Global Smart Labels Market

Market Size in USD Billion

CAGR :

%

USD

11.43 Billion

USD

40.46 Billion

2024

2032

USD

11.43 Billion

USD

40.46 Billion

2024

2032

| 2025 –2032 | |

| USD 11.43 Billion | |

| USD 40.46 Billion | |

|

|

|

|

Smart Labels Market Size

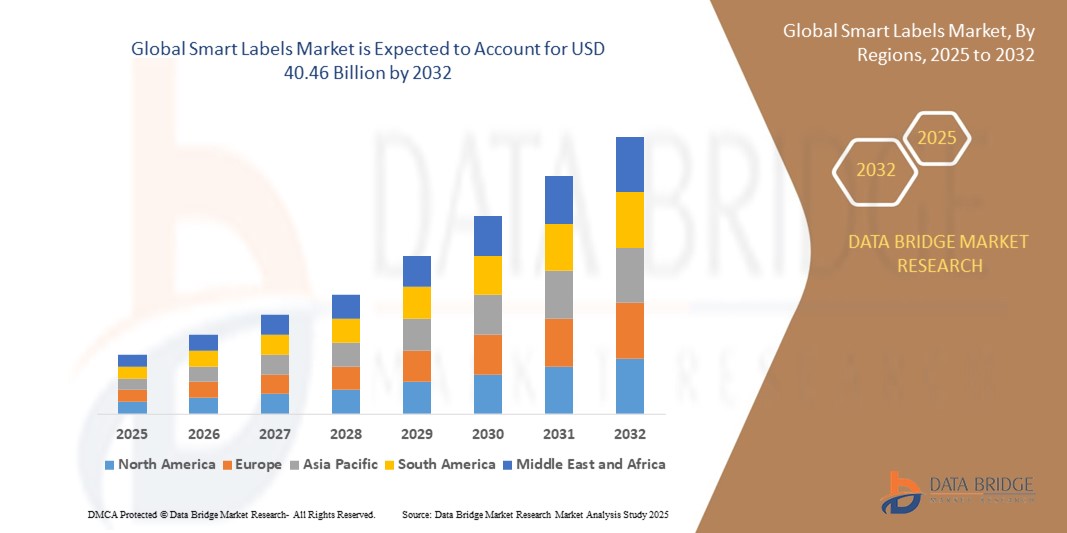

- The global smart labels market was valued at USD 11.43 billion in 2024 and is expected to reach USD 40.46 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 17.12%, primarily driven by growth of e-commerce

- This growth is driven by factors such as real-time tracking, enhanced customer experience, and supply chain optimization

Smart Labels Market Analysis

- Smart labels are a segment of the labeling and packaging industry focused on using technologies such as RFID, sensors, and dynamic displays to enhance tracking, authentication, and supply chain visibility

- Market growth is driven by increasing demand for efficient inventory management, enhanced supply chain transparency, and the need for product authentication, especially in industries such as retail, healthcare, and logistics

- The market is evolving through advancements in IoT integration, innovative sensing technologies, and the expansion of smart labels into new applications, such as temperature-sensitive packaging for perishable goods

- For instance, companies such as Zebra Technologies and Avery Dennison are developing smart labels with temperature monitoring and real-time tracking capabilities for logistics and pharmaceutical sectors

- The smart labels market is projected to experience significant growth, driven by the rise of e-commerce, technological advancements, regulatory requirements, and the growing demand for smarter, more connected supply chains

Report Scope and Smart Labels Market Segmentation

|

Attributes |

Smart Labels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Labels Market Trends

“Increasing Demand for Security and Tracking Solutions”

- One prominent trend in the global smart labels market is the increasing demand for security and tracking solutions

- This trend is driven by the rising need for product authentication, prevention of counterfeiting, and enhanced visibility across complex supply chains in sectors such as healthcare, logistics, and retail

- For instance, companies such as Avery Dennison and Zebra Technologies are introducing smart labels equipped with encrypted RFID, tamper-evident features, and IoT-enabled tracking to ensure product integrity and secure movement through distribution channels

- The shift toward secure, data-driven labeling is further supported by tightening regulatory standards, growing e-commerce activities, and increasing consumer awareness around product safety and traceability

- As industries prioritize transparency, safety, and operational efficiency, the demand for security-enhanced smart labels is expected to remain a key market driver—fueling continued innovation, adoption, and development of next-gen labeling technologies

Smart Labels Market Dynamics

Driver

“Enhanced Supply Chain Visibility”

- The growing emphasis on supply chain transparency and operational efficiency is a key driver of growth in the smart labels market. As companies seek greater control over product movement and inventory, demand for real-time tracking and data-enabled labeling solutions continues to rise

- This shift is particularly evident in industries such as food and beverage, healthcare, and logistics, where smart labels help monitor product status, ensure regulatory compliance, and reduce the risk of spoilage, loss, or counterfeiting

- With increasing complexity in global supply chains and rising customer expectations for speed and reliability, businesses are adopting smart labels to enhance traceability, accuracy, and responsiveness in their distribution networks

- Features such as RFID, sensing capabilities, and cloud connectivity are driving the development of intelligent labeling systems that offer automated updates and actionable insights across various supply chain stages

- Brands and logistics providers are investing in digital tracking tools and smart packaging innovations to optimize delivery performance and build consumer trust through greater visibility

For instance,

- FedEx and UPS use RFID-enabled smart labels to streamline parcel tracking and improve delivery accuracy

- Nestlé employs smart labeling to monitor temperature and handling conditions of perishable goods during transit

- As supply chain efficiency becomes a competitive advantage, this driver is expected to be a major force propelling the smart labels market toward widespread adoption and technological advancement

Opportunity

“Technological Advancements in Printed Electronics”

- Technological advancements in printed electronics present a significant opportunity for growth in the smart labels market. Innovations in printed RFID, sensors, and conductive inks are enabling cost-effective and flexible labeling solutions that expand the functionality of smart labels

- These advancements are creating new possibilities for product tracking, condition monitoring, and interactive features, all while reducing production costs and increasing scalability for businesses across industries

- Printed electronics also enable the integration of smart labels into more consumer-facing products, such as packaging that can change color, provide product information, or display real-time data, enhancing consumer engagement and brand experience

For instance,

- Companies such as PragmatIC and Thinfilm are using printed electronics to develop low-cost, flexible smart labels for a variety of applications, from pharmaceuticals to luxury goods

- Coca-Cola and AB InBev have implemented printed smart labels with QR codes and NFC capabilities to enhance consumer interaction and brand loyalty

- As printed electronics continue to evolve, companies that leverage these innovations for scalable, interactive, and cost-effective smart labels are poised to capitalize on expanding market opportunities and drive broader adoption

Restraint/Challenge

“Increased Costs Associated with the Use of Smart Labels”

- Increased costs associated with the use of smart labels present a notable challenge in the market. While smart labels offer enhanced tracking and security features, their higher production and integration costs can be a barrier to widespread adoption, particularly for small and medium-sized enterprises

- The expenses related to advanced technologies such as RFID tags, sensors, and the required infrastructure for data management and real-time monitoring can make smart labels significantly more expensive than traditional labeling solutions

- This challenge is particularly significant in industries with low margins or in markets where cost-efficiency is a primary concern, such as consumer goods or low-cost retail items

For instance,

- Smaller retailers or manufacturers might be hesitant to invest in smart labels due to the higher upfront costs of implementing the technology, particularly when compared to the more economical traditional labels

- Without clear cost-benefit justifications, the high initial investment required for smart labels may slow down their adoption in certain sectors, limiting their potential market growth and accessibility for businesses with constrained budgets

Smart Labels Market Scope

The market is segmented on the basis of technology, components, application, and end-user industry.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Components |

|

|

By Application |

|

|

By End-user Industry |

|

Smart Labels Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Smart Labels Market”

- Asia-Pacific dominates the smart labels market, driven by the rapid urbanization in developing regions, growing demand for smart labels across various end-user industries, and strong economic development

- China holds a significant share due to its massive population, thriving manufacturing sector, and widespread adoption of advanced technologies such as RFID, IoT, and sensor-based solutions for enhanced supply chain visibility and product tracking

- The region benefits from strong technological infrastructure, increasing investments in logistics, and government initiatives promoting digital transformation, further boosting the adoption of smart labeling solutions across industries such as retail, healthcare, and food & beverage

- With its growing urban middle class, increasing demand for traceability and security in the supply chain, and expanding e-commerce ecosystem, Asia-Pacific is expected to continue dominating the smart labels market through the forecast period of 2025 to 2032

“North America is Projected to Register the Highest Growth Rate”

- North America is expected to witness the highest growth rate in the smart labels market, driven by increasing adoption of smart technology across industries such as retail, logistics, healthcare, and pharmaceuticals

- U.S. is expected to be the fastest-growing country, due to its strong infrastructure, high adoption rates of advanced technology, and the presence of key players in the smart labeling and logistics sectors

- With its strong presence of key market players, high investment in research and development, and a robust focus on operational efficiency, North America is poised to register the fastest growth rate in the smart labels market from 2025 to 2032

- As industries in North America increasingly seek to improve supply chain visibility, reduce theft, and ensure product authenticity, the demand for smart labels is expected to rise sharply in the coming years

Smart Labels Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Avery Dennison Corporation (U.S.)

- Zebra Technologies Corp. (U.S.)

- Invengo Information Technology Co., Ltd. (China)

- Murata Manufacturing Co., Ltd. (Japan)

- NXP Semiconductors (Netherlands)

- Checkpoint Systems, Inc. (U.S.)

- Impinj, Inc. (U.S.)

- Advantech Co., Ltd (Taiwan)

- SATO Corporation (Japan)

- Honeywell International Inc. (U.S.)

- GLI, LLC (U.S.)

Latest Developments in Global Smart Labels Market

- In January 2025, Giesecke+Devrient (G+D) introduced the G+D Smart Label, an innovative tracking solution designed to transform any package into an IoT device. Ultra-thin and only slightly larger than a credit card, this new smart label, developed in collaboration with hardware partner Sensos, is set to revolutionize the tracking market. It offers a cost-effective and precise solution for a wide range of applications, including parcel delivery, fleet management, and the tracking of luxury goods

- In March 2024, Roambee launched the world's first true 5G GPS 'peel-and-ship' smart label, quickly adopted by leading Global 2000 brands. This 4-inch x 6-inch label integrates 5G, GPS, and NIST-calibrated sensors for monitoring temperature, humidity, shock, and light. Designed for single-journey applications, its disposable nature offers real-time visibility into distribution networks and direct-to-customer deliveries, providing unmatched insights where traditional reusable trackers fall short. This innovation is set to significantly impact the logistics market by enhancing tracking efficiency and product flow visibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Labels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Labels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Labels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.