.K.)

- Airbus S.A.S (France)

Latest Developments in Global Synthetic Aperture Radar Market

- In November 2025, Finnish satellite operator ICEYE, specializing in SAR technology, entered into a strategic agreement with Japan’s aerospace and defense firm IHI Corporation to create a constellation of Earth observation satellites for security, civilian, and commercial applications. This partnership is expected to strengthen ICEYE’s global SAR capabilities, expand its commercial footprint in Asia, and enhance its offerings in defense and intelligence solutions. The collaboration signals growing cross-border investments in SAR technology and is likely to accelerate market growth in both government and commercial segments

- In September 2025, Rocket Lab Corporation secured a second multi-launch agreement with Synspective, a leading SAR satellite data and analytics company. This agreement reinforces the commercialization of SAR services by enabling more frequent and reliable satellite deployments, which will improve temporal resolution for Earth observation applications. The partnership supports market expansion by facilitating data-driven solutions for urban planning, disaster management, and environmental monitoring, demonstrating the increasing demand for agile and scalable SAR deployment strategies

- In May 2025, Capella Space Corp. announced a collaboration with the U.S. Department of Defense’s Defense Innovation Unit (DIU) to develop new modes for SAR imaging acquisition that support the Hybrid Space Architecture (HSA). This initiative enhances the operational flexibility and efficiency of SAR satellites in capturing high-resolution imagery, strengthening defense and intelligence capabilities. The collaboration is expected to boost market confidence in advanced SAR solutions and drive investment in next-generation imaging technologies for both government and commercial applications

- In February 2025, the U.K. Ministry of Defense (MoD) awarded Airbus the Oberon contract to develop and construct two SAR satellites designed to provide continuous, all-weather, day-and-night space-based intelligence, surveillance, and reconnaissance (ISR) capabilities. This contract is anticipated to advance Europe’s SAR capabilities, increase operational readiness for defense missions, and drive technological innovation in satellite-based imaging. The program underscores the strategic importance of SAR technology in national security and is likely to stimulate market growth in defense-oriented SAR solutions

- In August 2024, ICEYE successfully launched four new SAR satellites, expanding its largest microsatellite constellation. This deployment strengthens ICEYE’s market position by increasing its imaging capacity, improving revisit frequency, and enhancing service reliability for commercial, governmental, and research clients. The launch underscores the growing demand for high-resolution, near-real-time SAR data, driving competitive advancements in the global SAR market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.