Global Smart Stethoscope Market

Market Size in USD Million

CAGR :

%

USD

58.96 Million

USD

99.80 Million

2024

2032

USD

58.96 Million

USD

99.80 Million

2024

2032

| 2025 –2032 | |

| USD 58.96 Million | |

| USD 99.80 Million | |

|

|

|

|

Smart Stethoscope Market Size

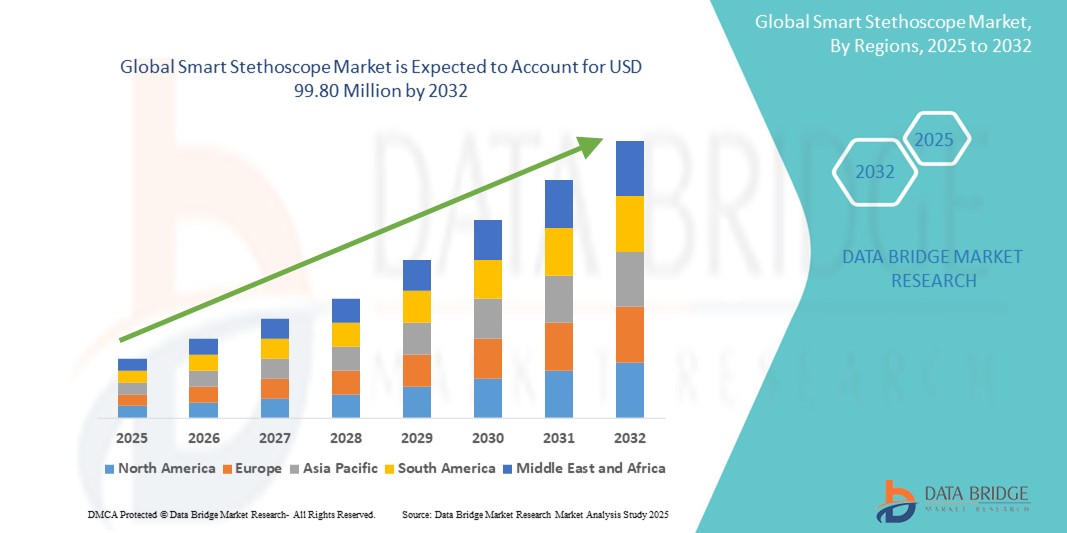

- The global smart stethoscope market size was valued at USD 58.96 million in 2024 and is expected to reach USD 99.80 million by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancement in digital healthcare and connected medical devices, leading to enhanced diagnostic accuracy and remote patient monitoring across both clinical and homecare settings

- Furthermore, rising demand for intelligent, user-friendly, and integrated auscultation tools is positioning smart stethoscopes as a next-generation solution for cardiovascular and respiratory assessment. These converging factors are accelerating the uptake of smart stethoscope solutions, thereby significantly boosting the industry's growth

Smart Stethoscope Market Analysis

- Smart stethoscopes, equipped with electronic sensors and digital signal processing, are becoming essential tools in modern healthcare settings for enhanced cardiovascular and pulmonary diagnostics. Their ability to record, analyze, and transmit auscultation data in real-time is revolutionizing both hospital-based and remote patient care

- The escalating demand for smart stethoscopes is primarily driven by the increasing adoption of telemedicine, growing prevalence of chronic heart and lung diseases, and a rising need for accurate, portable, and user-friendly diagnostic tools among healthcare professionals

- North America dominated the smart stethoscope market with the largest revenue share of 40.8% in 2024, supported by early adoption of digital health technologies, advanced healthcare infrastructure, high disposable incomes, and the strong presence of leading med-tech companies. The U.S. continues to witness significant growth in smart stethoscope adoption across hospitals, clinics, and home care settings, with innovations focused on AI-based heart sound analysis and cloud integration

- Asia-Pacific is expected to be the fastest growing region in the smart stethoscope market, projected to grow at a CAGR of 7.76% from 2025 to 2032, fueled by rapid urbanization, rising healthcare expenditure, growing awareness of remote diagnostics, and expanding access to digital health solutions in countries such as China, India, and Japan

- The cardiovascular segment dominated the smart stethoscope market, with a market share of 42.3% in 2024, driven by the growing burden of cardiovascular diseases and increasing demand for early-stage diagnostic tools in both hospital and home settings

Report Scope and Smart Stethoscope Market Segmentation

|

Attributes |

Smart Stethoscope Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Stethoscope Market Trends

“Technology-Driven Advancements Reshape the Smart Stethoscope Landscape”

- A significant and accelerating trend in the global smart stethoscope market is the integration of advanced technologies such as artificial intelligence (AI) and connectivity with digital health platforms, significantly improving diagnostic capabilities and ease of use in both clinical and remote care settings

- For instance, modern smart stethoscopes are capable of real-time heart and lung sound analysis, waveform visualization, and data sharing via mobile apps and cloud-based platforms—enabling healthcare providers to make faster, more informed decisions

- AI-powered smart stethoscopes can detect subtle abnormalities in heart or respiratory sounds, assist in early diagnosis of conditions like arrhythmias or murmurs, and even alert users to deviations from baseline recordings. These intelligent tools enhance diagnostic accuracy and reduce the likelihood of human error

- Integration with mobile applications and electronic health record (EHR) systems enables seamless data transfer, long-term health monitoring, and remote consultation workflows—supporting the expansion of telehealth services and virtual care

- This shift toward intelligent, connected, and user-centric diagnostic tools is reshaping the expectations of clinicians and patients alike. Manufacturers are focusing on intuitive designs, wireless models, and enhanced interoperability to meet the growing demand for real-time monitoring and remote patient management

- The rising adoption of smart stethoscopes across hospitals, primary care clinics, and home healthcare environments underscores a broader transformation in point-of-care diagnostics—driven by a desire for efficiency, accuracy, and proactive health management

Smart Stethoscope Market Dynamics

Driver

“Growing Need Due to Rising Chronic Diseases and Telehealth Adoption”

- The increasing prevalence of cardiovascular, pulmonary, and neonatal conditions, coupled with the accelerating adoption of telehealth and remote patient monitoring, is a significant driver for the heightened demand for smart stethoscopes

- For instance, in April 2024, Eko Health, a key player in the smart stethoscope industry, introduced its next-generation AI-powered stethoscope with enhanced murmur detection capabilities and Bluetooth integration. Such innovations are expected to drive Smart Stethoscope industry growth during the forecast period

- As healthcare providers and patients become more aware of the benefits of early diagnosis and remote monitoring, smart stethoscopes offer features such as digital auscultation, real-time data recording, and wireless transmission—making them a compelling upgrade over traditional acoustic stethoscopes

- Furthermore, the growing popularity of connected health devices and the increasing focus on home-based healthcare are making smart stethoscopes integral components of modern clinical workflows, offering seamless integration with EHR systems and teleconsultation platforms

- The convenience of wireless operation, cloud-based storage, AI-assisted diagnostics, and the ability to share recordings with specialists are key factors propelling the adoption of smart stethoscopes in hospitals, clinics, and home care settings. The trend toward value-based care and AI-enabled diagnostics further contributes to market growth

Restraint/Challenge

“Concerns Regarding Data Privacy and High Initial Costs”

- Concerns surrounding the data privacy vulnerabilities of connected medical devices, including smart stethoscopes, pose a significant challenge to broader market penetration. As these devices rely on network connectivity and cloud-based platforms, they are susceptible to data breaches and unauthorized access, raising anxieties among healthcare providers and regulatory bodies

- For instance, cybersecurity experts have warned that insufficient encryption in certain wireless medical devices could potentially expose sensitive patient data during transmission or storage

- Addressing these privacy and security concerns through robust encryption protocols, HIPAA/GDPR compliance, and regular software updates is crucial for building trust among users and healthcare institutions. Companies such as Eko and Thinklabs emphasize their secure data architecture in product marketing to reassure potential buyers

- In addition, the relatively high initial cost of smart stethoscopes compared to traditional models can be a barrier to adoption for smaller clinics and budget-constrained healthcare systems, particularly in developing regions. While basic digital models have become more affordable, premium stethoscopes with integrated ECG, AI, and Bluetooth still carry a significant price tag

- While the cost curve is gradually lowering, the perceived expense and lack of reimbursement pathways can still hinder widespread adoption—especially in public healthcare settings

- Overcoming these challenges through stronger data protection policies, user education, and the development of cost-effective smart stethoscope solutions will be vital for sustained market growth

Smart Stethoscope Market Scope

The market is segmented on the basis of application, product type, and end use.

- By Application

On the basis of application, the smart stethoscope market is segmented into cardiovascular, neonatal, pediatric, fetal, and teaching. The cardiovascular segment accounted for the largest market share of 42.3% in 2024, driven by the growing burden of cardiovascular diseases and increasing demand for early-stage diagnostic tools in both hospital and home settings.

The neonatal segment is expected to grow at the fastest CAGR of 23.5% from 2025 to 2032, fueled by rising global birth rates, increased NICU admissions, and the need for highly sensitive and non-invasive auscultation tools for newborns.

- By Product Type

On the basis of product type, the market is segmented into wired stethoscopes and wireless stethoscopes. The wired stethoscopes segment dominated with a market share of 58.7% in 2024, owing to their cost-effectiveness, consistent audio quality, and long-standing use in clinical environments.

The wireless stethoscopes segment is projected to expand at the highest CAGR of 24.2% from 2025 to 2032, due to increasing demand for mobility, remote patient monitoring, and seamless integration with telemedicine platforms.

- By End Use

On the basis of end use, the market is segmented into hospitals, clinics, ambulatory surgical centers (ASCs), and others. The hospitals segment held the largest revenue share of 49.6% in 2024, supported by high patient volumes, institutional spending on smart diagnostic tools, and incorporation of digital auscultation into clinical workflows.

The ambulatory surgical centers (ASCs) segment is anticipated to register the fastest CAGR of 22.1% from 2025 to 2032, driven by the shift toward outpatient care and growing preference for portable, point-of-care diagnostic solutions.

Smart Stethoscope Market Regional Analysis

- North America dominated the smart stethoscope market with the largest revenue share of 40.8% in 2024, driven by strong telehealth adoption, chronic disease burden, and widespread use of digital diagnostics

- Healthcare providers in this region prioritize diagnostic precision and seamless data integration

- High healthcare spending and favorable reimbursement policies support the rapid adoption of connected stethoscope technologies

U.S. Smart Stethoscope Market Insight

The U.S. smart stethoscope market accounted for 75% of North America's Smart Stethoscope revenue share in 2024, translating to approximately 32.5% of the global market. This dominant position is underpinned by the rapid integration of AI-powered auscultation tools, which enhance diagnostic accuracy in real-time through advanced sound interpretation. The widespread adoption of telemedicine platforms during and after the COVID-19 pandemic has further fueled the demand for smart stethoscopes, enabling healthcare providers to perform remote assessments of cardiovascular and respiratory conditions.

Europe Smart Stethoscope Market Insight

The Europe smart stethoscope market held a 26.8% global market share in 2024, supported by strong public healthcare systems and growing interest in digital diagnostics. Key contributing countries include Germany, the U.K., and France, which are actively investing in digitally integrated healthcare infrastructure and AI-powered diagnostic tools. The aging population across Europe is leading to a higher prevalence of chronic diseases, particularly cardiovascular and pulmonary disorders, driving the need for efficient diagnostic devices such as smart stethoscopes.

U.K. Smart Stethoscope Market Insight

The U.K. smart stethoscope market accounted for 23.5% of Europe’s smart stethoscope revenue in 2024. Market expansion is primarily driven by NHS-backed investments in AI diagnostic tools and efforts to digitize frontline care delivery. The U.K.'s focus on proactive and preventative care, particularly in monitoring early signs of heart failure and respiratory infections, is prompting broader use of smart stethoscopes among general practitioners and telehealth services.

Germany Smart Stethoscope Market Insight

Germany smart stethoscope market held the largest share of the European smart stethoscope market in 2024, accounting for 27.9%. This growth is attributed to the country’s emphasis on precision diagnostics, medical device quality standards, and interoperability within its healthcare system. Germany has long been a leader in connected health technologies, and the integration of smart stethoscopes in hospitals and specialized clinics aligns with its broader digitization efforts.

Asia-Pacific Smart Stethoscope Market Insight

The Asia-Pacific smart stethoscope market captured 22.6% of global revenue in 2024 and is projected to grow at the fastest CAGR of 7.76% from 2025 to 2032. Rapid urbanization, increasing disposable incomes, and government initiatives focused on expanding healthcare access are accelerating market growth across the region. Countries such as China, Japan, and India are emerging as key players due to the rising burden of chronic diseases, including COPD, asthma, and heart failure.

Japan Smart Stethoscope Market Insight

Japan smart stethoscope market accounted for 21.4% of the Asia-Pacific smart stethoscope market in 2024, representing 4.8% of the global market. As a global leader in medical technology innovation and elderly care infrastructure, Japan’s market growth is strongly influenced by its rapidly aging population and focus on non-invasive diagnostic tools. The country's IoT ecosystem and consumer readiness to adopt advanced health technologies support the high uptake of smart stethoscopes across hospitals and home care settings.

China Smart Stethoscope Market Insight

The China smart stethoscope market led the Asia-Pacific region with a 42.9% regional market share and accounted for 9.7% of the global market in 2024. This leadership is attributed to the country’s aggressive digital transformation in healthcare, substantial government investment in smart hospital development, and its position as a manufacturing powerhouse for electronic medical devices. Urban expansion and widespread internet connectivity are enabling smart stethoscope deployment in both private and public healthcare facilities.

Smart Stethoscope Market Share

The smart stethoscope industry is primarily led by well-established companies, including:

- Eko Health, Inc. (U.S.)

- Farmasino Pharmaceuticals (Jiangsu) Co. Ltd. (China)

- CONTEC MEDICAL SYSTEMS CO., LTD. (China)

- Rudolf Riester GmbH (Germany)

- American Diagnostic Corporation (U.S.)

- Cardionics Inc. (U.S.)

- HEINE Optotechnik GmbH & Co. KG (Germany)

- Medical Catalog Enterprises, Inc. (U.S.)

- ERKA (Germany)

- Prestige Medical (U.S.)

- Timesco Healthcare Ltd. (U.K.)

- Sklar Surgical Instruments (U.S.)

- System One (U.S.)

Latest Developments in Global Smart Stethoscope Market

- In April 2024, Eko Health, a leading innovator in digital health, received FDA clearance for its AI-powered algorithm capable of detecting signs of heart failure (low ejection fraction) during routine physical exams using its smart stethoscope. This collaboration with the Mayo Clinic represents a major advancement in integrating artificial intelligence into non-invasive, point-of-care diagnostics, significantly enhancing clinical decision-making in primary care settings

- In February 2025, Lapsi Health launched the Keikku Smart Stethoscope, an FDA-approved wireless device equipped with Bluetooth Low Energy (LE), LED indicators, and high-fidelity audio streaming. Designed to support telemedicine and remote diagnostics, the Keikku is expected to revolutionize clinical workflows by offering real-time connectivity and cloud-based auscultation tools

- In October 2024, researchers from Imperial College London conducted a groundbreaking study on over 1,000 patients using Eko’s AI-powered stethoscope to predict Major Adverse Cardiac Events (MACE). The findings demonstrated the potential of smart stethoscopes as effective tools for early cardiovascular risk detection in both clinical and remote settings

- In April 2025, a team of scientists at the University of Cambridge unveiled a multi-sensor smart stethoscope designed to detect early signs of heart valve disease, even through clothing. The device, which uses machine learning to analyze sounds and vibrations, has shown high accuracy and is expected to improve early intervention and preventive care for cardiovascular conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.