Global Sol Gel Coatings Market

Market Size in USD Billion

CAGR :

%

USD

3.76 Billion

USD

8.81 Billion

2024

2032

USD

3.76 Billion

USD

8.81 Billion

2024

2032

| 2025 –2032 | |

| USD 3.76 Billion | |

| USD 8.81 Billion | |

|

|

|

|

Sol-Gel Coatings Market Size

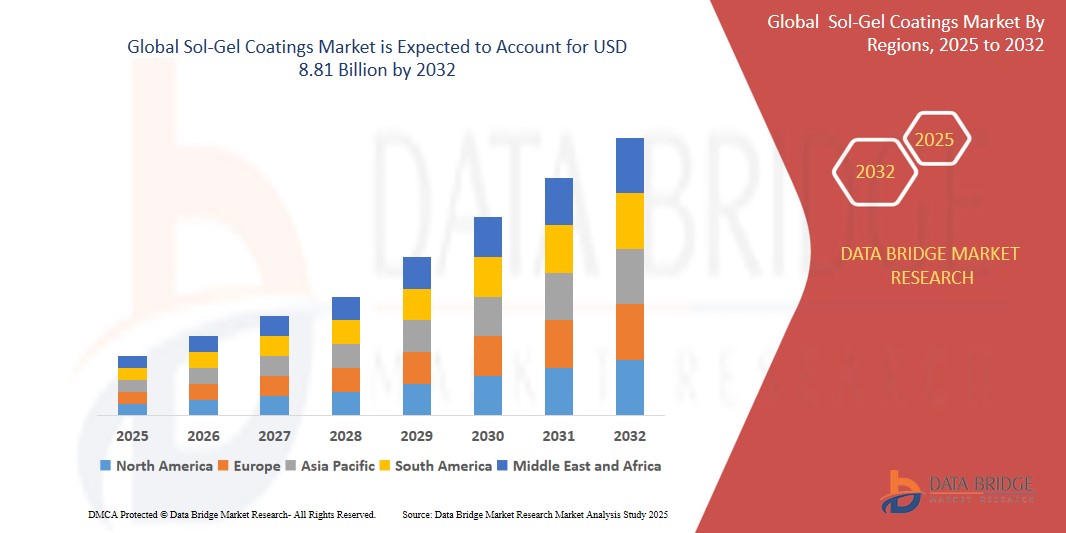

- The global sol-gel coatings market size was valued at USD 3.76 billion in 2024 and is expected to reach USD 8.81 billion by 2032, at a CAGR of 11.20% during the forecast period

- This growth is driven by factors such as the increasing demand for multifunctional coatings in automotive, electronics, and healthcare sectors, enhanced performance characteristics like abrasion resistance and UV protection, and advancements in nanotechnology enabling customized sol-gel formulations for specialized applications

Sol-Gel Coatings Market Analysis

-

Sol-Gel coatings are advanced materials applied as thin films that enhance surface properties such as hardness, corrosion resistance, thermal stability, and optical clarity. These coatings are widely used in industries such as automotive, electronics, aerospace, and healthcare

- The demand for Sol-Gel coatings is significantly driven by the increasing need for eco-friendly, high-performance coatings and the growing trend toward miniaturized and multifunctional devices

- North America is expected to dominate the Sol-Gel coatings market, with a projected market share of 35% in 2024. This dominance is driven by the strong presence of automotive and electronics manufacturers, a robust R&D infrastructure, and early adoption of advanced coating technologies

- Asia-Pacific is projected to be the fastest-growing region in the Sol-Gel coatings market, with a CAGR of 7.2% during the forecast period. This growth is fueled by rapid industrialization, rising demand for high-performance coatings, and expanding production bases in China, India, and Japan. The region’s market share is expected to rise to 32% by 2032

- The automotive segment is expected to hold the largest market share in the Sol-Gel coatings market, accounting for 40% of the total market in 2024. The growing use of Sol-Gel coatings for scratch resistance, anti-reflective surfaces, and corrosion protection in both interior and exterior applications is driving this growth

Report Scope and Sol-Gel Coatings Market Segmentation

|

Attributes |

Sol-Gel Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sol-Gel Coatings Market Trends

“Advancements in Functional Coatings and Nanotechnology Integration”

- A prominent trend in the Sol-Gel coatings market is the increasing integration of nanotechnology and functional coatings to create more efficient, durable, and specialized materials

- These innovations allow for enhanced coating properties such as improved wear resistance, self-healing capabilities, and increased UV stability, which significantly improve the performance of coatings in demanding applications

- For instance, nanostructured sol-gel coatings are being developed for use in electronic devices and automotive parts, where durability and performance under harsh conditions are crucial

- These advancements are transforming the Sol-Gel coatings market, driving demand for next-generation coatings that meet the increasingly stringent requirements of industries like automotive, aerospace, and electronics, while also contributing to more eco-friendly and sustainable solutions

Sol-Gel Coatings Market Dynamics

Driver

“Increasing Demand for High-Performance and Eco-Friendly Coatings”

- The growing need for durable, high-performance coatings across various industries, including automotive, electronics, and construction, is significantly driving the demand for Sol-Gel coatings

- As industries focus on improving product performance while reducing environmental impact, Sol-Gel coatings offer an ideal solution due to their eco-friendly nature and customizable properties, such as corrosion resistance, UV protection, and enhanced hardness

- Industries are increasingly adopting these coatings as sustainable alternatives to traditional coatings, particularly as environmental regulations tighten and demand for eco-conscious products rises

For instance,

- In January 2022, a leading automotive manufacturer implemented Sol-Gel coatings for anti-corrosion and scratch resistance on both exterior and interior parts of vehicles, helping meet environmental standards while enhancing the durability of the vehicle’s components

- As industries continue to focus on sustainability, Sol-Gel coatings are expected to see an increase in adoption, especially for applications in automotive, electronics, and renewable energy sectors

Opportunity

“Integration of Smart Coatings for Self-Healing and Monitoring”

- The development and integration of smart coatings that can self-heal, monitor environmental changes, and provide real-time feedback is opening up new opportunities for Sol-Gel coatings in industries such as automotive, aerospace, and electronics

- These self-healing coatings can repair themselves when exposed to damage, such as scratches or corrosion, significantly enhancing the durability and lifespan of the products they protect. In addition, coatings with embedded sensors can monitor environmental factors like humidity, temperature, or chemical exposure, providing valuable data for predictive maintenance and improving performance in extreme conditions

- The increasing focus on smart materials is driving demand for Sol-Gel coatings with advanced functionalities in sectors where product performance and longevity are critical

For instance,

- In March 2024, a leading aerospace company integrated self-healing Sol-Gel coatings into its aircraft components, significantly extending the life of its fleet and reducing maintenance costs by using coatings that could automatically repair damage caused by environmental exposure

- The self-healing and monitoring capabilities of Sol-Gel coatings are expected to revolutionize industries like aerospace, automotive, and electronics, where the ability to monitor and repair damage can significantly reduce downtime, improve safety, and lower maintenance costs

Restraint/Challenge

“High Production and Material Costs Limiting Market Growth”

- The high cost of raw materials and the complex manufacturing processes associated with Sol-Gel coatings pose a significant challenge for the market, particularly in terms of cost competitiveness

- While Sol-Gel coatings offer exceptional performance in terms of durability and functionality, their production costs are often higher than those of traditional coatings, due to the specialized materials and processes required. This can make it difficult for manufacturers to offer these coatings at competitive prices, particularly in industries that are highly cost-sensitive

- Smaller companies or those with budget constraints may face difficulty adopting these coatings, especially in regions with lower purchasing power. This can limit the overall market penetration and adoption of Sol-Gel coatings in certain sectors

For instance,

- In August 2024, an article published by a leading coatings manufacturer highlighted the challenges posed by the high costs of production for Sol-Gel coatings, which are a significant factor limiting their widespread use in industries like construction and automotive. Despite their superior properties, the cost is often prohibitive for small and medium enterprises looking to adopt these coatings as a standard option

- As a result, the high production and material costs of Sol-Gel coatings can limit their adoption, particularly in emerging markets where cost constraints are a significant factor

Sol-Gel Coatings Market Scope

The market is segmented on the basis of product type, end user, and application

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By End User |

|

|

By Application |

|

In 2025, the automotive segment is projected to dominate the market with a largest share in end user segment

The automotive segment is projected to dominate the Sol-Gel coatings market in 2025, driven by growing demand for durable, corrosion-resistant, and aesthetically appealing vehicle components. Sol-Gel coatings offer enhanced protection against environmental factors, leading to longer vehicle lifespans and reduced maintenance costs. These coatings are applied to various parts, including exteriors, interiors, and engine components, improving both performance and appearance. North America is expected to hold the largest market share for this segment, with the U.S. leading, contributing around 35% of the global market share due to its strong automotive manufacturing sector.

The wear-resistant is expected to account for the largest share during the forecast period in technology market

In 2025, wear-resistant coatings are projected to dominate the Sol-Gel coatings market, accounting for approximately 38% of the global market share. Their extensive application in high-performance sectors like automotive and aerospace—where components endure high friction and stress—drives demand. These coatings significantly enhance durability, extend part lifespan, and reduce maintenance costs, making them a top choice for manufacturers seeking long-term value. North America is expected to be the leading region, contributing around 36% of the global market, with the U.S. accounting for the largest share due to its strong industrial and aerospace sectors.

Sol-Gel Coatings Market Regional Analysis

“North America Holds the Largest Share in the Sol-Gel Coatings Market”

- North America dominates the global Sol-Gel coatings market with a projected market share of 35% in 2024, primarily due to its advanced industrial base, increasing demand for high-performance coatings, and rapid adoption of nanotechnology in manufacturing

- The U.S. accounts for the largest share in the region, driven by its strong presence in the automotive, aerospace, and electronics sectors where Sol-Gel coatings are widely utilized for their durability, corrosion resistance, and thermal stability

- Continuous investments in R&D, supported by government and private funding, as well as collaborations between universities and industry players, are enhancing innovation in coating technologies

- In addition, the growing emphasis on sustainability and regulatory push for eco-friendly, low-VOC coatings further propels the market across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Sol-Gel Coatings Market”

- The Asia-Pacific region is expected to witness the highest compound annual growth rate (CAGR) in the Sol-Gel coatings market during the forecast period, driven by expanding industrialization, increasing demand for high-performance materials, and supportive government initiatives for manufacturing innovation. The region’s market share is expected to rise to 32% by 2032

- Countries such as China, India, and Japan are emerging as major markets due to rapid infrastructure growth and rising adoption of Sol-Gel coatings across sectors like automotive, electronics, construction, and aerospace

- China, being a global manufacturing hub, is experiencing high demand for Sol-Gel coatings in automotive and electronics due to their durability and corrosion resistance.

- India is witnessing increased adoption due to growing infrastructure projects and rising demand for energy-efficient solutions in construction

- Japan, with its advanced R&D capabilities, is leading innovations in nanomaterial-based Sol-Gel applications, especially in optics and precision equipment

- The region’s growing focus on sustainability and environmental compliance is further accelerating the shift toward eco-friendly Sol-Gel technologies

Sol-Gel Coatings Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SOCOMORE (France)

- Akzo Nobel N.V. (Netherlands)

- SCHOTT AG (Germany)

- 3M (U.S.)

- PPG Industries Inc. (U.S.)

- CMR Coatings GmbH (Germany)

- Nanovations Pty Ltd. (Australia)

- Axalta Coating Systems (U.S.)

- The Sherwin-Williams Company (U.S.)

- Ferro Corporation (U.S.)

- Premium Coatings And Chemicals Pvt Ltd. (India)

- Euroglas GmbH (Germany)

- Warren Paint & Color Co. (U.S.)

- OPTICOTE INC (U.S.)

- Covestro AG (Germany)

- Thermolon Korea (South Korea)

- Praxair Technology Inc. (U.S.)

- NTC - Nano Tech Coatings GmbH (Germany)

- Nanogate (Germany)

Latest Developments in Global Sol-Gel Coatings Market

- In October 2023, Sherwin-Williams Aerospace Coatings introduced the Jet Prep Pretreatment (CM0220P01), a cutting-edge sol-gel metal pretreatment solution. This water-based, translucent, and chrome-free product is specifically designed for the aerospace industry. The two-component kit provides superior adhesion and corrosion protection for aluminum substrates, making it a practical and efficient choice for aviation applications. Its innovative formulation ensures durability while meeting industry standards. The Jet Prep Pretreatment reflects Sherwin-Williams' commitment to delivering advanced solutions for aerospace coatings

- In June 2023, Sol-Gel Technologies, Ltd., an Israeli dermatology company, partnered with Searchlight Pharma Inc., a Canadian specialty pharmaceutical firm, through exclusive license agreements. These agreements grant Searchlight Pharma the exclusive rights to market Sol-Gel's innovative dermatology products, TWYNEO and EPSOLAY, in Canada. TWYNEO is designed for treating acne vulgaris, while EPSOLAY targets inflammatory lesions of rosacea. This collaboration reflects Sol-Gel's commitment to expanding its presence in North America and bringing advanced dermatological solutions to Canadian patients

- In September 2023, composite nanomaterials emerged as the dominant type in the sol-gel nanocoatings market, driven by their superior properties such as corrosion resistance and durability. These advanced materials have gained significant traction in industries like automotive and aerospace, where performance and reliability are critical. Their ability to enhance surface protection and extend the lifespan of components has made them a preferred choice for various applications. This development highlights the growing demand for innovative solutions in the sol-gel nanocoatings sector

- In 2023, Nissan introduced "Scratch Shield," a sol-gel nanocoating for its vehicles' exterior paint. This advanced coating features self-healing properties, allowing it to repair minor scratches when exposed to heat. By restoring the surface to its original state, Scratch Shield enhances both the aesthetics and durability of vehicles. The innovative technology reflects Nissan's commitment to improving vehicle longevity and maintaining a polished appearance. This development highlights the growing adoption of sol-gel nanocoatings in the automotive industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sol Gel Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sol Gel Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sol Gel Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.