Global Spectroscopy Equipment And Accessories Market

Market Size in USD Billion

CAGR :

%

USD

13.71 Billion

USD

21.63 Billion

2025

2033

USD

13.71 Billion

USD

21.63 Billion

2025

2033

| 2026 –2033 | |

| USD 13.71 Billion | |

| USD 21.63 Billion | |

|

|

|

|

Spectroscopy Equipment and Accessories Market Size

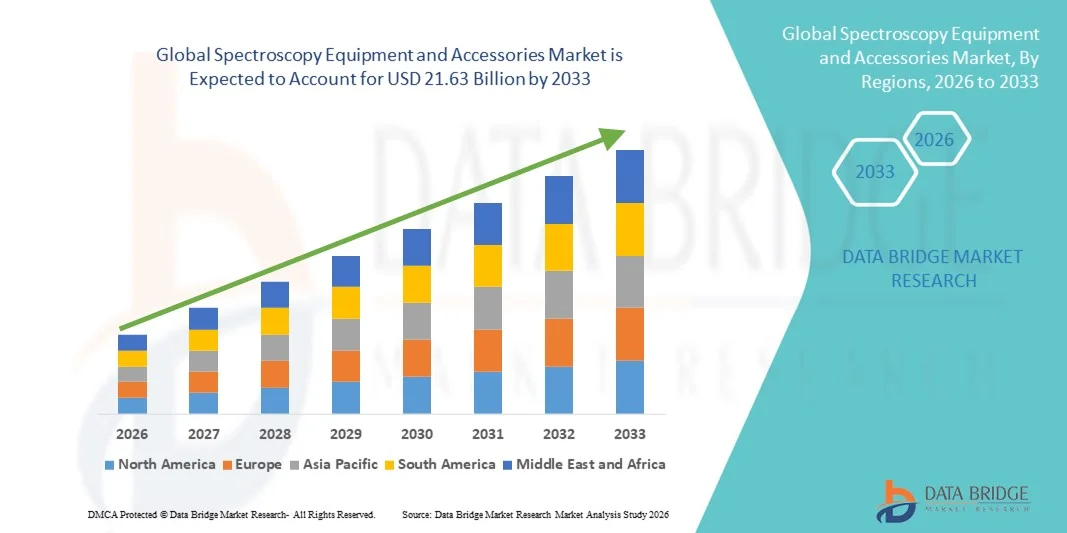

- The global spectroscopy equipment and accessories market size was valued at USD 13.71 billion in 2025 and is expected to reach USD 21.63 billion by 2033, at a CAGR of 5.87% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced analytical technologies across pharmaceutical, biotechnology, chemical, and academic research sectors, along with continuous technological advancements in spectroscopy systems, leading to higher accuracy, sensitivity, and automation in analytical workflows

- Furthermore, rising demand for precise, rapid, and non-destructive analytical solutions for material characterization, drug development, quality control, and environmental testing is establishing spectroscopy equipment and accessories as essential tools across industries. These converging factors are accelerating the uptake of Spectroscopy Equipment and Accessories solutions, thereby significantly boosting the industry’s growth

Spectroscopy Equipment and Accessories Market Analysis

- Spectroscopy equipment and accessories, which enable precise qualitative and quantitative analysis of chemical, biological, and material samples, are increasingly vital components of modern laboratory and industrial workflows across pharmaceuticals, biotechnology, chemicals, food & beverages, and academic research due to their high accuracy, sensitivity, and non-destructive testing capabilities

- The escalating demand for spectroscopy equipment and accessories is primarily fueled by the growing focus on drug discovery and development, increasing adoption of advanced analytical techniques, stringent regulatory requirements for quality control, and rising investments in research and development across multiple end-use industries

- North America dominated the spectroscopy equipment and accessories market with the largest revenue share of approximately 37.8% in 2025, supported by a strong research infrastructure, high adoption of advanced analytical instruments, substantial R&D spending, and the presence of leading market players, with the U.S. accounting for the majority of regional demand due to extensive use in pharmaceuticals, biotechnology, and academic research

- Asia-Pacific is expected to be the fastest-growing region in the spectroscopy equipment and accessories market during the forecast period, registering a high growth rate driven by expanding pharmaceutical and biotechnology industries, increasing government funding for scientific research, rapid industrialization, and growing adoption of advanced laboratory technologies in countries such as China, India, and Japan

- The medicine segment accounted for the largest market revenue share of approximately 38.9% in 2025, driven by the widespread use of spectroscopy techniques in disease diagnosis, drug development, and therapeutic monitoring

Report Scope and Spectroscopy Equipment and Accessories Market Segmentation

|

Attributes |

Spectroscopy Equipment and Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Spectroscopy Equipment and Accessories Market Trends

Advancements in Analytical Precision and Portable Spectroscopy Technologies

- A significant and accelerating trend in the global spectroscopy equipment and accessories market is the growing emphasis on enhancing analytical precision, sensitivity, and speed across a wide range of applications, including pharmaceuticals, environmental testing, food safety, materials science, and life sciences. Continuous advancements in optical components, detectors, and software integration are enabling more accurate and reproducible spectroscopic measurements, supporting critical research and quality control processes

- For instance, in March 2023, Bruker Corporation introduced advancements to its Fourier Transform Infrared (FTIR) spectroscopy systems, improving spectral resolution and data acquisition speed for pharmaceutical and polymer analysis. Such developments highlight the industry’s focus on delivering high-performance analytical tools that meet increasingly stringent regulatory and research requirements

- The rising adoption of portable and handheld spectroscopy instruments is another key trend reshaping the market, as end users seek rapid, on-site analysis without the need for centralized laboratory infrastructure. Portable Raman, NIR, and UV-Vis spectrometers are increasingly used in field-based applications such as environmental monitoring, forensic investigations, and raw material verification

- In addition, manufacturers are focusing on automation, intuitive software interfaces, and enhanced data processing capabilities to simplify complex analytical workflows. Advanced software platforms enable faster interpretation of spectral data, reduce operator dependency, and improve overall laboratory efficiency, particularly in high-throughput testing environments

- The integration of spectroscopy equipment with broader laboratory ecosystems, including laboratory information management systems (LIMS) and quality control platforms, is facilitating streamlined data management and regulatory compliance. This interconnected approach is becoming increasingly important for pharmaceutical and biotechnology companies operating under strict quality standards

- Overall, the trend toward more accurate, portable, and user-friendly spectroscopy solutions is redefining customer expectations, driving continuous innovation in both spectroscopy instruments and associated accessories such as probes, light sources, and sample handling components

Spectroscopy Equipment and Accessories Market Dynamics

Driver

Growing Demand from Pharmaceutical, Life Sciences, and Environmental Testing Applications

- The expanding use of spectroscopy equipment across pharmaceutical, biotechnology, and life sciences industries is a major driver of market growth, as these sectors increasingly rely on precise analytical techniques for drug development, quality assurance, and regulatory compliance

- For instance, in July 2024, Thermo Fisher Scientific expanded its spectroscopy portfolio with enhanced UV-Vis and Raman solutions, targeting pharmaceutical quality control and bioprocess monitoring applications. Such product developments underscore the rising demand for advanced analytical instrumentation in regulated environments

- Increasing global focus on environmental monitoring and food safety testing is further accelerating adoption of spectroscopy equipment. Governments and regulatory agencies worldwide are enforcing stricter standards for pollution control, contaminant detection, and food quality assessment, driving the need for reliable and rapid analytical tools

- The growing emphasis on research and development activities across academic institutions and industrial laboratories is also contributing to sustained market demand. Spectroscopy techniques play a critical role in materials characterization, chemical analysis, and nanotechnology research, making them indispensable in both fundamental and applied science

- Furthermore, technological advancements that reduce analysis time, improve accuracy, and lower operational complexity are making spectroscopy equipment more accessible to a broader range of end users, including small laboratories and field-based operations

Restraint/Challenge

High Capital Investment and Technical Complexity of Advanced Spectroscopy Systems

- The high initial cost associated with advanced spectroscopy equipment and accessories remains a significant challenge for market growth, particularly for small laboratories, academic institutions with limited funding, and end users in developing regions

- For instance, in November 2022, a report highlighted that several academic institutions in Southeast Asia delayed procurement of high-resolution NMR spectrometers due to budget constraints, despite urgent research needs. Sophisticated systems such as high-resolution mass spectrometers, nuclear magnetic resonance (NMR) spectrometers, and advanced Raman instruments require substantial capital investment, along with ongoing maintenance and calibration expenses, which can limit adoption

- In addition, the technical complexity of spectroscopy techniques presents a barrier for users lacking specialized training. Accurate operation, data interpretation, and troubleshooting often require skilled personnel, increasing operational costs and slowing deployment in resource-constrained settings

- Sample preparation requirements and sensitivity to environmental conditions can further complicate analysis, particularly in field-based or high-throughput applications. These factors may reduce efficiency and increase the risk of measurement variability if not properly managed

- While manufacturers are addressing these challenges through user-friendly software, training programs, and modular system designs, overcoming cost and complexity barriers remains critical for broader market penetration

- Continued innovation aimed at affordability, ease of use, and scalability will be essential for sustained growth of the Spectroscopy Equipment and Accessories market

Spectroscopy Equipment and Accessories Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Global Spectroscopy Equipment and Accessories market is segmented into Molecular Spectroscopy Equipment, Atomic Spectroscopy Equipment, Mass Spectroscopy Equipment, Molecular Spectroscopy Supplies, Atomic Spectroscopy Supplies, and Mass Spectroscopy Supplies. The molecular spectroscopy equipment segment dominated the largest market revenue share of around 34.6% in 2025, driven by its extensive use across pharmaceutical, biotechnology, chemical, and academic research laboratories. Techniques such as UV-Vis, IR, and NMR spectroscopy are widely adopted for compound identification, structural analysis, and quality control, making molecular spectroscopy indispensable in routine and advanced research workflows. The growing emphasis on drug discovery, protein characterization, and material science has further reinforced demand for molecular spectroscopy systems. Continuous technological advancements, including higher sensitivity detectors, automation, and integration with data analytics software, have enhanced efficiency and reproducibility. In addition, rising government and private investments in life sciences research and expanding laboratory infrastructure in emerging economies have supported segment dominance. The availability of a wide range of instruments across price points also makes molecular spectroscopy accessible to small and mid-scale laboratories. These factors collectively contributed to its leadership position in 2025.

The mass spectroscopy equipment segment is expected to witness the fastest growth, registering a CAGR of approximately 9.8% from 2026 to 2033. This rapid growth is attributed to increasing adoption in proteomics, metabolomics, clinical diagnostics, and environmental testing. Mass spectrometry offers high accuracy, sensitivity, and the ability to analyze complex biological samples, making it critical for precision medicine and biomarker discovery. Growing demand for advanced analytical techniques in pharmaceutical R&D and quality assurance is further accelerating uptake. Technological innovations such as hybrid mass spectrometers, miniaturized systems, and improved ionization techniques are expanding application scope. In addition, rising investments in omics research and increasing collaborations between academia and industry are boosting adoption. The expanding role of mass spectrometry in clinical and forensic laboratories also supports strong future growth.

- By Application

On the basis of application, the Global Spectroscopy Equipment and Accessories market is segmented into Medicine, Biological Research, Agriculture and Food, Physical Sciences, and Others. The medicine segment accounted for the largest market revenue share of approximately 38.9% in 2025, driven by the widespread use of spectroscopy techniques in disease diagnosis, drug development, and therapeutic monitoring. Spectroscopy plays a crucial role in clinical chemistry, molecular diagnostics, and pharmaceutical quality control, supporting accurate and rapid analysis. The rising prevalence of chronic diseases, growing demand for personalized medicine, and increasing clinical research activities have significantly boosted adoption. Hospitals and diagnostic laboratories increasingly rely on spectroscopy for biomarker detection, toxicology studies, and therapeutic drug monitoring. Regulatory emphasis on drug safety and quality has further strengthened demand from pharmaceutical manufacturers. Moreover, continuous advancements in medical spectroscopy instruments, including improved resolution and automation, have enhanced workflow efficiency. These factors collectively positioned medicine as the leading application segment in 2025.

The biological research segment is projected to register the fastest growth, with a CAGR of around 10.4% from 2026 to 2033. This growth is driven by expanding research in genomics, proteomics, metabolomics, and structural biology. Spectroscopy is extensively used for protein characterization, molecular interaction studies, and cellular analysis, making it essential in modern biological research. Increasing funding for academic and government research programs, particularly in life sciences, is accelerating demand. The rapid expansion of biotechnology startups and contract research organizations is also contributing to segment growth. In addition, integration of spectroscopy with advanced imaging and data analytics tools is improving research capabilities. Growing focus on fundamental biological studies and translational research is expected to sustain strong growth throughout the forecast period.

Spectroscopy Equipment and Accessories Market Regional Analysis

- North America dominated the spectroscopy equipment and accessories market with the largest revenue share of approximately 37.8% in 2025. The region’s leadership is supported by a strong research infrastructure, high adoption of advanced analytical instruments, substantial R&D spending, and the presence of leading market players

- The market accounted for the majority of regional demand due to extensive utilization of spectroscopy equipment in pharmaceuticals, biotechnology, chemical analysis, and academic research institutions

- The adoption is further bolstered by a large base of established laboratories, advanced healthcare and life sciences infrastructure, and favorable government funding for scientific research and innovation. North American laboratories are increasingly investing in high-resolution spectrometers, portable spectroscopy solutions, and automated analytical platforms to improve efficiency and accuracy in R&D and quality control applications

U.S. Spectroscopy Equipment and Accessories Market Insight

The U.S. spectroscopy equipment and accessories market captured the largest revenue share in North America in 2025, driven by widespread adoption of spectroscopy equipment in pharmaceutical testing, biotechnology research, and environmental analysis. Continuous advancements in instrument sensitivity, miniaturization, and software integration have fueled demand in both industrial and academic sectors. The presence of key players, coupled with strong research collaborations, ensures the U.S. remains a dominant market globally.

Europe Spectroscopy Equipment and Accessories Market Insight

The Europe spectroscopy equipment and accessories market is projected to witness substantial growth throughout the forecast period, fueled by stringent regulatory frameworks for pharmaceuticals, chemicals, and environmental monitoring. Increasing urbanization, the expansion of research and testing facilities, and adoption of high-performance analytical instruments across Germany, the U.K., and France are driving demand. The region is also witnessing growth in academic research, industrial R&D, and clinical laboratories.

U.K. Spectroscopy Equipment and Accessories Market Insight

The U.K. spectroscopy equipment and accessories market is anticipated to grow at a notable CAGR during the forecast period, supported by increasing investments in pharmaceutical R&D, environmental monitoring, and academic research. The country’s robust research ecosystem, combined with government support for innovation and scientific development, continues to stimulate market expansion.

Germany Spectroscopy Equipment and Accessories Market Insight

Germany spectroscopy equipment and accessories market is expected to expand at a considerable CAGR due to increasing awareness of advanced laboratory technologies, emphasis on sustainable and eco-conscious analytical solutions, and strong industrial and academic research infrastructure. The integration of high-resolution spectroscopy systems in chemical, pharmaceutical, and environmental laboratories is increasingly prevalent.

Asia-Pacific Spectroscopy Equipment and Accessories Market Insight

Asia-Pacific spectroscopy equipment and accessories market is expected to be the fastest-growing region during the forecast period, driven by rapid industrialization, expanding pharmaceutical and biotechnology sectors, and increasing government funding for scientific research. Countries such as China, India, and Japan are witnessing growing adoption of advanced laboratory technologies, including mass spectrometry, NMR, Raman, and portable spectroscopy systems. Increasing healthcare access, rising disease burden, and the development of industrial R&D hubs are encouraging the purchase of spectroscopy instruments. APAC is also emerging as a manufacturing base for laboratory equipment, making instruments more affordable and accessible to a broader customer base.

Japan Spectroscopy Equipment and Accessories Market Insight

The Japanese spectroscopy equipment and accessories market is gaining momentum due to the country’s high-tech research culture, increasing focus on industrial R&D, and strong emphasis on precision and quality in analytical laboratories. The aging population is further driving demand for pharmaceutical testing and biomedical research applications.

China Spectroscopy Equipment and Accessories Market Insight

China spectroscopy equipment and accessories market accounted for the largest market revenue share in Asia-Pacific in 2025, owing to rapid industrialization, expanding pharmaceutical and biotechnology industries, strong government support for research, and increasing adoption of advanced laboratory technologies. The push towards scientific innovation, growing number of research institutions, and development of affordable, high-quality spectroscopy systems are key factors propelling growth.

Spectroscopy Equipment and Accessories Market Share

The Spectroscopy Equipment and Accessories industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Agilent Technologies (U.S.)

- PerkinElmer (U.S.)

- Bruker Corporation (U.S.)

- Shimadzu Corporation (Japan)

- Waters Corporation (U.S.)

- JEOL Ltd. (Japan)

- Hitachi High-Technologies Corporation (Japan)

- HORIBA, Ltd. (Japan)

- Metrohm AG (Switzerland)

- Analytik Jena AG (Germany)

- Bio-Rad Laboratories (U.S.)

- Oxford Instruments plc (U.K.)

- Spectro Analytical Instruments GmbH (Germany)

- Malvern Panalytical Ltd. (U.K.)

- Anton Paar GmbH (Austria)

- Rigaku Corporation (Japan)

- LECO Corporation (U.S.)

Latest Developments in Global Spectroscopy Equipment and Accessories Market

- In November 2021, PerkinElmer, Inc. introduced the Avio 560 and NexION 5000 Multi-Quadrupole ICP-MS systems, offering enhanced elemental analysis and ultratrace detection capabilities, designed to improve precision in chemical, pharmaceutical, and environmental laboratories. These instrument launches underscored industry focus on higher throughput and accuracy in atomic spectroscopy workflows shortly after the pandemic period, addressing growing analytical demands

- In June 2023, Thermo Fisher Scientific Inc. introduced the Thermo Scientific Orbitrap Astral mass spectrometer, designed for high-performance proteomics and biomarker discovery, offering researchers improved sensitivity and analytical depth for complex biological samples used across pharmaceutical development and clinical research. This launch marked a significant upgrade in hybrid mass spectrometry capabilities

- In June 2024, Shimadzu unveiled a new series of LC-MS triple quadrupole mass spectrometers featuring enhanced gas flow and optimized nebulizer alignment to deliver improved sensitivity and analytical reliability across applications such as drug testing, food safety, and environmental analysis. These launches reflect ongoing enhancements in mass spectroscopy platforms

- In June 2024, ABB Group and Yokogawa Electric Corporation launched a modular process spectroscopy platform with seamless Distributed Control System (DCS) integration, enabling real-time in-line spectroscopy for industrial production monitoring, particularly in pulp, paper, and other process industries where continuous quality control is critical. This development illustrates the extension of spectroscopy beyond traditional labs into industrial environments

- In October 2024, Horiba Scientific announced the launch of its RamanPro 200 handheld Raman spectrometer, focusing on rapid field identification of chemical compounds and pharmaceutical materials, significantly enhancing portable spectroscopy capabilities for on-site research and quality assessments. This launch demonstrates the market’s push toward portable and versatile solutions

- In February 2025, Thermo Fisher Scientific launched a battery-optimized portable Raman spectrometer with a 12‑hour runtime designed for extended field use, improving adoption in pharmaceutical quality control and environmental testing across Europe and other regions

- In May 2025, Analytik Jena secured a multi‑site contract with a leading global pharmaceutical company to supply portable Raman and UV‑Vis spectrometers for on‑site quality control and active pharmaceutical ingredient screening, indicating strong industry demand for decentralized spectroscopy solutions

- In June 2025, Thermo Fisher Scientific announced the launch of the Orbitrap Astral Zoom MS and Orbitrap Excedion Pro MS at the American Society for Mass Spectrometry (ASMS) conference; these next‑generation mass spectrometers delivered faster scan speeds, higher throughput, and greater multiplexing capabilities, enhancing proteomics research and complex sample analysis

- In April 2025, Bruker Corporation introduced the timsOmni an advanced instrument combining trapped ion mobility spectrometry (timsTOF) with Omnitrap functionality, providing unmatched proteoform analysis and broadening the scope of high‑resolution mass spectrometry applications in biopharma and life sciences research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.