Global Soy Based Infant Formula Market, By Product Type (Stage 1, Stage 2, Stage 3, Stage 4, and Toddler Baby), Form (Powder, Liquid and Semi-Liquid), Type (Low Fat Soy-based Infant Formula and Whole-fat Soy-based Infant Formula), Application (0 to 3 Months, 4 to 7 Months, 8 to 11 Months, 12 to 23 Months, and 24 Months and Up), Distribution Channel (Online and Offline) – Industry Trends and Forecast to 2031.

Soy Based Infant Formula Market Analysis and Size

Soy-based infant formula is a crucial alternative for infants allergic to cow's milk protein or intolerant to lactose. The increasing prevalence of lactose intolerance and cow's milk protein allergy among infants drives the demand for alternative formula options. Soy-based infant formula is particularly favored by parents seeking a plant-based, non-dairy alternative. Globally, approximately 65.0% of the population is lactose intolerant, with Finland experiencing a notable impact, affecting 1 in 60,000 newborns and showing a rising trend. This underscores the importance of offering alternative formula options for infants with specific dietary needs.

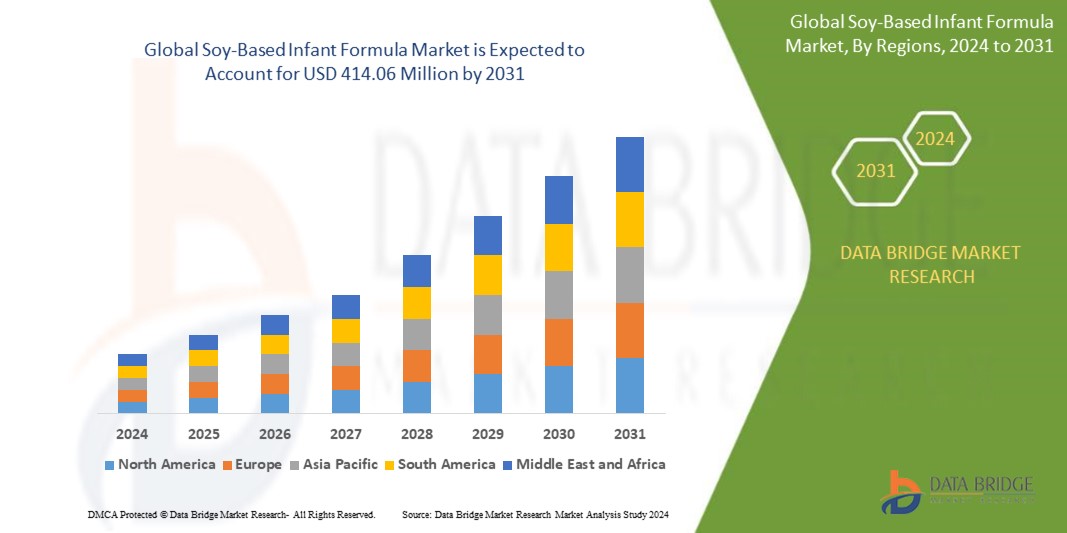

Global soy based infant formula market size was valued at USD 300.23 million in 2023 and is projected to reach USD 414.06 million by 2031, with a CAGR of 4.10% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016 - 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product Type (Stage 1, Stage 2, Stage 3, Stage 4, and Toddler Baby), Form (Powder, Liquid and Semi-Liquid), Type (Low Fat Soy-based Infant Formula and Whole-fat Soy-based Infant Formula), Application (0 to 3 Months, 4 to 7 Months, 8 to 11 Months, 12 to 23 Months, and 24 Months and Up), Distribution Channel (Online and Offline)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America

|

|

Market Players Covered

|

Nestlé (Switzerland), DANONE (France), Reckitt Benckiser Group PLC (U.K.), Abbott (U.S.), HiPP (Germany), The Kraft Heinz Company (U.S.), Hero Group (Switzerland), YILI.COM INC. (China), Kewpie Corporation (Japan), FrieslandCampina (Netherlands), Arla Foods amba (Denmark), The Honest Company, Inc. (U.S.), Woolworths Group Limited (Australia), Nutricia (U.S.), Mead Johnson & Company, LLC. (U.S.), Kerry Group plc. (Ireland), MyOrganicCo (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Soy-based infant formula is a type of formula made from soy protein isolate, which is derived from soybeans. It is designed to mimic the nutritional composition of breast milk and is used as an alternative to cow's milk-based formula for infants who are intolerant to lactose or have a cow's milk protein allergy. The soy-based formula contains essential nutrients such as protein, carbohydrates, fats, vitamins, and minerals, and is fortified to meet the specific nutritional needs of infants.

Soy Based Infant Formula Market Dynamics

- Increasing Incidence of Lactose Intolerance and Cow's Milk Protein Allergy

Lactose intolerance, characterized by the inability to digest lactose, the sugar found in milk, affects a significant portion of the global population. Similarly, cow's milk protein allergy, which can cause allergic reactions ranging from mild to severe, is increasingly recognized among infants. As more infants are diagnosed with these conditions, healthcare providers are recommending soy-based infant formula as a suitable substitute. Soy-based infant formula is lactose-free, driving the demand for soy-based infant formula as a safe and effective alternative.

- Growing Awareness about Plant-Based Diets

Consumers are increasingly seeking alternatives to traditional cow's milk formula, viewing soy-based options as a natural and healthy choice. Plant-based diets are associated with various health benefits, including reduced risk of chronic diseases and environmental sustainability. As a result, parents are more inclined to choose soy-based infant formula for their infants, believing it to be a healthier option. This shift in consumer preferences towards plant-based diets is expected to fuel the growth of the soy-based infant formula market.

Opportunities

- Increasing Research and Development

Manufacturers are continuously exploring ways to improve the formulation of soy-based formulas to make them more closely resemble the composition of breast milk. This includes optimizing the balance of proteins, fats, and carbohydrates and fortifying the formula with essential vitamins and minerals. Additionally, efforts are being made to enhance the taste and texture of soy-based formulas to make them more palatable for infants. These advancements in research and development are expected to drive the adoption of soy based formula for infants among consumers seeking high-quality, nutritious alternatives to traditional cow's milk formula. Ongoing research and development efforts are crucial in enhancing the nutritional profile and taste of soy-based infant formula, thereby new opportunities for market growth.

- Health Benefits of Soy

Soy contains phytoestrogens, which are plant compounds that have been studied for their potential health-promoting effects. Some studies suggest that consuming soy products may help reduce the risk of breast and prostate cancers, among other benefits. By highlighting these potential health benefits, manufacturers can attract health-conscious consumers who are seeking nutritious options for their infants. In addition, the association of soy with other health benefits, such as improved heart health and bone health, further strengthens the positioning of organic soy based infant formula as a healthy alternative to traditional formulas and presents a significant opportunity for manufacturers.

Top of Form

Restraints/Challenges

- Price Sensitivity of Soy Formulas

Compared to conventional cow's milk-based formula, soy-based formulas are often priced higher, which may deter price-sensitive consumers from choosing soy-based options. Price-conscious parents may opt for more affordable alternatives, especially when similar nutritional benefits can be obtained from other formula options. The price sensitivity of consumers is a significant factor that may impact the adoption of soy-based infant formula and challenge market growth.

- Availability of Alternative Formulas

Hydrolyzed protein formulas are designed for infants with cow's milk protein allergy and are often recommended as an alternative to soy-based formulas. These formulas are widely available and may be preferred by healthcare providers for infants with specific dietary needs. Additionally, the availability of other non-dairy options, such as goat milk-based formulas, further limits the growth potential of the soy-based infant formula market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In November 2023, Nestle is set to introduce a new infant formula featuring a proprietary blend in Hong Kong. This blend is designed to provide comprehensive nutrition, supporting various aspects of growth such as digestive, bone, and cognitive health

Soy Based Infant Formula Market Scope

The market is segmented on the basis of product type, form, type, application, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Toddler Baby

Form

- Powder

- Liquid

- Semi-Liquid

Type

- Low Fat Soy-based Infant Formula

- Whole-Fat Soy-based Infant Formula

Application

- 0 to 3 Months

- 4 to 7 Months

- 8 to 11 Months

- 12 to 23 Months

- 24 Months and Up

Distribution Channel

- Online

- Offline

Soy Based Infant Formula Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, product type, form, type, application, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

Asia-Pacific is expected to dominate the market due to the growing availability of breast milk banks. Moreover, increased consumer awareness regarding brand reputation, nutritional content, and safety further contributes to the accelerated growth rate of the soy-based infant formula market in Asia-Pacific.

North America is expected to show significant growth due to the increasing application of soy-based infant formula containing phytoestrogens in infant nutrition within the region, indicating a rising preference for plant-based alternatives in baby nutrition.

The country section of the report also provides individual market-impacting factors and changes in market regulation that affect the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Soy Based Infant Formula Market Share Analysis

The market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major market players operating in the market are:

- Nestlé (Switzerland)

- DANONE (France)

- Reckitt Benckiser Group PLC (U.K.)

- Abbott (U.S.)

- HiPP (Germany)

- The Kraft Heinz Company (U.S.)

- Hero Group (Switzerland)

- YILI.COM INC. (China)

- Kewpie Corporation (Japan)

- FrieslandCampina (Netherlands)

- Arla Foods amba (Denmark)

- The Honest Company, Inc. (U.S.)

- Woolworths Group Limited (Australia)

- Nutricia (U.S.)

- Mead Johnson & Company, LLC. (U.S.)

- Kerry Group plc. (Ireland)

- MyOrganicCo (U.S.)

SKU-