Swine Gluten Feed Market Analysis and Size

Swine gluten feed market size is expected to increase significantly globally between 2022 and 2029. The rise of gluten feed products is closely related to the growth of the animal feed sector. Consumer demand for meat and high-value animal protein is putting tremendous strain on the poultry, livestock, and aquaculture industries.

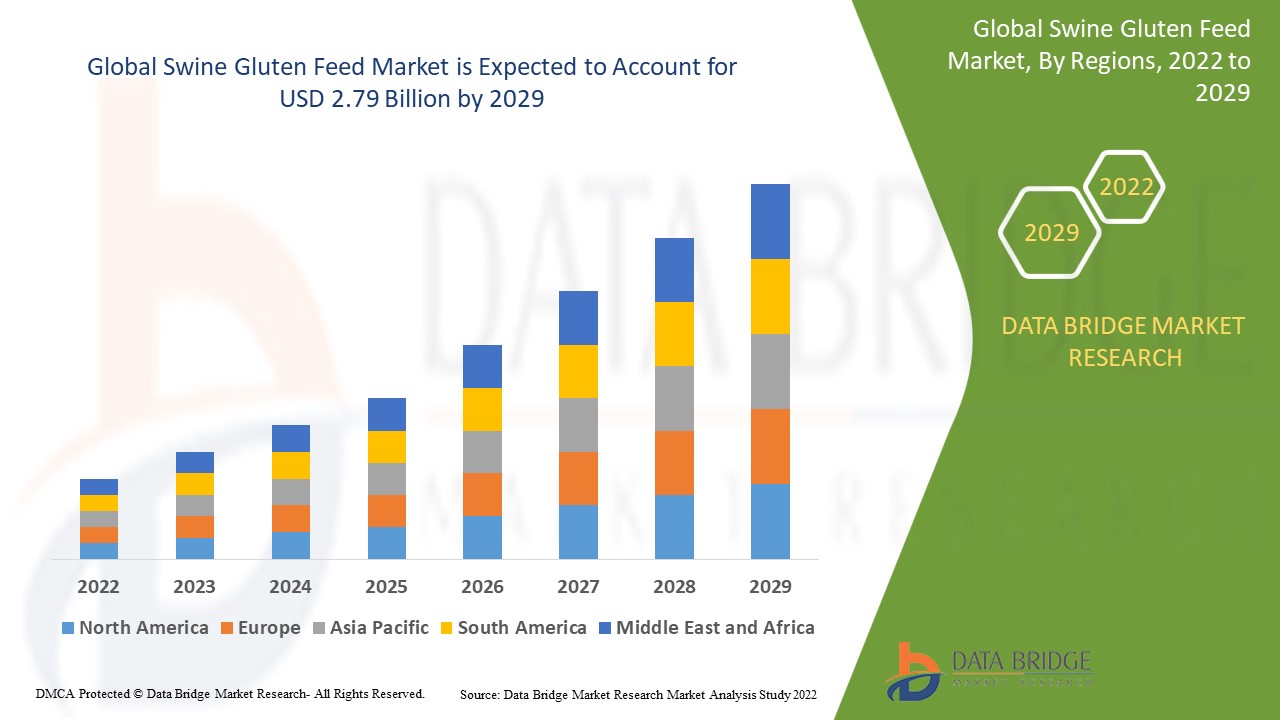

Data Bridge Market Research analyses that the swine gluten feed market which was valued at 1.74 billion in 2021 and is expected to reach the value of USD 2.79 billion by 2029, at a CAGR of 6.10% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Swine Gluten Feed Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Source (Wheat, Corn, Barley, Rye, Maize, Others), Product (Grain, Animal, Vegetable, Sugar and Starch Production) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Ingredion Incorporated (U.S.), Roquette Frères (France), ADM (U.S.), Cargill, Incorporated (U.S.), Tate & Lyle (U.K.), Bunge North America, Inc. (U.S.), Grain Processing Corporation (U.S.), AGRANA Beteiligungs-AG (Austria), Commodity Specialists Company. (U.S.), TEREOS (France), Aemetis (U.S.), BASF SE (Germany), Associated British Foods plc (U.K.), Gulshan Polyols Ltd. (India), NORDFEED (Tukey) |

|

Opportunities |

|

Market Definition

Gluten feed is a by-product of the corn starch and corn syrup manufacturing processes. This is a medium protein feed with digestible nutrient levels comparable to barley. Gluten feed is available for cattle, poultry, swine, and aquaculture, among other livestock. Because of the rapid industrialization of the livestock, feed, and processed meat industries, it has become necessary to use gluten feed as a nutrient enhancer. Gluten feed provides all of the nutrients required for healthy growth in animals.

Global Swine Gluten Feed Market Dynamics

Drivers

- Growing awareness on swine health and a healthy pig diet

Food safety concerns have increased the demand for high-quality swine feed to ensure meat safety. Another factor driving the growth of the swine gluten feed market is growing farm owner awareness of the importance of maintaining a healthy pig diet. As a result, they are transitioning from standard swine feed to functional and premium variants that help improve the animals' immunity against enzootic diseases while also lowering the risk of metabolic disorders, acidosis, injuries, and infections.

- Growth in the global livestock consumptions

The livestock industry has been under increasing pressure in recent years to meet rising demand for meat and high-value animal protein. Global livestock consumption has increased as a result of population growth, rising incomes in developing countries, and urbanisation. Income and consumption of animal protein have been found to be directly correlated, with milk, meat, and eggs consumption increasing at the expense of staple foods. The market for feed probiotics is being driven by rising life expectancy, limited availability of land and water resources for animal feed production, and strong demand for animal-based protein sources.

Opportunity

On the other hand, growing animal health issues and rising popularity of meat and meat-related products will open up new opportunities for swine gluten feed market during the forecast period. Rapid technological advancements, rising investments in R&D for developing new ingredient formulations, and rising demand for cost-effective ingredients that provide better quality products and nutrition are expected to drive the global swine gluten feed market.

Restraints

The availability of product substitutes, as well as gluten sensitivity, will act as market restraints in the growth of swine gluten feed during the forecast period. Changes in feed safety regulations, as well as sulphur toxicity, will be the most significant challenges to market growth.

This swine gluten feed market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the swine gluten feed market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Swine Gluten Feed Market

The COVID-19 outbreak had a negative impact on the global livestock trade due to lockdown restrictions imposed to stop the virus's spread. During the pandemic, the supply chain disruption increased feeding costs and raw ingredient prices while decreasing availability, stifling industry growth and consumers' purchasing power. However, due to successful vaccination drives worldwide, the poultry industry is regaining its pre-COVID momentum, which has benefited business growth. Notably, the COVID-19 pandemic has increased consumer interest in improving immunity, which has pushed the feed industry to ensure the quality of feedstuffs and that they are pathogen-free and environmentally friendly. As a result, the increased emphasis on poultry health, immunity, and production has influenced product outlook positively.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- Ohly (U.K.) and Lallemand (Canada) formed a strategic partnership in January 2019 to divest Ohly's Hutchinson Torula Yeast facility and associated Torula whole cell business in the United States. The long-term supply partnership between these companies aims to benefit Ohly by ensuring the site's long-term security.

- ADM acquired Neovia (Chicago) in January 2019, a global leader in value-added products and solutions for both production and companion animals. This acquisition would expand the existing portfolio with new products such as premixes, complete feed, ingredients, pet care solutions, aquaculture, additives, feed yeast, and amino acids.

Global Swine Gluten Feed Market Scope

Swine gluten feed market is segmented on the basis of source and product. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Source

- Wheat

- Corn

- Barley

- Rye

- Maize

- Others

Product

- Grain

- Distilling by-products/co-products

- Brewing by-products

- Milling by-products

- Baking by-products

- Animal

- Milk by-products

- Meat by-products

- Egg by-products

- Vegetable

- Potato by-products

- Cull beans

- Field peas

- Sugar

- Cane

- Beet and corn molasses

- Salvage candy

- Starch Production

Swine Gluten Feed Market Regional Analysis/Insights

The swine gluten feed market is analysed and market size insights and trends are provided by country source and product as referenced above.

The countries covered in the swine gluten feed market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The United States and Canada dominate the North American swine gluten feed market due to rising consumption of meat and meat products, as well as rising concern about protein and corn rich diet food supplements, while China, Japan, and India are expected to grow in the Asia-Pacific swine gluten feed market due to the growth of the aquaculture sector and rising demand for the product.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Swine Gluten Feed Market Share Analysis

The swine gluten feed market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to swine gluten feed market.

Some of the major players operating in the swine gluten feed market are:

- Ingredion Incorporated (U.S.)

- Roquette Frères (France)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Tate & Lyle (U.K.)

- Bunge North America, Inc. (U.S.)

- Grain Processing Corporation (U.S.)

- AGRANA Beteiligungs-AG (Austria)

- Commodity Specialists Company. (U.S.)

- TEREOS (France)

- Aemetis (U.S.)

- BASF SE (Germany)

- Associated British Foods plc (U.K.)

- Gulshan Polyols Ltd. (India)

- NORDFEED (Tukey)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.