Global Sulfate of Potash Market, By Form (Solid, and Liquid), Product (Standard SOP, Granular SOP, and Soluble SOP), Crop Type (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, and Others), Application (Agricultural, Industrial, and Others) - Industry Trends and Forecast to 2031.

Sulfate of Potash Market Analysis and Size

The sulfate of potash market is experiencing rapid growth, fueled by advancements in extraction methods and technology. Innovations such as improved production processes and enhanced nutrient delivery systems are driving efficiency and expanding market reach. With increasing demand for high-quality fertilizers, this sector is poised for further expansion, offering promising opportunities for agricultural productivity and sustainability.

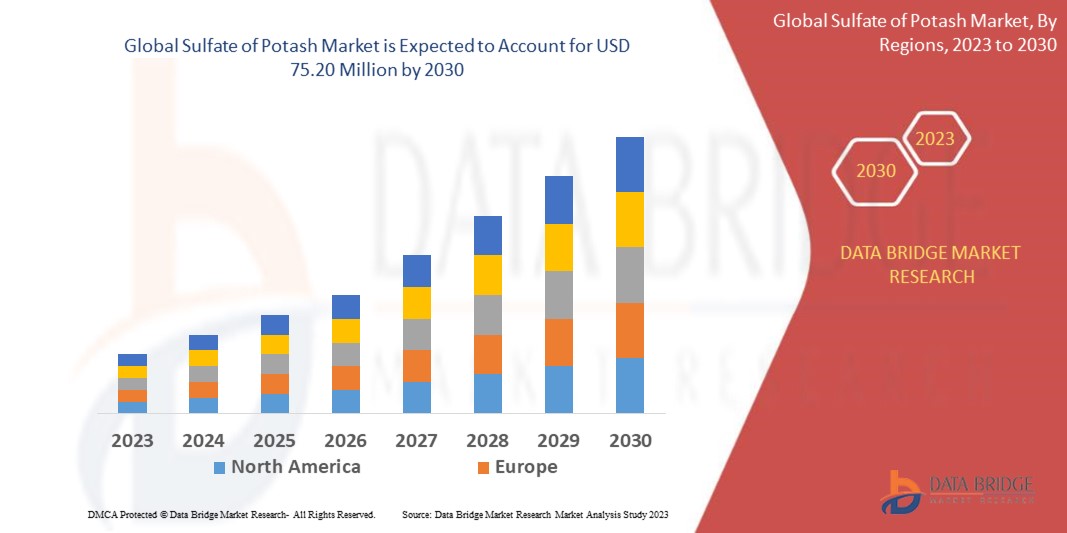

The global sulfate of potash market size was valued at USD 53.45 billion in 2023 and is projected to reach USD 78.96 billion by 2031, with a CAGR of 5% during the forecast period 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Form (Solid, and Liquid), Product (Standard SOP, Granular SOP, and Soluble SOP), Crop Type (Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, and Others), Application (Agricultural, Industrial, and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

SESODA CORPORATION (South Korea), Sinofert Holdings Limited (China), Compass Minerals (U.S.), Jiangsu Kolod Food Ingredients Co.,Ltd. (China), Tessenderlo Kerley International (U.S.), Yara (India), SDIC lnc. (China), Kemira (Finland), Intrepid Potash (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Sulfate of potash, also known as potassium sulfate, is a premium fertilizer containing potassium and sulfur, essential nutrients for plant growth. It is produced through a chemical reaction between potassium chloride and sulfuric acid. With a low chloride content compared to other potassium fertilizers, it's favored for sensitive crops. Its water-soluble form ensures efficient nutrient uptake, promoting healthy plant development and improved crop yields.

Sulfate of Potash Market Dynamics

Drivers

- Increasing Agricultural Demand

Rising global population and shrinking arable land intensify the need for high-yield agriculture. Sulfate of potash, a crucial potassium source, becomes pivotal for enhancing crop productivity and quality. With farmers increasingly relying on advanced fertilizers, the sulfate of potash market expands to meet this demand. For instance, in regions such as Asia and Africa, where population growth strains food production, farmers turn to sulfate of potash to optimize yields and ensure food security.

- Expansion of Potash Mining

Advancements in potash mining, including exploration of reserves and innovative extraction methods, bolster the availability of sulfate of potash. Emerging mining projects and technological breakthroughs ensure a consistent supply of potassium fertilizers, meeting escalating demand. For instance, in Canada's Saskatchewan province, ongoing investments in potash extraction technologies have substantially increased sulfate of potash production, supporting global agricultural needs and driving market expansion.

Opportunities

- Soil Salinity Concerns

Increasing soil salinity, exacerbated by climate change and poor irrigation practices, propels demand for SOP as a chloride-free solution in affected regions. For instance, in coastal areas where seawater intrusion elevates soil salinity, farmers prefer SOP to mitigate chloride accumulation and sustain crop productivity. This rising concern amplifies SOP's market demand, positioning it as a crucial remedy in combating soil salinity challenges worldwide.

- Growing Global Food Security Concerns

Governments and international organizations prioritize agricultural productivity to address global food security concerns. Sulfate of potash (SOP) is pivotal in sustainable farming practices to meet rising food demand. Its chloride-free composition makes it essential for sensitive crops, ensuring high yields and quality. For instance, SOP usage in high-value crops such as tomatoes and almonds not only boosts yields but also enhances food security by ensuring reliable access to nutritious produce worldwide.

Restraints/Challenges

- Seasonal Demand Fluctuations

Seasonal demand fluctuations hinder the sulfate of potash market, as sales and revenues are heavily influenced by agricultural cycles, weather patterns, and planting decisions. This unpredictability creates challenges for producers in terms of inventory management, revenue forecasting, and maintaining stable operations throughout the year.

- High Production Costs

High production costs, driven by the energy-intensive potassium sulfate production process, present a significant hindrance to the sulfate of potash market. These costs restrict profitability and competitiveness, impeding market growth and potentially limiting accessibility for farmers. This financial barrier poses a formidable challenge for industry players, impacting their ability to scale operations and meet demand efficiently.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In May 2020, Uralkali, a leading potash producer, announced that its subsidiary, Uralkali Trading, had finalized a contract with Indian Potash Limited (IPL), a primary importer of fertilizers in India. The agreement entails the delivery of potash, vital for agricultural productivity. This strategic partnership underscores Uralkali's commitment to serving global agricultural needs while solidifying its presence in the Indian market, essential for sustaining agricultural growth and food security in the region.

Sulfate of Potash Market Scope

The market is segmented on the basis of form, product, crop type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Form

- Solid

- Liquid

Product

- Standard SOP

- Granular SOP

- Soluble SOP

Crop Type

- Fruits and Vegetables

- Cereals and Grains

- Oilseeds and Pulses

- Others

Application

- Agricultural

- Industrial

- Others

Sulfate of Potash Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by form, product, crop type and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to dominate the sulfate of potash market in the forecasted period due to its vast agricultural land and rising demand in the food and beverage industry. This growth is driven by increased agricultural activities and the region's focus on enhancing crop yield and quality.

North America is expected to exhibit the highest CAGR in the sulfate of potash market during the forecast period, driven by robust SOP production for both agricultural and industrial sectors. This growth is fueled by increasing demand for high-quality fertilizers and industrial applications.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Sulfate of Potash Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- SESODA CORPORATION (South Korea)

- Sinofert Holdings Limited (China)

- Compass Minerals (U.S.)

- Jiangsu Kolod Food Ingredients Co.,Ltd. (China)

- Tessenderlo Kerley International (U.S.)

- Yara (India)

- SDIC lnc. (China)

- Kemira (Finland)

- Intrepid Potash (U.S.)

SKU-