Global Specialty Feed Additives Market, By Source (Natural, and Synthetic), Type (Vitamins, Antioxidants, Amino Acids, Feed Enzymes, Feed Acidifiers, Phosphates, Carotenoids, Mycotoxin Detoxifiers, Flavors and Sweeteners, Minerals, Non-Protein Nitrogen, Phytogenics, Preservatives, Probiotics, and Other Products), Form (Liquid Feed, Dry Feed, and Others), Function (Palatability Enhancement, Mycotoxin Management, Ingredient Preservation, Digestive Performance Enhancement, and Others), Livestock (Aquatic Animals, Poultry, Swine, Ruminants, and Others) – Industry Trends and Forecast to 2031.

Specialty Feed Additives Market Analysis and Size

The specialty feed additives market continues to surge with cutting-edge advancements and technologies, driving unprecedented growth. Utilizing the latest methods, such as precision nutrition and nanotechnology, manufacturers are enhancing animal health and performance. Insights reveal a shift towards sustainable and natural additives, meeting consumer demand for healthier livestock products while maintaining efficiency in feed utilization.

The global specialty feed additives market size was valued at USD 11.83 billion in 2023, is projected to reach USD 19.43 billion by 2031, with a CAGR of 6.40% during the forecast period 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Source (Natural, and Synthetic), Type (Vitamins, Antioxidants, Amino Acids, Feed Enzymes, Feed Acidifiers, Phosphates, Carotenoids, Mycotoxin Detoxifiers, Flavors and Sweeteners, Minerals, Non-Protein Nitrogen, Phytogenics, Preservatives, Probiotics, and Other Products), Form (Liquid Feed, Dry Feed, and Others), Function (Palatability Enhancement, Mycotoxin Management, Ingredient Preservation, Digestive Performance Enhancement, and Others), Livestock (Aquatic Animals, Poultry, Swine, Ruminants, and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

BASF SE (Germany), Novus International, Inc. (U.S.), Evonik Industries AG (Germany), DSM (Netherlands), Yara (Norway), Mosaic (U.S.), K+S Aktiengesellschaft (Germany), Compass Minerals (U.S.), Akzo Nobel N.V. (Sweden), Nutreco (Netherlands), Novozymes A/S (Denmark), Kemin Industries Inc. (U.S.), Brookside Agra (U.S.), Pancosma - an ADM brand (France), and Chr. Hansen Holdings A/S (Denmark)

|

|

Market Opportunities

|

|

Market Definition

Specialty feed additive are nutritional supplements formulated for specific needs in animal diets. These additives enhance feed quality, promote animal health, and optimize performance in areas such as digestion, immune function, and growth. They often contain vitamins, minerals, amino acids, enzymes, or probiotics tailored to address deficiencies or support particular physiological processes, ensuring optimal nutrition for livestock and pets.

Specialty Feed Additives Market Dynamics

Drivers

- Rising Demand for High-Quality Animal Products

Growing consumer demand for high-quality animal products is propelling the specialty feed additives market. With heightened awareness of nutrition's impact on meat, eggs, and dairy quality, producers are investing in additives that optimize animal health and performance. For instance, additives such as omega-3 fatty acids enhance the nutritional profile of eggs, meeting consumer preferences for healthier options. This trend incentivizes continuous innovation and investment in specialty feed additives to meet evolving consumer demands.

- Livestock Health and Disease Prevention

As antibiotic resistance concerns grow, stringent regulations on their use in livestock push the demand for alternative solutions such as probiotics, prebiotics, and organic acids. These specialty feed additives bolster gut health and immunity in animals, promoting disease prevention. For instance, the use of probiotics containing beneficial bacteria such as Lactobacillus and Bifidobacterium has shown promise in enhancing digestive health and reducing the need for antibiotics in livestock farming, driving market growth.

Opportunities

- Rising Meat Consumption and Production

The surge in global meat consumption propels livestock producers to enhance production efficiency. Specialty feed additives, such as growth promoters and enzymes, optimize feed conversion, bolster nutrient absorption, and expedite animal growth. For instance, enzymes break down complex feed components, maximizing nutrient utilization in livestock, ultimately amplifying productivity and profitability in the industry. This demand for efficiency-boosting additives fuels the growth of the specialty feed additives market.

- Technological Advancements and Product Innovation

Ongoing research and development in animal nutrition are revolutionizing the specialty feed additives market. Innovations in biotechnology, nanotechnology, and feed processing techniques are yielding additives with superior efficacy and safety. For instance, nanotechnology enables the development of nano-encapsulated nutrients for targeted delivery, maximizing absorption. These advancements not only enhance animal health and performance but also meet the growing demand for sustainable and efficient livestock production.

Restraints/Challenges

- Supply Chain Complexity

Supply chain complexity in the specialty feed additives market arises from the need for specialized ingredients and manufacturing processes. Dependency on specific raw materials increases vulnerability to supply disruptions, impacting production and distribution negatively.

- Resistance and Safety Concerns

Overuse or misuse of specialty feed additives can lead to microbial resistance and unintended side effects in livestock, hampering market growth. Addressing concerns related to antimicrobial resistance and ensuring product safety is essential to maintain consumer confidence.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In July 2023, Olmix bolstered its animal care portfolio through the acquisition of Yes Sinergy, signaling a strategic move for international expansion. This transaction positioned Olmix as a key provider of bio-sourced solutions, enhancing its competitiveness in the market

- In June 2023, Alltech introduced Triad, an innovative solution designed to bolster pig livability and optimize farrowing success. Comprising a proprietary blend of premium ingredients, Triad underscores Alltech's commitment to advancing animal health and welfare

- In May 2023, Kemin Food Technologies inaugurated BITEPod, a cutting-edge facility in Asia dedicated to driving food innovation. With a focus on prototyping and formulation enhancement, BITEPod strengthens Kemin's position as a leader in the food and beverage sector

- In December 2022, Adisseo Group finalized the acquisition of Nor-Feed and its subsidiaries, marking a strategic move to develop botanical additives for animal feed. This acquisition expands Adisseo's product portfolio and reinforces its commitment to advancing animal nutrition and welfare

- In October 2022, Evonik secured non-exclusive licensing rights to OpteinicsTM through a partnership with BASF, facilitating the adoption of digital solutions to improve sustainability in the animal protein and feed industries. This collaboration underscores Evonik's dedication to driving technological advancements and reducing environmental impact

Specialty Feed Additives Market Scope

The market is segmented on the basis of source, type, form, function and livestock. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Source

- Natural

- Synthetic

Type

- Vitamins

- Antioxidants

- Amino Acids

- Tryptophan

- Lysine

- Methionine

- Threonine

- Other Amino Acids

- Feed Enzymes

- Phytase

- Non-Starch Polysaccharides

- Other Feed Enzymes

- Feed Acidifiers

- Phosphates

- Carotenoids

- Mycotoxin Detoxifiers

- Flavors and Sweeteners

- Minerals

- Non-Protein Nitrogen

- Phytogenics, Preservatives

- Probiotics

- Other Products

Form

- Liquid Feed

- Dry Feed

- Others

Function

- Palatability Enhancement

- Mycotoxin Management

- Ingredient Preservation

- Digestive Performance Enhancement

- Others

Livestock

- Aquatic Animals

- Poultry

- Swine

- Ruminants

- Others

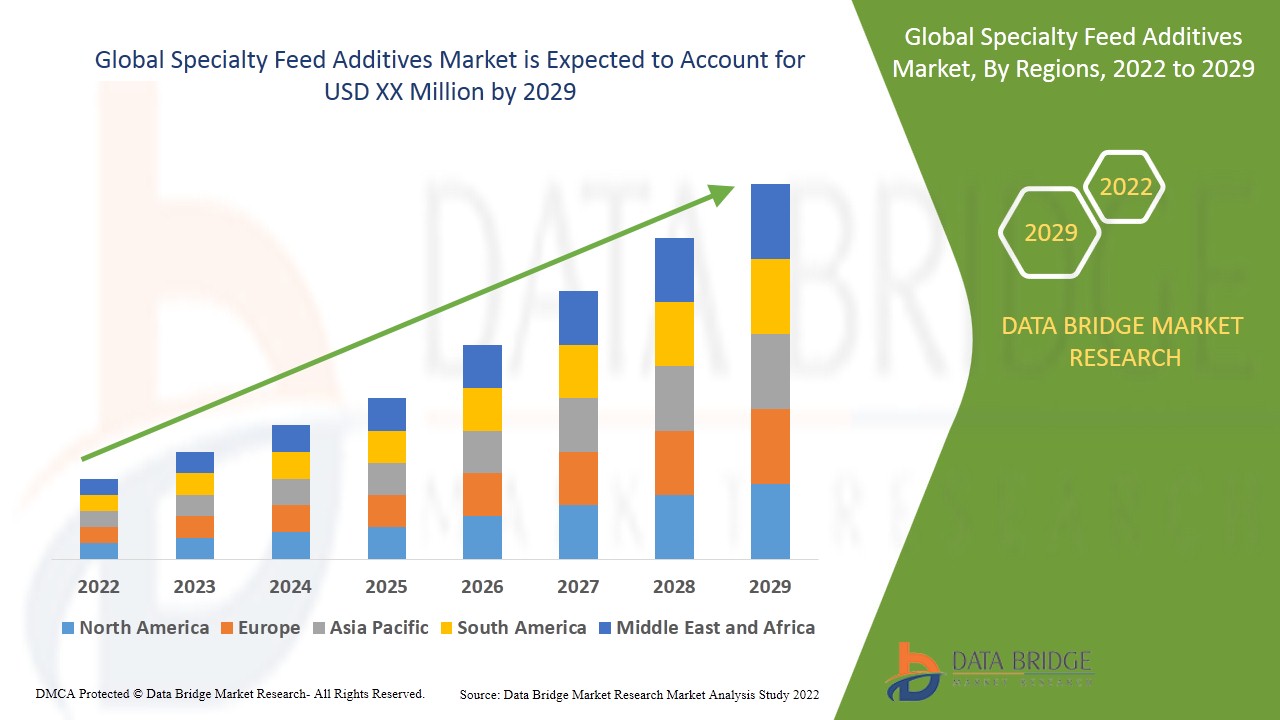

Specialty Feed Additives Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, source, type, form, function and livestock as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to witness high growth in the specialty feed additives market, propelled by progressive urbanization and rising demand for quality meat products in the region. This surge reflects evolving dietary preferences and the need for enhanced animal nutrition to meet consumer expectations.

North America is expected to dominate the specialty feed additives market due to heightened demand for animal products and rising disposable incomes in the region. This trend underscores the region's pivotal role in driving growth and innovation within the industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Specialty Feed Additives Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- BASF SE (Germany)

- Novus International, Inc. (U.S.)

- Evonik Industries AG (Germany)

- DSM (Netherlands)

- Yara (Norway)

- Mosaic (U.S.)

- K+S Aktiengesellschaft (Germany)

- Compass Minerals (U.S.)

- Akzo Nobel N.V. (Sweden)

- Nutreco (Netherlands)

- Novozymes A/S (Denmark)

- Kemin Industries Inc. (U.S.)

- Brookside Agra (U.S.)

- Pancosma - an ADM brand (France)

- Chr. Hansen Holdings A/S (Denmark)

SKU-