Global Solid State Drive Market

Market Size in USD Billion

CAGR :

%

USD

69.08 Billion

USD

207.83 Billion

2024

2032

USD

69.08 Billion

USD

207.83 Billion

2024

2032

| 2025 –2032 | |

| USD 69.08 Billion | |

| USD 207.83 Billion | |

|

|

|

|

What is the Global Solid State Drive Market Size and Growth Rate?

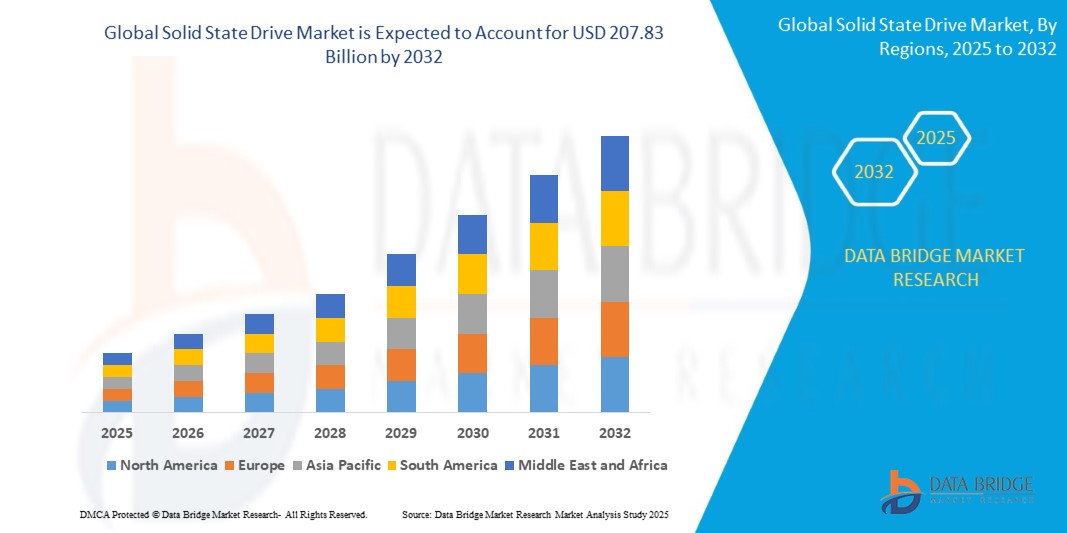

- The global solid state drive market size was valued at USD 69.08 billion in 2024 and is expected to reach USD 207.83 billion by 2032, at a CAGR of 14.76% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing Solid State Drives as the modern access control system of choice. These converging factors are accelerating the uptake of Solid State Drive solutions, thereby significantly boosting the industry's growth

What are the Major Takeaways of Solid State Drive Market?

- Solid State Drives, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for solid state drives is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominated the solid state drive market with the largest revenue share of 43.25% in 2024, driven by increasing demand across enterprise and consumer segments for high-speed, reliable storage. Widespread digitalization, cloud computing, and AI adoption have fueled the demand for SSDs in data centers and consumer electronics

- Asia-Pacific is expected to be the fastest-growing region, projected to expand at a CAGR of 18.25% from 2025 to 2032, fueled by rapid urbanization, increasing smartphone and laptop penetration, and rising disposable incomes

- The Internal segment dominated the SSD market with the largest revenue share of 68.3% in 2024, primarily due to its widespread use in laptops, desktops, and servers. Internal SSDs offer high-speed data access, lower power consumption, and greater reliability

Report Scope and Solid State Drive Market Segmentation

|

Attributes |

Solid State Drive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Solid State Drive Market?

“Integration of AI and Edge Computing for Performance Optimization”

- A major emerging trend in the global solid state drive market is the integration of artificial intelligence (AI) and edge computing capabilities to enhance performance, data management, and security. These technologies enable SSDs to intelligently manage workloads, optimize data placement, and reduce latency in high-speed computing environments

- For instance, Samsung’s SmartSSD incorporates built-in compute functionality to offload tasks from the CPU, enhancing overall system performance and efficiency. Similarly, Kioxia’s SSDs feature AI-driven predictive analytics to assess drive health and forecast failures, increasing reliability in data centers

- The adoption of edge AI-capable SSDs is gaining traction in applications such as autonomous vehicles, real-time video processing, and industrial IoT, where rapid, localized data processing is crucial. These SSDs reduce dependence on central servers, lowering network congestion and boosting operational responsiveness

- By embedding intelligence within the drive itself, manufacturers are offering smarter storage solutions that improve data throughput and contribute to more secure and resilient infrastructures

- As enterprises and consumers demand higher-speed data access, lower latency, and greater storage reliability, AI-powered and edge-computing-enabled SSDs are becoming a pivotal innovation in the evolving digital ecosystem

What are the Key Drivers of Solid State Drive Market?

- The explosive growth of data-intensive applications, including 4K/8K video, cloud computing, AI, and machine learning, is a major driver for the SSD market, due to the need for high-speed, low-latency storage

- For instance, in March 2024, Western Digital announced new PCIe Gen 5 SSDs designed to meet enterprise demands for faster processing and improved energy efficiency—highlighting ongoing innovation as a key growth strategy

- Rising adoption of cloud services and hyperscale data centers is significantly increasing SSD demand, particularly for NVMe-based drives that offer faster data transfer speeds compared to traditional HDDs

- The increasing shift from HDDs to SSDs across consumer electronics, laptops, and gaming consoles due to falling SSD prices, better durability, and energy efficiency continues to drive global market growth

- In addition, government investments in digital transformation, smart cities, and next-generation communication infrastructure (such as 5G) further propel SSD adoption across multiple verticals, including healthcare, automotive, and education

Which Factor is challenging the Growth of the Solid State Drive Market?

- A prominent challenge facing the SSD market is the volatility of NAND flash memory prices, which directly impacts SSD production costs and market stability. Periodic oversupply or shortage in NAND chips can cause erratic pricing, affecting OEM margins and end-user affordability

- For instance, in 2023, several SSD manufacturers experienced pricing pressure due to NAND oversupply, leading to inventory surpluses and reduced profitability despite growing demand

- In addition, concerns regarding data security and endurance limitations in some consumer-grade SSDs hinder adoption in critical enterprise and government sectors. Prolonged write cycles can degrade SSD performance over time, especially under heavy workloads

- Furthermore, limited awareness in emerging markets, where traditional HDDs still dominate due to cost advantages, presents a barrier to widespread SSD adoption

- Addressing these issues through advanced controller technologies, improved wear leveling algorithms, and increased consumer education will be crucial to maintaining market momentum and expanding SSD penetration globally

How is the Solid State Drive Market Segmented?

The market is segmented on the basis of type, form factor, interface, storage, technology and end user.

• By Type

On the basis of type, the solid state drive (SSD) market is segmented into External and Internal. The Internal segment dominated the SSD market with the largest revenue share of 68.3% in 2024, primarily due to its widespread use in laptops, desktops, and servers. Internal SSDs offer high-speed data access, lower power consumption, and greater reliability, making them the preferred choice across both consumer and enterprise environments.

The External segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for portable, high-capacity storage devices compatible with USB and Thunderbolt interfaces. The growing trend of remote work, content creation, and mobile device usage is also contributing to this segment’s accelerated growth.

• By Form Factor

On the basis of form factor, the SSD market is segmented into 1.8”/2.5”, 3.5”, M.2/mSATA, U.2 (SFF 8639), and FHHL and HHHL. The M.2/mSATA segment held the largest revenue share in 2024, accounting for 35.7%, due to its compact design, higher speed capability, and compatibility with ultrabooks and next-generation laptops.

The U.2 (SFF 8639) segment is projected to grow at the fastest CAGR through 2032, driven by increasing adoption in enterprise and data center environments where high performance and hot-swapping capability are essential.

• By Interface

Based on interface, the market is categorized into Serial ATA (SATA), Serial Attached SCSI (SAS), and Peripheral Component Interconnect Express (PCIe). The PCIe segment dominated the market in 2024 with a revenue share of 47.9%, owing to its superior speed, low latency, and direct CPU communication which make it ideal for gaming, AI, and enterprise workloads.

The SAS segment is expected to register the fastest growth, propelled by demand in mission-critical enterprise applications requiring high reliability, speed, and scalable storage solutions.

• By Storage

On the basis of storage capacity, the market is segmented into Under 500 GB, 500 GB–1 TB, 1 TB–2 TB, and Above 2 TB. The 500 GB–1 TB segment held the largest share of 38.5% in 2024, due to its optimal balance of performance and price for mainstream consumer and business usage.

The Above 2 TB segment is expected to register the highest CAGR from 2025 to 2032, driven by growing data-intensive applications such as 4K video editing, cloud computing, and AI workloads requiring vast storage capacity.

• By Technology

On the basis of technology, the SSD market is segmented into TLC 3D, TLC Planar, MLC 3D, MLC Planar, and SLC. The TLC 3D segment dominated the market with a market share of 42.6% in 2024, benefiting from its cost-effectiveness, durability, and increased data density, making it the preferred option for consumer electronics and mid-range enterprise storage.

The SLC segment is projected to witness the fastest growth due to its superior speed, longevity, and reliability, which are essential for high-performance industrial and mission-critical applications.

• By End User

On the basis of end user, the SSD market is segmented into Enterprise, Client, Industrial, and Automotive. The Enterprise segment accounted for the largest market share of 49.1% in 2024, fueled by the expanding demand for data centers, cloud services, and virtualization technologies requiring high-speed, scalable storage solutions.

The Automotive segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing use of SSDs in advanced infotainment systems, autonomous vehicle platforms, and vehicle-to-everything (V2X) communication systems.

Which Region Holds the Largest Share of the Solid State Drive Maret?

- North America dominated the solid state drive market with the largest revenue share of 43.25% in 2024, driven by increasing demand across enterprise and consumer segments for high-speed, reliable storage. Widespread digitalization, cloud computing, and AI adoption have fueled the demand for solid state drives in data centers and consusmer electronics

- Enterprises in the region continue to upgrade legacy storage systems with advanced solid state drives to enhance performance and reduce latency. Meanwhile, consumers prioritize solid state drives for faster boot times, gaming, and multimedia editing

- The strong presence of key industry players and a well-established tech infrastructure also contribute to North America's dominance in the solid state drive market

U.S. Solid State Drive Market Insight

The U.S. solid state drive market captured the largest revenue share within North America in 2024, propelled by rapid enterprise digital transformation, a thriving gaming industry, and surging adoption of edge computing. Organizations across sectors are heavily investing in solid state drive-enabled infrastructure for data-intensive workloads, while consumers demand faster storage solutions for high-performance computing. The U.S. also leads in technological innovation and R&D, reinforcing its market position.

Europe Solid State Drive Market Insight

The Europe solid state drive market is expected to register a strong CAGR during the forecast period, driven by regulatory initiatives for data security, widespread adoption of cloud technologies, and the transition to solid state drives in public and private sectors. The growth is further supported by increased demand from the automotive industry and expanding 5G infrastructure, making solid state drives critical for next-gen connected applications.

U.K. Solid State Drive Market Insight

The U.K. solid state drive market is set to grow at a healthy CAGR, bolstered by the country’s booming e-commerce sector, strong gaming community, and increasing demand for portable, high-speed data solutions. The rise of remote work and hybrid cloud solutions is prompting enterprises to adopt high-performance solid state DRIVEs to support latency-sensitive applications.

Germany Solid State Drive Market Insight

The Germany solid state drive market is expected to grow steadily due to strong industrial automation trends and the country’s leadership in manufacturing and engineering. Demand for solid state drives is rising in automotive electronics, edge computing systems, and smart manufacturing platforms. Germany’s emphasis on efficiency, speed, and data security aligns with solid state drive advantages, fostering broader adoption.

Which Region is the Fastest Growing in the Solid State Drive Market?

Asia-Pacific is expected to be the fastest-growing region, projected to expand at a CAGR of 18.25% from 2025 to 2032, fueled by rapid urbanization, increasing smartphone and laptop penetration, and rising disposable incomes. Government-led digital transformation initiatives and booming e-commerce platforms are accelerating solid state drive demand in both enterprise and consumer segments. In addition, Asia-Pacific’s role as a global manufacturing hub for solid state drive components ensures cost advantages and market accessibility, particularly in emerging markets such as India and Southeast Asia.

Japan Solid State Drive Market Insight

The Japan solid state drive market is gaining momentum, driven by its tech-savvy population, high 5G and IoT adoption rates, and a growing need for secure, efficient storage in aging infrastructure. Enterprises and consumers alike are turning to solid state drives for faster data access, reduced power consumption, and enhanced device longevity, especially in robotics and AI-powered systems.

China Solid State Drive Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, supported by a large consumer electronics base, aggressive smart city projects, and strong local solid state drive production capabilities. As one of the world’s leading tech exporters, China’s solid state drive demand is driven by both domestic consumption and global supply chain integration, positioning it as a key growth engine for the regional market.

Which are the Top Companies in Solid State Drive Market?

The solid state drive industry is primarily led by well-established companies, including:

- Panasonic Corporation (Japan)

- Sony Corporation (Japan)

- Seiko Epson Corporation (Japan)

- Barco (Belgium)

- NEC Display Solutions (Japan)

- BenQ America Corp. (Taiwan)

- LG Electronics (South Korea)

- Xiaomi (China)

- Delta Electronics, Inc. (Taiwan)

- Optoma (Taiwan)

- Ricoh (Japan)

- Canon Inc. (Japan)

- Christie Digital Systems USA, Inc. (U.S.)

- Dell (U.S.)

- Hitachi Digital Media Group (Japan)

- FARO Technologies, Inc. (U.S.)

- LAP GmbH (Germany)

- CASIO COMPUTER CO., LTD. (Japan)

- ViewSonic Corporation (U.S.)

- Digital Projection, Inc. (U.K.)

- VAVA (China)

- Eiki International, Inc. (Japan)

- Production Resource Group LLC (U.S.)

- Kvant Lasers SRO (Slovakia)

What are the Recent Developments in Global Solid State Drive Market?

- In July 2022, Kioxia introduced its CM7 series, a new line of enterprise NVMe SSDs built on PCIe 5.0 technology and available in E3.S and 2.5-inch EDSFF form factors. These SSDs are engineered to support next-generation data center requirements, offering enhanced high-speed data processing across diverse workloads. This launch reinforces Kioxia’s position in delivering cutting-edge storage solutions for evolving enterprise environments

- In July 2022, Innodisk unveiled its industrial-grade SSDs — the 2.5" SATA 3TS6-P, 3TS9-P, and M.2 (P80) 4TS2-P — focused on low latency, high endurance (DWPD), and large capacity features suited for edge AI computing. These SSDs are specifically designed to operate in challenging edge environments while maintaining high reliability and performance. This innovation strengthens Innodisk’s commitment to robust, AI-ready storage solutions

- In June 2022, Micron launched the 5400 SATA SSD, its 11th-generation enterprise SSD, utilizing 176-layer NAND technology to address the needs of critical infrastructure applications. The SSD promises enhanced performance, increased durability, and improved reliability for modern data centers with demanding workloads. This launch underscores Micron’s leadership in advancing enterprise storage efficiency and resilience

- In April 2022, SK Hynix, in collaboration with Solidigm, released the P5530 SSD series for data centers, integrating 128-layer NAND flash and custom Solidigm SSD controllers. These SSDs, available in 1TB, 2TB, and 4TB variants, leverage the PCIe Gen 4 interface to offer high-speed data transfer and enterprise-level performance. This release highlights a strategic step toward meeting the accelerating data demands of hyperscale and enterprise infrastructures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Solid State Drive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Solid State Drive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Solid State Drive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.