Global Surgical Scissor Market

Market Size in USD Million

CAGR :

%

USD

399.12 Million

USD

541.20 Million

2025

2033

USD

399.12 Million

USD

541.20 Million

2025

2033

| 2026 –2033 | |

| USD 399.12 Million | |

| USD 541.20 Million | |

|

|

|

|

Surgical Scissor Market Size

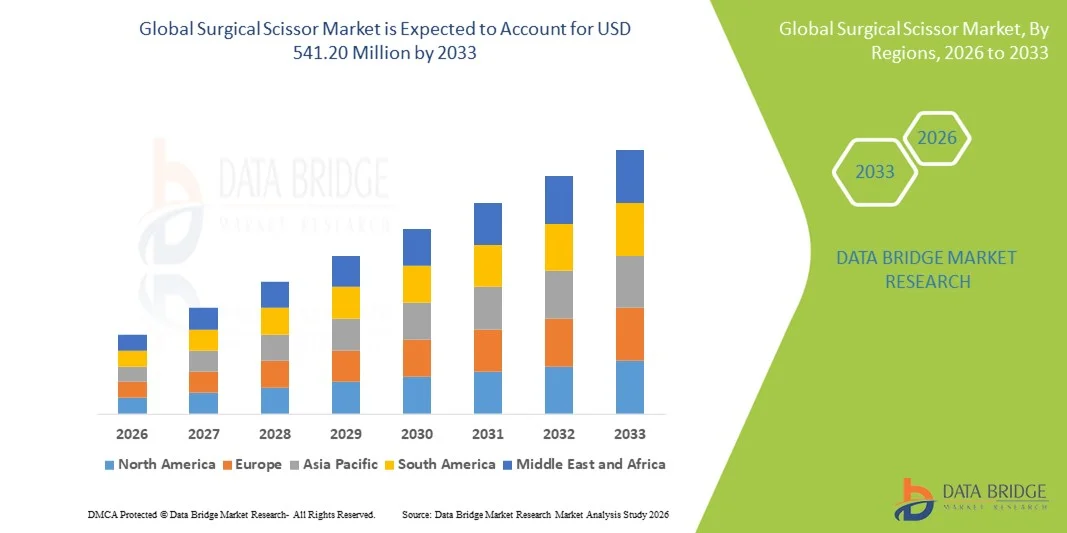

- The global surgical scissor market size was valued at USD 399.12 million in 2025 and is expected to reach USD 541.20 million by 2033, at a CAGR of 3.88% during the forecast period

- The market growth is largely fueled by the increasing number of surgical procedures worldwide, driven by a growing geriatric population and higher prevalence of chronic diseases that require surgical interventions. In addition, advancements in surgical techniques and precision instruments are enhancing demand for high‑quality surgical scissors across various medical specialties

- Furthermore, rising adoption of minimally invasive surgical procedures and preference for ergonomic, durable, and sterile instruments in hospitals, ambulatory surgical centers, and specialty clinics are establishing surgical scissors as essential tools in modern operative settings. These converging factors are accelerating the uptake of surgical scissor solutions, thereby significantly boosting the industry’s growth

Surgical Scissor Market Analysis

- Surgical scissors, essential precision instruments used for cutting tissues and sutures during surgeries, are increasingly vital components of modern operating rooms across hospitals, ambulatory surgical centers, and specialty clinics due to their precision, durability, and compliance with sterilization standards

- The escalating demand for surgical scissors is primarily fueled by the rising number of surgical procedures worldwide, increasing prevalence of chronic diseases, and growing preference for minimally invasive and precision surgical techniques that require high-quality, ergonomically designed instruments

- North America dominated the surgical scissor market with the largest revenue share of 38.7% in 2025, driven by advanced healthcare infrastructure, high adoption of modern surgical technologies, and a strong presence of leading surgical instrument manufacturers. The U.S. experienced substantial growth in surgical scissor usage, particularly in specialty surgeries and outpatient surgical centers, supported by continuous innovations in stainless steel alloys and ergonomic designs

- Asia-Pacific is expected to be the fastest-growing region in the surgical scissor market during the forecast period due to rapid expansion of healthcare infrastructure, increasing number of surgical procedures, and rising disposable incomes, particularly in countries such as China and India

- Steel segment dominated the surgical scissor market with a market share of 45.3% in 2025, driven by its high durability, resistance to corrosion, ease of sterilization, and widespread acceptance in both routine and complex surgical procedures

Report Scope and Surgical Scissor Market Segmentation

|

Attributes |

Surgical Scissor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Surgical Scissor Market Trends

Advancements in Ergonomic and Precision Designs

- A significant and accelerating trend in the global surgical scissor market is the development of ergonomically designed, precision-engineered scissors that reduce hand fatigue and enhance surgical accuracy across multiple procedures

- For instance, Mayo scissors with angled and contoured handles allow surgeons to perform delicate tissue dissection with greater control and comfort, improving operative efficiency

- Innovations in material technology, such as hardened stainless steel, titanium coatings, and anti-reflective finishes, are enhancing durability, corrosion resistance, and precision during surgeries. For instance, some Castroviejo scissors utilize titanium coatings to increase longevity and maintain sharpness over repeated sterilization cycles

- The integration of specialized tips, such as blunt, sharp, or micro-serrated edges, allows surgeons to choose the optimal instrument for specific procedures, reducing tissue trauma and improving patient outcomes

- This trend towards more ergonomic, precise, and procedure-specific surgical scissors is fundamentally reshaping expectations in operating rooms. Consequently, companies such as Aesculap are developing scissors with modular handle systems and interchangeable blades for improved surgeon adaptability

- The demand for surgical scissors that combine precision, ergonomic comfort, and durability is growing rapidly across hospitals, outpatient surgical centers, and specialty clinics, as surgical efficiency and patient safety become top priorities

- Increasing collaboration between surgical instrument manufacturers and hospitals to co-develop customized scissors for specialized procedures is driving adoption of advanced, user-centric designs

Surgical Scissor Market Dynamics

Driver

Increasing Surgical Procedures and Minimally Invasive Surgeries

- The rising number of surgical procedures globally, coupled with the growing preference for minimally invasive and precision surgeries, is a significant driver for heightened demand for surgical scissors

- For instance, in March 2025, Aesculap reported increased adoption of micro-serrated and curved scissors in ophthalmic and orthopedic surgeries, highlighting their efficiency in delicate procedures

- As hospitals and clinics focus on reducing operative time and patient recovery periods, surgical scissors with improved ergonomics, sharpness, and sterilization compatibility provide a compelling upgrade over older, conventional instruments

- Furthermore, the increasing number of outpatient surgical centers and ambulatory clinics is boosting demand for durable, easy-to-sterilize surgical scissors that can withstand high-frequency usage

- The combination of rising chronic disease prevalence, an aging population, and expanding surgical interventions is driving adoption of high-quality surgical scissors across both developed and emerging markets

- For instance, the growing adoption of robotic-assisted and laparoscopic surgeries is creating demand for specialized scissors compatible with robotic surgical systems

- Increasing government initiatives to improve healthcare infrastructure in emerging economies are further propelling the adoption of modern, high-quality surgical instruments, including scissors

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of precision surgical scissors, particularly those made from advanced materials such as titanium or with specialized coatings, poses a significant challenge to market penetration in price-sensitive regions

- For instance, high-end micro-serrated surgical scissors can be several times more expensive than standard stainless steel alternatives, limiting adoption in smaller clinics and developing countries

- Strict regulatory requirements and certifications, such as FDA clearance and ISO compliance, are mandatory for surgical instruments, which can delay product launches and increase development costs

- In addition, improper sterilization practices or handling errors can reduce the lifespan of surgical scissors, creating perceived reliability issues among healthcare providers

- Overcoming these challenges through development of cost-effective, durable instruments, streamlined regulatory approvals, and training programs for proper usage and maintenance will be vital for sustained market growth

- For instance, frequent updates in sterilization protocols and material standards require manufacturers to continually invest in product redesigns, increasing operational costs

- Rising competition from low-cost regional manufacturers offering standard stainless steel scissors can pressure established players to balance pricing with quality, posing a challenge to market growth

Surgical Scissor Market Scope

The market is segmented on the basis of type, material, model, and end user.

- By Type

On the basis of type, the surgical scissor market is segmented into disposable surgical scissors and reusable surgical scissors. The reusable surgical scissors segment dominated the market with the largest market revenue share in 2025, driven by its durability, cost-efficiency over multiple uses, and widespread adoption in hospitals and large surgical centers. Reusable scissors, often made from high-grade stainless steel or titanium, maintain sharpness over repeated sterilization cycles, ensuring consistent performance in precision surgeries. Surgeons prefer reusable scissors for critical procedures such as ophthalmic, orthopedic, and cardiovascular surgeries where reliability is paramount. The segment’s dominance is further supported by healthcare facilities investing in long-term equipment to reduce recurring procurement costs. In addition, reusable scissors are compatible with various sterilization methods, including autoclaving and chemical sterilants, enhancing their operational flexibility. Strong brand loyalty and trust in established surgical instrument manufacturers also contribute to the sustained demand for reusable scissors.

The disposable surgical scissors segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing awareness of infection control and cross-contamination prevention in hospitals and ambulatory surgical centers. Disposable scissors are particularly popular in high-volume surgical settings, outpatient procedures, and developing regions where sterilization facilities are limited. Their ready-to-use nature reduces instrument turnaround time, helping healthcare providers improve efficiency. Moreover, regulatory guidelines emphasizing single-use instruments in certain procedures, such as minor outpatient surgeries, are further accelerating adoption. The convenience of disposing of scissors after each use without compromising patient safety makes this segment highly attractive. Growing concerns about hospital-acquired infections and the increasing prevalence of day-care surgical procedures are expected to sustain this growth trajectory.

- By Material

On the basis of material, the market is segmented into steel, ceramic, tungsten, and others. The steel segment dominated the market in 2025 with a market share of 45.3%, driven by the material’s widespread availability, cost-effectiveness, and ability to maintain sharp edges over multiple sterilization cycles. Surgical scissors made from stainless steel or high-carbon steel are preferred in general surgeries, emergency procedures, and standard hospital operations due to their strength, corrosion resistance, and long service life. Steel scissors also offer excellent handling characteristics, balancing weight and flexibility for precise cutting. The segment’s dominance is supported by strong familiarity among surgeons and procurement practices favoring proven, durable materials. Steel scissors are compatible with autoclaving, chemical sterilants, and other hospital-grade sterilization methods, enhancing operational efficiency. In addition, they are produced in a variety of designs and tip types, making them suitable for a broad spectrum of surgical procedures.

The ceramic segment is expected to witness the fastest growth during 2026–2033, owing to increasing demand for lightweight, high-precision, and corrosion-resistant instruments in specialty surgeries. Ceramic scissors maintain edge sharpness longer than traditional steel scissors and are ideal for delicate procedures, such as ophthalmic and microsurgeries. The non-metallic nature reduces magnetic interference in certain surgical environments and allows for sterilization without degradation of cutting performance. Growing adoption in private specialty clinics and high-end surgical centers is further accelerating growth. Ceramic instruments are also hypoallergenic and compatible with advanced coating technologies, enhancing surgeon confidence. Increasing R&D investments in ceramic material technologies are expected to expand the availability of cost-effective options, supporting market penetration.

- By Model

On the basis of model, the market is segmented into dissecting, operating, stitch, iris, fine serrated blade, razor-micro cut, and light weight-delicate. The operating scissors segment dominated the market in 2025, due to its versatility in cutting tissues, sutures, and other surgical materials across a wide range of procedures. Operating scissors are a staple in general surgery, cardiovascular, and orthopedic operating rooms, making them a high-volume segment for manufacturers. Their established presence, variety of tip configurations (straight, curved, blunt, or sharp), and compatibility with standard sterilization processes support sustained adoption. Surgeons prefer operating scissors for their reliability, ease of handling, and consistent performance over multiple uses. The segment’s dominance is reinforced by strong institutional purchasing patterns in hospitals and ambulatory surgical centers. Moreover, continuous innovations in handle ergonomics and material coatings are keeping this model in high demand.

The fine serrated blade segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising preference for precise tissue handling and minimally invasive surgical techniques. Fine serrated scissors provide superior grip on delicate tissues without slippage, making them ideal for ophthalmic, neurosurgical, and microsurgeries. Advancements in micro-serration and blade-edge technology have improved accuracy, reducing tissue trauma and improving surgical outcomes. Specialty clinics and high-end hospitals are increasingly adopting these instruments to enhance procedural precision. Their growing popularity is also linked to the expansion of day-care surgeries and outpatient procedures requiring minimally invasive instruments. Manufacturers are introducing lightweight, ergonomic designs to further increase adoption.

- By End User

On the basis of end user, the market is segmented into hospitals and ambulatory surgical centers. The hospitals segment dominated the market in 2025, driven by the high number of surgical procedures performed daily, larger budgets for premium instruments, and the need for durable, reusable surgical scissors for diverse specialties. Hospitals rely on high-quality scissors for general, orthopedic, cardiovascular, and microsurgical procedures, ensuring patient safety and efficiency. Their large-scale procurement practices favor long-lasting instruments compatible with hospital sterilization protocols. Hospitals also benefit from training programs that familiarize surgeons with specialized scissors, supporting consistent adoption. The segment’s dominance is strengthened by ongoing investments in advanced surgical suites and technology upgrades, creating demand for precision instruments. Strong partnerships between hospitals and established surgical instrument manufacturers further reinforce the segment’s market share.

The ambulatory surgical centers segment is expected to witness the fastest growth during the forecast period, fueled by the rising number of outpatient procedures and minor surgeries performed outside traditional hospitals. These centers prioritize disposable and lightweight scissors to reduce sterilization time and prevent cross-contamination. Growing awareness of day-care surgeries, shorter patient recovery periods, and cost-efficient operations are driving demand. The trend towards minimally invasive and rapid procedures in outpatient settings is further boosting adoption. In addition, government and private sector initiatives supporting ambulatory care expansion in emerging markets are expected to accelerate growth in this segment.

Surgical Scissor Market Regional Analysis

- North America dominated the surgical scissor market with the largest revenue share of 38.7% in 2025, driven by advanced healthcare infrastructure, high adoption of modern surgical technologies, and a strong presence of leading surgical instrument manufacturers

- Hospitals and ambulatory surgical centers in the region prioritize precision, durability, and sterilization-compatible instruments, making high-quality reusable and specialized surgical scissors a standard requirement

- The widespread adoption of minimally invasive, robotic-assisted, and outpatient surgeries further supports demand for advanced scissors, as surgeons increasingly rely on ergonomic and micro-serrated instruments for delicate procedures

U.S. Surgical Scissor Market Insight

The U.S. surgical scissor market captured the largest revenue share of 78% in 2025 within North America, driven by the high number of surgical procedures, advanced healthcare infrastructure, and strong presence of established surgical instrument manufacturers. Hospitals and ambulatory surgical centers are increasingly prioritizing precision, durability, and sterilization-compatible instruments for general, cardiovascular, orthopedic, and microsurgeries. The rising adoption of minimally invasive and robotic-assisted procedures is further fueling demand for specialized scissors, such as fine serrated and lightweight delicate models. Moreover, the growing emphasis on infection control and reusable surgical instruments aligns with hospitals’ long-term investment strategies. Continuous innovation in ergonomic designs, high-quality steel and titanium materials, and modular handle systems is also contributing to market growth.

Europe Surgical Scissor Market Insight

The Europe surgical scissor market is projected to expand at a substantial CAGR during the forecast period, driven by stringent healthcare regulations, rising surgical procedure volumes, and growing awareness of infection prevention. Hospitals and specialty clinics are increasingly adopting precision scissors for cardiovascular, ophthalmic, and orthopedic surgeries. The trend toward minimally invasive surgeries and outpatient procedures is accelerating the demand for lightweight, high-precision scissors. In addition, European surgeons prefer durable, sterilization-compatible instruments with ergonomic designs to reduce fatigue during long procedures. Investment in modern surgical suites and integration of advanced surgical instruments in hospitals further supports market expansion. The market is also witnessing increased adoption in multi-specialty hospitals and private healthcare facilities across major countries such as Germany, France, and Italy.

U.K. Surgical Scissor Market Insight

The U.K. surgical scissor market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising number of surgical procedures, expanding outpatient care, and demand for precision instruments in both hospitals and specialty clinics. Concerns regarding surgical safety, infection control, and instrument reliability are encouraging healthcare providers to adopt high-quality reusable and disposable surgical scissors. The growing trend of minimally invasive and microsurgeries is driving the adoption of fine serrated, lightweight, and ergonomic scissors. In addition, the U.K.’s robust healthcare infrastructure, coupled with strong procurement practices and e-commerce availability for surgical instruments, supports consistent market growth. Continuous innovation by surgical instrument manufacturers and collaborations with hospitals for procedure-specific scissors are further stimulating adoption.

Germany Surgical Scissor Market Insight

The Germany surgical scissor market is expected to expand at a considerable CAGR during the forecast period, driven by a technologically advanced healthcare system, high surgical procedure volumes, and strong emphasis on quality and patient safety. German hospitals are increasingly prioritizing reusable, precision-engineered scissors for cardiovascular, orthopedic, ophthalmic, and general surgeries. There is growing demand for instruments compatible with minimally invasive and robotic-assisted procedures. In addition, manufacturers focusing on eco-friendly materials and ergonomic designs are gaining traction in Germany, where sustainability and efficiency are key considerations. Integration of advanced surgical scissors in modern operating rooms, alongside professional training for surgeons on new instrument designs, supports market growth. The market is also benefiting from strong R&D investments and collaborations between hospitals and manufacturers to develop procedure-specific scissors.

Asia-Pacific Surgical Scissor Market Insight

The Asia-Pacific surgical scissor market is poised to grow at the fastest CAGR of 23% during 2026–2033, fueled by rising surgical procedure volumes, expanding healthcare infrastructure, and increasing awareness of infection control and surgical precision in countries such as China, India, and Japan. The region’s growing number of outpatient surgeries and minimally invasive procedures is driving the adoption of lightweight, disposable, and fine serrated surgical scissors. Increasing investments in hospital upgrades, medical tourism, and government initiatives to expand healthcare access further boost demand. Moreover, the availability of cost-effective instruments from regional manufacturers is making high-quality surgical scissors more accessible. Surgeons and hospitals in APAC are also increasingly adopting advanced ergonomics and precision-focused designs to improve efficiency and outcomes in complex procedures.

Japan Surgical Scissor Market Insight

The Japan surgical scissor market is gaining momentum due to the country’s technologically advanced healthcare system, high surgical procedure volumes, and focus on precision and safety. Japanese hospitals are increasingly adopting lightweight, fine serrated, and specialized scissors for ophthalmic, cardiovascular, and microsurgeries. The growing number of smart hospitals and robotic-assisted surgeries is driving demand for precision instruments compatible with advanced surgical techniques. In addition, Japan’s aging population is fueling demand for instruments that improve efficiency and reduce surgeon fatigue. The integration of modern surgical instruments with advanced sterilization and tracking systems enhances operational efficiency in hospitals. Continuous innovation in ergonomic and durable designs is further supporting market growth.

India Surgical Scissor Market Insight

The India surgical scissor market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by expanding healthcare infrastructure, rapid urbanization, and rising surgical procedure volumes. Hospitals, specialty clinics, and ambulatory surgical centers are increasingly adopting both reusable and disposable surgical scissors to ensure precision, safety, and infection control. Government initiatives promoting hospital upgrades and medical tourism are further supporting market growth. Affordable instruments from domestic manufacturers, coupled with rising awareness of minimally invasive procedures, are boosting adoption. The demand for lightweight, fine serrated, and ergonomically designed scissors is increasing across ophthalmic, orthopedic, and general surgeries. In addition, the growth of private healthcare facilities and outpatient surgical centers is expected to continue driving demand in India.

Surgical Scissor Market Share

The Surgical Scissor industry is primarily led by well-established companies, including:

- Wexler Surgical (U.S.)

- Aesculap, Inc. (U.S.)

- Sklar Surgical Instruments (U.S.)

- Integra LifeSciences Corporation (U.S.)

- B. Braun SE (Germany)

- Ethicon, Inc. (U.S.)

- BD (U.S.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- CONMED Corporation (U.S.)

- CooperSurgical, Inc. (U.S.)

- Aspen Surgical Products, Inc. (U.S.)

- Karl Storz SE & Co. KG (Germany)

- Scanlan International, Inc. (U.S.)

- Roboz Surgical Instrument Co. (U.S.)

- Fine Science Tools, Inc. (U.S.)

- Geister Medizintechnik GmbH (Germany)

- Richard Wolf GmbH (Germany)

- Smith & Nephew (U.K.)

- Medline Industries, Inc (U.S.)

What are the Recent Developments in Global Surgical Scissor Market?

- In December 2025, Medical Microinstruments (MMI) received FDA 510(k) clearance for its NanoWrist® Scissors and Forceps, enabling robotic soft tissue dissection and marking the world’s first fully wristed robotic dissection instruments for microsurgery; the first U.S. clinical use was successfully completed at Tampa General Hospital, expanding precision instrument capabilities in complex surgical procedures

- In December 2025, industry press also reported that the FDA clearance of NanoWrist Scissors and Forceps will broaden the surgical robotics portfolio and includes expanded clinical use cases, representing a significant technological advancement for precision surgical tools used alongside robotic systems

- In August 2025, Bio-Optica proudly announced the launch of its new comprehensive autopsy and forensic pathology instrument line, which includes a range of precision surgical scissors engineered for enhanced control, durability, and ergonomic performance in post-mortem examinations

- In July 2024, Dr. Devgan Scientific Beauty launched a new line of precision surgical instruments, including curved dissection scissors designed to address ergonomic challenges for surgeons with smaller hands by offering high-grade stainless-steel construction and millimeter-level precision for soft-tissue dissection tasks

- In October 2023, Planatome secured USD 6 million in capital investment to support advanced manufacturing technology for surgical blades and precision instruments, including applications such as surgical scissors, enabling more refined instrument surfaces and potential future product enhancements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.