Global Sterile Filtration Market

Market Size in USD Billion

CAGR :

%

USD

2.23 Billion

USD

4.61 Billion

2024

2032

USD

2.23 Billion

USD

4.61 Billion

2024

2032

| 2025 –2032 | |

| USD 2.23 Billion | |

| USD 4.61 Billion | |

|

|

|

|

Sterile Filtration Market Size

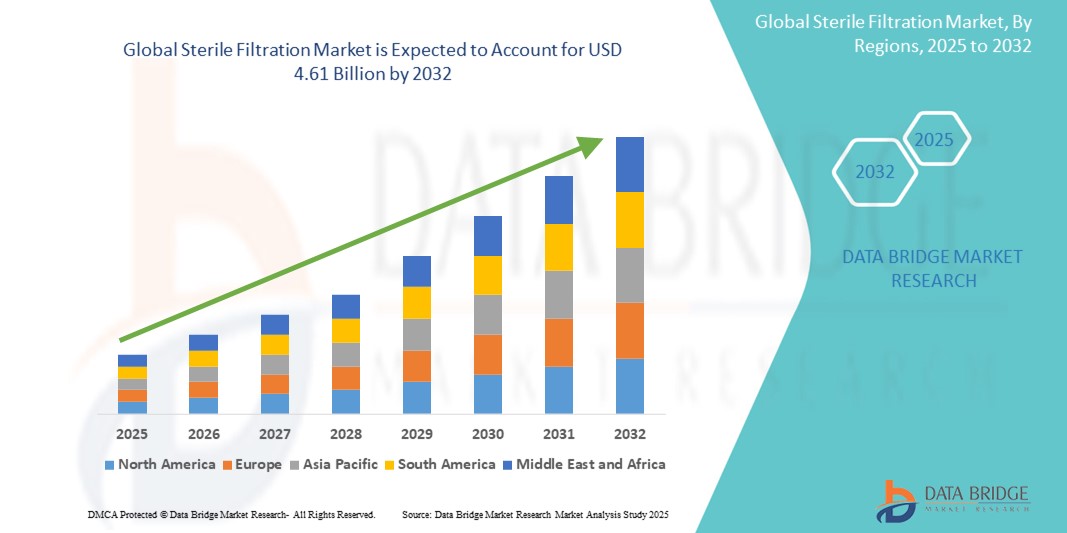

- The global sterile filtration market size was valued at USD 2.23 billion in 2024 and is expected to reach USD 4.61 billion by 2032, at a CAGR of 9.50% during the forecast period

- The market growth is primarily driven by the increasing demand for sterile and contamination-free manufacturing processes in biopharmaceuticals, food & beverages, and medical device industries

- In addition, the expanding biologics and vaccine production, coupled with stringent regulatory standards for product safety, is accelerating the adoption of sterile filtration systems globally. These combined dynamics are contributing to robust market expansion and technological innovation in filtration solutions

Sterile Filtration Market Analysis

- Sterile filtration, a key technique for removing microorganisms from liquids and gases without compromising the product, plays a critical role in biopharmaceutical production, medical device sterilization, and food & beverage safety, owing to its high efficiency, regulatory compliance, and reliability in contamination control

- The rising demand for biopharmaceuticals, including monoclonal antibodies and vaccines, along with stricter regulatory standards for product safety and manufacturing hygiene, is significantly driving the adoption of sterile filtration technologies across multiple sectors

- North America dominated the sterile filtration market with the largest revenue share of 40.2% in 2024, supported by advanced healthcare infrastructure, robust pharmaceutical R&D investments, and a strong presence of key filtration technology providers

- Asia-Pacific is projected to be the fastest-growing region in the sterile filtration market during the forecast period due to rapid expansion of biopharma manufacturing, increased regulatory enforcement, and growing healthcare expenditures

- The membrane filters segment dominated the sterile filtration market with a share of 42.1% in 2024, attributed to its superior filtration efficiency, broad application in aseptic processing, and growing usage in the pharmaceutical and biotechnology industries

Report Scope and Sterile Filtration Market Segmentation

|

Attributes |

Sterile Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sterile Filtration Market Trends

“Advancements in Single-Use Technologies and Bioprocessing Integration”

- A major and accelerating trend in the global sterile filtration market is the increasing adoption of single-use filtration systems and their integration into continuous bioprocessing workflows, particularly in biopharmaceutical and vaccine production. These innovations are enhancing operational efficiency, reducing contamination risk, and aligning with industry demands for scalable and flexible manufacturing

- For instance, companies such as Merck KGaA and Sartorius are offering advanced single-use sterile filters compatible with modular bioreactors, enabling quicker turnaround times between production batches. These filters minimize cleaning and validation needs, significantly reducing operational downtime

- Integration of sterile filtration into upstream and downstream processes is becoming more seamless, particularly with advancements in membrane materials that improve throughput and protein retention while ensuring microbial integrity. For instance, 3M’s Emphaze AEX Hybrid Purifier combines depth filtration and anion exchange to enhance downstream purification

- In addition, automation in sterile filtration systems—especially with real-time monitoring and data analytics is supporting compliance with regulatory standards and improving process control. Companies are developing smart filter systems capable of providing usage data, pressure differentials, and predictive maintenance alerts

- This growing focus on integrated, intelligent, and single-use sterile filtration technologies is transforming the industry by meeting both efficiency and regulatory demands. As a result, firms such as Danaher Corporation (via Cytiva and Pall Corporation) are investing heavily in R&D for next-generation filtration products tailored to evolving biomanufacturing requirements

- The rising trend toward personalized medicine, biologics, and pandemic preparedness is further strengthening demand for innovative sterile filtration technologies that enable faster, safer, and more adaptable production cycles

Sterile Filtration Market Dynamics

Driver

“Rising Biopharmaceutical Demand and Stringent Regulatory Requirements”

- The growing global demand for biopharmaceutical products, including monoclonal antibodies, gene therapies, and vaccines, is a major driver of the sterile filtration market. These products require aseptic processing to ensure patient safety, increasing reliance on sterile filtration throughout manufacturing

- For instance, the expansion of mRNA vaccine production following the COVID-19 pandemic has accelerated investments in sterile processing technologies by leading biomanufacturers such as Pfizer and Moderna, driving demand for advanced filtration systems

- In addition, stringent regulatory guidelines from agencies such as the U.S. FDA and EMA mandate validated filtration processes that meet high microbial retention standards. This regulatory pressure encourages pharmaceutical companies to invest in certified sterile filtration systems that ensure batch consistency and safety

- The increasing outsourcing of sterile drug manufacturing to contract manufacturing organizations (CMOs) and the globalization of supply chains also contribute to the demand for standardized, high-performance sterile filters that support compliance and scalability

Restraint/Challenge

“High Operational Costs and Compatibility Limitations”

- Despite strong growth, the high operational cost associated with sterile filtration—particularly for large-scale and high-purity applications—remains a significant challenge, especially for small to mid-sized biomanufacturers and companies in emerging markets

- For instance, the cost of replacing membrane filters regularly, along with the need for validation, integrity testing, and specialized personnel, can significantly raise overall production costs, affecting market adoption

- Compatibility issues between sterile filters and complex biologics or aggressive solvents used in pharmaceutical processes can also hinder filter performance, leading to product loss or the need for customized filtration setups

- Furthermore, the requirement for compliance with changing international regulatory standards often necessitates repeated filter requalification, adding time and financial burden to production workflows

- Addressing these challenges through the development of cost-effective, broadly compatible filtration systems, as well as providing robust technical support and training, will be critical for sustaining long-term growth in the sterile filtration market

Sterile Filtration Market Scope

The market is segmented on the basis of product, membrane pore size, membrane type, application, and end user.

- By Product

On the basis of product, the sterile filtration market is segmented into cartridge filters, capsule filters, membrane filters, syringe filters, bottle-top and table-top filtration systems, and accessories. The membrane filters segment dominated the market with the largest market revenue share of 42.1% in 2024, driven by their broad application in aseptic processing and high microbial retention capacity. Their versatility across various filtration stages and compatibility with multiple membrane materials makes them the preferred choice for pharmaceutical and biopharmaceutical companies.

The capsule filters segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of single-use technologies in biomanufacturing. Capsule filters offer pre-sterilized, compact, and ready-to-use options ideal for reducing contamination risks and simplifying workflows in small to mid-scale production environments.

- By Membrane Pore Size

On the basis of membrane pore size, the sterile filtration market is segmented into 0.2–0.22 µm, 0.45 µm, and 0.1 µm. The 0.2–0.22 µm segment held the largest revenue share in 2024, owing to its regulatory preference for bacterial retention and its widespread use in sterilizing-grade filtration across biopharmaceutical processes. It is regarded as the gold standard for sterile filtration in liquid applications, particularly for protein-based therapeutics and injectables.

The 0.1 µm segment is expected to exhibit the fastest during forecast period, particularly in applications involving highly sensitive biologics or nanoparticle filtration, where tighter retention is essential for product integrity and sterility assurance

- By Membrane Type

On the basis of membrane material, the sterile filtration market is segmented into polyethersulfone, polyvinylidene difluoride, nylon, polytetrafluoroethylene, mixed cellulose ester and cellulose acetate, and other materials. The polyethersulfone segment dominated the market in 2024 due to its low protein-binding properties, high flow rates, and broad pH compatibility, making it highly suitable for sterile filtration of biologics and vaccines.

Polytetrafluoroethylene membranes are projected to witness the fastest CAGR during the forecast period due to their superior chemical resistance and strong performance in gas sterilization and aggressive solvent filtration, particularly within cleanroom and critical manufacturing environments.

- By Application

On the basis of application, the sterile filtration market is segmented into bioprocesses, fill-finish process, utilities filtration, pre-filtration, virus filtration, and other applications. The bioprocesses segment held the largest market share in 2024, driven by the expanding biologics pipeline, increased monoclonal antibody production, and a strong focus on contamination-free upstream processes.

The fill-finish process segment is expected to register the highest growth rate during the forecast period due to rising injectable drug manufacturing and the critical need for sterility in final drug product packaging.

- By End User

On the basis of end user, the sterile filtration market is segmented into pharmaceutical companies, biopharmaceutical companies, food and beverage companies, contract manufacturing organizations (CMOs) and contract research organizations (CROs), and academic institutes and research laboratories. Biopharmaceutical companies dominated the market in 2024, accounting for the largest revenue share, as these organizations extensively deploy sterile filtration in vaccine production, monoclonal antibody development, and gene therapy manufacturing.

CMOs and CROs are expected to exhibit the fastest growth from 2025 to 2032 due to the rising trend of outsourcing sterile manufacturing services, increasing demand for flexible production capacities, and the need to comply with global regulatory standards.

Sterile Filtration Market Regional Analysis

- North America led the sterile filtration market with the largest revenue share of 40.2% in 2024, supported by advanced healthcare infrastructure, robust pharmaceutical R&D investments, and a strong presence of key filtration technology providers

- The region’s well-established healthcare infrastructure, combined with high investments in biologics, vaccines, and sterile drug manufacturing, has significantly increased the demand for sterile filtration solutions

- Moreover, the presence of leading filtration technology providers, ongoing R&D initiatives, and a growing focus on manufacturing efficiency and contamination control have reinforced the widespread adoption of sterile filtration systems across North American pharmaceutical, biotechnology, and research sectors

U.S. Sterile Filtration Market Insight

The U.S. sterile filtration market captured the largest revenue share of 78.5% in 2024 within North America, driven by the country’s strong biopharmaceutical manufacturing base, stringent regulatory standards, and rapid innovation in biologics and vaccine production. A robust research infrastructure and the presence of leading life science companies further support demand. In addition, increased investment in sterile injectable drugs and expanding outsourcing activities have significantly contributed to the market’s dominance.

Europe Sterile Filtration Market Insight

The Europe sterile filtration market is projected to expand at a steady CAGR throughout the forecast period, supported by strict regulatory environments (such as, EMA standards), growing biologics and biosimilars production, and expanding pharmaceutical R&D. Increasing investments in cleanroom technologies, single-use systems, and aseptic processing are accelerating adoption. The region’s strong emphasis on quality assurance and sterility control continues to drive demand across key biopharma hubs.

U.K. Sterile Filtration Market Insight

The U.K. sterile filtration market is anticipated to grow at a notable CAGR during the forecast period, propelled by the country's focus on biopharma innovation and clinical research. The demand for contamination-free processes in drug development, especially within biologics and advanced therapies, is elevating the use of sterile filtration. Moreover, increased investments in life sciences and expansion of manufacturing capabilities post-Brexit are supporting market growth.

Germany Sterile Filtration Market Insight

The Germany sterile filtration market is expected to expand at a considerable CAGR during the forecast period, owing to the country’s strong pharmaceutical industry, emphasis on automation, and adherence to rigorous quality control standards. High manufacturing output of APIs and biologics, combined with increasing adoption of advanced filtration systems, supports strong market growth. In addition, Germany’s push towards sustainability and innovation in clean processing fuels demand for efficient sterile filtration solutions.

Asia-Pacific Sterile Filtration Market Insight

The Asia-Pacific sterile filtration market is poised to grow at the fastest CAGR of 23.2% during the forecast period from 2025 to 2032, driven by expanding pharmaceutical production, growing investments in biologics, and improving healthcare infrastructure across nations such as China, India, Japan, and South Korea. Government initiatives to promote local manufacturing and biopharma R&D, along with increased demand for sterile injectables, are significantly boosting market growth in the region.

Japan Sterile Filtration Market Insight

The Japan sterile filtration market is gaining traction due to a strong domestic pharmaceutical industry, high regulatory compliance, and demand for high-purity products in both healthcare and food sectors. Japan’s emphasis on innovation, automation, and precision in manufacturing supports the integration of advanced sterile filtration systems, particularly in biotech and injectable drug production.

India Sterile Filtration Market Insight

The India sterile filtration market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the nation’s growing pharmaceutical manufacturing sector, cost-competitive biologics production, and expanding demand for sterile injectables and vaccines. India’s role as a global supplier of generics and contract manufacturing services, along with supportive government policies under programs such as “Make in India” and “Pharma Vision 2020,” continues to drive market expansion.

Sterile Filtration Market Share

The sterile filtration industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Pall Corporation (U.S.)

- Sartorius AG (Germany)

- GE HealthCare (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- 3M (U.S.)

- Amazon Filters Ltd. (U.K.)

- PARKER HANNIFIN CORP (U.S.)

- Meissner Filtration Products, Inc. (U.S.)

- Repligen Corporation (U.S.)

- Saint-Gobain (France)

- Cobetter (China)

- Porvair Filtration Group (U.K.)

- Graver Technologies (U.S.)

- CELLTREAT Scientific Products (U.S.)

- Sterlitech Corporation (U.S.)

- Microfilt India (India)

- Advantec MFS, Inc. (U.S.)

- GVS S.p.A. (Italy)

- Axiva Sichem Pvt. Ltd. (India)

What are the Recent Developments in Global Sterile Filtration Market?

- In February 2025, Thermo Fisher Scientific Inc. announced the acquisition of Solventum's purification and filtration business for USD 4.1 billion. This strategic move is aimed at strengthening Thermo Fisher’s capabilities in bioprocess filtration and sterile processing, significantly expanding its life sciences portfolio. The acquisition is expected to enhance the company’s ability to serve customers in the biologics and vaccine production sectors, reinforcing its leadership in high-performance sterile filtration technologies

- In January 2025, Cytiva, a Danaher Corporation company, launched a next-generation sterile filtration solution engineered for high-concentration biologic feeds. The innovation enables greater throughput with minimal filter area, thereby reducing hold-up volume and product loss. This development addresses a growing need in biopharmaceutical manufacturing for scalable, efficient, and low-waste filtration systems and reflects Cytiva’s continued investment in process intensification

- In April 2025, Amazon Filters Ltd. introduced a suite of high-performance sterile filters and sanitary housings at the InterPhex Conference in New York. These solutions were designed to meet the evolving demands of pharmaceutical and biotech manufacturers, focusing on sterile liquid and gas applications. The company emphasized customizability and operational reliability, reinforcing its commitment to providing tailored sterile filtration technologies to support GMP-compliant production

- In December 2024, Pall Corporation unveiled its new Ultipleat High Flow XT filter cartridges tailored for critical sterile filtration stages in biologics manufacturing. The filters are designed to increase capacity and operational flexibility while maintaining high microbial retention rates. This innovation aligns with the industry’s need for scalable, single-use solutions that reduce contamination risks and support continuous bioprocessing initiatives

- In November 2024, Merck KGaA (MilliporeSigma) announced the expansion of its filtration product line with the launch of the Durapore 0.1 µm sterile membrane filter, designed specifically for ultra-sensitive sterile filtration applications such as virus filtration and endotoxin removal. This development demonstrates Merck’s ongoing efforts to support the rapid growth in cell and gene therapy production by offering ultra-high-performance and regulatory-compliant filtration technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.