Global Solar Encapsulation Market

Market Size in USD Billion

CAGR :

%

USD

3.63 Billion

USD

7.29 Billion

2024

2032

USD

3.63 Billion

USD

7.29 Billion

2024

2032

| 2025 –2032 | |

| USD 3.63 Billion | |

| USD 7.29 Billion | |

|

|

|

|

Solar Encapsulation Market Size

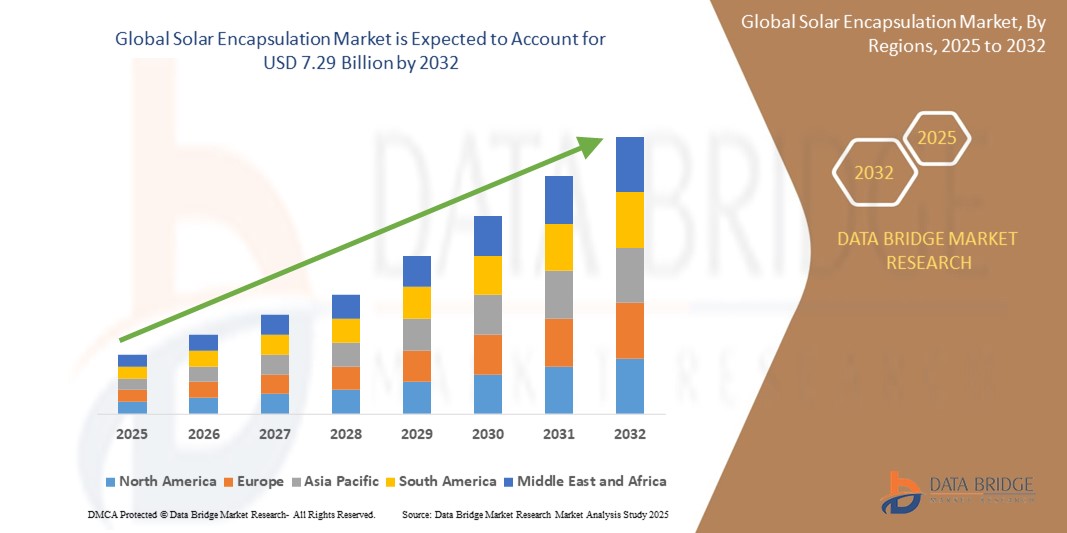

- The global Solar Encapsulation market was valued at USD 3.63 billion in 2024 and is expected to reach USD 7.29 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.10%, primarily driven by increasing installation of solar photovoltaic systems across residential, commercial, and utility sectors

- This growth is driven by factors such as the rising demand for renewable energy, government incentives for solar projects, and advancements in encapsulation materials that enhance solar panel durability and efficiency

Solar Encapsulation Market Analysis

- Solar encapsulation plays a crucial role in protecting photovoltaic cells from environmental elements such as moisture, dirt, and mechanical stress. This protective layer ensures long-term durability and performance of solar panels, which is essential for maximizing energy output over decades of use

- The market is evolving rapidly with growing emphasis on the development of advanced encapsulant materials. Traditional materials such as ethylene vinyl acetate are still dominant, but newer formulations are being designed to resist discoloration, ultraviolet damage, and delamination for improved solar panel lifespan

- There is also increasing integration of solar encapsulants in thin-film and flexible solar technologies. These require highly adaptive and lightweight encapsulation materials that can withstand bending and temperature variation while maintaining optical clarity and adhesion

- Sustainability is another key factor shaping the market. Manufacturers are exploring recyclable and environmentally friendly encapsulants that align with the clean energy goals of solar power without compromising on protection or efficiency

- For instance, in early 2024, DuPont introduced a new generation of solar encapsulants under its Clear Tedlar brand. These materials were designed to boost panel durability and were immediately adopted by leading module manufacturers for their clarity and long-term performance

Report Scope and Solar Encapsulation Market Segmentation

|

Attributes |

Solar Encapsulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Solar Encapsulation Market Trends

“Advanced Encapsulation Materials”

- The solar encapsulation market is witnessing a significant shift towards advanced materials that enhance the efficiency and durability of photovoltaic modules

- Traditional encapsulants such as ethylene vinyl acetate are being supplemented or replaced by innovative materials such as UV-curable resins and non-ethylene vinyl acetate compounds

- These alternatives offer improved resistance to ultraviolet radiation, moisture, and mechanical stress, thereby extending the lifespan of solar panels

- For instance, in May 2022, JA Solar Holdings introduced the DeepBlue 4.0 X module, featuring specially designed encapsulation materials and patented Gapless Flexible Interconnection technology to address mechanical stress at cell interconnections and reduce the risk of microcracking

- This trend towards advanced encapsulation materials aligns with the industry's focus on enhancing the performance and longevity of solar energy systems

Solar Encapsulation Market Dynamics

Driver

“Increasing Demand for Renewable Energy”

- The escalating global demand for renewable energy sources is a primary driver of the solar encapsulation market

- As nations strive to reduce carbon emissions and transition towards sustainable energy solutions, the adoption of solar power systems has surged

- This growth necessitates the development and deployment of efficient encapsulation materials that protect photovoltaic cells from environmental factors, ensuring their longevity and optimal performance

- Government incentives, subsidies, and favorable policies further accelerate the adoption of solar energy, thereby driving the demand for high-quality encapsulation solutions

- The integration of advanced encapsulation materials plays a crucial role in enhancing the efficiency and durability of solar modules, supporting the broader transition to renewable energy

Opportunity

“Expansion in Emerging Markets”

- Emerging economies present significant growth opportunities for the solar encapsulation market

- Countries in regions such as Asia Pacific, Latin America, and Africa possess abundant solar resources and are increasingly investing in solar energy infrastructure

- For instance, India has witnessed a remarkable 210% year-on-year increase in rooftop solar installations in 2021, highlighting the growing demand for solar energy solutions

- As these nations expand their solar energy capacities, the need for reliable and cost-effective encapsulation materials becomes paramount

- This trend offers lucrative prospects for manufacturers to supply advanced encapsulants tailored to the specific environmental conditions of these regions, thereby fostering market growth and contributing to global sustainability goals

Restraint/Challenge

“High Initial Costs of Encapsulation Materials”

- A significant challenge in the solar encapsulation market is the high initial costs associated with advanced encapsulation materials

- The specialized nature of these materials, designed to withstand extreme environmental conditions, often involves complex manufacturing processes and the use of high-quality raw materials

- This complexity translates into higher production costs, which can be a barrier for manufacturers, especially in price-sensitive markets

- Additionally, the intricate nature of solar encapsulation materials complicates the recycling process, increasing costs and reducing the overall viability of recycling initiatives

- These factors collectively pose challenges to the widespread adoption of advanced encapsulation materials, potentially hindering market growth

Solar Encapsulation Market Scope

The market is segmented on the basis material, technology, and application.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Technology |

|

|

By Application |

|

Solar Encapsulation Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Solar Encapsulation Market”

- Asia Pacific held a significant share of the global solar encapsulation market in 2023, driven by robust manufacturing capabilities and substantial investments in solar energy infrastructure

- Countries such as China, India, Japan, and South Korea are leading the region, with China being the largest producer of solar panels globally

- The region benefits from cost-effective production, technological advancements, and supportive government policies promoting renewable energy adoption

- In India, for instance, the government has implemented various incentives to boost solar installations, contributing to the region's dominance in the market

- The rapid urbanization and industrialization in Asia Pacific further accelerate the demand for solar encapsulation materials, ensuring the region's continued leadership in the market

“North America is Projected to Register the Highest Growth Rate”

- North America is experiencing significant growth in the solar encapsulation market, driven by increasing environmental awareness and supportive government policies

- For Instance, U.S., in particular, has seen a surge in solar installations, with over 30 gigawatts of solar capacity added in 2023, marking a year-on-year growth of more than 51% compared to 2022

- Technological innovations, such as bifacial solar panels and smart encapsulation materials, are gaining traction in North America, enhancing the efficiency and durability of solar installations

- Partnerships between industry players and research institutions, such as the National Renewable Energy Laboratory (NREL), are driving R&D efforts for the development of next-generation encapsulation materials tailored to the region's climatic conditions and energy needs

- With ambitious renewable energy targets set by governments and corporations alike, North America is poised to witness sustained growth in the solar encapsulation market

Solar Encapsulation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- First Solar (U.S.)

- STR Holdings Inc. (U.S.)

- Hangzhou First Applied Material Co., Ltd. (China)

- Dow (U.S.)

- DuPont (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Cambiosolar (Spain)

- Kuraray Europe Gmbh (Germany)

- 3M (U.S.)

- RenewSys India Pvt. Ltd (India)

- VIKRAM SOLAR LTD. (India)

- Jinko Solar (China)

- Jinko Solar (U.S.)

- Q CELLS (South Korea)

- SunPower Corporation (U.S.)

- Trina Solar (China)

- Canadian Solar (Canada)

- JA SOLAR Technology Co., Ltd., (China)

- The Solaria Corporation (U.S.)

Latest Developments in Global Solar Encapsulation Market

- In December 2023, RenewSys introduced India's first Polyolefin Elastomer (POE) encapsulant tailored for n-type TOPCon solar cells, named CONSERV E – NT. This product aims to reduce degradation in n-type TOPCon modules by incorporating a free radical scavenger to protect against environmental stresses such as temperature fluctuations, moisture, and chemical exposure

- In October 2023, Shanghai-based AIKO launched its cutting-edge solar cell products, including solar encapsulation technology, in Australia at the All-Energy exhibition in Melbourne

- In August 2023, Alishan Green Energy launched the Alishan BackPro back sheets, a line of photovoltaic cell encapsulants combining fluoro and non-fluoro options. These back sheets, produced at Alishan's Raipur facility, feature a proprietary multi-layer coating that enhances electrical insulation, moisture barrier properties, and resistance to mechanical stress and partial electrical discharges. This innovation aims to improve the performance and longevity of solar modules, catering to the growing demand for durable and efficient solar energy solutions

- In March 2023, Dow expanded its solar encapsulation offerings by introducing the DOWSIL™PV product line, which includes six silicone-based sealants and adhesives designed to enhance the durability and performance of photovoltaic modules. These products are intended for applications such as frame sealing, rail bonding, and junction box bonding, supporting the global shift toward renewable energy by improving the reliability and lifespan of solar installations

- In March 2023, the Chemical conglomerate DOW, a US-based company, launched photovoltaic (PV) product solutions for PV module assembly and line with six silicone-based sealants

- In May 2022, JA Solar launched the DeepBlue 4.0 X module, featuring specially designed encapsulation materials and patented Gapless Flexible Interconnection (GFI) high-density module encapsulation technology. This advancement addresses mechanical stress at cell interconnections and reduces the risk of microcracking, thereby enhancing the efficiency and durability of photovoltaic modules

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.