Global Soy Based Infant Formula Market

Market Size in USD Million

CAGR :

%

USD

312.53 Million

USD

431.02 Million

2024

2032

USD

312.53 Million

USD

431.02 Million

2024

2032

| 2025 –2032 | |

| USD 312.53 Million | |

| USD 431.02 Million | |

|

|

|

|

Soy Based Infant Formula Market Size

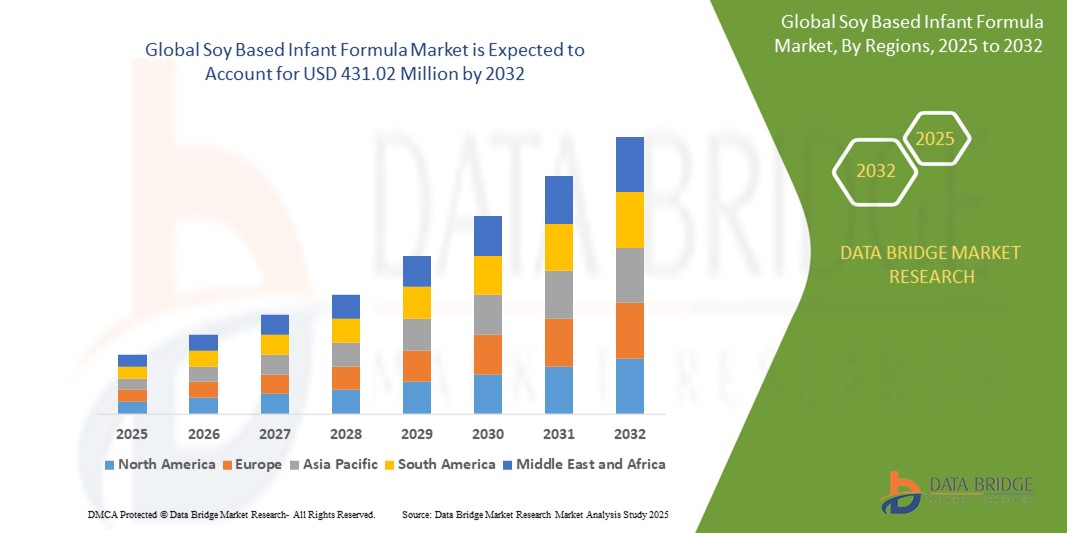

- The global soy based infant formula market size was valued at USD 312.53 million in 2024 and is expected to reach USD 431.02 million by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by the rising prevalence of lactose intolerance and cow milk allergies among infants, prompting parents and healthcare professionals to seek plant-based nutritional alternatives such as soy-based infant formulas

- Furthermore, increasing awareness about infant nutrition, combined with growing demand for organic, non-dairy, and allergen-friendly formulas, is positioning soy-based products as a trusted solution for specialized dietary needs. These converging factors are accelerating the adoption of soy-based infant formula, thereby significantly boosting the industry's growth

Soy Based Infant Formula Market Analysis

- Soy-based infant formulas, offering a plant-based alternative to traditional dairy-based options, are increasingly essential in infant nutrition for children with lactose intolerance, cow milk allergies, or dietary restrictions, providing complete nutritional support during early developmental stages

- The escalating demand for soy-based formulas is primarily driven by growing awareness of food allergies, increasing preference for vegan and allergen-friendly options, and rising recommendations from healthcare professionals for specialized infant nutrition

- Asia-Pacific dominated the soy based infant formula market with a share of 45.5% in 2024, due to a rapidly growing infant population, increasing awareness of infant nutrition, and rising cases of lactose intolerance and milk allergies across emerging economies

- North America is expected to be the fastest growing region in the soy based infant formula market during the forecast period due to increasing lactose intolerance prevalence and rising vegan and vegetarian populations.

- Powder segment dominated the market with a market share of 65.5% in 2024, due to its longer shelf life, ease of storage, and cost-effectiveness. Powdered soy-based formulas are preferred by consumers seeking value and convenience, particularly in regions with limited access to refrigeration or consistent supply chains

Report Scope and Soy Based Infant Formula Market Segmentation

|

Attributes |

Soy Based Infant Formula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Soy Based Infant Formula Market Trends

“Rising Awareness of Infant Nutrition”

- A significant and accelerating trend in the global soy-based infant formula market is the growing awareness among parents and caregivers about the importance of specialized and balanced nutrition during early childhood development. This heightened focus on nutritional adequacy is driving demand for alternative formulas that cater to specific dietary needs, such as soy-based options for infants with lactose intolerance or milk protein allergies

- For instance, healthcare providers increasingly recommend soy-based formulas as safe and effective substitutes for dairy-based products, especially for infants experiencing gastrointestinal discomfort or allergic reactions. Public health campaigns and digital parenting platforms are also playing a critical role in educating caregivers about non-dairy nutritional solutions

- This growing awareness is supported by the rising availability of clinical research, pediatric endorsements, and product transparency in labeling, enabling informed decision-making by parents seeking optimal nutrition for their children. Brands such as Enfamil and Earth's Best have expanded their soy-based product lines to meet this demand

- The trend is also fueled by the increasing penetration of social media, online forums, and parenting communities, where information about hypoallergenic, plant-based feeding options is widely shared. These platforms help demystify soy-based formulas and reduce stigma associated with non-dairy feeding practices

- This shift in consumer mindset toward proactive, informed nutrition choices is fundamentally transforming the infant formula market, encouraging companies to innovate and launch scientifically supported, allergen-conscious, and nutritionally complete soy-based products

- The demand for soy-based infant formulas is growing rapidly across both developed and developing economies, as modern parents prioritize safe, tailored, and evidence-backed nutritional solutions for their infants’ well-being

Soy Based Infant Formula Market Dynamics

Driver

“Growing Awareness about Plant-Based Diets”

- The growing awareness about plant-based diets and their associated health and environmental benefits is a significant driver for the rising demand for soy-based infant formula

- For instance, in April 2024, Australian company Coco2 launched what is claimed to be the world’s first coconut-based infant formula after a decade of development. This breakthrough underscores the increasing interest in non-dairy, plant-based nutrition options for infants and reflects a broader shift in consumer preference toward sustainable and allergen-friendly alternatives

- As more families adopt plant-based lifestyles due to ethical, environmental, or health reasons, soy-based formulas offer a nutritionally viable and trusted dairy-free option for infant feeding, Furthermore, the increasing promotion of vegan and vegetarian diets by health organizations and pediatricians, combined with rising concerns over lactose intolerance and dairy allergies, is reinforcing demand for soy-based alternatives in infant nutrition

- The growing availability of certified organic, non-GMO, and clean-label soy infant formulas also appeals to health-conscious parents seeking transparency and quality in their purchasing decisions

- As this shift toward plant-based consumption continues to gain traction globally, soy-based infant formula is emerging as a mainstream solution, driving market growth across diverse consumer segments

Restraint/Challenge

“Price Sensitivity of Soy Formulas”

- The price sensitivity of soy-based infant formulas poses a significant challenge to broader market adoption, particularly among low- and middle-income households. These formulas often come at a premium compared to standard dairy-based options due to specialized ingredients, processing requirements, and certifications such as organic or non-GMO

- For instance, soy-based formulas marketed as organic or plant-based alternatives frequently carry higher price tags, which may deter cost-conscious parents, especially in regions where public subsidies or health insurance coverage for specialty formulas are limited

- Addressing this pricing challenge requires strategic efforts such as expanding affordable product lines, scaling production to achieve cost efficiencies, and working with healthcare providers and policymakers to increase access through nutritional support programs. Brands such as Earth's Best and Parent's Choice have introduced more budget-friendly options to cater to economically diverse consumer segments

- While premium soy-based formulas appeal to a health-conscious demographic, the perceived high cost remains a barrier to adoption for families weighing affordability against dietary or allergy-related needs

- Overcoming this challenge will be essential for expanding the market's reach, particularly in emerging economies, and requires a balance between maintaining quality and offering accessible price points through innovation in sourcing, manufacturing, and distribution

Soy Based Infant Formula Market Scope

The market is segmented on the basis of product type, form, type, application, and distribution channel.

- By Product Type

On the basis of product type, the soy-based infant formula market is segmented into Stage 1, Stage 2, Stage 3, Stage 4, and Toddler Baby. The Stage 1 segment dominated the largest market revenue share in 2024, primarily due to its critical role in meeting the nutritional needs of newborns from birth. Parents often opt for Stage 1 soy-based formulas when infants exhibit lactose intolerance or cow milk protein allergies. The demand is further supported by pediatric recommendations and increasing awareness regarding alternative feeding solutions for early infancy.

The Toddler Baby segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health consciousness among parents and the growing preference for plant-based nutrition during early childhood. Toddler-specific soy formulas often include fortified nutrients tailored for toddlers’ growth, supporting demand in developed and developing economies.

- By Form

On the basis of form, the market is segmented into Powder, Liquid, and Semi-Liquid. The Powder segment held the largest market revenue share of 65.5% in 2024 due to its longer shelf life, ease of storage, and cost-effectiveness. Powdered soy-based formulas are preferred by consumers seeking value and convenience, particularly in regions with limited access to refrigeration or consistent supply chains.

The Liquid segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by its ready-to-feed nature and rising demand in urban areas where parents prefer on-the-go feeding options. Liquid formulas also reduce the risk of incorrect mixing, appealing to first-time parents and caregivers.

- By Type

On the basis of type, the soy-based infant formula market is segmented into Low Fat Soy-based Infant Formula and Whole-fat Soy-based Infant Formula. The Low Fat segment accounted for the largest market revenue share in 2024, driven by pediatric preferences and regulatory standards emphasizing controlled fat intake for infants with specific dietary needs.

The Whole-fat segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing demand for high-energy formulas for underweight or nutritionally deficient infants. Whole-fat formulas are also gaining popularity among parents preferring more natural, less-processed alternatives.

- By Application

On the basis of application, the market is segmented into 0 to 3 Months, 4 to 7 Months, 8 to 11 Months, 12 to 23 Months, and 24 Months and Up. The 0 to 3 Months segment held the largest market revenue share in 2024, attributed to the high incidence of formula use during early infancy, especially among working mothers and parents of lactose-intolerant newborns.

The 12 to 23 Months segment is projected to grow at the fastest CAGR from 2025 to 2032, as soy-based formulas increasingly serve as a transition product before shifting to solid food. The segment benefits from heightened attention to nutritional continuity during the critical toddler development phase.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment captured the largest market revenue share in 2024 due to the trust associated with pharmacies, supermarkets, and specialty baby stores. Parents prefer buying infant formula in-store for perceived freshness, immediate availability, and access to professional advice.

The Online segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing e-commerce penetration, convenience, and the availability of subscription-based delivery models. Digital platforms also facilitate access to a wider variety of products, reviews, and price comparisons.

Soy Based Infant Formula Market Regional Analysis

- Asia-Pacific dominated the soy based infant formula market with the largest revenue share of 45.5% in 2024, driven by a rapidly growing infant population, increasing awareness of infant nutrition, and rising cases of lactose intolerance and milk allergies across emerging economies

- The region’s expanding middle class, rising disposable income, and growing penetration of e-commerce platforms are major contributors to market growth

- In addition, supportive government regulations on infant nutrition and health, local manufacturing capabilities, and increasing investments in research and development of plant-based nutrition products are accelerating adoption across the region

Japan Soy-Based Infant Formula Market Insight

The Japan market is expanding due to increasing demand for specialized infant nutrition catering to infants with dietary restrictions and allergies. Japanese consumers prioritize quality, safety, and innovation in infant formulas. Local manufacturers are focusing on improving product formulations and packaging convenience to meet the needs of busy parents and aging demographics.

China Soy-Based Infant Formula Market Insight

The China market held the largest share in Asia-Pacific in 2024, supported by its large infant population and rising urbanization. Government initiatives promoting breastfeeding alternatives and improving infant health are driving demand. Chinese manufacturers are increasingly investing in product innovation and expanding distribution channels, including online platforms, to reach wider consumer bases.

Europe Soy-Based Infant Formula Market Insight

The Europe market is projected to grow steadily, fueled by increasing awareness about allergies and intolerances, as well as the rising preference for plant-based and organic infant nutrition products. Strong regulatory frameworks ensuring product safety and labeling transparency boost consumer confidence. Western Europe leads in innovation and adoption of premium soy-based formulas.

U.K. Soy-Based Infant Formula Market Insight

The U.K. market is expected to grow moderately due to growing consumer preference for natural and allergen-friendly infant nutrition options. Increasing availability of soy-based formulas in supermarkets and pharmacies, coupled with healthcare professional recommendations, supports market growth. Sustainability concerns and demand for clean-label products further influence purchasing decisions.

Germany Soy-Based Infant Formula Market Insight

Germany’s soy-based infant formula market is experiencing steady growth driven by heightened consumer focus on infant health and allergy management. German consumers prefer products with certified quality and sustainable sourcing. Innovation in formula compositions and eco-friendly packaging aligns with the country’s strong environmental standards.

North America Soy-Based Infant Formula Market Insight

North America market is projected to register the fastest CAGR from 2025 to 2032, driven by increasing lactose intolerance prevalence and rising vegan and vegetarian populations. Growing health awareness and demand for allergen-free, plant-based infant nutrition boost market adoption. Advances in product formulation and expanding distribution networks support growth.

U.S. Soy-Based Infant Formula Market Insight

The U.S. market captured the largest revenue share in North America in 2024, supported by strong demand for alternatives to dairy-based infant formulas and increased healthcare provider endorsements. E-commerce and specialty retail channels are expanding access to soy-based formulas. The emphasis on non-GMO and organic certifications also fuels consumer preference.

Soy Based Infant Formula Market Share

The soy based infant formula industry is primarily led by well-established companies, including:

The Major Market Leaders Operating in the Market Are:

- Nestlé (Switzerland)

- DANONE (France)

- Reckitt Benckiser Group PLC (U.K.)

- Abbott (U.S.)

- HiPP (Germany)

- The Kraft Heinz Company (U.S.)

- Hero Group (Switzerland)

- YILI.COM INC. (China)

- Kewpie Corporation (Japan)

- FrieslandCampina (Netherlands)

- Arla Foods amba (Denmark)

- The Honest Company, Inc. (U.S.)

- Woolworths Group Limited (Australia)

- Nutricia (U.S.)

- Mead Johnson & Company, LLC. (U.S.)

- Kerry Group plc. (Ireland)

- MyOrganicCo (U.S.)

Latest Developments in Global Soy Based Infant Formula Market

- In April 2025, Bobbie launched its fourth infant formula, the Bobbie Organic Whole Milk Infant Formula, marking a significant milestone as the first and only USDA Organic Whole Milk formula manufactured in the U.S. After three years of development, this product sets a new benchmark for quality and safety in infant nutrition. Produced at Bobbie’s advanced facility in Heath, Ohio, it addresses growing consumer demand for organic, reliable infant nutrition amid ongoing uncertainties in the U.S. infant formula market. This innovation strengthens Bobbie’s position as a trusted leader and is expected to influence market dynamics by raising quality standards and expanding organic formula adoption

- In April 2024, Australian company Coco2 introduced what it claims to be the world’s first coconut-based infant formula, developed over a decade with input from the University of Queensland, parents, and healthcare experts. Designed to closely replicate the nutritional profile and health benefits of breast milk, this formula includes essential vitamins, minerals, and fatty acids. Coco2’s pioneering product is poised to disrupt the infant formula market by offering a novel plant-based alternative, appealing to consumers seeking dairy-free and allergen-friendly options, thereby expanding market diversity and fostering innovation in infant nutrition globally

- In November 2023, Nestle is set to introduce a new infant formula featuring a proprietary blend in Hong Kong. This blend is designed to provide comprehensive nutrition, supporting various aspects of growth such as digestive, bone, and cognitive health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Soy Based Infant Formula Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Soy Based Infant Formula Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Soy Based Infant Formula Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.