Global Solar Photovoltaic Pv Panels Market

Market Size in USD Billion

CAGR :

%

USD

152.53 Billion

USD

215.27 Billion

2025

2033

USD

152.53 Billion

USD

215.27 Billion

2025

2033

| 2026 –2033 | |

| USD 152.53 Billion | |

| USD 215.27 Billion | |

|

|

|

|

Solar Photovoltaic (PV) Panels Market Size

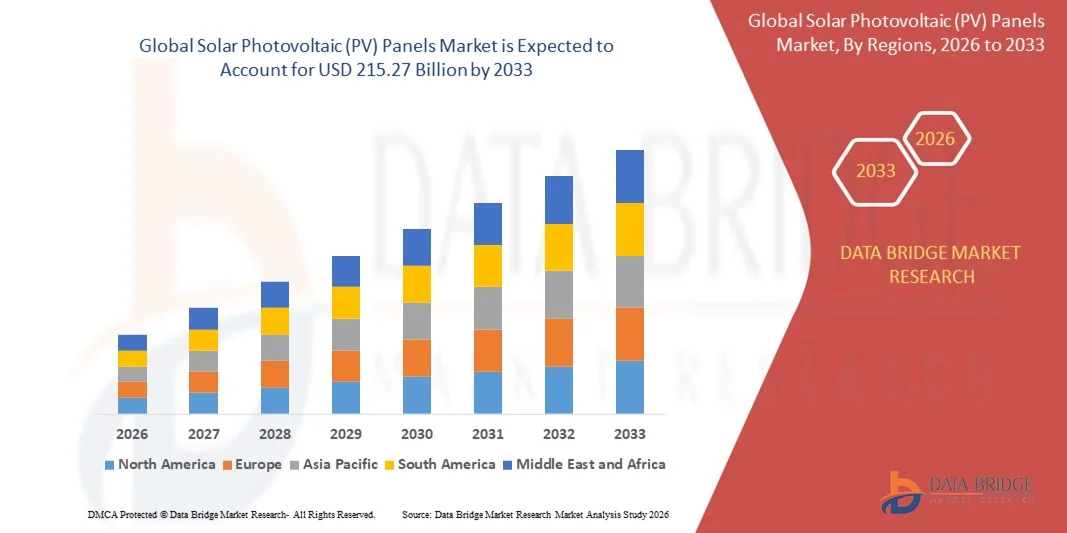

- The global solar photovoltaic (PV) panels market size was valued at USD 152.53 billion in 2025 and is expected to reach USD 215.27 billion by 2033, at a CAGR of 4.40% during the forecast period

- The market growth is largely fueled by increasing global demand for clean and renewable energy, coupled with continuous technological advancements in solar panel efficiency and manufacturing processes, which are enabling cost reductions and wider adoption across residential, commercial, and utility-scale projects

- Furthermore, supportive government policies, incentives, and subsidy programs in major markets such as India, China, the U.S., and Europe are promoting the installation of solar PV systems. These converging factors are accelerating the deployment of solar panels, thereby significantly boosting the market's growth

Solar Photovoltaic (PV) Panels Market Analysis

- Solar PV panels, converting sunlight into electricity for on-grid and off-grid applications, are increasingly critical for achieving sustainability and carbon reduction goals. Their integration into residential, commercial, and industrial energy systems offers reliable energy generation, energy cost savings, and independence from conventional power sources

- The escalating demand for solar PV panels is primarily fueled by rising electricity costs, growing environmental awareness, and ambitious renewable energy targets across governments and corporations. In addition, technological innovations such as bifacial panels, thin-film modules, and high-efficiency crystalline silicon panels are enhancing energy yield and adoption rates

- Asia-Pacific dominated the solar photovoltaic (PV) panels market with a share of 54.5% in 2025, due to expanding renewable energy initiatives, favorable government policies, and rapid industrialization across developing economies

- North America is expected to be the fastest growing region in the solar photovoltaic (PV) panels market during the forecast period due to strong adoption of solar PV in residential, commercial, and utility-scale projects

- On grid segment dominated the market with a market share of 71.4% in 2025, due to the growing adoption of grid-tied solar systems for residential and commercial applications. On-grid systems allow users to feed excess electricity back to the grid, providing financial incentives such as net metering and reducing overall energy costs. Homeowners increasingly prioritize on-grid installations for their ability to integrate seamlessly with existing utility networks, as well as for reliable, uninterrupted power supply. The segment also benefits from supportive policies and renewable energy targets in key markets such as the U.S., Germany, and China, which further accelerate adoption

Report Scope and Solar Photovoltaic (PV) Panels Market Segmentation

|

Attributes |

Solar Photovoltaic (PV) Panels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Solar Photovoltaic (PV) Panels Market Trends

Rising Adoption of High-Efficiency and Bifacial Solar Panels

- The solar photovoltaic (PV) panels market is evolving rapidly as manufacturers and end-users embrace high-efficiency and bifacial panel technologies to maximize power generation and land-use efficiency. The transition toward more advanced modules is driven by the need to improve energy yield, reduce the levelized cost of electricity, and meet the growing demand for clean energy in both utility and distributed generation projects

- For instance, JinkoSolar Holding Co., Ltd. has launched its Tiger Neo series comprising n-type TOPCon bifacial modules that achieve greater energy conversion efficiency and superior low-light performance compared to conventional models. Similarly, LONGi Green Energy Technology Co., Ltd. continues to innovate with its bifacial PERC modules offering enhanced energy gains of up to 25 percent under reflective surface conditions, appealing to large-scale solar developers worldwide

- High-efficiency modules featuring advanced cell architectures such as heterojunction, TOPCon, and IBC are transforming the performance standards of the solar industry. These panels deliver consistent productivity across diverse climatic conditions, enabling reliable energy output even in regions with limited sunlight or partial shading. As a result, both residential and commercial consumers are increasingly opting for these premium solutions to ensure long-term sustainability and higher returns on investment

- Bifacial technology is also driving growth in ground-mounted and rooftop installations by enabling power generation from both sides of the panel. This dual absorption capability enhances total energy output and optimizes levelized costs, making bifacial configurations a preferred choice in large solar farms and industrial installations

- The ongoing integration of high-efficiency panels with digital monitoring platforms and energy storage systems is improving operational control and energy utilization. IoT-enabled analytics and remote performance tracking are helping optimize maintenance and increase lifespan, strengthening the value proposition for modern solar assets

- Overall, the adoption of high-efficiency and bifacial PV panels signifies a major shift toward advanced, durable, and smart energy solutions. With global commitments to carbon neutrality, these innovations are accelerating the expansion of solar energy capacity across residential, commercial, and industrial sectors

Solar Photovoltaic (PV) Panels Market Dynamics

Driver

Government Incentives and Subsidies for Renewable Energy Deployment

- Global policy frameworks promoting renewable energy are critical drivers for the solar PV panels market, enabling large-scale deployment through fiscal support and strategic initiatives. Governments across regions are implementing tax credits, feed-in tariffs, and rebate programs to reduce the upfront cost of solar panel installations and enhance profitability for investors and end users

- For instance, in the United States, the federal Investment Tax Credit (ITC) continues to provide significant financial benefits for solar energy installations, covering up to 30 percent of system costs. In addition, China’s National Energy Administration (NEA) has expanded its renewable energy subsidy scheme to boost solar PV adoption across distributed and utility-scale projects, fostering both domestic manufacturing and export opportunities

- These regulatory measures are encouraging corporate power-purchase agreements and large-scale renewable procurement by industries seeking to meet ESG objectives. Such support mechanisms are pivotal in de-risking investments and accelerating the uptake of photovoltaic systems across residential rooftops, commercial buildings, and rural electrification programs

- Developing economies are also launching dedicated solar subsidy programs under sustainable infrastructure plans, helping bridge the energy access gap and reduce reliance on fossil fuels. Net metering policies and renewable energy credits further incentivize households and businesses to install solar systems and inject surplus electricity into the grid

- Sustained government backing through favorable regulations, grants, and green financing mechanisms is reinforcing investor confidence and ensuring long-term growth. This proactive policy environment remains central to driving the global transition toward clean energy generation through widespread photovoltaic panel adoption

Restraint/Challenge

Fluctuating Raw Material Prices

- Volatility in raw material prices, particularly polysilicon, silver, and aluminum, poses significant challenges to the solar PV panel manufacturing industry. Frequent cost fluctuations directly impact production expenses and supply chain stability, making it difficult for large manufacturers to maintain consistent pricing and profitability

- For instance, in 2024, the global polysilicon market experienced sharp price spikes due to restricted supply from major producers in China, leading to delays and cost escalations across the solar manufacturing value chain. This variability in input costs compelled several module producers, including Canadian Solar and JA Solar, to adjust shipment timelines and pricing to mitigate margin pressures

- Since solar panel production depends on energy-intensive processes and specialized materials, any disruption in upstream supply can significantly influence overall system affordability. These fluctuations also affect downstream customers, leading to delayed project completions and reduced financial feasibility for utility-scale solar developments

- The dependency on limited suppliers for key materials increases vulnerability to price instability. Market players are responding by diversifying raw material sourcing, improving material efficiency through technological innovation, and developing thinner wafers or alternative conductive materials to reduce cost volatility

- Addressing raw material price fluctuations through supply chain resilience, localized sourcing, and recycling of PV materials will be essential for sustainable market growth. Long-term stability in raw material costs will play a critical role in ensuring continued affordability and scalability of solar photovoltaic panel production across global energy ecosystems

Solar Photovoltaic (PV) Panels Market Scope

The market is segmented on the basis of technology, grid type, end-use, and deployment.

- By Technology

On the basis of technology, the Solar Photovoltaic (PV) Panels market is segmented into Thin Film, Crystalline Silicon, and Others. The Crystalline Silicon segment dominated the market with the largest revenue share of 62.5% in 2025, driven by its high efficiency, long lifespan, and well-established presence in both residential and commercial applications. Homeowners and businesses often prefer crystalline silicon panels for their proven reliability, strong energy yield, and compatibility with a wide range of inverters and mounting systems. The segment benefits from ongoing technological enhancements such as PERC (Passivated Emitter Rear Cell) and bifacial designs that further improve efficiency and energy generation. Crystalline silicon panels are also widely supported by government incentives and subsidy programs, enhancing their adoption in key markets.

The Thin Film segment is anticipated to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by increasing demand for lightweight, flexible, and aesthetically adaptable solutions. Thin film technology is particularly suitable for rooftops with weight restrictions or unconventional shapes, and its declining production cost makes it attractive for commercial-scale installations. For instance, companies such as First Solar have accelerated thin film adoption by offering high-efficiency, low-cost modules optimized for large-scale solar farms. The segment’s growing popularity is also driven by innovations in cadmium telluride and CIGS (Copper Indium Gallium Selenide) technologies, which improve performance under low-light conditions and high temperatures.

- By Grid Type

On the basis of grid type, the Solar PV Panels market is segmented into On-Grid and Off-Grid systems. The On-Grid segment dominated the market with the largest revenue share of 71.4% in 2025, driven by the growing adoption of grid-tied solar systems for residential and commercial applications. On-grid systems allow users to feed excess electricity back to the grid, providing financial incentives such as net metering and reducing overall energy costs. Homeowners increasingly prioritize on-grid installations for their ability to integrate seamlessly with existing utility networks, as well as for reliable, uninterrupted power supply. The segment also benefits from supportive policies and renewable energy targets in key markets such as the U.S., Germany, and China, which further accelerate adoption.

The Off-Grid segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by increasing demand in remote or rural areas with limited grid connectivity. Off-grid solar systems are favored for providing energy independence and resilience in regions where electricity access is intermittent or unavailable. For instance, companies such as Schneider Electric are expanding off-grid solutions with solar + storage systems designed for rural electrification and small-scale commercial setups. Technological advancements in battery storage and modular system design are also enhancing the feasibility and adoption of off-grid solar solutions.

- By End-Use

On the basis of end-use, the Solar PV Panels market is segmented into Residential and Non-Residential sectors. The Residential segment dominated the market with the largest revenue share of 55.8% in 2025, driven by growing consumer awareness of clean energy, government incentives, and rising electricity costs. Homeowners increasingly invest in rooftop solar installations to reduce energy bills, increase energy independence, and achieve sustainability goals. Residential solar adoption is also encouraged by innovative financing models such as solar leases, power purchase agreements, and subsidies for residential installations. The segment benefits from the rising integration of smart inverters and home energy management systems, allowing homeowners to monitor and optimize energy generation and consumption efficiently.

The Non-Residential segment is anticipated to witness the fastest growth rate of 20.9% from 2026 to 2033, fueled by the rapid adoption of commercial and industrial solar projects. Businesses are increasingly turning to solar energy to reduce operational costs, achieve sustainability targets, and enhance brand image. For instance, companies such as Tesla and Walmart are deploying large-scale rooftop and ground-mounted solar systems to power operations while minimizing carbon footprints. The segment’s growth is supported by corporate renewable energy commitments, favorable tax credits, and technological innovations enabling faster deployment of high-capacity systems.

- By Deployment

On the basis of deployment, the Solar PV Panels market is segmented into Ground Mounted and Rooftop Solar. The Rooftop Solar segment dominated the market with the largest revenue share of 59.3% in 2025, driven by increasing adoption in urban residential and commercial spaces. Rooftop installations allow efficient utilization of available building space, reduce transmission losses, and offer direct energy consumption for homeowners and businesses. The segment benefits from supportive government programs that encourage distributed generation and provide incentives for rooftop solar adoption. Rooftop solar is also favored for its relatively shorter installation timelines, scalable capacity, and integration with smart energy management solutions, which enhance its convenience and appeal.

The Ground Mounted segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, fueled by the expansion of utility-scale solar farms in regions with ample open land and high solar irradiance. Ground-mounted solar systems offer higher energy output and easier maintenance compared with rooftop installations, making them ideal for commercial and industrial applications. For instance, companies such as First Solar and SunPower are investing heavily in large-scale solar farms across the U.S. and India to meet rising energy demand sustainably. Technological advancements in tracking systems and modular racking further enhance the efficiency and profitability of ground-mounted solar projects.

Solar Photovoltaic (PV) Panels Market Regional Analysis

- Asia-Pacific dominated the solar photovoltaic (PV) panels market with the largest revenue share of 54.5% in 2025, driven by expanding renewable energy initiatives, favorable government policies, and rapid industrialization across developing economies

- The region’s cost-effective manufacturing landscape, abundant solar resources, and strong presence of PV module producers are accelerating market expansion. Countries such as China, India, and Japan are investing heavily in solar capacity addition, grid modernization, and distributed energy systems

- Increasing electricity demand, coupled with rising environmental awareness and commitments to net-zero targets, is contributing to higher adoption of solar PV solutions in both residential and commercial sectors

China Solar PV Panels Market Insight

China held the largest share in the Asia-Pacific Solar PV Panels market in 2025, owing to its position as a global leader in solar module manufacturing and utility-scale project deployment. The country’s strong industrial base, extensive government incentives, and large-scale investments in renewable energy infrastructure are major growth drivers. Demand is further supported by China’s Belt and Road solar projects, domestic rooftop installations, and advancements in high-efficiency crystalline silicon and thin-film technologies.

India Solar PV Panels Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapidly rising electricity demand, government-backed renewable energy targets, and large-scale solar park developments. Initiatives such as the National Solar Mission, along with increasing adoption of rooftop and decentralized solar solutions, are strengthening market growth. In addition, declining costs of PV modules, rising corporate renewable energy commitments, and expanding local manufacturing under the “Make in India” program are driving robust expansion.

Europe Solar PV Panels Market Insight

The Europe Solar PV Panels market is expanding steadily, supported by ambitious renewable energy targets, incentives for distributed generation, and high adoption of residential and commercial solar solutions. The region places strong emphasis on sustainable energy, grid integration, and energy efficiency standards, particularly in countries such as Germany, France, and Spain. Growing demand for green electricity, coupled with investment in energy storage solutions and solar-plus-storage projects, is further enhancing market growth.

Germany Solar PV Panels Market Insight

Germany’s Solar PV Panels market is driven by its leadership in residential rooftop solar installations, high efficiency and quality standards, and supportive government policies. The country benefits from advanced R&D in PV technologies, strong solar project financing mechanisms, and continued focus on decarbonizing the energy mix. Demand is particularly strong for high-efficiency crystalline silicon panels in residential and small commercial projects.

U.K. Solar PV Panels Market Insight

The U.K. market is supported by growing residential and commercial solar adoption, government-backed subsidy schemes, and efforts to increase energy security. Rising interest in solar-plus-storage solutions, corporate renewable energy procurement, and advancements in building-integrated photovoltaics are boosting the market. The country continues to prioritize low-carbon energy generation, which drives demand for reliable and high-performance solar PV systems.

North America Solar PV Panels Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong adoption of solar PV in residential, commercial, and utility-scale projects. Rising electricity costs, sustainability initiatives, and federal and state incentives for solar installations are boosting market demand. In addition, technological advancements in bifacial and high-efficiency modules, as well as increasing deployment of energy storage with solar systems, are contributing to rapid expansion.

U.S. Solar PV Panels Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by robust investment in residential rooftop solar, utility-scale solar farms, and corporate renewable energy projects. The country’s focus on clean energy policies, tax incentives such as the Investment Tax Credit (ITC), and innovative financing solutions is driving PV adoption. Presence of major solar manufacturers, project developers, and a mature distribution network further solidify the U.S.’s leading position in the region.

Solar Photovoltaic (PV) Panels Market Share

The solar photovoltaic (PV) panels industry is primarily led by well-established companies, including:

- JA Solar Technology Co., Ltd. (China)

- SunPower Corporation (U.S.)

- AGC Glass Europe (Belgium)

- Nippon Sheet Glass Co., Ltd. (Japan)

- HeckerGlastechnik GmbH & Co. KG (Germany)

- Euroglas (Germany)

- Emmvee Toughened Glass Private Limited (India)

- F solar GmbH (Germany)

- Taiwan Glass Ind. Corp (Taiwan)

- Xinyi Solar Holdings Ltd (China)

- Sisecam Flat Glass (Turkey)

- Guardian Glass (U.S.)

- Saint-Gobain Solar (France)

- Flat Glass Co., Ltd (China)

- Guangdong Golden Glass Technologies (China)

- Henan HuameiCinda Industrial Co., Ltd. (China)

- Interfloat Corporation (U.S.)

Latest Developments in Global Solar Photovoltaic (PV) Panels Market

- In September 2025, the government of India reduced the goods and services tax (GST) on solar cells and modules from 12 % to 5 %. This significant policy move lowers the upfront capital cost of solar installations for residential, commercial, and industrial users, making solar projects more financially attractive. The reduction is expected to drive accelerated adoption of rooftop and utility-scale solar systems across the country, strengthen domestic manufacturing, and increase overall investment in the renewable energy sector. This development positions India as a rapidly expanding market with one of the highest growth trajectories globally

- In August 2025, the Australian Renewable Energy Agency (ARENA) announced AUD 34.5 million in funding to expand domestic solar module manufacturing at Tindo Solar in South Australia, increasing annual production capacity from 20 MW to 180 MW. This initiative strengthens the local supply chain, reduces dependence on imports, and ensures greater resilience against global supply disruptions. The expansion is expected to enhance adoption of solar panels across residential, commercial, and utility-scale projects in Australia, supporting both cost reduction and faster project deployment

- In July 2025, First Solar, Inc. entered into a long‑term exclusive agreement with UbiQD, Inc. to integrate quantum-dot nanotechnology into its thin-film bifacial solar modules. This technological advancement promises higher module efficiency and energy yield, which could set new performance benchmarks in the global PV market. Widespread adoption of quantum-dot-enhanced panels is likely to increase competition among manufacturers, drive innovation in next-generation solar technologies, and accelerate the transition toward higher-efficiency, lower-cost solar installations worldwide

- In May 2025, Australia’s Solar Sunshot Program selected 5B Solar Systems for funding up to AUD 46 million to scale the production of its pre-wired ‘Maverick’ solar deployment system. This system reduces installation time and labor requirements for large-scale solar farms, enabling faster project execution and lower overall costs. The funding supports the adoption of more efficient ground-mounted solar solutions, enhances project feasibility, and is likely to encourage private investment in large-scale solar infrastructure

- In April 2025, the International Energy Agency Photovoltaic Power Systems Programme (IEA‑PVPS) reported that global cumulative PV capacity exceeded 2.2 TW, with annual installations between ~554 GW and ~602 GW. This record growth highlights strong global demand for solar energy and signals that the market continues to expand at an unprecedented pace. Despite challenges such as manufacturing overcapacity and module price fluctuations, the report underscores the PV sector’s resilience and its central role in global decarbonization and renewable energy adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Solar Photovoltaic Pv Panels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Solar Photovoltaic Pv Panels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Solar Photovoltaic Pv Panels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.