Global Engineering Software Market Segmentation, By Software Type (Electronic Design Automation (EDA), Computer-Aided Designing (CAD), Architecture, Engineering & Construction (AEC), Computer-Aided Engineering (CAE), and Computer-Aided Manufacturing (CAM)), Application (Product Design, 3D Modelling, Automation Design, Plant Design, and Others), Enterprise Size (Large Enterprise, Medium Enterprise, and Small Enterprise), End User (Automotive, Aerospace & Defense, Oil & Gas, IT & Telecommunication, Healthcare, and Others) – Industry Trends and Forecast to 2032

Engineering Software Market Analysis

The engineering software market encompasses a broad spectrum of tools designed to facilitate various aspects of the engineering process, from design and simulation to project management and analysis. Its size and scope are driven by the increasing complexity of engineering projects across industries such as automotive, aerospace, construction, and manufacturing. As technology advances, demand for sophisticated software solutions that streamline workflows, enhance collaboration, and improve efficiency continues to rise. The market size for engineering software reflects this trend, with steady growth driven by the need for innovative solutions to address evolving challenges in design optimization, cost reduction, and time-to-market acceleration.

Engineering Software Market Size

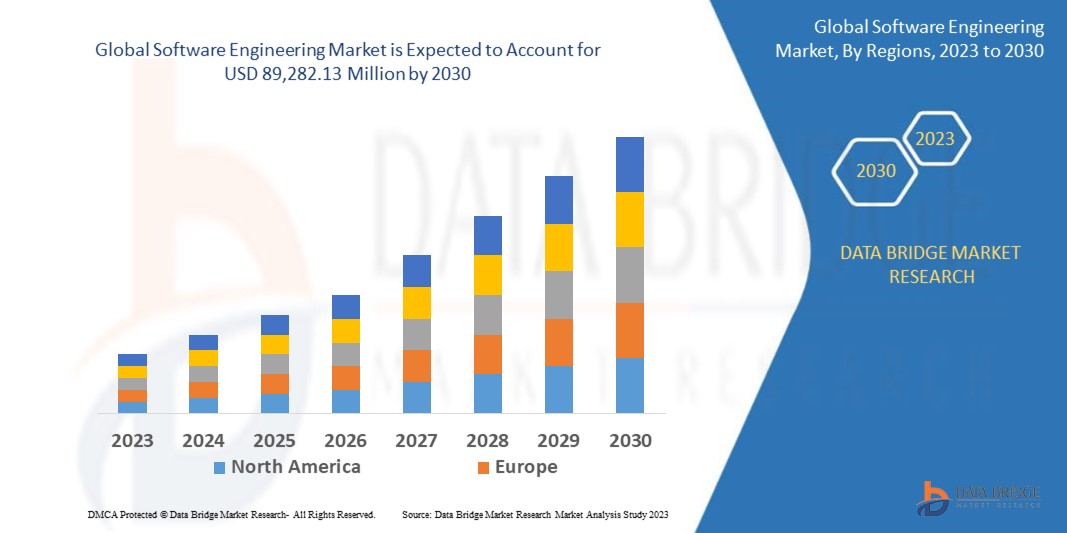

The global engineering software market size was valued at USD 48.82 billion in 2024 and is projected to reach USD 93.80 billion by 2032, with a CAGR of 8.50% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Engineering Software Market Segmentation

|

Attributes

|

Engineering Software Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Autodesk Inc., Synopsys, Inc., Dassault Systèmes, ANSYS, Inc, Cadence Design Systems, Inc., The MathWorks, Inc., PTC, Siemens, Bentley Systems, Incorporated, Hexagon AB, Altair Engineering Inc., Altium Limited, HCL Technologies Limited, AVEVA Group, BY COMSOL, BETA CAE Systems, CNC Software, LLC, Carlson Software, ESI Group, ZWSOFT CO., LTD., SimScale, and Computers and Structures, Inc.

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Engineering Software Market Definition

Global engineering software market describes a wide variety of computer programs and applications that are specifically made to help engineers in different areas of their job. These areas include software, mechanical, electrical, and civil engineering. Tasks including design, simulation, analysis, drawing, documentation, and project management are made easier with the help of these software tools. These tools facilitate the visualization of ideas, the modelling of intricate systems, performance analysis, design optimization, and workflow optimization, all of which help engineers work more efficiently and creatively on engineering projects in a variety of fields and sectors. In today's technologically advanced environment, engineering software is essential for promoting productivity, teamwork, and the creation of innovative solutions. With the increasing complexity of engineering projects and the growing demand for innovative solutions to address evolving challenges, the global engineering software market continues to expand.

Engineering Software Market Dynamics

Drivers

- Rising Adoption of Cloud Based Engineering Software due to Flexibility and Collaborative Nature of Work

The surge in cloud-based engineering software adoption fuels global market growth, offering flexibility and scalability for remote access and collaboration. Subscription models reduce upfront costs, democratizing access. Automatic updates streamline maintenance, ensuring access to latest features. Cloud scalability optimizes performance, catering to industry demands for agility and cost-effectiveness, fostering innovation.

- Rising Investments in Infrastructure Projects

The rising investments in infrastructure projects worldwide serve as a significant driver for the global engineering software market. As governments and private sectors allocate substantial funds towards infrastructure development, the demand for engineering software solutions intensifies. These investments span a wide range of projects, including transportation, energy, water supply, and urban development, among others. Engineering software plays a crucial role in these projects by enabling engineers to design, simulate, and manage complex infrastructure systems effectively.

Opportunities

- Continuous Technological Advancement in Engineering Software

Continuous technological advancement in engineering software presents a significant opportunity for the global market by driving innovation and enhancing capabilities. Advancements such as artificial intelligence, machine learning, and augmented reality are revolutionizing how engineers design, simulate, and analyze systems. These developments enable more efficient workflows, improved accuracy, and the ability to tackle increasingly complex challenges. Moreover, emerging technologies such as cloud computing and Internet of Things (IoT) integration offer new avenues for collaboration, mobility, and data-driven decision-making. As engineering software continues to evolve, there is immense potential for companies to differentiate themselves through cutting-edge solutions, thereby capturing greater market share and driving industry growth.

- Increasing Partnership and Acquisition among Market Players

By collaboration and partnership among industry players present for the global engineering software market by fostering innovation and expanding market reach. By combining expertise and resources, companies can develop comprehensive solutions that address evolving customer needs. Strategic alliances also enable access to new markets and technologies, driving growth. Moreover, cooperative efforts enhance interoperability and integration, enhancing the overall value proposition for customers.

Restraints/Challenges

- Complexity of Software and Limited Standardization Limits the Interoperability of Projects and Software

The complexity of software and limited standardization pose significant challenges to the interoperability of projects, acting as restraints for the global engineering software market. The sheer complexity of modern software systems, especially in engineering domains, makes it difficult for different software solutions to seamlessly communicate and integrate with one another. Each software package may have its own unique data structures, APIs, and protocols, making interoperability a daunting task. The lack of standardized practices across the industry exacerbates this issue. Without universally accepted standards for data formats, communication protocols, and software interfaces, developers face an uphill battle when trying to make their software compatible with others. This results in siloed ecosystems where software from different vendors struggles to work together efficiently.

- Shift of Companies from Licensing Model to Subscription Based Create Challenge in Adoption from End-Users

The shift of companies' licensing models from perpetual to subscription-based presents challenges for adoption in the engineering software market. End-users accustomed to one-time purchases may resist the ongoing financial commitment of subscriptions. In addition, concerns about data security and reliability of cloud-based services can deter users from embracing subscription models. Moreover, transitioning existing workflows and integrating new payment structures can be disruptive for businesses. Overcoming these challenges requires clear communication of the benefits, such as access to updates and support, and ensuring a seamless transition process to incentivize users to adopt subscription-based models.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Engineering Software Market Scope

The market is segmented on the basis of software type, application, enterprise size, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Software Type

- Electronic Design Automation (EDA)

- Computer-Aided Designing (CAD)

- Architecture, Engineering & Construction (AEC)

- Computer-Aided Engineering (CAE)

- Computer-Aided Manufacturing (CAM)

Application

- Product Design

- 3d Modelling

- Automation Design

- Plant Design

- Others

Enterprise Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

End User

- Automotive

- Aerospace & Defense

- Oil & Gas

- It & Telecommunication

- Healthcare

- Others

Engineering Software Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, software type, application, enterprise size, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Europe is expected to dominate the global engineering software market due to its strong presence of key players and robust technological advancements. Germany is expected to dominate the Europe engineering software market due to increased industrial activity and stringent environmental regulations. China is expected to dominate the Asia Pacific engineering software market due to growing emphasis on environmental compliance and modernization. U.S. is expected to dominate the North America engineering software market due to rapid industrialization and environmental regulations.

The Asia-Pacific region is the fastest-growing market for Engineering Software. This growth is driven by increasing awareness about child safety, rising disposable incomes, urbanization, and higher vehicle ownership in countries like China and India. However, challenges such as inconsistent safety regulations and a lack of awareness in some areas persist. Europe also has a robust market due to strict regulations but shows slower growth due to market saturation in certain countries

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Engineering Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Engineering Software Market Leaders Operating in the Market Are:

- Autodesk Inc.

- Synopsys, Inc.

- Dassault Systèmes

- ANSYS, Inc.

- Cadence Design Systems, Inc.

- The MathWorks, Inc.

- PTC

- Siemens

- Bentley Systems, Incorporated

- Hexagon AB

- Altair Engineering Inc.

- Altium Limited

- HCL Technologies Limited

- AVEVA Group Limited

- COMSOL

- BETA CAE Systems

- CNC Software, LLC

- Carlson Software

- ESI Group

- ZWSOFT CO., LTD.

- SimScale

- Computers and Structures, Inc.

Latest Developments in Engineering Software Market

- In April 2024, Ansys launched AnsysGPT, an AI-powered virtual assistant. With an expanded knowledge base and advanced infrastructure, it provided 24/7 customer support, enhancing real-time assistance. AnsysGPT complemented Ansys’ AI+ products, offering curated knowledge and vast multiphysics expertise, benefiting the company by improving response accuracy and customer experience

- In May 2024, the MathWorks, Inc. disclosed Toyota's decision to expand its usage of MATLAB and Simulink platforms and embrace Model-Based Design (MBD) to bolster their "ever-better cars" initiative. MBD streamlines development processes, enabling quick market responses and efficient investment in development capabilities. This move not only enhances Toyota's engineering efficiency but also expected to create more business opportunity for MathWorks

SKU-