Global Sports Fishing Equipment Market Segmentation, By Product (Rods, Reels, Hooks, Lures, Lines, Rigs, Jig Heads, and Others), Application (Freshwater Fishing and Saltwater Fishing), Distribution Channel (Independent Sports Outlets, Franchised Sports Outlets, Modern Trade Channels, Direct to Consumer Brand Outlets, and Direct to Customer Online Channels), End Users (Individual Consumers, Clubs, and Sports Organizers) – Industry Trends and Forecast to 2031.

Sports Fishing Equipment Market Analysis

The sports fishing equipment market is witnessing significant growth due to advancements in materials such as carbon fiber and technology such as smart fishing rods and GPS-enabled fish finders. Innovations in sustainable practices and eco-friendly materials are also driving market expansion. Rising recreational fishing activities and increasing disposable income among enthusiasts further fuel growth.

Sports Fishing Equipment Market Size

The global sports fishing equipment market size was valued at USD 4.99 billion in 2023 and is projected to reach USD 6.57 billion by 2031, with a CAGR of 3.5% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and consumer behaviour.

Report Scope and Market Segmentation

|

Attributes

|

Sports Fishing Equipment Key Market Insights

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016- 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (Rods, Reels, Hooks, Lures, Lines, Rigs, Jig Heads, and Others), Application (Freshwater Fishing and Saltwater Fishing), Distribution Channel (Independent Sports Outlets, Franchised Sports Outlets, Modern Trade Channels, Direct to Consumer Brand Outlets, and Direct to Customer Online Channels), End Users (Individual Consumers, Clubs, and Sports Organizers)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

|

Market Players Covered

|

Eagle Claw (U.S.), Newell Brands (U.S.), OKUMA FISHING TACKLE CO., LTD. (China), Pure Fishing, Inc. (U.S.), St. Croix Rods (U.S.), SHIMANO INC. (Japan), MOONSHINE ROD COMPANY (U.S.), AFTCO (U.S.), TICA FISHING TACKLE (China), GLOBERIDE, Inc.(Japan), O. Mustad & Son AS (Norway), KISTLER Fishing (U.S.), Pride Rods (U.S.), and Rapala VMC Corporation (Finland)

|

|

Market Opportunities

|

|

Sports Fishing Equipment Market Definition

Sport fishing equipment includes rods, reels, lines, hooks, lures, and tackle boxes. These tools are designed to enhance the fishing experience by improving precision, control, and effectiveness. Advanced equipment may also include electronic fish finders and specialized gear for different types of fishing, such as fly fishing or deep-sea fishing, tailored to specific fish species and environments.

Sports Fishing Equipment Market Dynamics

Drivers

- Rising Recreational Fishing Popularity

The rising popularity of recreational fishing has significantly boosted the demand for specialized equipment such as rods, reels, and tackle boxes. For instance, the surge in fishing licenses issued in states such as Florida and California reflects this growing interest. This trend drives the market, as more enthusiasts invest in quality gear to enhance their fishing experience, leading to increased sales and innovation in the sports fishing equipment industry.

- Increasing Fishing Tourism

Increasing fishing tourism significantly drives the sports fishing equipment market. Destinations such as Florida and the Great Lakes region offer guided fishing tours and charters, attracting numerous tourists. For instance, Alaska’s renowned salmon fishing tours draw anglers worldwide, boosting the demand for high-quality rods, reels, and tackle. This surge in fishing tourism directly impacts the market, as tourists often purchase or rent specialized gear for their fishing expeditions.

Opportunities

- Online Retail Growth

Online retail growth creates significant opportunities in the sports fishing equipment market. E-commerce platforms such as Amazon and specialized stores such as Bass Pro Shops provide easy access to diverse fishing gear, reaching a global audience. For instance, a local fishing brand can now sell high-quality rods and reels to customers worldwide, increasing their market presence and revenue. This accessibility fosters competition and innovation, benefiting both consumers and manufacturers.

- Advancement in Technology

Technological advancements such as GPS fish finders and advanced rod materials create significant opportunities in the sports fishing equipment market. For instance, GPS-enabled fish finders such as the Garmin Striker series allow anglers to locate fish with high precision, enhancing their success rates. Additionally, rods made from advanced materials such as carbon fiber offer improved sensitivity and strength, attracting more enthusiasts and driving sales. These innovations cater to both amateur and professional anglers, expanding the market.

Restraints/Challenges

- Rising Overfishing Concerns

Rising overfishing concerns can lead to stringent regulations and reduced fishing activity, which negatively impacts the demand for sports fishing equipment. As awareness of overfishing increases, restrictions on fishing practices and catch limits are enforced, leading to fewer opportunities for recreational fishing. This reduced activity can diminish the market for fishing gear, as fewer consumers engage in the sport or require new equipment.

- Competition from Alternative Recreational Activities

The rising popularity of alternative recreational activities, such as hiking, cycling, and water sports, diverts potential customers from sports fishing. This shift in interest reduces the market demand for fishing equipment. As more individuals opt for diverse leisure pursuits, sports fishing faces declining participation rates, which hampers market growth and affects the overall sales and revenue of fishing equipment manufacturers and retailers.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In October 2020, Kistler Rods announced the launch of their Kistler GRAPHITE rods, priced at USD 150 each. These rods, known for their handcrafted quality, come with a one-year replacement warranty. They are appreciated by anglers for their sensitivity, durability, and ease of handling, enhancing fishing performance

- In December 2020, Catch Co., a digital sportfishing platform, secured USD 6 million in funding led by Listen Ventures. This investment will support new product developments and the launch of Karl's Bait & Tackle's e-Commerce site. Catch Co. aims to create exceptional fishing brands and shopping experiences for modern anglers

Sports Fishing Equipment Market Scope

The market is segmented on the basis of product, application, distribution channel and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Rods

- Reels

- Hooks

- Lures

- Lines

- Rigs

- Jig Heads

- Others

Application

- Freshwater Fishing

- Saltwater Fishing

Distribution Channel

- Independent Sports Outlets

- Franchised Sports Outlets

- Modern Trade Channels

- Direct to Consumer Brand Outlets

- Direct to Customer Online Channels

End Users

- Individual Consumers

- Clubs

- Sports Organizers

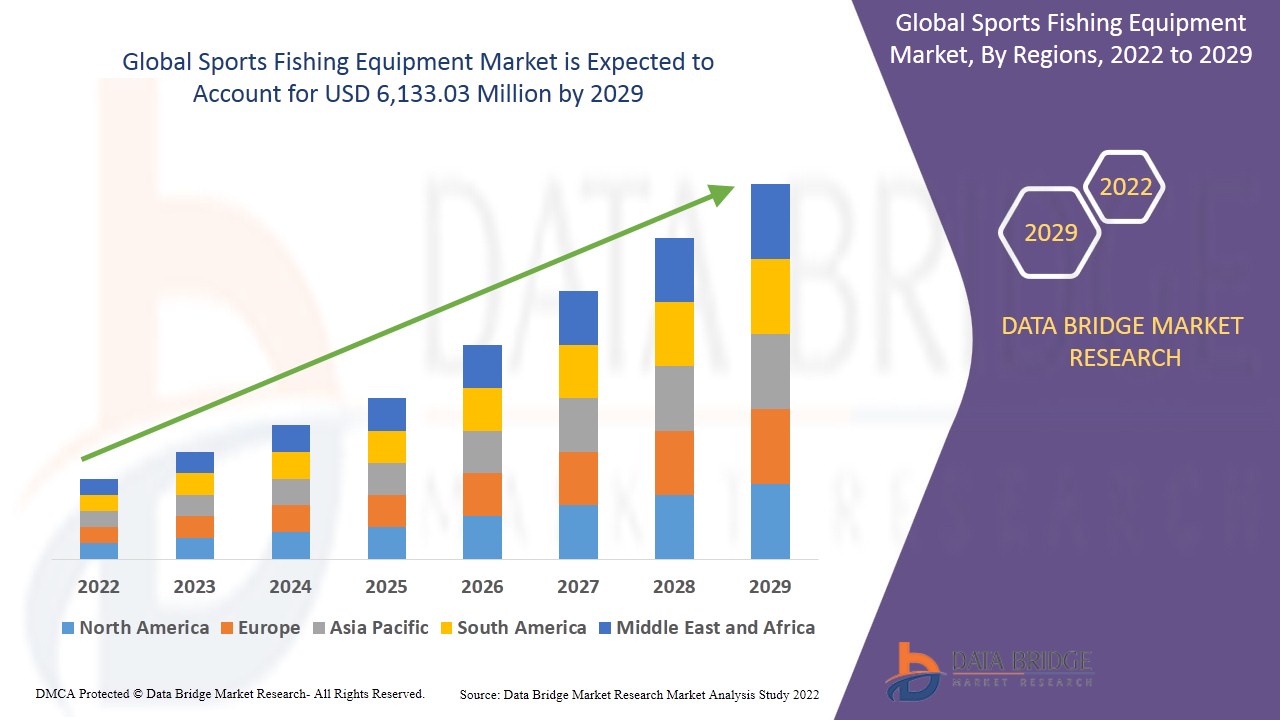

Sports Fishing Equipment Market Regional Analysis

The market is analyzed and market size insights and trends are provided by product, application, distribution channel and end users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the sports fishing equipment market due to its strong demand for fishing sports and substantial expenditure on related gear. The region’s rich fishing culture, sports direct fishing equipment, and high disposable income contribute to this trend, driving growth in both recreational and competitive fishing sectors.

Asia-Pacific is estimated to register a significant growth in the sports fishing equipment market due to the booming fishing industry and rising fish consumption in the region. Increasing recreational fishing activities and expanding coastal populations are driving demand, fostering market expansion and innovation in sports fishing gear across Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Sports Fishing Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- Eagle Claw (U.S.)

- Newell Brands (U.S.)

- OKUMA FISHING TACKLE CO., LTD. (China)

- Pure Fishing, Inc. (U.S.)

- St. Croix Rods (U.S.)

- SHIMANO INC. (Japan)

- MOONSHINE ROD COMPANY (U.S.)

- AFTCO (U.S.)

- TICA FISHING TACKLE (China)

- GLOBERIDE, Inc.(Japan)

- O. Mustad & Son AS (Norway)

- KISTLER Fishing (U.S.)

- Pride Rods (U.S.)

- Rapala VMC Corporation (Finland)

SKU-