Global Sutures Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

7.46 Billion

2024

2032

USD

4.47 Billion

USD

7.46 Billion

2024

2032

| 2025 –2032 | |

| USD 4.47 Billion | |

| USD 7.46 Billion | |

|

|

|

|

Sutures Market Size

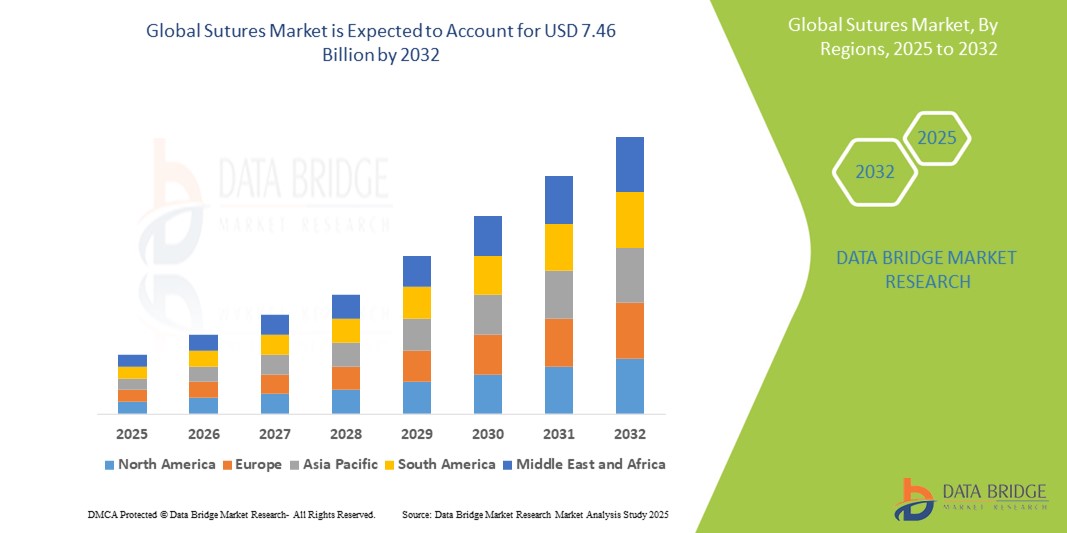

- The global Sutures Market was valued at USD 4.47 billion in 2024 and is expected to reach USD 7.46 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.6%, primarily driven by growing number of surgeries

- This growth is driven by factors such as growing in geriatric population, and advancements in suture technology

Sutures Market Analysis

- Sutures are fundamental medical tools used to close wounds, incisions, and surgical openings, facilitating tissue healing and minimizing infection risk. They are essential across a wide range of surgeries, including general surgery, cardiovascular, orthopedic, gynecological, and cosmetic procedures

- The demand for sutures is significantly driven by the growing number of surgical procedures worldwide, spurred by the rising prevalence of chronic diseases, trauma cases, and elective surgeries. The global shift toward minimally invasive and robotic-assisted surgeries is also contributing to the increased use of advanced suturing materials

- North America stands out as one of the dominant regions in the global sutures market, supported by its well-established healthcare infrastructure, strong reimbursement systems, and high volume of surgical procedures performed annually

- For instance, the United States sees millions of surgeries annually—from orthopedic and cardiovascular to cosmetic—which consistently drives the need for both absorbable and non-absorbable sutures

- Globally, sutures are ranked among the most essential consumables in any surgical setting, often used alongside staples and surgical glues. The market is increasingly leaning toward the use of antibacterial and barbed sutures, which enhance wound healing and surgical efficiency, especially in complex and high-risk procedures

Report Scope and Sutures Market Segmentation

|

Attributes |

Sutures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sutures Market Trends

“Shift Toward Advanced, Antibacterial, and Biodegradable Sutures”

- One prominent trend in the global sutures market is the growing shift toward advanced suture technologies, including antibacterial coatings and biodegradable materials, aimed at reducing surgical site infections and improving healing outcomes

- These next-generation sutures are especially valuable in high-risk and minimally invasive surgeries, where infection control and tissue compatibility are critical

- For instance, antibacterial sutures coated with triclosan have been shown to significantly reduce the incidence of post-operative infections in general and cardiovascular surgeries

- Biodegradable sutures eliminate the need for suture removal and reduce patient discomfort—making them ideal for internal soft tissue closures and pediatric procedures

- The combination of patient-centric innovation and rising demand for minimally invasive surgeries is accelerating the adoption of these high-performance sutures, especially in developed regions and advanced hospital settings

Sutures Market Dynamics

Driver

“Rising Surgical Volumes Due to Aging Population and Chronic Disease Burden”

- The growing global population of elderly individuals and increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and obesity are significantly contributing to the rise in surgical procedures

- Older adults are more prone to conditions that require surgical intervention, including hernias, joint replacements, cardiovascular surgeries, and wound closures—driving the need for reliable and effective suturing solutions

- The increasing number of elective and emergency surgeries worldwide is also fueling demand for sutures across both developed and developing healthcare systems

- Moreover, advancements in minimally invasive surgical techniques continue to support the use of both absorbable and non-absorbable sutures for quicker wound healing and reduced risk of infections

- As hospitals and outpatient surgical centers strive for better surgical outcomes, sutures remain indispensable in ensuring tissue approximation, healing support, and post-operative safety

For instance:

- In a 2023 report by the World Health Organization (WHO), it was projected that the number of surgeries worldwide is increasing at a steady pace, with over 300 million major surgical procedures performed annually—a figure that is expected to rise significantly in aging populations

- According to a 2022 article published in The Lancet, there is a global unmet need for 143 million surgical procedures annually, highlighting the scale of surgical demand and the corresponding market opportunity for essential surgical tools such as sutures

- The rising global surgical volumes, driven by aging populations and chronic diseases, are significantly fueling the demand for sutures as essential tools for effective wound closure and healing

Opportunity

“Innovation in Biodegradable and Antibacterial Sutures”

- One of the key opportunities in the sutures market lies in the development of advanced suture materials—such as biodegradable, drug-eluting, and antimicrobial sutures—which reduce infection risk and improve post-operative healing

- These sutures are particularly beneficial in trauma care, orthopedic, and gastrointestinal surgeries where minimizing infection and inflammation is critical

- The integration of slow-release antibiotic coatings and collagen-based materials offers improved tissue compatibility, eliminates the need for suture removal, and enhances patient comfort and recovery

- As hospitals and surgical centers prioritize patient safety and faster healing, the demand for next-generation sutures continues to rise

For instance:

- In March 2024, a Journal of Biomedical Materials Research article highlighted that, antibacterial sutures with triclosan coating reduced surgical site infection rates by 30%, especially in colorectal and general surgeries

- In 2023, Johnson & Johnson MedTech launched a new line of barbed, absorbable sutures that simplify wound closure in laparoscopic procedures, gaining rapid adoption due to reduced operating time and superior wound healing outcomes

- The growing demand for advanced suture materials—such as antimicrobial and absorbable options—is creating significant market opportunities by enhancing surgical outcomes, reducing infection rates, and improving patient recovery

Restraint/Challenge

“Stringent Regulatory Approvals and Pricing Pressure”

- The sutures market faces challenges due to strict regulatory frameworks governing surgical device approvals, which require extensive clinical validation and compliance with international standards

- In addition, pricing pressure from public health systems and insurance providers has led to competitive cost-cutting, affecting profit margins for suture manufacturers

- Smaller companies and emerging market players face hurdles in navigating regulatory landscapes such as the U.S. FDA and European MDR, delaying product launches and limiting innovation diffusion

- In low- and middle-income countries, limited healthcare budgets and lack of awareness about advanced suturing options restrict access to premium products

For instance:

- A 2024 report from Medical Device Regulatory Review noted that new EU MDR guidelines have significantly increased documentation and clinical trial requirements for surgical devices, impacting market entry timelines for sutures and other wound care tools

- In 2023, the Indian Medical Device Industry Association highlighted cost-containment policies under national health insurance schemes, which have placed caps on pricing for sutures and implants—challenging manufacturers to maintain quality while staying competitive

- The sutures market is challenged by stringent regulatory requirements and pricing pressures, which hinder product innovation, delay approvals, and limit access to advanced suturing solutions, especially in emerging markets

Sutures Market Scope

The market is segmented on the basis of product type, type, form, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Type |

|

|

By Form |

|

|

By Application

|

|

|

By End User |

|

Sutures Market Regional Analysis

“North America is the Dominant Region in the Sutures Market”

- North America leads the global sutures market, fuelled by a robust healthcare infrastructure, high surgical volumes, and strong presence of established medical device companies

- U.S. accounts for a major share due to increasing numbers of elective and trauma-related surgeries, aging population, and widespread adoption of advanced wound closure techniques

- Well-developed reimbursement frameworks and consistent R&D investments by industry leaders further enhance the region’s market dominance

- In addition, the rise in outpatient procedures and minimally invasive surgeries across hospitals and ambulatory surgical centres supports the continuous demand for both absorbable and non-absorbable sutures

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest growth in the sutures market, driven by rising healthcare expenditures, expanding surgical infrastructure, and growing awareness about wound care management

- Countries such as India, China, and Japan are seeing a surge in surgical interventions due to increasing chronic disease prevalence and road traffic accidents

- Japan stands out with its technologically advanced healthcare system and focus on precision-based surgical techniques, contributing to strong uptake of high-performance sutures

- Meanwhile, China and India benefit from government initiatives to enhance surgical care in public hospitals and growing medical tourism, which is attracting investments from global suture manufacturers aiming to expand their footprint

Sutures Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- Smith+Nephew (U.K)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- DemeTECH Corporation (U.S.)

- Peters Surgical (France)

- Corza Medical (U.S.)

- CONMED Corporation (U.S.)

- Zimmer Biomet (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Medline Industries, Inc. (U.S.)

- Demcon (Netherlands)

- Teleflex Incorporated (U.S.)

- Atramat (Mexico)

- Dolphin Sutures (India)

Latest Developments in Global Sutures Market

- In March 2025, Johnson & Johnson MedTech announced the launch of its new line of advanced barbed sutures, designed to significantly reduce the need for knot tying in surgical procedures, thus improving operating time and minimizing post-operative complications. These sutures are designed to improve wound closure and provide greater patient comfort during recovery

- In November 2024, Medtronic introduced a new line of antimicrobial sutures that incorporate an innovative silver-ion coating to prevent surgical site infections (SSIs). These sutures have been clinically proven to reduce the risk of infection, particularly in orthopedic and abdominal surgeries

- In September 2024, B. Braun Melsungen AG expanded its suture portfolio with the introduction of biodegradable sutures with enhanced tissue compatibility. These new sutures are aimed at reducing patient discomfort and eliminating the need for removal, making them particularly suitable for pediatric and geriatric surgeries

- In August 2024, Smith+Nephew unveiled a new range of absorbable sutures with improved tensile strength and more flexible designs. These sutures are targeted for use in laparoscopic surgeries, offering enhanced surgical precision and reducing the risk of post-operative complications

- In June 2024, Zimmer Biomet launched a next-generation suture technology that incorporates collagen-based material to improve tissue regeneration and healing in joint replacement surgeries. The new sutures have demonstrated faster healing and better post-operative outcomes, making them a valuable tool for orthopedic surgeons

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.