Global Small Scale Lng Market

Market Size in USD Billion

CAGR :

%

USD

9.64 Billion

USD

17.73 Billion

2024

2032

USD

9.64 Billion

USD

17.73 Billion

2024

2032

| 2025 –2032 | |

| USD 9.64 Billion | |

| USD 17.73 Billion | |

|

|

|

|

Small-Scale Liquefied Natural Gas (LNG) Market Size

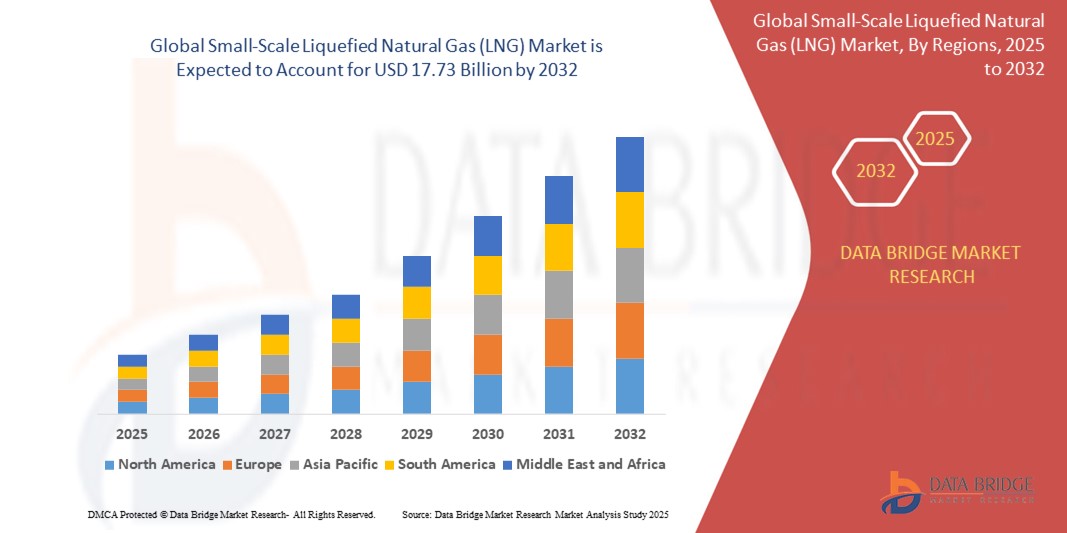

- The global small-scale liquefied natural gas (LNG) market was valued at USD 9.64 billion in 2024 and is expected to reach USD 17.73 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.91%, primarily driven by rising demand for cleaner alternative fuels

- This growth is driven by increasing adoption of LNG in transportation sectors

Small-Scale Liquefied Natural Gas (LNG) Market Analysis

- The small-scale liquefied natural gas (LNG) market is witnessing robust growth, primarily driven by its growing role in energy diversification, especially in regions with limited access to natural gas pipelines. Small-scale LNG is gaining traction for transportation, industrial use, and as a clean alternative fuel, offering environmental and cost benefits over traditional fuels.

- Key factors driving market expansion include increased demand for LNG in marine applications, particularly for LNG-powered vessels, and the rising adoption of LNG in the road and rail transport sectors. In addition, regulatory support for decarbonization, including carbon tax policies and subsidies for LNG infrastructure, is fueling growth

- For instance, in November 2023, Elengy launched a small-scale LNG carrier loading service at its Fos Tonkin terminal in France, enhancing distribution capabilities and demonstrating growing demand for small-scale LNG in the region

- Globally, the small-scale LNG market is evolving with significant advancements in LNG liquefaction and regasification technologies, making it more cost-competitive and accessible. Companies are focused on expanding infrastructure, reducing LNG supply chain costs, and improving the efficiency of liquefaction processes to meet growing demand from industries and transportation

Report Scope and Small-Scale Liquefied Natural Gas (LNG) Market Segmentation

|

Attributes |

Small-Scale Liquefied Natural Gas (LNG) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Small-Scale Liquefied Natural Gas (LNG) Market Trends

“Growth in LNG as an Alternative Fuel for Transportation”

- The transportation sector is increasingly turning to small-scale liquefied natural gas (LNG) as an environmentally friendly alternative to diesel and heavy fuel oils. LNG’s low emissions profile and cost-effectiveness are driving its adoption in both marine and road transport

- Regulatory pressure to reduce greenhouse gas emissions is prompting the adoption of cleaner fuels, with LNG being a prime candidate for reducing carbon emissions in heavy-duty trucks and ships

- Many shipping companies and logistics providers are incorporating LNG-powered vessels and fleets to comply with global environmental standards

For instance,

- In February 2024, CMA CGM Group, a leading global shipping company, announced that it would expand its fleet of LNG-powered ships to meet stricter emission regulations, further enhancing LNG's role in the maritime industry

- This trend is expected to continue, positioning Small-Scale LNG as a key component in the decarbonization of the transportation industry, particularly in sectors with high fuel consumption

Small-Scale Liquefied Natural Gas (LNG) Market Dynamics

Driver

“Increased Demand for Energy Security and Diversification”

- Small-Scale Liquefied Natural Gas (LNG) is gaining prominence as a flexible and secure energy source for regions seeking to diversify their energy portfolios and reduce dependence on conventional grid power

- Small-scale LNG is especially critical for remote areas, islands, and off-grid locations that require reliable energy solutions with limited access to pipelines or large LNG infrastructure.

- LNG is increasingly being used to stabilize energy supply during peak demand periods and in regions facing energy shortages or disruptions

For instance,

- In March 2024, the Philippines implemented a new policy to support the development of Small-Scale LNG terminals, aiming to provide reliable and clean energy to its rural and island communities

- This growing reliance on Small-Scale LNG for energy security is expected to drive its adoption globally, particularly in underserved areas

Opportunity

“Growing Adoption in Emerging Markets”

- Small-Scale Liquefied Natural Gas (LNG) offers a major opportunity for emerging markets to access cleaner and more affordable energy, contributing to economic development and industrial growth

- Increased investments from governments, international organizations, and private players are focusing on building LNG infrastructure in developing countries to meet rising energy demands while reducing carbon footprints

- LNG is also gaining popularity in industries such as agriculture, mining, and manufacturing, where it is being used as a cleaner alternative to coal and oil

For instance,

- In January 2024, the Indian government announced funding for the construction of small-scale LNG infrastructure in multiple states, aiming to reduce the country's reliance on coal and increase access to cleaner energy sources

- The increasing adoption of Small-Scale LNG in emerging markets presents a key growth opportunity for stakeholders in the energy sector

Restraint/Challenge

“High Initial Infrastructure Costs”

- While small-scale liquefied natural gas (LNG) is seen as a cost-effective energy solution, the initial infrastructure investment required for LNG terminals, storage, and distribution systems remains a major barrier, particularly for developing countries

- Building the necessary infrastructure to support small-scale LNG requires significant capital, which can delay projects or discourage investment, especially in regions with limited financial resources

- The ongoing costs of maintaining LNG facilities and transporting the gas also pose challenges for the long-term profitability of projects

For instance,

- In November 2023, a small-scale LNG project in South Africa faced delays due to budget constraints and challenges in financing infrastructure development, which resulted in increased costs for stakeholders

- Addressing the high infrastructure costs through public-private partnerships and international financial support will be essential for the widespread adoption of Small-Scale LNG, particularly in developing regions

Small-Scale Liquefied Natural Gas (LNG) Market Scope

The market is segmented on the basis of type, mode of supply, storage tank capacity, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Mode of Supply |

|

|

By Storage Tank Capacity |

|

|

By Application |

|

Small-Scale Liquefied Natural Gas (LNG) Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Small-Scale Liquefied Natural Gas (LNG) Market”

- Asia-Pacific has emerged as the leading region in the small-scale liquefied natural gas (LNG) market due to rising industrial expansion and increasing investment in LNG infrastructure

- The growing awareness among customers regarding cleaner fuel alternatives is driving regional demand for small-scale LNG solutions

- There is surging demand in the transportation sector, especially for marine and heavy-duty vehicles, further strengthening the market position of Asia-Pacific

- With strong economic growth, supportive policies, and increased LNG adoption across sectors, Asia-Pacific is expected to maintain its dominance in the small-scale LNG market

“North America is projected to register the Highest Growth Rate”

- North America is projected to witness lucrative growth in the small-scale LNG market due to rising consumption of LNG across industrial and transportation sectors

- The region hosts the highest number of natural gas manufacturing units, contributing to consistent and scalable production

- The widespread availability of gas terminals and supportive infrastructure further enhances distribution efficiency and market penetration

- Backed by robust production capacity and advanced infrastructure, North America is poised for significant growth in the small-scale LNG market from 2025 to 2035

Small-Scale Liquefied Natural Gas (LNG) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gazprom (Russia)

- ENGIE (France)

- Honeywell International Inc. (U.S.)

- Wärtsilä (Finland)

- Linde plc (Germany)

- Gasum Ltd (Norway)

- IHI Corporation (Japan)

- Excelerate Energy, Inc. (U.S.)

- Prometheus Fuels (U.S.)

- Cryostar (U.S.)

- General Electric Company (U.S.)

- PAO NOVATEK (Russia)

- Engie (France) (duplicate, already listed above)

- NYK Line (Japan)

- Mitsui O.S.K. Lines (Japan)

- Teekay Corporation Ltd. (Bermuda)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- Kawasaki Heavy Industries, Ltd. (Japan)

Latest Developments in Global Small-Scale Liquefied Natural Gas (LNG) Market

- In April 2024, the Indian Gas Exchange announced contracts for small-scale liquefied natural gas (LNG) on its trading platform after receiving regulatory approval from the Petroleum and Natural Gas Regulatory Board. This marks a major milestone in boosting domestic LNG trading and accelerating small-scale LNG adoption across India

- In November 2023, Elengy, a unit of Engie’s GRTgaz, introduced a new small-scale LNG carrier loading service at its Fos Tonkin terminal on France’s Mediterranean coast. This expansion is expected to improve LNG shipping logistics and enhance supply efficiency in southern Europe

- In June 2023, Wärtsilä Corporation secured a contract to expand the regasification system capacity aboard the FSRU vessel owned by LNG Hrvatska on Krk Island, Croatia. This upgrade will increase regasification capacity by 212 million standard cubic feet per day, significantly boosting the region’s LNG terminal efficiency.

- In July 2022, Snam and Edison entered into a strategic partnership to develop opportunities across the entire small-scale LNG value chain, including transportation, liquefaction, and distribution. This collaboration supports innovation and infrastructure development in the European small-scale LNG sector

- In December 2021, Elengy, a subsidiary of ENGIE S.A., launched a Micro-LNG carrier loading service at the Marseille-Fos terminal, enabling micro carriers to supply LNG-powered ships more efficiently. The service enhances the availability of LNG in maritime applications and supports cleaner shipping solutions.

- In February 2021, Elengy signed an agreement with Delta Rail to offer rail-based LNG container transport from multimodal platforms in France and Belgium. This initiative is expected to reduce transportation costs and lower the environmental footprint of LNG logistics across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Small Scale Lng Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Small Scale Lng Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Small Scale Lng Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.