Global Starch Recovery Systems Market

Market Size in USD Million

CAGR :

%

USD

352.82 Million

USD

550.35 Million

2024

2032

USD

352.82 Million

USD

550.35 Million

2024

2032

| 2025 –2032 | |

| USD 352.82 Million | |

| USD 550.35 Million | |

|

|

|

|

Starch Recovery Systems Market Size

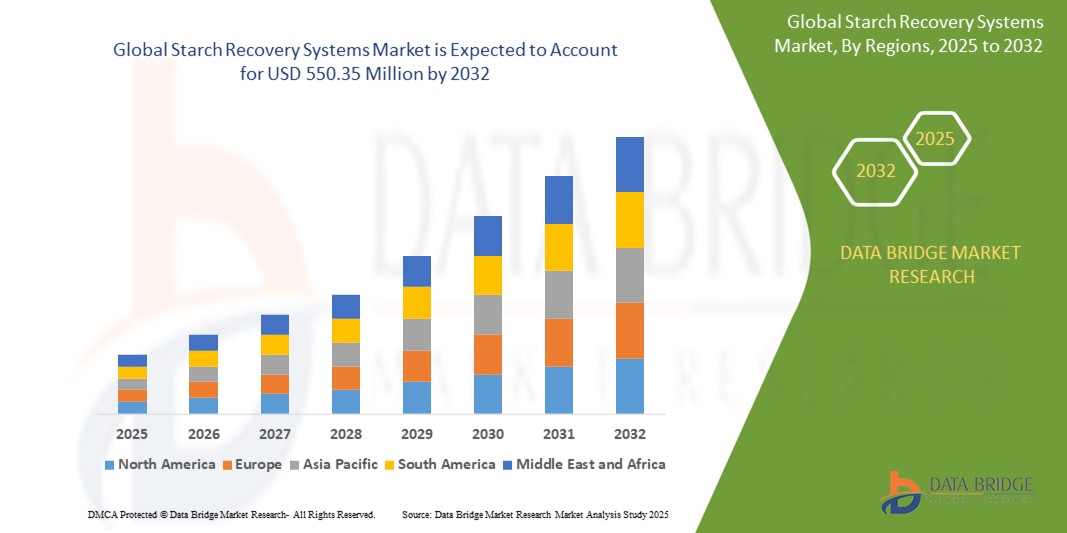

- The Global Starch Recovery Systems Market size was valued at USD 352.82 Million in 2024 and is expected to reach USD 550.35 Million by 2032, at a CAGR of 3.5% during the forecast period

- This growth is primarily fueled by Growing of the potato processing industry around the world is boosting the demand for the growth for starch recovery systems market. Moreover, fluctuating acceptance of starch and its derivatives for food nutrition is also contemplated to impact the starch recovery systems market immensely.

Starch Recovery Systems Market Analysis

- Starch is a carbohydrate is adopted from agricultural raw materials which are extensively present in food and non-food implementations. It is a essential carbohydrate in the human diet. When potatoes are sliced or cut, the potato cells release white potato starch.

- The growth of the potato processing industry and the growing capability for environment-friendly procedure are escalating the growth of starch recovery system market demand. The growing need for processed potato products has concluded in the growth of potato processing plants; this demand is boosting the starch recovery system market for starch recovery systems.

- North America dominates the global market with a 35.18% share in 2025, driven by demand from the pharmaceutical, food, and chemical sectors for automated, hygienic processing. Advanced infrastructure, Industry 4.0 adoption, and strict FDA/EPA norms fuel innovation and market leadership.

- Asia-Pacific is the fastest-growing region in the global Starch Recovery Systems market, projected to register a robust CAGR of over 7.8% through 2025, driven by expanding food processing industries and growing awareness of sustainable manufacturing practices.

- In 2025, Hydrocyclones dominate the starch recovery systems market with over 35% market share, owing to their high efficiency in separating starch from process water, low maintenance, and compact design. They are widely used in potato and cassava starch processing plants.

Report Scope and Starch Recovery Systems Market Segmentation

|

Attributes |

Starch Recovery Systems Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Starch Recovery Systems Market Trends

“Integration of Energy-Efficient and Sustainable Processing Technologies”

- A prominent trend in the Global Starch Recovery Systems Market is the shift toward energy-efficient and environmentally sustainable processing technologies to meet strict regulatory requirements and corporate ESG goals.

- Manufacturers are increasingly adopting low-energy centrifuges, optimized hydrocyclones, and high-efficiency decanters designed to recover more starch with minimal energy and water usage, particularly in potato and corn processing industries.

For instance,

- In March 2024, Flottweg SE introduced its new “E-Decanter Series,” featuring energy-saving drives and enhanced separation efficiency, cutting power consumption by up to 20% while improving starch yield.

- These advancements enable processors to lower operational costs, reduce carbon footprint, and align with global climate action initiatives, giving companies a competitive edge in both developed and emerging markets.

Starch Recovery Systems Market Dynamics

Driver

“Rising Demand for Waste Reduction and Resource Optimization in Food Processing”

- Growing pressure on food processors to reduce raw material waste and maximize yield is significantly driving adoption of advanced starch recovery systems, especially in potato, cassava, and corn-based industries.

- Companies are increasingly installing systems with high recovery rates, minimal water usage, and low energy consumption to improve overall process efficiency and sustainability

For instance,

- In August 2023, GEA Group launched a modular starch recovery solution tailored for snack and chips manufacturers, capable of recovering over 90% of starch from wash water, significantly lowering waste disposal costs and improving ROI

- With mounting environmental regulations and the need to cut operational costs, resource-efficient starch recovery solutions are becoming essential for competitive and compliant food production.

Restraint/Challenge

“High Capital Investment and Operational Complexity”

- One of the key challenges limiting wider adoption of starch recovery systems is the high upfront cost associated with advanced equipment, installation, and integration—especially for small and mid-sized processors in developing economies.

- Additionally, these systems require skilled operators, regular maintenance, and precise calibration to ensure efficiency, which adds to long-term operational costs and complexity.

For instance,

- In December 2023, a mid-sized snack food processor in Southeast Asia postponed its starch recovery system upgrade citing high installation costs and lack of trained technical staff, impacting its resource optimization goals.

- The combination of high CapEx and skill shortages acts as a barrier for new entrants and limits market penetration in cost-sensitive regions, slowing overall market growth.

Starch Recovery Systems Market Scope

The market is segmented on the basis of component, plant size, and application.

- By component

On the basis of component, the starch recovery systems are segmented into refining sieves, hydrocyclones and centrifuges, vacuum filters, screw conveyors, and filling stations. In 2025, Hydrocyclones dominate the starch recovery systems market with over 35% market share, owing to their high efficiency in separating starch from process water, low maintenance, and compact design. They are widely used in potato and cassava starch processing plants.

Centrifuges are the fastest-growing segment, projected to grow at a CAGR of around 7.5% due to increasing demand for high-purity starch recovery, automation compatibility, and their suitability for continuous, high-capacity industrial applications in food and pharmaceutical sectors.

- By plant size

On the basis of plant size, the starch recovery systems are segmented into large, medium, and small. Large plants dominate the starch recovery systems market due to their high processing capacity, better ROI, and greater adoption of advanced technologies. They are widely preferred by large-scale food and beverage manufacturers aiming for efficiency and sustainability.

Medium-sized plants are the fastest-growing segment as mid-tier manufacturers increasingly invest in semi-automated, cost-effective starch recovery solutions to reduce waste and comply with environmental regulations. These plants balance affordability and performance, driving significant adoption in emerging economies.

- By application

On the basis of application, the starch recovery systems are segmented into frozen products, chips and snack pellets, dehydrated products, others. The chips and snack pellets segment dominate the starch recovery systems market due to the high volume of starch-rich wastewater generated during cutting and frying processes. Efficient recovery reduces waste, improves yield, and supports sustainability in large-scale snack production.

Frozen products are the fastest-growing segment, driven by rising global demand for frozen convenience foods. Manufacturers are adopting starch recovery systems to minimize processing losses, enhance water reuse, and comply with strict hygiene and environmental standards in frozen food facilities.

Starch Recovery Systems Market Regional Analysis

- North America dominates the global market with a 35.18% share in 2025, driven by demand from the pharmaceutical, food, and chemical sectors for automated, hygienic processing. Advanced infrastructure, Industry 4.0 adoption, and strict FDA/EPA norms fuel innovation and market leadership.

- The region’s strong manufacturing infrastructure supports the seamless integration of advanced starch recovery systems, ensuring consistency, productivity, and compliance with stringent hygiene protocols across food and industrial processing units.

- Widespread adoption of Industry 4.0 technologies, such as IoT-enabled sensors and AI-based automation, enhances system control, predictive maintenance, and performance monitoring, improving starch recovery efficiency and operational decision-making.

U.S. Starch Recovery Systems Market Insight

The U.S. dominates the global starch recovery systems market in 2025 with a 13.7% share, driven by its advanced manufacturing infrastructure, strong demand for clean-label food, and significant investment in pharmaceutical and hygienic processing technologies.

Canada Starch Recovery Systems Market Insight

Canada’s market grows steadily, driven by rising food and pharma manufacturing. Government support for sustainable technologies and modernization enhances adoption of energy-efficient starch recovery systems, especially in healthcare, institutional, and environmentally conscious sectors seeking cleaner, cost-effective production methods.

Europe Starch Recovery Systems Market Insight

Europe holds a 27.9% share in 2024, propelled by stringent hygiene and emission norms. Demand is strong for automated, CIP-enabled systems in food, cosmetics, and chemical industries striving for carbon neutrality, resource efficiency, and compliance with evolving environmental regulations.

U.K. Starch Recovery Systems Market Insight

The U.K. market advances with closed-loop, high-shear technologies in food, beverage, and cosmetics. Growing emphasis on sustainability and cleaner manufacturing, alongside innovation funding, drives upgrades in processing equipment for quality assurance and environmental performance across production environments.

Germany Starch Recovery Systems Market Insight

Germany leads Europe in system innovation, with rising demand for sustainable, GMP-compliant starch processing. Strong environmental policies, skilled engineering expertise, and automation-driven production trends fuel investments in precision, hygienic, and energy-efficient mixing technologies for industrial and pharmaceutical use.

Asia Pacific Starch Recovery Systems Market Insight

Asia-Pacific is the fastest-growing region in the global Starch Recovery Systems market, projected to register a robust CAGR of over 7.8% through 2025, driven by expanding food processing industries and growing awareness of sustainable manufacturing practices.

China Starch Recovery Systems Market Insight

China is projected to hold a 21.1% market share in 2025, growing at a CAGR of 7.4%, fueled by rising processed food and pharmaceutical demand. Government incentives for green technologies and domestic equipment production support rapid market expansion.

Starch Recovery Systems Market Share

The Starch Recovery Systems Market is primarily led by well-established companies, including:

- SiccaDania (Denmark)

- Flottweg SE (Germany)

- ANDRITZ (Austria)

- GEA Group Aktiengesellschaft (Germany)

- ALFA LAVAL (Sweden)

- NivobaHovex B.V. (Netherlands)

- MICROTECH ENGINEERING GROUP PTY LTD. (Australia)

- Myande Group Co., Ltd. (China)

- Sino-Food Machinery Co., Ltd. (China)

- FLO-MECH (United Kingdom)

- Hiller Separation & Process (Germany)

- FLOTTWEG SE (Germany)

- Stamex Technology GmbH (Germany)

- HAUS Centrifuge Technologies (Turkey)

Latest Developments in Global Starch Recovery Systems Market

- In March 2025, Alfa Laval launched a next-gen decanter centrifuge optimized for starch recovery from potato and corn processing wastewater. The new unit improves solids separation, reduces water usage by 15%, and integrates advanced IoT features for predictive maintenance, aligning with sustainability and Industry 4.0 initiatives.

- In February 2025, GEA unveiled a suite of automation upgrades for starch recovery systems, including AI-based process control and clean-in-place (CIP) enhancements. The updates aim to increase system uptime, reduce manual intervention, and improve compliance with stringent hygiene standards in food and pharmaceutical production.

- In January 2025, Andritz announced a strategic partnership with Chinese manufacturers to localize production of starch recovery units. This move aims to meet China's growing demand efficiently while aligning with government incentives promoting domestic manufacturing and low-emission technologies in the food processing industry.

- In November 2024, SPX FLOW introduced modular, pre-engineered starch recovery skids for small to mid-sized food processing plants. The skids are designed for rapid installation and integration, offering flexibility, lower capital costs, and energy-efficient operations, catering to expanding markets in Southeast Asia and Eastern Europe.

- In October 2024, Tetra Pak piloted a new system for potato processors that enables near-zero starch loss during wastewater treatment. The pilot, conducted in the Netherlands, showed a 98% recovery rate and 12% reduction in energy use, signaling a shift toward more sustainable operations in snack manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Starch Recovery Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Starch Recovery Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Starch Recovery Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.