Global Sweet Potatoes Market

Market Size in USD Billion

CAGR :

%

USD

37.11 Billion

USD

59.60 Billion

2024

2032

USD

37.11 Billion

USD

59.60 Billion

2024

2032

| 2025 –2032 | |

| USD 37.11 Billion | |

| USD 59.60 Billion | |

|

|

|

|

Sweet Potatoes Market Size

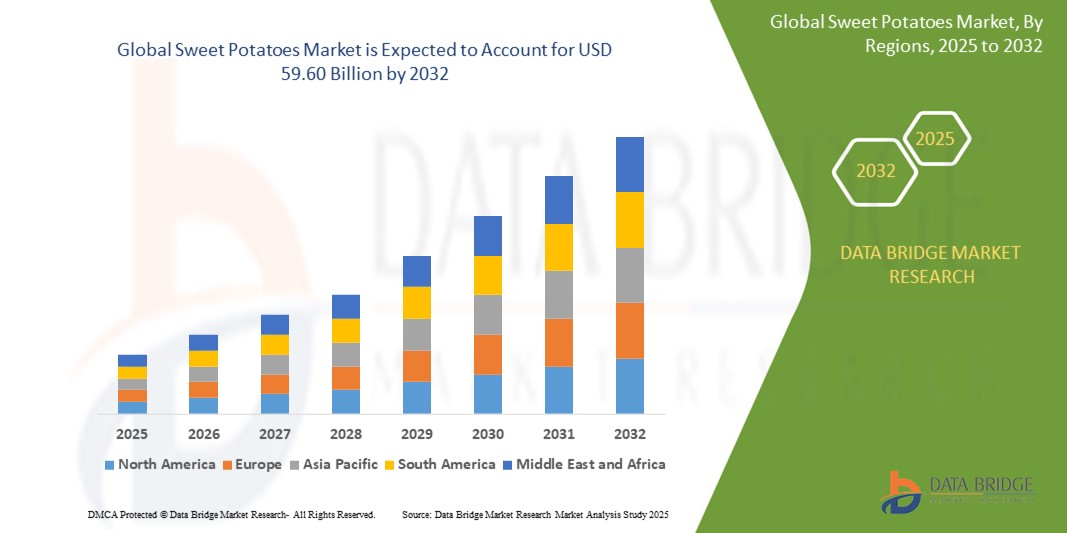

- The global sweet potatoes market size was valued at USD 37.11 billion in 2024 and is expected to reach USD 59.60 billion by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of the nutritional benefits of sweet potatoes, rising demand for healthy and natural food products, and growing adoption in the food and beverage industry

- The shift toward plant-based diets and the versatility of sweet potatoes in various culinary applications are further accelerating market expansion, particularly in processed and value-added products

Sweet Potatoes Market Analysis

- Sweet potatoes, recognized for their rich nutritional profile, including high fiber, vitamins, and antioxidants, are gaining popularity as a staple in both household and commercial food applications

- The rising demand for sweet potatoes is fueled by growing health consciousness, the expansion of the food service sector, and increasing use in processed food products such as snacks, purees, and flours

- North America dominated the sweet potatoes market with the largest revenue share of 40.01% in 2024, driven by high consumer demand for healthy foods, established agricultural production, and the presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by increasing urbanization, rising disposable incomes, and growing awareness of sweet potato health benefits

- The whole product segment held the largest market revenue share of 48.43% in 2024, driven by increasing consumer awareness of sweet potatoes' health benefits, such as lower risk of type 2 diabetes, improved digestive health, and enhanced immune function

Report Scope and Sweet Potatoes Market Segmentation

|

Attributes |

Sweet Potatoes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sweet Potatoes Market Trends

“Increasing Adoption of Health-Conscious Diets and Functional Foods”

- The global sweet potatoes market is experiencing a notable trend toward the adoption of health-conscious diets, with sweet potatoes gaining popularity as a nutrient-dense superfood

- Sweet potatoes are rich in vitamins, minerals, antioxidants, and dietary fiber, making them a preferred choice for consumers seeking healthier food options

- The integration of sweet potatoes into functional foods, such as snacks, beverages, and plant-based products, is driven by their natural sweetness and versatility

- For instances, companies are developing sweet potato-based chips, purees, and even gluten-free flours to cater to diverse dietary preferences, including vegan and low-carb diets

- This trend is appealing to both individual consumers and food manufacturers, enhancing the market's growth by aligning with global wellness movements

- Research into sweet potatoes’ health benefits, such as blood sugar regulation and improved gut health, is further boosting their demand in the functional food sector

Sweet Potatoes Market Dynamics

Driver

“Rising Consumer Awareness of Nutritional Benefits and Sustainable Agriculture”

- Growing consumer awareness of the nutritional benefits of sweet potatoes, such as their high beta-carotene and fiber content, is a key driver for the global sweet potatoes market

- Sweet potatoes are increasingly incorporated into diets as a healthier alternative to traditional staples such as white potatoes or rice

- Government initiatives promoting sustainable agriculture and crop diversification are supporting sweet potato cultivation, as they are resilient to harsh climates and require fewer inputs than other crops

- The rise of e-commerce and online grocery platforms has made sweet potatoes more accessible, enabling producers to reach a broader consumer base

- Food and beverage companies are increasingly incorporating sweet potatoes into innovative products to meet consumer demand for natural and minimally processed foods

Restraint/Challenge

“Limited Processing Infrastructure and Price Volatility”

- The lack of advanced processing and storage infrastructure in many regions poses a significant challenge to the sweet potatoes market, particularly in developing countries where post-harvest losses are high

- Sweet potatoes are perishable, and inadequate cold storage or transportation facilities can lead to spoilage, impacting supply chains and market availability

- Price volatility due to seasonal production and fluctuating demand can deter farmers and buyers, especially in regions with unstable agricultural economies

- In addition, competition from other starchy crops, such as cassava and regular potatoes, can limit market expansion in price-sensitive markets

- Regulatory differences in food safety and quality standards across countries create challenges for exporters, complicating international trade and market growth

Sweet Potatoes market Scope

The market is segmented on the basis of type, product type, nature, packaging type, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into whole product, processed sweet potatoes, paste/purees, and sweet potato flour. The whole product segment held the largest market revenue share of 48.43% in 2024, driven by increasing consumer awareness of sweet potatoes' health benefits, such as lower risk of type 2 diabetes, improved digestive health, and enhanced immune function. Their versatility in culinary applications further boosts demand.

The sweet potato Flour segment is expected to witness the fastest growth rate from 2025 to 2032, with a projected CAGR of 4.7%. This growth is fueled by rising demand for gluten-free and plant-based alternatives, particularly in baking and confectionery, as consumers with gluten intolerance or vegan diets adopt sweet potato flour for its nutritional value and functionality.

- By Product Type

On the basis of product type, the market is segmented into fresh, frozen, dried, and others. The fresh segment dominated with a market revenue share of 42.21% in 2024, attributed to rapid urbanization, heightened consumer awareness of the benefits of fresh produce, and its widespread use in household and food service applications. Fresh sweet potatoes are favored for their taste, texture, and perceived health benefits.

The frozen segment is anticipated to experience the fastest growth from 2025 to 2032, driven by increasing demand for convenient, ready-to-cook food options. Frozen sweet potato products, such as fries and pre-packaged offerings, cater to busy lifestyles while maintaining nutritional value, particularly in North America and Europe.

- By Nature

On the basis of nature, the market is segmented into organic and conventional. The conventional segment held the largest market revenue share of 76.45% in 2024, owing to its lower production costs and widespread availability, making it a preferred choice for manufacturers and consumers.

The organic segment is projected to witness the fastest growth from 2025 to 2032, driven by rising consumer demand for chemical-free, non-GMO, and sustainable food options. Health-conscious consumers in North America and Europe, where 25% opt for organic sweet potatoes, are fueling this trend.

- By Packaging Type

On the basis of packaging type, the market is segmented into bag, pouches, box, tray, and others. The bag segment dominated with a market revenue share of 41.07% in 2024, due to its cost-effectiveness, variety of material options, and availability in multiple sizes, making it ideal for both retail and bulk purchases.

The pouches segment is expected to see the fastest growth from 2025 to 2032, driven by their convenience, portability, and appeal in urban markets. Pouches are increasingly used for processed sweet potato products such as fries and snacks, aligning with the growing demand for on-the-go food options.

- By End User

On the basis of end user, the market is segmented into household, food service sector, food and beverages industry, and others. The household segment held the largest market revenue share of 45% in 2024, driven by widespread residential consumption of sweet potatoes for home cooking, particularly in dishes such as casseroles and desserts, fueled by their nutritional benefits and versatility.

The food and beverages Industry segment is anticipated to witness rapid growth from 2025 to 2032, with a projected CAGR of 5.6%. This growth is driven by the increasing use of sweet potato-based ingredients, such as flour, puree, and extracts, in snacks, bakery products, and beverages, catering to demand for plant-based and gluten-free options.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based retailing and online retail. The store-based retailing segment dominated with a market revenue share of 90% in 2024, driven by consumer trust in offline channels such as supermarkets and hypermarkets, which offer security and bulk purchasing options, particularly in urban and rural areas.

The online retail segment is expected to experience the fastest growth from 2025 to 2032, fueled by the rise of e-commerce platforms and home delivery services. The convenience of online grocery shopping, coupled with post-pandemic shifts in consumer behavior, supports this segment's growth, especially in urban markets.

Sweet Potatoes Market Regional Analysis

- North America dominated the sweet potatoes market with the largest revenue share of 40.01% in 2024, driven by high consumer demand for healthy foods, established agricultural production, and the presence of key industry players

- Consumers prioritize sweet potatoes for their health benefits, culinary versatility, and sustainability, particularly in regions with growing health-conscious population

- Growth is supported by advancements in agricultural practices, including organic farming and improved storage technologies, alongside rising adoption in both retail and foodservice sectors

U.S. Sweet Potatoes Market Insight

The U.S. sweet potatoes market captured the largest revenue share of 89.9% in 2024 within North America, fueled by strong consumer demand for healthy and sustainable food options. The trend towards plant-based diets and increasing awareness of sweet potatoes’ nutritional benefits, such as high fiber and vitamin content, further boost market expansion. Food processors’ growing incorporation of sweet potatoes in snacks, fries, and processed foods complements retail sales, creating a diverse product ecosystem.

Europe Sweet Potatoes Market Insight

The European sweet potatoes market is expected to witness significant growth, supported by increasing consumer interest in healthy eating and sustainable agriculture. Consumers seek sweet potatoes for their nutritional value and versatility in culinary applications. The growth is prominent in both retail and foodservice sectors, with countries such as Germany and France showing significant uptake due to rising health awareness and demand for plant-based foods.

U.K. Sweet Potatoes Market Insight

The U.K. market for sweet potatoes is expected to witness rapid growth, driven by demand for nutritious and versatile food options in urban and suburban settings. Increased interest in plant-based diets and rising awareness of sweet potatoes’ health benefits encourage adoption. Evolving dietary trends and sustainability concerns influence consumer choices, balancing nutritional value with environmental considerations.

Germany Sweet Potatoes Market Insight

Germany is expected to witness rapid growth in the sweet potatoes market, attributed to its advanced agricultural sector and high consumer focus on health and sustainability. German consumers prefer nutrient-rich sweet potatoes that contribute to balanced diets and lower environmental impact. The integration of sweet potatoes in premium food products and retail channels supports sustained market growth.

Asia-Pacific Sweet Potatoes Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding agricultural production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of sweet potatoes’ health benefits, culinary versatility, and affordability is boosting demand. Government initiatives promoting sustainable agriculture and food security further encourage the use of sweet potatoes.

Japan Sweet Potatoes Market Insight

Japan’s sweet potatoes market is expected to witness rapid growth due to strong consumer preference for high-quality, nutrient-rich sweet potatoes that enhance dietary health. The presence of major food processors and the integration of sweet potatoes in traditional and modern cuisine accelerate market penetration. Rising interest in retail and foodservice applications also contributes to growth.

China Sweet Potatoes Market Insight

China holds the largest share of the Asia-Pacific sweet potatoes market, propelled by rapid urbanization, rising food demand, and increasing awareness of sweet potatoes’ nutritional benefits. The country’s growing middle class and focus on healthy eating support the adoption of sweet potatoes in various forms. Strong domestic agricultural capabilities and competitive pricing enhance market accessibility.

Sweet Potatoes Market Share

The sweet potatoes industry is primarily led by well-established companies, including:

- Conagra Brands, Inc. (U.S.)

- Nash Produce (U.S.)

- Sweet Potato Spirit Company (U.K.)

- Ham Farms (U.S.)

- Dole Food Company, Inc. (Ireland)

- McCain Foods Limited (Canada)

- A.V. Thomas Produce (U.S.)

- Jackson Farming Company (U.S.)

- J.R. Simplot Company (U.S.)

- Idahoan Foods, LLC. (U.S.)

- KP Snacks (U.K.)

- Lamb Weston Holdings, Inc. (U.S.)

- Simplot Foods (U.S)

- The Kraft Heinz Company (U.S.)

- Ingredion Incorporated (U.S.)

What are the Recent Developments in Global Sweet Potatoes Market?

- In October 2022, Burton and Bamber, a Kenyan food processing company, partnered with the International Potato Center (CIP) to establish East Africa’s first aseptic orange-fleshed sweet potato (OFSP) puree processing unit. Located in Yatta, Machakos, this facility enables the production of shelf-stable OFSP puree, which can be stored for up to 12 months without refrigeration. The initiative aims to enhance food security, reduce post-harvest losses, and increase adoption of OFSP in Kenyan diets, offering a nutritious alternative to traditional sweet potato varieties

- In August 2022, McCain Foods Limited and McDonald's Canada launched the Future of Potato Farming Fund, investing $1 million in grants to support Canadian potato farmers in adopting regenerative practices and technologies. This initiative aims to enhance soil health, build farm resilience, and mitigate climate change impacts on crop yield and quality. The fund provides education, demonstrations, and cost-sharing grants, encouraging farmers to implement cover crops, reduced tillage, and biodiversity enhancements. These advancements in sustainable agriculture could also benefit sweet potato cultivation through shared agricultural innovations

- In June 2022, Idahoan Foods, under its Honest Earth brand, launched Mashed Sweet Potatoes, a microwaveable product designed for wholesome convenience. Made from real sweet potatoes, brown sugar, and butter, it is free from artificial colors, flavors, and preservatives, catering to health-conscious consumers. The product offers a quick 60-second preparation, making it an ideal comfort food for busy households. Idahoan Foods emphasized its commitment to natural ingredients and sustainable sourcing, expanding its presence in the sweet potato market

- In December 2021, Strong Roots, a leading plant-based frozen food company, partnered with McCain Foods, securing a USD 55 million minority investment. This strategic alliance aims to expand Strong Roots’ global footprint, leveraging McCain’s supply chain and distribution networks. Strong Roots will continue to operate independently, while McCain gains access to the fast-growing plant-based frozen category. The partnership supports sustainability efforts, reinforcing McCain’s commitment to planet-friendly foods. In addition, Strong Roots’ expertise in natural, healthy meals complements McCain’s portfolio

- In September 2021, The Kraft Heinz Company introduced HEINZ BY NATURE, a new baby food product line featuring 40 SKUs, including flavors such as Sweet Potato/Plum/Pear. This launch reflects the growing demand for natural ingredients in infant nutrition, offering organic options and recyclable glass jar packaging. The lineup emphasizes simple, homemade-style processing, reinforcing Heinz’s commitment to wholesome, convenient baby food

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sweet Potatoes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sweet Potatoes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sweet Potatoes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.