Global Solar Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

1.53 Billion

USD

20.26 Billion

2025

2033

USD

1.53 Billion

USD

20.26 Billion

2025

2033

| 2026 –2033 | |

| USD 1.53 Billion | |

| USD 20.26 Billion | |

|

|

|

|

Solar Vehicle Market Size

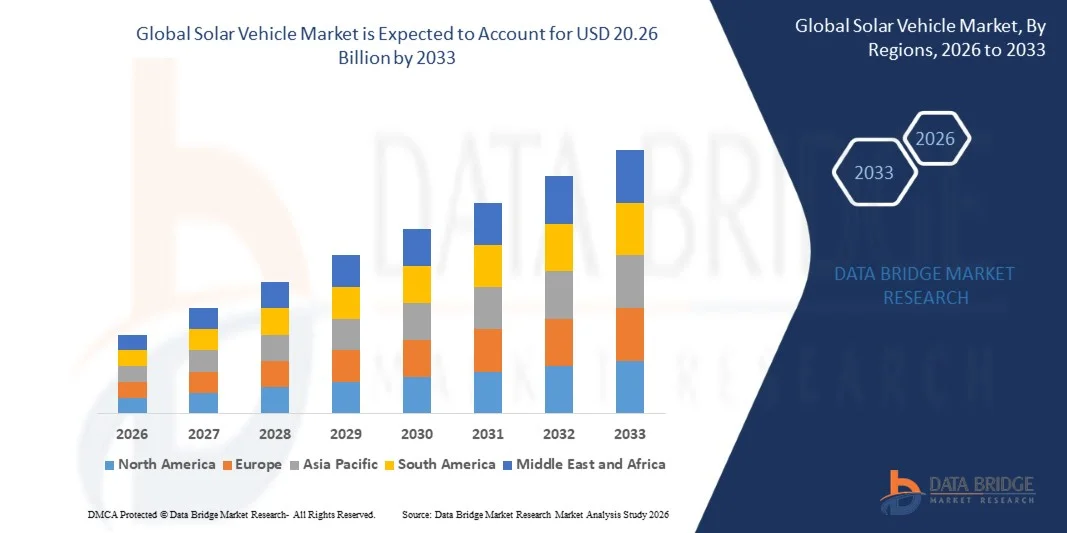

- The global solar vehicle market size was valued at USD 1.53 billion in 2025 and is expected to reach USD 20.26 billion by 2033, at a CAGR of 38.09% during the forecast period

- The market growth is largely driven by the increasing adoption of electric vehicles and rising integration of renewable energy technologies within the automotive sector, encouraging the development of solar-assisted mobility solutions across passenger and commercial vehicles

- Furthermore, growing concerns over fuel costs, carbon emissions, and energy efficiency are pushing consumers and manufacturers toward solar vehicles, as these systems help reduce charging dependency and operating expenses, thereby supporting sustained market expansion

Solar Vehicle Market Analysis

- Solar vehicles are electric or hybrid vehicles integrated with photovoltaic panels that convert sunlight into electrical energy to support battery charging and auxiliary vehicle functions, enhancing driving range and overall energy efficiency

- The rising demand for solar vehicles is primarily fueled by global decarbonization initiatives, advancements in lightweight solar panel technology, and increasing investments by automotive manufacturers to improve vehicle sustainability and reduce long-term energy consumption

- North America dominated the solar vehicle market with a share of around 35% in 2025, due to early adoption of electric vehicles, strong investments in renewable energy, and growing interest in energy-efficient mobility solutions

- Asia-Pacific is expected to be the fastest growing region in the solar vehicle market during the forecast period due to rapid urbanization, rising EV adoption, and expanding renewable energy initiatives

- Passenger cars segment dominated the market with a market share of 62.5% in 2025, due to growing consumer interest in sustainable personal mobility. Solar integration in passenger vehicles helps reduce fuel dependency and charging frequency. Increasing urban adoption of solar-assisted electric cars drives volume sales. Automakers focus on passenger models to showcase solar technology feasibility. Favorable policies and rising environmental awareness strengthen demand

Report Scope and Solar Vehicle Market Segmentation

|

Attributes |

Solar Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Solar Vehicle Market Trends

“Rising Integration of Solar Panels with Electric Vehicle Platforms”

- A prominent trend in the solar vehicle market is the increasing integration of photovoltaic panels into electric vehicle platforms to enhance energy efficiency and extend driving range. Automotive manufacturers are actively exploring solar roofs and body-integrated panels to supplement battery charging and reduce dependence on grid-based charging infrastructure. This integration is strengthening the positioning of solar vehicles as a viable solution for sustainable mobility, particularly in regions with high solar irradiance

- For instance, Lightyear has developed solar-integrated electric vehicles that incorporate body-mounted solar panels designed to directly support daily driving needs. This approach demonstrates how solar integration can meaningfully contribute to vehicle range and energy autonomy, reinforcing confidence in solar-assisted EV platforms

- The adoption of solar panels in electric vehicles is gaining traction as advancements in lightweight and flexible photovoltaic materials improve efficiency without significantly increasing vehicle weight. These technological improvements are enabling smoother integration into vehicle design while maintaining aerodynamic performance

- Passenger vehicles are increasingly being used as pilot platforms for solar integration, allowing manufacturers to test performance, durability, and real-world energy contribution. This trend is accelerating learning curves and supporting gradual commercialization across broader vehicle categories

- Urban mobility solutions are also adopting solar-assisted vehicles to support short-distance commuting and shared mobility applications. Solar integration aligns well with city-focused sustainability initiatives and helps lower operational energy costs

- Overall, the rising integration of solar panels with electric vehicle platforms is reinforcing the transition toward cleaner transportation systems. This trend is shaping long-term innovation strategies and supporting the evolution of energy-efficient automotive architectures

Solar Vehicle Market Dynamics

Driver

“Increasing Demand for Sustainable and Energy-Efficient Mobility”

- The growing demand for sustainable and energy-efficient mobility solutions is a key driver of the solar vehicle market, as consumers and governments seek to reduce carbon emissions and reliance on fossil fuels. Solar vehicles offer an opportunity to complement electric drivetrains with renewable energy, improving overall efficiency and environmental performance

- For instance, Toyota Motor Corporation has explored solar roof technologies in select hybrid and electric models to support auxiliary power generation and improve fuel efficiency. Such initiatives highlight how established automakers are responding to sustainability-focused consumer preferences

- Rising fuel prices and concerns over long-term energy costs are further encouraging interest in vehicles that can partially self-generate power. Solar-assisted charging helps reduce operating expenses and enhances energy independence for vehicle owners

- Government policies promoting clean transportation and renewable energy adoption are also reinforcing this driver. Incentives for electric and low-emission vehicles indirectly support solar vehicle development by improving market acceptance

- This sustained emphasis on sustainability and efficiency continues to strengthen market momentum, positioning solar vehicles as an emerging component of future mobility ecosystems

Restraint/Challenge

“High Cost and Limited Efficiency of Automotive Solar Panels”

- The solar vehicle market faces a significant challenge due to the high cost and limited efficiency of automotive-grade solar panels. Integrating durable, lightweight, and efficient photovoltaic systems into vehicles requires advanced materials and manufacturing processes, increasing overall vehicle costs

- For instance, Sono Motors has highlighted challenges related to scaling solar panel integration while maintaining affordability in its solar electric vehicle programs. Balancing cost, durability, and performance remains a critical hurdle for commercialization

- Automotive solar panels generate limited power due to constrained surface area, which restricts their ability to fully charge vehicle batteries. This limitation affects consumer expectations regarding range extension and energy contribution

- Ensuring long-term reliability under harsh automotive conditions such as vibration, heat, and weather exposure further complicates panel design and raises production complexity. These factors contribute to higher development and maintenance costs

- Collectively, high costs and efficiency constraints continue to challenge market expansion, requiring ongoing technological innovation and cost optimization to unlock the full potential of solar vehicles

Solar Vehicle Market Scope

The market is segmented on the basis of component, industry trends, charging infrastructure type, vehicle type, solar panel, and EV type.

- By Component

On the basis of component, the solar vehicle market is segmented into EV battery cells and packs, on-board charger, infotainment system, and instrument cluster. The EV battery cells and packs segment dominated the largest market revenue share in 2025, driven by their critical role in energy storage and vehicle performance. Solar vehicles rely heavily on high-capacity and efficient battery systems to store energy generated from solar panels and external charging sources. Continuous advancements in lithium-ion and next-generation battery chemistries have improved energy density, durability, and charging efficiency. The high cost contribution of battery packs to overall vehicle pricing further strengthens this segment’s revenue dominance. Growing investments by automotive manufacturers to enhance battery efficiency for solar-assisted driving continue to reinforce this leadership position.

The infotainment system segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing consumer demand for connected, intelligent, and user-centric vehicle experiences. Solar vehicles increasingly integrate real-time energy monitoring, navigation optimization, and solar efficiency analytics through advanced infotainment platforms. The convergence of digital dashboards with AI-driven interfaces enhances user engagement and operational transparency. Automakers are prioritizing smart displays to differentiate solar vehicles in competitive EV markets. Rising adoption of connected mobility solutions further accelerates growth in this segment.

- By Industry Trends

On the basis of industry trends, the solar vehicle market is segmented into electric taxi, robo-taxi, light solar vehicle, battery swapping, and electric autonomous vehicles. The electric taxi segment accounted for the largest revenue share in 2025, driven by high utilization rates and the need for cost-efficient urban mobility solutions. Solar-assisted electric taxis benefit from reduced operating costs through supplemental solar charging. Fleet operators increasingly adopt solar vehicles to improve energy efficiency and sustainability credentials. Government incentives supporting electric public transport further strengthen demand. High daily mileage makes electric taxis an ideal application for solar integration.

The robo-taxi segment is projected to grow at the fastest rate during the forecast period, fueled by advancements in autonomous driving and smart energy optimization technologies. Solar integration supports extended operational range and improved energy autonomy for driverless fleets. Technology companies and mobility providers are investing heavily in autonomous electric platforms with solar augmentation. Reduced dependency on manual charging aligns well with continuous operation requirements. The rapid evolution of shared autonomous mobility ecosystems accelerates this segment’s expansion.

- By Charging Infrastructure Type

On the basis of charging infrastructure type, the solar vehicle market is segmented into normal charge, CCS, Chademo, and Tesla Supercharger. The normal charge segment dominated market revenue in 2025 due to its widespread availability and compatibility with residential and commercial charging setups. Solar vehicle owners frequently combine rooftop solar panels with standard AC charging systems to maximize renewable energy usage. Lower installation costs and ease of access make normal charging a preferred option. This infrastructure supports overnight charging and localized energy management. Its strong presence in emerging solar vehicle markets sustains dominance.

The CCS segment is anticipated to register the fastest growth from 2026 to 2033, driven by rising demand for fast-charging solutions compatible with long-range solar EVs. CCS infrastructure enables higher power delivery, reducing charging downtime for commercial and fleet vehicles. Automakers increasingly standardize CCS to support scalable charging networks. Integration with renewable-powered fast chargers further enhances appeal. Expansion of highway charging corridors supports accelerated adoption.

- By Vehicle Type

On the basis of vehicle type, the solar vehicle market is segmented into passenger cars and commercial vehicles. The passenger cars segment held the largest market share of 62.5% in 2025, supported by growing consumer interest in sustainable personal mobility. Solar integration in passenger vehicles helps reduce fuel dependency and charging frequency. Increasing urban adoption of solar-assisted electric cars drives volume sales. Automakers focus on passenger models to showcase solar technology feasibility. Favorable policies and rising environmental awareness strengthen demand.

The commercial vehicles segment is expected to grow at the fastest rate during the forecast period, driven by logistics, delivery, and fleet operators seeking long-term cost savings. Solar vehicles help reduce operational expenses through partial energy self-generation. High vehicle utilization amplifies the benefits of solar augmentation. Fleet electrification initiatives support rapid deployment. Sustainability mandates further accelerate adoption across commercial applications.

- By Solar Panel

On the basis of solar panel, the solar vehicle market is segmented into monocrystalline solar panel and polycrystalline solar panel. The monocrystalline solar panel segment dominated revenue share in 2025 due to its higher efficiency and superior power output. Limited vehicle surface area necessitates high-efficiency panels for meaningful energy generation. Monocrystalline panels perform better in low-light and high-temperature conditions. Their longer lifespan supports automotive durability requirements. Premium vehicle models increasingly adopt this panel type.

The polycrystalline solar panel segment is projected to witness the fastest growth from 2026 to 2033, driven by cost advantages and improving efficiency levels. Manufacturers targeting mass-market solar vehicles favor polycrystalline panels to reduce production costs. Technological advancements are narrowing performance gaps. Their affordability supports wider adoption in entry-level models. Expanding production capacity further fuels growth.

- By EV Type

On the basis of EV type, the solar vehicle market is segmented into HEV, BEV, and PHEV. The BEV segment dominated the market in 2025, driven by full electrification and higher compatibility with solar energy systems. Solar panels directly support auxiliary and traction energy needs in BEVs. Increasing charging infrastructure availability strengthens BEV adoption. Automakers prioritize BEVs for maximum emission reduction. Solar integration enhances driving range and efficiency.

The PHEV segment is expected to grow at the fastest pace from 2026 to 2033, supported by its dual powertrain flexibility. Solar energy complements electric driving while reducing reliance on conventional fuel. Consumers view PHEVs as a transitional solution toward full electrification. Solar-assisted charging improves fuel economy and emissions performance. Growing demand for hybrid flexibility accelerates segment growth.

Solar Vehicle Market Regional Analysis

- North America dominated the solar vehicle market with the largest revenue share of around 35% in 2025, driven by early adoption of electric vehicles, strong investments in renewable energy, and growing interest in energy-efficient mobility solutions

- Consumers in the region increasingly value extended driving range, reduced charging dependency, and lower operating costs offered by solar-integrated vehicles

- Supportive government incentives, well-developed EV infrastructure, and strong presence of advanced automotive technology players have positioned solar vehicles as an emerging solution across passenger and commercial segments

U.S. Solar Vehicle Market Insight

The U.S. solar vehicle market captured the largest revenue share within North America in 2025, fueled by rapid EV adoption and increasing integration of solar technologies in automotive design. Consumers are prioritizing sustainability and long-term cost savings, encouraging automakers to explore solar roofs and auxiliary charging systems. Strong federal and state-level incentives for clean energy vehicles continue to support market expansion. The presence of major EV manufacturers and innovation-driven startups further accelerates solar vehicle development.

Europe Solar Vehicle Market Insight

The Europe solar vehicle market is projected to grow at a substantial CAGR during the forecast period, driven by stringent emission regulations and aggressive decarbonization targets. Rising demand for renewable-powered mobility and strong focus on sustainability are encouraging the adoption of solar-assisted vehicles. European automakers are actively investing in lightweight solar integration technologies. Growth is evident across passenger cars and urban mobility solutions, supported by expanding EV infrastructure.

U.K. Solar Vehicle Market Insight

The U.K. solar vehicle market is expected to witness steady growth, supported by increasing adoption of electric vehicles and strong government commitment to net-zero emissions. Consumers are showing rising interest in innovative green mobility solutions that reduce energy costs. Urbanization and investments in smart transportation are supporting solar vehicle adoption. The presence of pilot projects and solar EV trials further contributes to market development.

Germany Solar Vehicle Market Insight

The Germany solar vehicle market is anticipated to expand at a notable CAGR during the forecast period, driven by the country’s leadership in automotive engineering and renewable energy adoption. Strong emphasis on innovation, sustainability, and energy efficiency supports solar vehicle development. German automakers are actively exploring solar integration to enhance EV performance. Advanced infrastructure and consumer preference for eco-friendly mobility solutions continue to strengthen market growth.

Asia-Pacific Solar Vehicle Market Insight

The Asia-Pacific solar vehicle market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, rising EV adoption, and expanding renewable energy initiatives. Governments across the region are promoting clean mobility through incentives and policy support. Growing manufacturing capabilities and cost-effective production are improving market accessibility. Increasing demand for affordable and efficient transportation solutions further accelerates adoption.

Japan Solar Vehicle Market Insight

The Japan solar vehicle market is gaining traction due to strong technological expertise and a high focus on energy efficiency. Consumers value compact, innovative mobility solutions suited for urban environments. Solar-assisted vehicles align well with Japan’s emphasis on sustainability and reduced energy dependence. Integration of advanced electronics and smart energy management systems supports market growth.

China Solar Vehicle Market Insight

The China solar vehicle market accounted for the largest revenue share in Asia-Pacific in 2025, driven by massive EV adoption, rapid urbanization, and strong government support for renewable energy. China’s dominance in EV manufacturing and battery production supports large-scale solar vehicle development. Rising demand for cost-effective, clean transportation and smart city initiatives continues to propel market expansion across passenger and commercial vehicle segments.

Solar Vehicle Market Share

The solar vehicle industry is primarily led by well-established companies, including:

- Ford Motor Company (U.S.)

- General Motors (U.S.)

- Kia Motors Corporation (South Korea)

- SAIC Motor Corporation Limited (China)

- BMW AG (Germany)

- Hyundai Motor Company (South Korea)

- BYD Company Ltd. (China)

- Continental AG (Germany)

- TOYOTA MOTOR CORPORATION (Japan)

- Nissan Motor Co., LTD. (Japan)

- Volkswagen AG (Germany)

- Honda Motor Co., Ltd. (Japan)

Latest Developments in Solar Vehicle Market

- In January 2023, Sono Group N.V., a prominent player in solar mobility solutions, secured funding of USD 1.61 million from the European Climate, Infrastructure, and Environment Executive Agency to accelerate the development of advanced solar technologies. This funding strengthened the company’s ability to commercialize solar integration for vehicles, reinforcing investor confidence in solar-assisted mobility. The development supported broader market progress by encouraging innovation and validation of solar vehicle technologies across Europe

- In December 2022, Sono Motors advanced the solar vehicle market by designing and developing the Sion, a battery electric vehicle fully integrated with body-mounted solar panels. The company recorded approximately 42,000 pre-orders from both businesses and consumers, highlighting strong market acceptance and demand for solar-powered vehicles. This milestone demonstrated the commercial viability of solar EVs and significantly boosted market awareness and adoption momentum

- In June 2022, the University of New South Wales introduced the Sunswift 7, a high-performance solar-powered car capable of traveling up to 1,000 km on a single charge. This achievement showcased technological advancements in lightweight design and solar efficiency, strengthening confidence in the long-range potential of solar vehicles. The project contributed to industry innovation by proving the feasibility of high-efficiency solar mobility solutions

- In June 2022, Bridgestone partnered with Lightyear to develop a long-range solar electric vehicle, combining expertise in tire technology and solar-powered automotive engineering. This collaboration underscored growing cross-industry partnerships focused on sustainability and renewable mobility. The partnership enhanced technological development within the solar vehicle market and supported broader commercialization efforts

- In January 2022, Sono Motors announced plans to expand into the refrigerated trailer segment using its proprietary Sono Solar Technology. This strategic move highlighted the applicability of solar technology beyond passenger vehicles, opening new commercial and logistics-related opportunities. The development supported market expansion by addressing emission reduction needs in heavy-duty and temperature-controlled transport segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.