Global Smart Electricity Meter Market

Market Size in USD Billion

CAGR :

%

USD

13.71 Billion

USD

22.02 Billion

2024

2032

USD

13.71 Billion

USD

22.02 Billion

2024

2032

| 2025 –2032 | |

| USD 13.71 Billion | |

| USD 22.02 Billion | |

|

|

|

Smart Electricity Meter Market Analysis

The smart electricity meter market is experiencing significant growth driven by increasing demand for energy efficiency, grid modernization, and the integration of renewable energy sources. Smart meters enable real-time energy consumption monitoring, reduce transmission losses, and support demand-side management, making them essential for both utilities and consumers. Advancements in communication technologies, such as IoT-enabled smart meters, AI-driven analytics, and cloud-based energy management systems, are revolutionizing the market by improving data accuracy and operational efficiency. Governments worldwide are implementing regulations and incentives to accelerate smart meter adoption, particularly in regions focused on reducing carbon footprints and enhancing energy conservation. The rise of smart city initiatives and smart grid deployments further propels market expansion, with key players such as Landis+Gyr, Itron, and Schneider Electric investing in next-generation metering solutions. In addition, the development of hybrid smart meters that combine electricity, water, and gas metering capabilities is gaining traction. With increasing urbanization, growing digitalization, and enhanced cybersecurity measures to protect data integrity, the smart electricity meter market is poised for substantial expansion, ensuring a more resilient, efficient, and intelligent energy infrastructure globally.

Smart Electricity Meter Market Size

The global smart electricity meter market size was valued at USD 13.71 billion in 2024 and is projected to reach USD 22.02 billion by 2032, with a CAGR of 6.10% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Smart Electricity Meter Market Trends

“Rising Deployment of Smart Prepaid Meters”

The smart electricity meter market is experiencing significant growth, driven by the increasing adoption of advanced metering infrastructure (AMI) and the integration of IoT and AI-powered analytics in energy management. A key trend shaping the market is the rising deployment of smart prepaid meters, which allow consumers to monitor and control their electricity consumption in real time. These meters enhance billing accuracy, prevent energy theft, and reduce operational costs for utility providers. For instance, Landis+Gyr and Itron have introduced smart prepaid meters that enable users to recharge electricity credits remotely via mobile apps, promoting energy efficiency and demand-side management. In addition, governments worldwide are implementing smart grid initiatives and mandating the rollout of intelligent metering systems to modernize energy distribution. With increasing concerns over energy conservation and sustainability, the demand for smart electricity meters continues to rise, transforming the way consumers and utilities interact with electricity usage.

Report Scope and Smart Electricity Meter Market Segmentation

|

Attributes |

Smart Electricity Meter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Landis+Gyr (Switzerland), Itron Inc. (U.S.), Elster GmbH (Germany), Hubbell (U.S.), Iskraemeco Group (Balkans), Microchip Technology Inc. (U.S.), Wasion Holdings International (China), Schneider Electric (France), Siemens (Germany), Jiangsu Linyang Energy Co., Ltd. (China), Genus (India), Networked Energy Services (U.S.), Holley Performance Products, Inc. (U.K.), OSAKI ELECTRIC CO., LTD. (Japan), Xylem (U.S.), ABB (Switzerland), Trilliant Holdings Inc. (U.S.), Kamstrup (Denmark), and E.ON UK plc (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Smart Electricity Meter Market Definition

A smart electricity meter is an advanced digital device that records and monitors electricity consumption in real time and communicates the data to both consumers and utility providers through a secure network. Unlike traditional meters, smart meters enable automated billing, remote monitoring, and two-way communication, allowing users to track their energy usage patterns and make informed decisions to improve efficiency.

Smart Electricity Meter Market Dynamics

Drivers

- Growing Adoption of Smart Grid Technology

The rising implementation of smart grid technology is a key driver of the smart electricity meter market, as governments and utility companies invest heavily in modernizing energy infrastructure. Smart grids integrate advanced digital communication and automation technologies, enabling efficient energy distribution, real-time monitoring, and predictive maintenance. Smart meters are a fundamental component of these grids, allowing utilities to detect power outages, reduce transmission losses, and improve demand response strategies. For instance, China’s State Grid Corporation has deployed millions of smart meters as part of its national smart grid initiative, significantly enhancing power distribution efficiency and energy management capabilities. As global electricity consumption rises, countries are increasingly mandating smart grid deployment, further propelling the demand for smart electricity meters.

- Rising Demand for Energy Efficiency and Conservation

The need for energy efficiency and conservation is driving the widespread adoption of smart electricity meters among consumers and businesses. These devices enable real-time monitoring of power usage, allowing users to identify energy-intensive appliances, optimize consumption, and lower electricity bills. In addition, features such as dynamic pricing models and demand response programs help balance supply and demand, reducing overall energy wastage. For instance, in the U.K., the government’s Smart Metering Implementation Programme (SMIP) is encouraging households and businesses to switch to smart meters, leading to lower carbon emissions and improved energy savings. With increasing emphasis on sustainable energy practices, the smart electricity meter market continues to expand, driven by the growing focus on resource efficiency and cost reduction.

Opportunities

- Increasing Deployment of Prepaid Smart Meters

The rising adoption of prepaid smart meters presents a significant market opportunity, as consumers and businesses seek better control over electricity consumption. Unlike traditional meters, prepaid smart meters allow users to preload credit and track usage in real time, preventing overuse and unexpected high bills. This shift benefits utility providers by automating billing, reducing operational expenses, and minimizing revenue loss due to unpaid bills or energy theft. For instance, in India, the Smart Prepaid Metering Program under the Revamped Distribution Sector Scheme (RDSS) is encouraging nationwide adoption, helping both consumers and utilities manage electricity distribution more efficiently. As more countries recognize the advantages of prepaid metering, this segment continues to grow, creating new opportunities for technology providers and smart meter manufacturers.

- Rising Urbanization and Smart City Initiatives

The rapid pace of urbanization and smart city development is fueling the demand for smart electricity meters as part of sustainable energy management solutions. With increasing populations in urban centers, the need for efficient energy distribution, consumption tracking, and automated grid management is higher than ever. Governments worldwide are integrating smart metering technology into smart city infrastructure to enhance energy conservation, grid reliability, and environmental sustainability. For instance, the European Union’s Smart Cities Marketplace promotes the deployment of smart metering systems across member states to modernize power grids and support renewable energy integration. Similarly, cities in China and Japan are aggressively adopting smart grid and metering solutions to manage their growing energy demands. This trend provides lucrative opportunities for smart meter vendors, IoT solution providers, and energy management firms as urban areas continue expanding globally.

Restraints/Challenges

- High Initial Deployment Costs

The deployment of smart electricity meters requires substantial capital investment, which includes the cost of smart meters, infrastructure upgrades, advanced communication networks, and cybersecurity measures. Utility providers must also develop real-time data management systems and integrate them with existing power grids, adding to the financial burden. In addition, installation and maintenance costs increase the total expenditure, making it difficult for small and mid-sized utilities to implement large-scale smart meter programs. This financial constraint is particularly pronounced in developing regions, where government budgets and private investments in the energy sector are limited. The high initial investment slows the adoption of smart meters, delaying the benefits of real-time energy monitoring, efficient grid management, and automated billing systems.

- Data Privacy and Cybersecurity Risks

Smart electricity meters continuously collect and transmit real-time energy consumption data, increasing concerns about data privacy, cyber threats, and unauthorized access. Since these meters are connected to cloud-based platforms and communication networks, they become vulnerable to hacking, data breaches, and energy fraud. Cyberattacks on smart meters can lead to false energy readings, billing manipulation, or even large-scale power disruptions, posing a significant risk to both consumers and energy providers. In addition, consumer skepticism regarding data collection and surveillance by utility companies may lead to resistance against smart meter installations. To address these concerns, utility providers must invest in robust encryption, multi-factor authentication, and secure data storage solutions, adding further costs and complexity to smart meter implementation.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Smart Electricity Meter Market Scope

The market is segmented on the basis of type, communication type, component type, phase, technology type, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Electric

- Gas

- Water

Communication Type

- RF

- PLC

- Cellular

Component Type

- Hardware

- Software

Phase

- Single-Phase

- Three-Phase

Technology Type

- AMI

- AMR

End User

- Residential

- Commercial

- Industrial

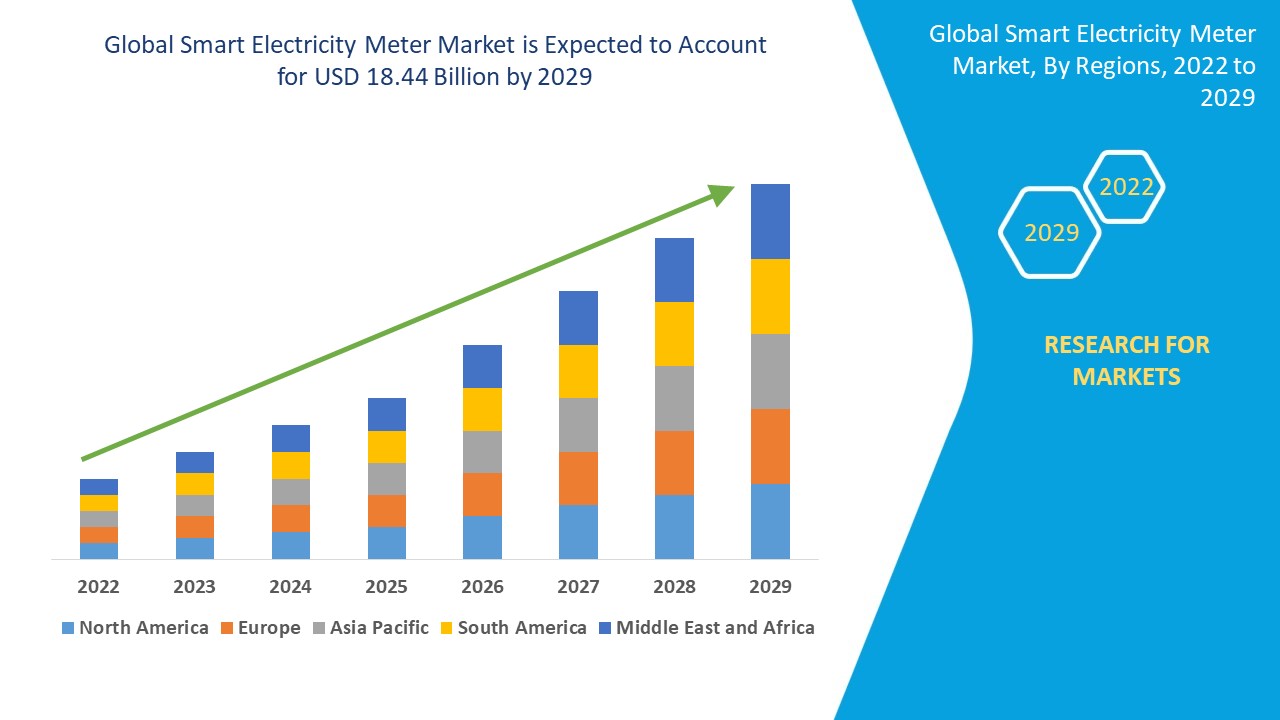

Smart Electricity Meter Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, communication type, component type, phase, technology type, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the smart electricity meter market due to increasing competition among key players, which has driven advancements in technology and cost reductions. The heightened market rivalry has led to a decrease in the per-unit price of smart electricity meters, making them more accessible to consumers. In addition, government initiatives promoting smart grid adoption and energy efficiency further support market growth. As a result, the region continues to witness widespread deployment of smart electricity meters across residential, commercial, and industrial sectors.

Asia-Pacific is projected to experience fastest growth in the smart electricity meter market from 2025 to 2032, driven by the increasing implementation of smart city initiatives across both developing and developed nations in the region. Governments are investing heavily in modernizing infrastructure, integrating advanced metering systems to enhance energy efficiency and grid reliability. The rising demand for sustainable energy solutions and real-time monitoring further accelerates market expansion. As a result, the adoption of smart electricity meters is expected to grow significantly across residential, commercial, and industrial sectors.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Smart Electricity Meter Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Smart Electricity Meter Market Leaders Operating in the Market Are:

- Landis+Gyr (Switzerland)

- Itron Inc. (U.S.)

- Elster GmbH (Germany)

- Hubbell (U.S.)

- Iskraemeco Group (Balkans)

- Microchip Technology Inc. (U.S.)

- Wasion Holdings International (China)

- Schneider Electric (France)

- Siemens (Germany)

- Jiangsu Linyang Energy Co., Ltd. (China)

- Genus (India)

- Networked Energy Services (U.S.)

- Holley Performance Products, Inc. (U.K.)

- OSAKI ELECTRIC CO., LTD. (Japan)

- Xylem (U.S.)

- ABB (Switzerland)

- Trilliant Holdings Inc. (U.S.)

- Kamstrup (Denmark)

- E.ON UK plc (U.K.)

Latest Developments in Smart Electricity Meter Market

- In May 2023, Honeywell announced the Next Generation Mobile Module (NXCM), an Advanced Measurement Infrastructure (AMI) solution designed to upgrade existing gas and water meters into smart meters at no additional cost. This module enables wireless connectivity over public cellular networks, enhancing monitoring, security, and data analysis for service providers and consumer

- In November 2022, Landis+Gyr expanded its portfolio in Smart Metering, Grid Edge Intelligence, and Smart Infrastructure, introducing new hardware and software solutions for electricity, heat, gas, and water metering

- In November 2022, Itron, Inc. collaborated with various technology innovators, consultants, service providers, and channel partners to enhance utilities and cities' ability to connect with customers and accelerate energy, water, and smart infrastructure modernization in global markets

- In September 2022, EDMI introduced its brand MIRA, featuring communication-agnostic technology that enables end-to-end visibility and control using industry-standard protocols such as DLMS, IDIS, and LWM2M over multiple bearer services, including 4G, NB-IoT, and RF Mesh

- In February 2022, ABB India launched a new series of electronic power meters and monitoring meters, expanding its digital panel meter market offerings. This addition complements ABB’s existing range of individual multi-function meters and network analyzers, catering to sectors such as healthcare, hospitality, infrastructure, and food and beverage industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Electricity Meter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Electricity Meter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Electricity Meter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.