Global Steel Rebar Market

Market Size in USD Billion

CAGR :

%

USD

216.50 Billion

USD

260.66 Billion

2024

2032

USD

216.50 Billion

USD

260.66 Billion

2024

2032

| 2025 –2032 | |

| USD 216.50 Billion | |

| USD 260.66 Billion | |

|

|

|

|

Steel Rebar market Size

-

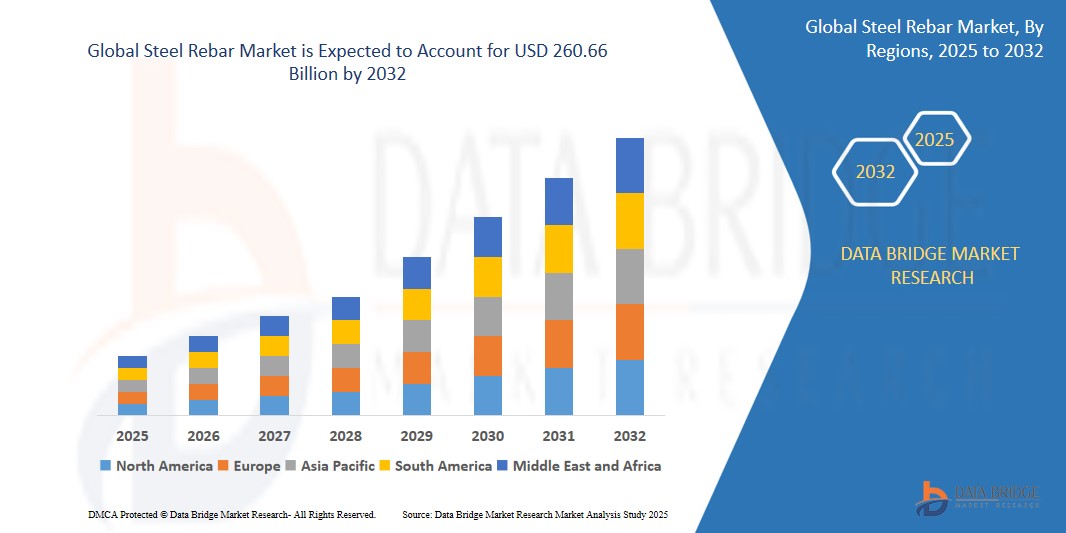

The global steel rebar market was valued at USD 216.5 billion in 2024 and is expected to reach USD 260.66 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.75%, primarily driven by the rising environmental concerns and regulatory pressures to decarbonize the construction sector

- This growth is driven by factors such as rise in demand for sustainable energy sources such as wind and hydropower and increasing demand for steel in motors of hybrid/electrical vehicles

Steel Rebar market Analysis

-

The steel rebar market is primarily driven by rising infrastructure development and urbanization, especially in emerging economies, leading to increased demand for reinforced concrete in residential, commercial, and industrial construction.

- The transition toward sustainable energy sources such as wind and hydropower is creating additional demand for rebar in renewable energy infrastructure like turbine foundations and hydroelectric plants.

- Growing emphasis on seismic-resistant structures and durable high-strength concrete is pushing the demand for thermomechanically treated (TMT) and corrosion-resistant steel rebars in both developed and developing regions.

- Asia Pacific, led by China and India, dominates the market due to large-scale construction projects, industrial expansion, and government-backed infrastructure initiatives such as India’s Smart Cities Mission and China’s Belt and Road Initiative.

Report Scope and Steel Rebar market Segmentation

|

Attributes |

Steel rebar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Steel Rebar Market Trends

“Increasing Use of Green Steel and Sustainable Construction Practices”

- The steel rebar industry is witnessing a shift toward low-carbon and green steel production, driven by rising environmental concerns and regulatory pressures to decarbonize the construction sector.

- Green steel rebar, produced using electric arc furnaces (EAFs) and renewable energy sources, is gaining traction in markets with stringent carbon emission targets.

- Major players are investing in carbon-neutral manufacturing processes and certifications (e.g., EPDs – Environmental Product Declarations) to align with ESG goals and meet demand from eco-conscious infrastructure projects.

- Government-backed green energy investments and sustainability targets are accelerating the development of renewable infrastructure, directly boosting steel rebar consumption across emerging and developed economies.

- For instance, ArcelorMittal announced the launch of XCarb R rebars in Europe, a low-carbon steel product made with scrap and renewable energy, aimed at sustainable construction initiatives.

- As sustainable building practices become mainstream, demand for eco-friendly steel rebar products is expected to accelerate across both public infrastructure and commercial construction segments.

Steel Rebar Market Dynamics

Driver

“Rise in Demand for Sustainable Energy Sources Such as Wind and Hydropower”

- The global transition toward renewable energy has led to a surge in the construction of wind farms and hydropower plants, both of which require robust structural materials such as steel rebar for foundations, towers, dams, and associated infrastructure.

- Steel rebar is critical in these projects to ensure structural integrity under high-load and variable weather conditions, especially in offshore wind turbines and large hydroelectric dams.

- Government-backed green energy investments and sustainability targets are accelerating the development of renewable infrastructure, directly boosting steel rebar consumption across emerging and developed economies.

For instance,

- According to the U.S. Department of Energy (DOE), the U.S. is planning to utilize wind energy to generate at least 20% of the overall energy generated in the country, after considering an overall environmental, economic and societal advantage of the same. For the respective purpose, two workshops were hosted in Virginia and Washington, D.C. in which stakeholders and industrialists participated along with government representatives.

- As renewable energy projects expand globally, the demand for durable and high-performance construction materials like steel rebar is projected to rise substantially.

Opportunity

“Rising Infrastructure Development in Emerging Economies”

- Rapid urbanization in emerging economies is fueling large-scale investments in transportation, housing, and utility infrastructure, significantly increasing the demand for construction materials like steel rebar.

- Countries in Asia, Africa, and Latin America are launching megaprojects such as metro rail systems, highways, and smart cities that require reinforced concrete structures.

- Government-backed infrastructure initiatives and foreign direct investments are further accelerating construction activities, creating long-term growth potential for rebar manufacturers.

For instance,

- India's PM Gati Shakti National Master Plan aims to transform the country's infrastructure landscape with a coordinated, efficient, and integrated approach. Announced in October 2021, the plan proposes an investment of INR 100 trillion (~USD 1.2 trillion) to develop world-class infrastructure, integrating various ministries and national schemes like Bharatmala, Sagarmala, UDAN, and industrial corridors. This unified framework enhances connectivity across roadways, railways, ports, waterways, and airports, thereby boosting demand for construction materials such as steel rebar.

Restraint/Challenge

“Environmental Regulations and Carbon Emission Restrictions”

- The steel industry is one of the largest industrial sources of carbon emissions globally, leading to increasing scrutiny from environmental regulators and pressure to decarbonize operations.

- Regulatory frameworks such as the EU Emissions Trading System (ETS), carbon border adjustment mechanisms (CBAM), and local emission caps are imposing compliance costs and penalties on high-emission steel producers.

- Transitioning to greener production methods—such as electric arc furnaces (EAFs) using renewable energy or hydrogen-based steelmaking—is capital-intensive and not yet widely feasible for many manufacturers, especially in developing countries.

- These regulations also influence public and private procurement policies, where low-emission materials are prioritized, pushing traditional steel rebar suppliers to adapt or risk losing market share.

- Environmental compliance adds complexity to operations, including the need for emission monitoring, reporting, and third-party audits, increasing overhead costs.

For instance,.

- According to a report by ICRA, the EU's CBAM framework is projected to affect between 15% and 40% of India's annual steel exports to Europe, with compliance costs potentially reducing profits by USD 60–165 per metric ton. This significant financial impact underscores the urgency for Indian steel manufacturers to adopt cleaner production methods to retain their market share in the EU

Steel Rebar Market Scope

The market is segmented on the basis of process, type, application and finishing type.

|

Segmentation |

Sub-Segmentation |

|

By Process |

|

|

By Type |

|

|

By Application |

|

|

By Finishing Type |

|

Steel Rebar Market Regional Analysis

“Asia Pacific is the Dominant Region in the Steel Rebar market”

- Asia-Pacific leads the global steel rebar market, driven by rapid urbanization, infrastructure development, and growth in the construction sector across countries like China, India, and Southeast Asia.

- China holds a significant share due to its massive construction industry, infrastructure projects such as high-speed railways, bridges, and urban development, which heavily rely on steel rebar.

- India is experiencing strong demand for steel rebar in its rapidly expanding residential and commercial construction sectors, bolstered by government initiatives such as "Housing for All" and infrastructure development projects under the National Infrastructure Pipeline (NIP).

- The booming construction of smart cities, industrial parks, and energy infrastructure across Southeast Asia is contributing to the increasing demand for steel rebar in the region.

- Government policies promoting infrastructural development and construction activities, such as China’s Belt and Road Initiative and India’s push for modern infrastructure, continue to enhance steel rebar consumption in the region.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The region is expected to grow at the fastest rate, driven by strong growth in the construction and infrastructure sectors, particularly in emerging economies like India, Indonesia, and Vietnam.

- India’s increasing focus on infrastructure modernization, including urbanization, highway construction, and large-scale projects like metro systems, will contribute to the region’s rapid market growth.

- Southeast Asia, with its rising industrialization and urban population, is emerging as a key market for steel rebar, as governments in countries like Indonesia and the Philippines continue to invest heavily in infrastructure projects.

- China’s continued dominance in construction, particularly in large-scale residential, commercial, and infrastructure projects, will further drive the demand for steel rebar in the region.

- Increased foreign investments in the region’s construction and manufacturing sectors, along with rising demand for high-strength and corrosion-resistant steel rebars, will propel the growth rate of the steel rebar market in Asia-Pacific.

Steel Rebar Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gerdau S.A. (Brazil)

- NIPPON STEEL CORPORATION (Japan)

- POSCO (South Korea)

- YAMATO (Japan)

- VINASAN (Vietnam)

- Tata Steel (India)

- Essar (India)

- Mechel (Russia)

- EVRAZ plc (U.K.)

- Sohar Steel Group (Oman)

- KOBE STEEL Ltd. (Japan)

- SHAGANG GROUP Inc. (China)

- NJR Steel (South Africa)

- CMC (U.S.)

- Conco (South Africa)

- Jindal Steel & Power Limited (India)

- Steel Dynamics Inc. (U.S.)

- SteelAsia (Philippines)

- Outokumpu (Finland)

- Acerinox S.A. (Spain)

- ArcelorMittal (Luxembourg)

Latest Developments in Global Steel Rebar Market

- In November 2023, Nippon Steel announced its plans to acquire stakes in iron ore and coking coal. This is to ensure the uninterrupted supply of raw materials such as iron ore and coking coal and prevent the losses from price fluctuations. Through this move, the company plans to acquire 20% stake in Teck Resources for coal unit.

- In August 2023, JSW Steel announced plans to expand its long steel product capacity in response to rising infrastructure demand, aiming to grow its current 28% share of total capacity dedicated to long steel to 35% in the coming years.

- In November 2022. Commercial Metals Company has completed the acquisition of a Galveston area metals recycling facility and related assets from Kodiak Resources, Inc. and Kodiak Properties, LLC (US).

- In September 2022, NLMK Group signed an agreement with NLMK Belgium Holding (NBH) to integrate NLMK Dansteel ('Dansteel') into NBH.

- In June 2022, Nucor Corporation announced the acquisition of Summit Utility Structures LLC and a related company. Sovereign Steel Manufacturing LLC,

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Steel Rebar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Steel Rebar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Steel Rebar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.