Global Surgical Sealants Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

2.71 Billion

USD

5.25 Billion

2024

2032

USD

2.71 Billion

USD

5.25 Billion

2024

2032

| 2025 –2032 | |

| USD 2.71 Billion | |

| USD 5.25 Billion | |

|

|

|

Surgical Sealants and Adhesives Market Analysis

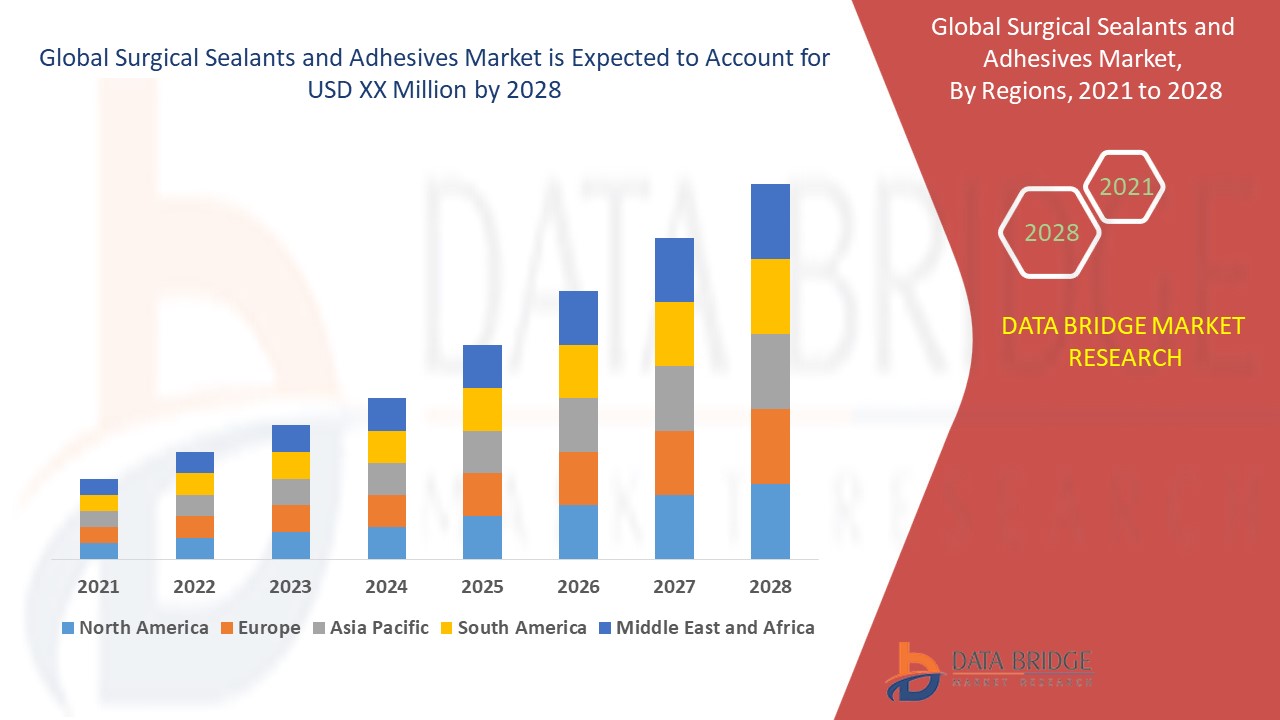

The surgical sealants and adhesives market is experiencing significant growth, driven by advancements in medical technology, rising surgical procedures, and increasing demand for efficient wound closure solutions. These products play a crucial role in preventing leakage, reducing blood loss, and enhancing post-surgical recovery. The market is segmented into natural/biological and synthetic/semi-synthetic sealants, with applications spanning general surgery, cardiovascular, orthopedic, neurological, ophthalmic, and cosmetic procedures. North America dominates the market due to its advanced healthcare infrastructure and rapid adoption of innovative technologies, while Asia-Pacific is expected to register the highest CAGR, fueled by improving healthcare systems and rising investments. Continuous R&D efforts have led to the development of next-generation bioadhesives, biodegradable hydrogels, and hemostatic agents that offer superior efficacy, biocompatibility, and reduced complications. Companies such as Ethicon, Medtronic, and Baxter are actively introducing FDA-approved solutions, such as tissue adhesives that eliminate the need for sutures and staples. As minimally invasive surgeries gain traction, the demand for biodegradable, transparent, and high-strength sealants continues to rise, positioning this market for sustained expansion in the coming years.

Surgical Sealants and Adhesives Market Size

The global surgical sealants and adhesives market size was valued at USD 2.71 billion in 2024 and is projected to reach USD 5.25 billion by 2032, with a CAGR of 8.60% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Surgical Sealants and Adhesives Market Trends

“Development of Biodegradable and Bioresorbable Sealants”

The surgical sealants and adhesives market is witnessing a major trend in the development of biodegradable and bioresorbable sealants, driven by the growing demand for minimally invasive procedures and enhanced biocompatibility. These next-generation adhesives, designed to degrade naturally within the body, eliminate the need for post-surgical removal, reducing complications and improving patient outcomes. A key instance is Animus Surgical’s transparent, biodegradable hydrogel wound sealant, introduced in March 2023, which offers non-toxic wound closure with improved healing efficiency. Leading players such as Ethicon, Medtronic, and Baxter are investing in biodegradable polymers, fibrin-based adhesives, and synthetic hydrogels, aiming to provide strong adhesion, reduced inflammatory response, and enhanced tissue integration. The rise of bioengineered adhesives is transforming the market, particularly in cardiovascular, orthopedic, and CNS surgeries, where precision, durability, and resorption rate are critical. As regulatory approvals increase, biodegradable solutions are expected to dominate the future landscape of surgical wound management.

Report Scope and Surgical Sealants and Adhesives Market Segmentation

|

Attributes |

Surgical Sealants and Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

CryoLife, Inc. (U.S.), Baxter (U.S.), Johnson & Johnson Services, Inc. (U.S.), BD (U.S.), Medtronic (Ireland), Sanofi (France), B. Braun SE (Germany), Cohere Med (U.S.), Ocular Therapeutix, Inc. (U.S.), Vivostat A/S (Denmark), Advanced Medical Solutions Group plc (U.K.), Cardinal Health (U.S.), Integra LifeSciences Corporation (U.S.), Mallinckrodt (Ireland), Lifebond (Israel), Grünenthal (Germany), Takeda Pharmaceutical Company Limited (Japan), Medline Industries, Inc. (U.S.), H.B. Fuller Medical Adhesive Technologies, LLC (U.S.), CSL (Australia), and Stryker (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surgical Sealants and Adhesives Market Definition

Surgical sealants and adhesives are medical-grade substances used to bind or seal tissues during surgical procedures, aiding in wound closure, preventing fluid or air leakage, and reducing the need for traditional sutures or staples.

Surgical Sealants and Adhesives Market Dynamics

Drivers

- Increasing Number of Minimally Invasive and Open Surgeries

The increasing number of minimally invasive and open surgeries worldwide is a key driver of the surgical sealants and adhesives market. As healthcare infrastructure improves and access to advanced surgical techniques expands, the global volume of procedures such as cardiovascular surgeries, orthopedic reconstructions, and neurosurgeries continues to rise. For instance, according to the American College of Cardiology, over 500,000 open-heart surgeries are performed annually in the U.S. alone, necessitating effective hemostatic agents and tissue adhesives to prevent excessive bleeding and promote wound healing. In addition, the shift toward minimally invasive procedures, such as laparoscopic and robotic-assisted surgeries, has created a demand for biocompatible and high-strength adhesives that offer superior wound closure without the need for sutures or staples. This growing reliance on advanced surgical adhesives highlights the market’s expansion, as hospitals and surgical centers adopt innovative products to enhance patient outcomes and reduce recovery times.

- Rising Incidence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases, orthopedic disorders, and cancer is another significant market driver, leading to a surge in surgical interventions that rely on advanced wound closure solutions. Cardiovascular diseases (CVDs) remain the leading cause of mortality worldwide, with the Centers for Disease Control and Prevention (CDC) reporting that nearly 18 million deaths occur annually due to heart-related conditions. Surgical procedures such as valve replacements, arterial bypasses, and aortic aneurysm repairs require hemostatic sealants to prevent excessive bleeding and ensure secure tissue adhesion. Similarly, in orthopedic surgeries, such as hip and knee replacements, tissue adhesives play a vital role in stabilizing surgical incisions and reducing recovery time. The growing adoption of biomaterial-based adhesives in these procedures is expected to drive market expansion, as hospitals increasingly prefer biodegradable and high-strength surgical sealants.

Opportunities

- Increasing Advancements in Medical Technology

The development of biodegradable and bioresorbable sealants is revolutionizing the surgical sealants and adhesives market, significantly reducing post-surgical complications and improving patient recovery. Traditional wound closure methods, such as sutures and staples, often lead to infections, scarring, and prolonged healing times. In contrast, biodegradable sealants naturally degrade within the body, eliminating the need for removal and minimizing inflammatory reactions. For instance, Vivostat A/S, a key player in the market, has developed an autologous fibrin sealant, which enhances wound healing and tissue regeneration without leaving behind synthetic residues. Similarly, Resivant Medical received FDA clearance in 2024 for its Cutiva PLUS Skin Closure System, an adhesive mesh patch combined with a high-viscosity liquid adhesive, designed to provide a secure, yet bioresorbable closure for surgical wounds. As the demand for minimally invasive surgeries grows, the market for biodegradable sealants presents a significant opportunity for expansion, particularly in fields such as cardiovascular, orthopedic, and neurological surgeries, where post-operative complications need to be minimized.

- Growing Number of Regulatory Approvals and Product Innovations

The growing number of FDA and CE approvals for novel surgical adhesives is creating new opportunities in the global market, enabling the introduction of safer, more effective, and high-performance solutions. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a critical role in approving innovative medical adhesives, ensuring their safety and efficacy before commercialization. In August 2024, Resivant Medical secured 510(k) clearance from the FDA for its Cutiva Topical Skin Adhesive and Cutiva PLUS Skin Closure System, marking a major advancement in sutureless wound closure solutions. Similarly, in March 2024, TELA Bio, Inc. launched LIQUIFIX FIX8, the first adhesive-based product for hernia mesh fixation that eliminates the need for mechanical fasteners, reducing patient discomfort. These regulatory milestones increase market confidence and encourage greater adoption of advanced adhesives, particularly in hospitals, ambulatory surgical centers, and specialty clinics.

Restraints/Challenges

- High Cost of Development

Developing advanced surgical sealants and adhesives requires substantial investment in research and development (R&D), clinical trials, and regulatory approvals. Companies must invest in biocompatibility testing, efficacy studies, and long-term safety evaluations, which significantly increase costs. In addition, specialized materials such as fibrin, albumin, and synthetic polymers used in formulations can be expensive to source and process. These high development costs lead to expensive end products, making it difficult for hospitals, particularly in cost-sensitive markets, to adopt these solutions on a large scale. For instance, fibrin-based sealants such as Tisseel (Baxter International Inc.) and Evicel (Ethicon, Inc.) are highly effective but come at a premium price, limiting their use compared to traditional closure methods. This financial barrier slows market penetration, making cost reduction a key challenge for manufacturers.

- Competition with Conventional Methods

Despite technological advancements, traditional sutures and staples remain the standard in many surgical procedures due to their cost-effectiveness, familiarity, and widespread availability. Surgeons are trained extensively in using these conventional methods, making the transition to adhesives slower. In addition, staples and sutures are generally covered under existing reimbursement policies, while many advanced adhesives and sealants face reimbursement challenges, further hindering their adoption. For instance, in cardiovascular surgery, Progel (Becton, Dickinson and Company) is a sealant designed for lung surgery, but many hospitals still prefer conventional suturing due to cost concerns and surgeon familiarity. The resistance to change and the need for specialized training in adhesive application create a barrier to market expansion, posing a challenge for companies looking to drive adoption in a competitive landscape.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Surgical Sealants and Adhesives Market Scope

The market is segmented on the basis of product, indication, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Natural/Biological Sealants and Adhesives

- Synthetic and Semisynthetic Sealants and Adhesives

Indication

- Surgical Haemostasis

- Tissue Sealing

- Tissue Engineering

Application

- Central Nervous System (CNS) Surgeries

- General Surgeries

- Cardiovascular Surgeries

- Orthopaedic Surgeries

- Cosmetic Surgeries

- Ophthalmic Surgeries

- Urological Surgeries

- Pulmonary Surgeries

- Other ApplicationsTop of Form

Surgical Sealants and Adhesives Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, indication, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the surgical sealants and adhesives market and is expected to maintain its dominance throughout the forecast period. This growth is driven by the widespread adoption of advanced medical technologies and well-established healthcare infrastructure. The region benefits from continuous research and development efforts, leading to innovative surgical solutions. In addition, the high prevalence of surgical procedures and increasing demand for effective wound closure further contribute to market expansion.

Asia-Pacific is expected to register the highest CAGR during the forecast period, driven by the rapid transformation of healthcare delivery systems. The region is witnessing significant investments in medical infrastructure, leading to improved access to advanced surgical technologies. Rising healthcare expenditures, coupled with increasing awareness of innovative treatment options, are further fueling market growth. In addition, a growing number of surgical procedures and a strong focus on healthcare modernization contribute to the expanding demand for surgical sealants and adhesives.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Surgical Sealants and Adhesives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Surgical Sealants and Adhesives Market Leaders Operating in the Market Are:

- CryoLife, Inc. (U.S.)

- Baxter (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- BD (U.S.)

- Medtronic (Ireland)

- Sanofi (France)

- B. Braun SE (Germany)

- Cohere Med (U.S.)

- Ocular Therapeutix, Inc. (U.S.)

- Vivostat A/S (Denmark)

- Advanced Medical Solutions Group plc (U.K.)

- Cardinal Health (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Mallinckrodt (Ireland)

- Lifebond (Israel)

- Grünenthal (Germany)

- Takeda Pharmaceutical Company Limited (Japan)

- Medline Industries, Inc. (U.S.)

- H.B. Fuller Medical Adhesive Technologies, LLC (U.S.)

- CSL (Australia)

- Stryker (U.S.)

Latest Developments in Surgical Sealants and Adhesives Market

- In August 2024, Resivant Medical received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its first product offerings, the Cutiva Topical Skin Adhesive and the Cutiva PLUS Skin Closure System. The latter uniquely integrates an adhesive mesh patch with the high-viscosity Cutiva liquid adhesive

- In March 2024, TELA Bio, Inc. introduced the LIQUIFIX FIX8 Laparoscopic and LIQUIFIX Precision Open Hernia Mesh Fixation Devices in the U.S. These devices mark a significant advancement, as LIQUIFIX is the first adhesive-based solution designed to affix mesh without penetrating patient tissue, ensuring a secure and reliable application

- In November 2023, Ethicon, a division of Johnson & Johnson MedTech, launched Ethizia, a hemostatic sealing patch designed to control bleeding during surgical procedures

- In November 2023, Pramand LLC introduced the CraniSeal Dural Sealant System to the U.S. market, specifically developed for use in cranial surgeries

- In March 2023, Animus Surgical unveiled a new transparent, biodegradable, and non-toxic hydrogel wound sealant, enhancing wound management solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Surgical Sealants Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Surgical Sealants Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Surgical Sealants Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.