Global Small Drones Market

Market Size in USD Billion

CAGR :

%

USD

18.38 Billion

USD

53.98 Billion

2024

2032

USD

18.38 Billion

USD

53.98 Billion

2024

2032

| 2025 –2032 | |

| USD 18.38 Billion | |

| USD 53.98 Billion | |

|

|

|

|

Small Drones Market Size

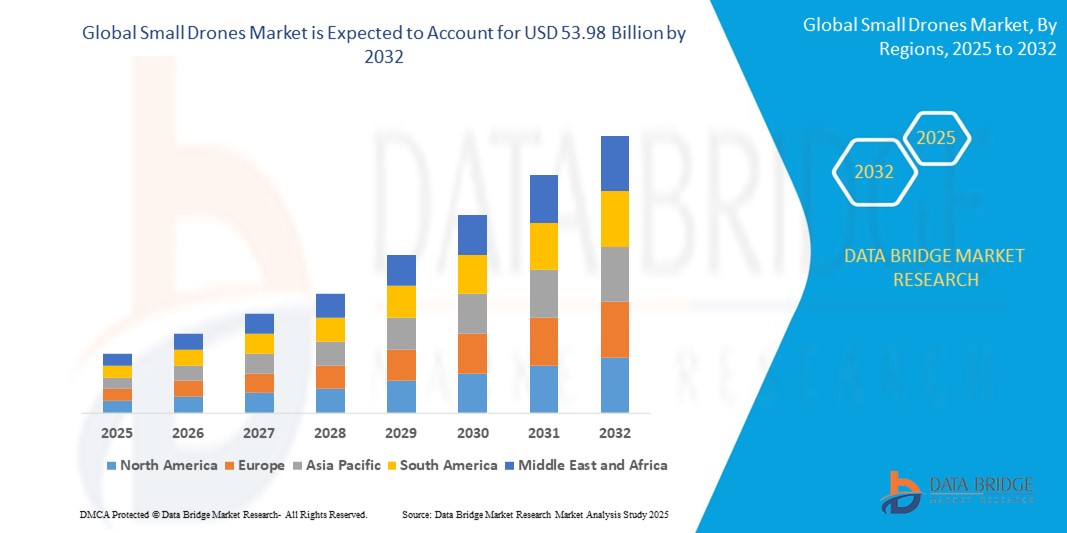

- The global small drones market size was valued at USD 18.38 billion in 2024 and is expected to reach USD 53.98 billion by 2032, at a CAGR of 14.42% during the forecast period

- The market growth is primarily driven by increasing demand for drones in military, commercial, and consumer applications, fueled by advancements in drone technology, cost-effective solutions, and rising needs for surveillance, delivery, and aerial photography

- Growing awareness of the benefits of small drones, such as enhanced maneuverability, portability, and integration with advanced sensors, is boosting demand across OEM and aftermarket channels

Small Drones Market Analysis

- The small drones market is experiencing robust growth as industries and consumers prioritize applications such as aerial surveillance, precision agriculture, and last-mile delivery, alongside recreational uses

- Demand from military, civil, and commercial sectors is driving manufacturers to innovate with lightweight, durable, and autonomous drone solutions equipped with advanced payloads such as cameras and CBRN sensors

- North America dominates the small drones market with the largest revenue share of 35.2% in 2024, driven by a strong presence of OEMs, technological advancements, and high adoption in military and homeland security applications

- Europe is projected to be the fastest-growing region during the forecast period, propelled by rapid advancements in drone regulations, increasing commercial applications, and growing investments in drone technology in countries such as Germany, France, and the U.K.

- The lithium-ion segment is expected to hold the largest market revenue share of 67.4% in 2024, owing to its high energy density, reliability, and widespread availability, supporting diverse drone operations

Report Scope and Small Drones Market Segmentation

|

Attributes |

Small Drones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Small Drones Market Trends

“Rising Preference for Hybrid Wing Drones”

- The Hybrid wing drones are gaining traction due to their unique combination of vertical takeoff and landing (VTOL) capabilities and the extended range of fixed-wing designs

- These drones offer enhanced efficiency, longer flight times, and the ability to carry heavier payloads, making them ideal for applications requiring flexibility and endurance

- In regions with diverse terrains, such as North America and Europe, hybrid wing drones are favored for tasks such as agricultural monitoring, disaster management, and logistics

- Military and commercial users seek hybrid drones for their versatility, combining the maneuverability of rotary wing drones with the efficiency of fixed-wing models

- For instance, companies such as A2Z Drone Delivery, Inc. have introduced hybrid VTOL drones, such as the RDSX Pelican, to meet the growing demand for delivery and surveillance solutions

- Dealerships and service providers are increasingly offering hybrid drone solutions as part of customized packages for industries such as agriculture, construction, and homeland security

Small Drones Market Dynamics

Driver

“Rising Demand for Enhanced Efficiency and Versatility”

- Growing awareness of the benefits of small drones, such as cost-effective surveillance, real-time data collection, and access to hard-to-reach areas, is driving market demand

- Small drones improve operational efficiency by reducing the need for manned operations, cutting costs, and enhancing safety in applications such as military reconnaissance, infrastructure inspection, and delivery services

- These drones provide critical capabilities, such as high-resolution imaging and real-time monitoring, improving decision-making in military, civil, and commercial sectors, especially in regions such as North America and Europe

- Automakers and tech companies are responding by integrating drones into their ecosystems or partnering with drone manufacturers to offer tailored solutions

- For instance, the U.K. Ministry of Defense awarded Lockheed Martin a USD 157 million contract in December 2022 to deliver mini drones, including hybrid and fixed-wing models, for military applications

Restraint/Challenge

“Regulatory Restrictions on Drone Operations”

- Regulatory restrictions on drone operations, such as airspace limitations and maximum take-off weight (MTOW) classifications, impact market growth and user choice

- Different countries have varying laws, complicating standardization for manufacturers and operators in global markets such as North America and Europe

- Excessive autonomy or payload capacities, especially for drones above 25 to 150 kg, are often viewed as safety risks due to potential collisions, privacy concerns, and challenges in air traffic management

- For instance, many U.S. states and European countries impose strict rules, such as requiring remotely piloted or optionally piloted drones to operate within visual line of sight (VLOS) and limiting autonomous flight in urban areas

- These stringent regulations discourage widespread adoption, particularly for consumer and civil applications, and may result in fines or operational bans, limiting market expansion

Small Drones Market Scope

The market is segmented on the basis of type, maximum take-off weight, power source, mode of operation, application, and payload.

- By Type

On the basis of type, the small drones market is segmented into fixed wing, rotary wing, and hybrid wing. The rotary wing segment is expected to hold the largest market revenue share of 62.8% in 2024, driven by its versatility, ease of use, and ability to hover and maneuver in tight spaces, making it ideal for applications such as aerial photography, surveillance, and inspections.

The hybrid wing segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by its combination of fixed-wing endurance and rotary-wing maneuverability, catering to advanced military and commercial needs.

- By Maximum Take-off Weight

On the basis of maximum take-off weight, the small drones market is segmented into less than 5 kg, 5 to 25 kg, and above 25 to 150 kg. The less than 5 kg segment is expected to dominate with a market revenue share of 58.3% in 2024, attributed to its affordability, portability, and widespread use in consumer, commercial, and recreational applications.

The 5 to 25 kg segment is projected to experience the fastest growth from 2025 to 2032, driven by increasing demand in military and civil applications for enhanced payload capacity and longer flight durations.

- By Power Source

On the basis of power source, the small drones market is segmented into lithium-ion, solar cells, hybrid cells, and fuel cells. The lithium-ion segment is expected to hold the largest market revenue share of 67.4% in 2024, owing to its high energy density, reliability, and widespread availability, supporting diverse drone operations.

The solar cells segment is anticipated to witness significant growth from 2025 to 2032, fueled by advancements in solar technology and rising demand for eco-friendly, long-endurance drones in remote monitoring and environmental applications.

- By Mode of Operation

On the basis of mode of operation, the small drones market is segmented into remotely piloted, optionally piloted, and autonomous. The remotely piloted segment is expected to lead with a market revenue share of 55.7% in 2024, driven by its extensive use in military, homeland security, and commercial applications requiring human control for precision and safety.

The autonomous segment is projected to grow at the fastest rate from 2025 to 2032, supported by advancements in AI, machine learning, and sensor technology, enabling fully automated missions for surveillance, delivery, and agriculture.

- By Application

On the basis of application, the small drones market is segmented into military, civil and commercial, homeland security, and consumer. The military segment is expected to dominate with a revenue share of 48.6% in 2024, propelled by the critical role of small drones in reconnaissance, target acquisition, and battlefield monitoring.

The civil and commercial segment is anticipated to witness rapid growth from 2025 to 2032, driven by increasing adoption in agriculture, infrastructure inspection, logistics, and aerial imaging, supported by regulatory easing and technological advancements.

- By Payload

On the basis of payload, the small drones market is segmented into cameras, CBRN sensors, electronic intelligence, and UAV radar. The cameras segment is expected to hold the largest market revenue share of 60.2% in 2024, driven by high demand for high-resolution imaging in surveillance, mapping, and consumer photography.

The UAV radar segment is projected to experience robust growth from 2025 to 2032, fueled by its growing use in military and homeland security for detection, tracking, and navigation in challenging environments.

Small Drones Market Regional Analysis

- North America dominates the small drones market with the largest revenue share of 35.2% in 2024, driven by a strong presence of OEMs, technological advancements, and high adoption in military and homeland security applications

- Europe is projected to be the fastest-growing region during the forecast period, propelled by rapid advancements in drone regulations, increasing commercial applications, and growing investments in drone technology in countries such as Germany, France, and the U.K.

U.S. Small Drones Market Insight

The U.S. leads the North American small drones market, driven by robust demand from military, homeland security, and commercial sectors. High consumer awareness of drone benefits, such as surveillance, delivery, and precision agriculture, coupled with favorable FAA regulations, accelerates market expansion. OEMs’ focus on advanced, integrated drone systems further supports growth.

Europe Small Drones Market Insight

Europe is expected to witness significant growth, propelled by regulatory support for drone integration in airspace, rising demand for commercial applications such as delivery and infrastructure inspection, and emphasis on safety and sustainability. Countries such as Germany, France, and the U.K. lead adoption, driven by technological innovation and environmental concerns.

U.K. Small Drones Market Insight

The U.K. market is anticipated to experience healthy growth, fueled by demand for drones in urban planning, agriculture, and homeland security. Increasing interest in autonomous and connected drone solutions, alongside regulatory advancements for safe operations, drives adoption. Consumer and commercial focus on efficiency and safety further boosts the market.

Germany Small Drones Market Insight

Germany is expected to see robust growth in the small drones market, attributed to its advanced manufacturing sector, strong focus on precision engineering, and adoption in agriculture, logistics, and surveillance. High demand for efficient, eco-friendly drone solutions and integration by OEMs in innovative applications support sustained market expansion.

Asia-Pacific Small Drones Market Insight

The Asia-Pacific region is expected to hold a significant share, driven by rapid urbanization, growing drone adoption in agriculture and consumer applications, and supportive government policies in countries such as China, India, and Japan. Rising investments in smart cities and infrastructure monitoring further accelerate market growth.

Japan Small Drones Market Insight

Japan’s small drones market is projected to grow robustly, driven by consumer preference for advanced, high-quality drone solutions for surveillance, disaster management, and agriculture. Major manufacturers’ integration of drones in OEM offerings and rising demand for aftermarket customization fuel market penetration.

China Small Drones Market Insight

China holds a substantial share of the Asia-Pacific small drones market, propelled by rapid industrial growth, increasing drone use in agriculture, delivery, and surveillance, and strong domestic manufacturing capabilities. Competitive pricing, a growing tech-savvy population, and government support for smart mobility enhance market accessibility.

Small Drones Market Share

The small drones industry is primarily led by well-established companies, including:

- Skycatch, Inc (U.S.)

- L3Harris Technologies, Inc. (Canada)

- SCI Technology (Australia)

- C-Astral d.o.o (Slovenia)

- Boeing (U.S.)

- Airbus (Netherlands)

- Yuneec (China)

- Thales Group (France)

- Parrot Drones SAS (France)

- DJI (China)

- 3DR, Inc. (U.S.)

- Kespry Inc. (U.S.)

- Textron Inc. (U.S.)

- Northrop Grumman (U.S.)

- BAE Systems (U.K.)

Latest Developments in Global Small Drones Market

- In January 2025, Pix4D and Freefly Systems announced a strategic partnership to integrate Pix4D's advanced photogrammetry software with Freefly's high-performance drones. This collaboration enhances aerial data collection and processing, streamlining workflows for industries such as construction, surveying, and agriculture. The partnership provides users with a seamless drone-to-data workflow, offering a one-year license for Pix4Dmatic, Pix4Dsurvey, Pix4Dcloud, or Pix4Dfields with select Freefly drones

- In September 2024, SAN LEANDRO introduced Trace, a pocket-sized nano drone designed for covert aerial reconnaissance and precision operations in confined spaces. The drone weighs just 153 grams, making it highly portable while maintaining advanced flight and camera capabilities. Trace features a gimbal-stabilized thermal camera, a 48MP EO camera with 24x zoom, and a proprietary Poplar radio for secure communication over a 2 km range. Its compact design allows seamless indoor and outdoor navigation, enhancing real-time surveillance for infrastructure management, law enforcement, and national security applications

- In August 2024, EndureAir, in collaboration with IIT Kanpur, introduced the Sabal UAV, a tandem-rotor unmanned helicopter designed for high efficiency and superior load-carrying capability. The Sabal UAV features a variable-speed electric propulsion system, enabling optimized performance in diverse geographical terrains. With vertical takeoff and landing (VTOL) capabilities, it is engineered for logistics and transportation applications, offering extended flight time and enhanced autonomy. The Sabal 10 and Sabal 20 variants provide payload capacities of 10 kg and 20 kg, respectively, making them ideal for middle-mile deliveries and surveillance operations

- In May 2024, Airbus finalized the acquisition of Aerovel, a U.S.-based unmanned aerial system (UAS) company, along with its Flexrotor module. The Flexrotor is a small tactical drone designed for intelligence, surveillance, target acquisition, and reconnaissance (ISTAR) missions at sea and over land. This acquisition strengthens Airbus’s portfolio of tactical unmanned solutions and expands its presence in the small drone market. The Flexrotor features vertical takeoff and landing (VTOL) capabilities, making it ideal for expeditionary missions requiring minimal footprint

- In February 2022, Zain Saudi Arabia partnered with King Abdulaziz City for Science and Technology (KACST) to advance drone technologies through research and development. This collaboration focuses on integrating drone systems into commercial applications, supporting local content, and fostering innovation in logistics, surveillance, and emergency response. The partnership aims to accelerate technological solutions for the private sector while enhancing Saudi Arabia’s strategic plans for drone applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Small Drones Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Small Drones Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Small Drones Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.