Global Smart Utilities Market

Market Size in USD Billion

CAGR :

%

USD

56.48 Billion

USD

149.10 Billion

2024

2032

USD

56.48 Billion

USD

149.10 Billion

2024

2032

| 2025 –2032 | |

| USD 56.48 Billion | |

| USD 149.10 Billion | |

|

|

|

|

Smart Utilities Market Size

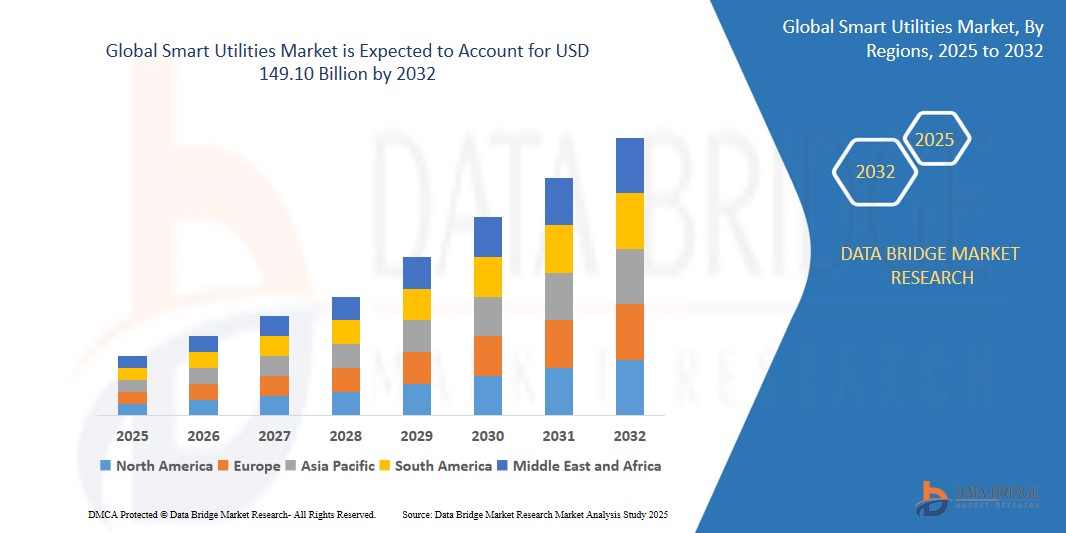

- The global smart utilities market size was valued at USD 56.48 billion in 2024 and is expected to reach USD 149.10 billion by 2032, at a CAGR of 12.90% during the forecast period

- This growth is driven by factors such as rising adoption of smart grids and meters, increasing investments in smart city infrastructure, stringent government regulations on energy efficiency, and growing demand for sustainable and efficient utility service

Smart Utilities Market Analysis

- Smart utilities are essential for the modernization of electricity, water, and gas infrastructure, enabling real-time data collection, remote monitoring, and enhanced efficiency in resource management. They integrate digital technologies such as smart meters, IoT sensors, and AI analytics into traditional utility services.

- The demand for smart utilities is significantly driven by the growing need for sustainable energy solutions, increasing urbanization, and the adoption of smart city initiatives globally.

- North America is expected to dominate the smart utilities market, accounting for 35-40% of the market share. This dominance is driven by well-established utility infrastructure, strong regulatory frameworks supporting digital transformation, and large-scale deployment of smart grid technologies. The region’s advanced technological landscape and commitment to smart utility systems further reinforce its leading position

- Asia-Pacific is projected to be the fastest-growing region in the smart utilities market during the forecast period, with its market share estimated to reach 25-30% by 2025. This growth is driven by rapid industrialization, rising energy demands, and significant government investments in smart infrastructure in countries such as China, India, and Japan

- The software segment is projected to dominate the component segment of the global smart utilities market, accounting for approximately 42-46% of the total market share. As the operational core of smart utilities, software plays a vital role in managing and analyzing large volumes of data generated by smart infrastructure

Report Scope and Smart Utilities Market Segmentation

|

Attributes |

Smart Utilities Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Utilities Market Trends

“Growing Integration of AI, IoT & Advanced Metering Infrastructure (AMI) in Utility Operations”

- One prominent trend in the development of smart utilities is the rising adoption of Artificial Intelligence (AI), Internet of Things (IoT), and Advanced Metering Infrastructure (AMI) across electricity, water, and gas utilities

- These technologies enhance operational efficiency by enabling real-time monitoring, predictive maintenance, and automated response systems

- For instance, In March 2024, Landis+Gyr launched a new grid edge intelligence platform integrated with AI and AMI, aimed at helping utilities optimize energy distribution and proactively manage grid stability. This development offers utilities better visibility into consumption patterns and allows for faster response to faults or outages

- These innovations are transforming utility operations, enhancing sustainability and resilience, while driving demand for smarter, interconnected infrastructure that supports long-term grid modernization efforts

Smart Utilities Market Dynamics

Driver

“Rising Demand for Grid Modernization and Energy Efficiency”

- The growing need for efficient energy distribution and real-time monitoring is significantly contributing to the adoption of smart utility solutions across the power, water, and gas sectors

- Urbanization, increased energy consumption, and the integration of renewable energy sources are placing greater demands on traditional utility infrastructure, prompting a shift toward smarter, more adaptive systems

- Smart utilities help reduce energy losses, improve demand forecasting, and support sustainability goals, making them vital for next-generation utility operations

- For instance, In October 2023, Schneider Electric announced the deployment of its EcoStruxure™ Grid platform across several European cities to enhance grid stability, enable real-time analytics, and promote decentralized energy resource integration. This move supports the broader push toward digitalization and smarter energy management across utility networks

- As a result of these growing requirements for modernized infrastructure, energy efficiency, and sustainability, the global demand for smart utilities is steadily increasing

Opportunity

“Leveraging AI and IoT for Predictive Maintenance and Operational Efficiency”

- The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in smart utilities presents an opportunity to enhance predictive maintenance, improve operational efficiency, and reduce downtime across electricity, water, and gas utilities.

- AI algorithms can analyze data from connected sensors to predict equipment failures, optimize energy consumption, and enhance resource management, offering utilities the ability to take preventive measures before issues escalate.

- In addition, AI-powered solutions can help in load forecasting, demand-response strategies, and fault detection, contributing to more efficient energy distribution and reducing operational costs

- For instance, In September 2024, Siemens launched an AI-driven predictive maintenance platform for smart grids, which integrates IoT sensors and machine learning to monitor grid infrastructure in real-time. The platform can identify potential faults, predict failure timelines, and suggest preventive maintenance, thus minimizing unplanned outages and improving service reliability

- The integration of AI and IoT technologies can further help utilities drive sustainability goals, reduce operational costs, and enhance service reliability, making this a key opportunity in the smart utilities market

Restraint/Challenge

“High Infrastructure and Implementation Costs Limiting Market Growth”

- The high initial investment required for smart utilities infrastructure poses a significant challenge, particularly for utilities in developing regions or smaller municipalities with limited budgets

- Smart utilities require substantial investments in advanced metering systems, sensors data analytics platforms, and other IoT-enabled devices. These upfront costs can be prohibitive for utilities operating under tight financial constraints

- Furthermore, the integration of legacy systems with modern smart grid technologies often demands significant resources, time, and expertise, further increasing the cost burden

- For instance, In February 2025, the International Energy Agency (IEA) published a report highlighting that the initial costs associated with smart grid deployment in emerging markets can exceed USD 100 billion annually, which may delay investments in smart utilities in these regions. The report also noted that the inability to secure funding for such extensive infrastructure projects limits the pace of modernization in many parts of the world.

- As a result, these high costs can delay the widespread adoption of smart utilities, particularly in areas where financial resources are constrained, thereby limiting market growth potential

Smart Utilities Market Scope

The market is segmented on the basis components, technology, applications, utility type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Components |

|

|

By Technology |

|

|

By Applications |

|

|

By Utility Type |

|

|

By End User |

|

In 2025, the software segment is projected to dominate the market with a largest share in component segment

In 2025, the software segment is projected to dominate the component segment of the global smart utilities market, accounting for approximately 42-46% of the total market share. As the operational core of smart utilities, software plays a vital role in managing and analyzing large volumes of data generated by smart infrastructure. These platforms help optimize energy distribution, enhance service reliability, and improve customer engagement. With increasing emphasis on data-driven decision-making and digital transformation in the utilities sector, demand for intelligent software solutions is expected to surge

The smart grid technology is expected to account for the largest share during the forecast period in technology market

The smart grid technology segment is expected to lead the technology market within the smart utilities sector in 2025, capturing a share of around 38-42%. This dominance is driven by the smart grid’s pivotal role in improving energy distribution efficiency and supporting renewable energy integration. Growing needs for real-time monitoring, advanced load management, and reduced energy losses are fueling the adoption of smart grid solutions globally. Continued investments in grid modernization and digital infrastructure are expected to reinforce this trend

Smart Utilities Market Regional Analysis

“North America Holds the Largest Share in the Smart Utilities Market”

- North America is projected to dominate the global smart utilities market in 2025, holding an estimated 35-40% of the total market share. This leadership is attributed to the region’s advanced infrastructure, widespread adoption of IoT and AI technologies, and strong emphasis on sustainability and energy efficiency

- The U.S. holds a significant share due to increased investments in grid modernization, the growing demand for efficient energy distribution, and government incentives for renewable energy integration and energy storage solutions

- The presence of major players such as Siemens, Schneider Electric, and IBM, coupled with the region's commitment to enhancing smart grid and metering technologies, further strengthens the market

- In addition, the increasing focus on reducing energy consumption, improving grid resilience, and supporting the integration of renewable energy sources is fueling market growth across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Smart Utilities Market”

- The Asia-Pacific region is expected to experience the highest compound annual growth rate (CAGR) in the smart utilities market during the forecast period, with its market share projected to reach 28-33% by 2025. This growth is driven by rapid urbanization, increasing investments by governments in infrastructure modernization, and rising demand for energy-efficient and sustainable solutions

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, increasing energy consumption, and a growing focus on renewable energy integration and smart grid development

- Japan, with its advanced technology adoption and significant investments in smart grid systems, remains a crucial market for smart utilities. The country continues to lead in deploying energy-efficient infrastructure, leveraging IoT and AI technologies to optimize energy distribution and grid management

- China and India, with their vast populations and expanding industrial sectors, are seeing growing demand for smart metering, real-time data analytics, and predictive maintenance solutions in the energy, water, and gas sectors. The increased presence of global technology providers, coupled with government initiatives promoting sustainable energy use, further strengthens the market growth in the region

Smart Utilities Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- General Electric (U.S.)

- Abb (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- Itron Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Ibm (U.S.)

- Oracle (U.S.)

- Honeywell International (U.S.)

- Eaton (Us.)

- Tech Mahindra Limited (India)

- Tantalus (Canada)

- Mitsubishi Electric Corporation (Japan)

- Sap (Germany)

- Wipro (India)

- Trilliant Holdings Inc. (U.S.)

- Globema (Poland)

- Kamstrup (Denmark)

- Xylem (U.S.)

- Enel X S.R.L. (Italy)

Latest Developments in Global Smart Utilities Market

- In September 2024, Siemens introduced an AI-powered predictive maintenance platform tailored for smart grids. This innovative solution enables real-time monitoring, fault detection, and predictive analysis, significantly enhancing grid reliability and minimizing downtime. By leveraging advanced artificial intelligence, the platform supports proactive management of grid infrastructure, ensuring efficient energy distribution and stability. Siemens' commitment to driving technological advancements in energy systems is evident in this launch, which marks a step forward in sustainable and resilient energy solutions

- In October 2023, Schneider Electric implemented its EcoStruxure Grid platform across multiple European cities. This advanced platform offers real-time analytics, improves grid stability, and facilitates the integration of decentralized renewable energy sources into the energy network. By leveraging cutting-edge technology, EcoStruxure™ Grid enhances energy management and supports the transition to sustainable and resilient energy systems. Schneider Electric's initiative reflects its commitment to driving innovation and addressing the challenges of modern energy demands

- In June 2023, IBM collaborated with National Grid to deploy AI and IoT-driven smart grid solutions. This partnership focuses on enhancing energy distribution efficiency, managing peak demand, and minimizing energy losses through advanced predictive analytics. By integrating cutting-edge technologies, the initiative aims to optimize grid performance and support sustainable energy management. The collaboration underscores IBM's commitment to innovation and National Grid's dedication to modernizing energy infrastructure

- In March 2023, General Electric (GE) unveiled a suite of digital energy solutions aimed at optimizing utility operations. These innovative solutions leverage AI to enhance grid management and facilitate the efficient integration of renewable energy sources into existing infrastructure. GE's approach focuses on improving energy distribution, reliability, and sustainability, addressing the evolving needs of modern utilities. This launch underscores GE's commitment to advancing technology in the energy sector and supporting the transition to cleaner energy systems

- In January 2024, Honeywell announced the expansion of its smart metering systems across India. This initiative focuses on enhancing utility operations, enabling real-time monitoring of energy consumption, and promoting energy efficiency nationwide. By leveraging advanced metering technology, Honeywell aims to support India's transition to more sustainable and efficient energy management practices. The expansion underscores Honeywell's commitment to innovation and addressing the growing energy demands of the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.