Global Simultaneous Localization And Mapping Market

Market Size in USD M

CAGR :

%

USD

673.05 M

USD

8,269.90 M

2024

2032

USD

673.05 M

USD

8,269.90 M

2024

2032

| 2025 –2032 | |

| USD 673.05 M | |

| USD 8,269.90 M | |

|

|

|

|

Simultaneous Localization and Mapping Market Size

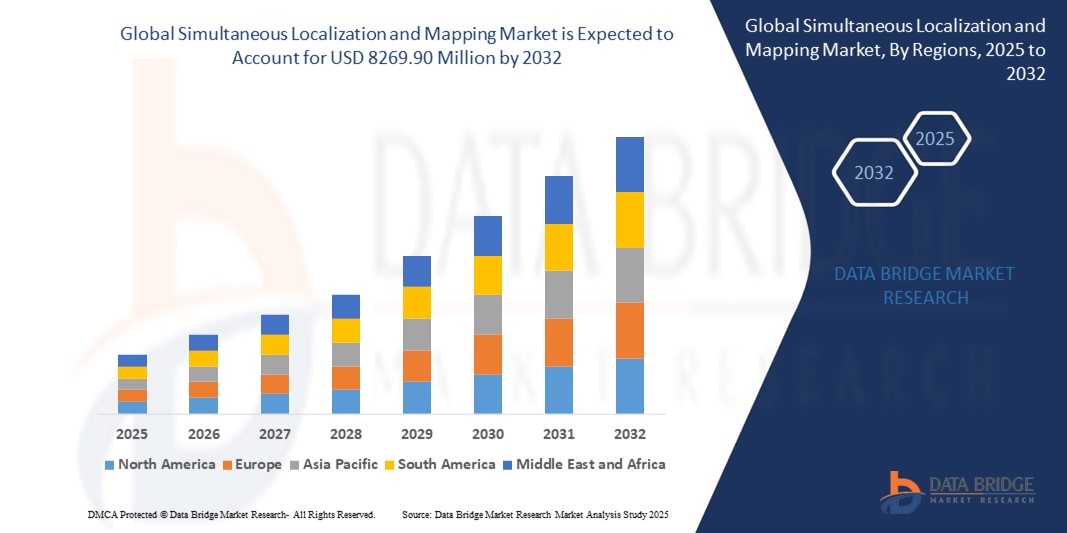

- The global simultaneous localization and mapping market size was valued at USD 673.05 million in 2024 and is expected to reach USD 8,269.90 million by 2032, at a CAGR of 36.83% during the forecast period

- The market growth is significantly driven by the increasing adoption of autonomous systems across various industries, including robotics, drones, and self-driving cars, which heavily rely on SLAM for navigation and mapping

- Furthermore, advancements in sensor technology and computing power, coupled with the growing demand for improved spatial awareness in applications such as augmented reality and virtual reality, are accelerating the integration of SLAM solutions, thereby substantially boosting the industry's expansion

Simultaneous Localization and Mapping Market Analysis

- Simultaneous Localization and Mapping is a computational problem of constructing or updating a map of an unknown environment while simultaneously keeping track of an agent's location within it

- The escalating demand for SLAM is primarily fueled by the widespread deployment of robotics in manufacturing, logistics, and healthcare, the burgeoning drone market for inspection and delivery, and the rapid development of autonomous vehicles requiring precise navigation in dynamic environments

- Europe dominated the simultaneous localization and mapping market with the largest revenue share of 49.01% in 2024, characterized by significant investment in R&D, a strong presence of leading technology companies, and early adoption of advanced robotics and autonomous vehicle technologies. The U.S. is experiencing substantial growth in SLAM applications, particularly in industrial automation

- North America is expected to be the fastest-growth rate of 48.12% in the simultaneous localization and mapping market during the forecast period due to increasing industrial automation, growing adoption of drones in various sectors, and rising government initiatives supporting the development of smart cities and autonomous technologies

- Robotics application segment dominated the simultaneous localization and mapping market with a largest market share of 35.1% in 2024, driven by the increasing deployment of robots in diverse industries for tasks such as manufacturing, logistics, and exploration, where accurate navigation and environmental understanding are paramount.

Report Scope and Simultaneous Localization and Mapping Market Segmentation

|

Attributes |

Simultaneous Localization and Mapping Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Simultaneous Localization and Mapping Market Trends

“Advancements in AI and Sensor Fusion Driving Enhanced Performance”

- A significant and accelerating trend in the global simultaneous localization and mapping market is the continuous advancement in artificial intelligence algorithms and the deepening integration of various sensor modalities, commonly known as sensor fusion

- For instance, modern autonomous vehicles from companies such as Waymo and Cruise extensively utilize SLAM systems that fuse data from LiDAR, cameras, radar, and ultrasonic sensors. AI algorithms, particularly deep learning, are employed to process this multi-modal data, enabling more accurate localization and mapping in complex and dynamic environments

- AI integration in SLAM enables features such as improved loop closure detection, robust outlier rejection, and semantic mapping, where the system not only builds a geometric map but also understands the meaning of objects within the environment

- Furthermore, the fusion of diverse sensor data provides redundancy and complementarity, mitigating the limitations of individual sensors and enhancing the overall reliability of the SLAM system in various conditions, such as poor lighting or dusty environments

- This trend towards more intelligent, resilient, and precise SLAM systems is fundamentally reshaping capabilities in autonomous navigation and spatial computing

- The demand for SLAM systems offering advanced AI and sensor fusion capabilities is growing rapidly across applications in robotics, autonomous vehicles, augmented reality, and virtual reality, as industries increasingly prioritize reliable and high-performance spatial awareness

Simultaneous Localization and Mapping Market Dynamics

Driver

“Increasing Adoption of Autonomous Systems and Robotics”

- The increasing prevalence and deployment of autonomous systems, including robotics, autonomous vehicles, and unmanned aerial vehicles, across various industries represent a significant driver for the heightened demand for simultaneous localization and mapping solutions

- For instance, as of 2023, the global industrial robot market continued its robust growth, with SLAM being a foundational technology for mobile robots in warehouses and manufacturing facilities, enabling efficient navigation and task execution

- As these autonomous systems become more ubiquitous, the critical need for them to understand their environment, localize themselves within it, and build maps for navigation and planning becomes paramount

- The convenience of autonomous operation, enhanced efficiency in logistics and manufacturing, and the ability to perform tasks in hazardous or inaccessible environments are key factors propelling the adoption of SLAM in these applications

- The trend towards automation across sectors and the increasing availability of affordable and capable autonomous platforms further contribute to market growth

Restraint/Challenge

“High Computational Requirements and Data Processing Complexity”

- Concerns surrounding the high computational requirements and inherent data processing complexity of simultaneous localization and mapping algorithms pose a significant challenge to broader market penetration and widespread adoption

- For instance, complex 3D SLAM algorithms, especially those incorporating visual and LiDAR data fusion, demand substantial processing power, memory, and energy, which can be a limiting factor for deployment on smaller, battery-powered devices such as drones or mobile robots. This often necessitates expensive, high-performance hardware, increasing the overall cost of implementation

- Addressing these computational challenges through optimized algorithms, efficient data structures, hardware acceleration, and edge computing solutions is crucial for making SLAM more accessible and cost-effective. Companies such as NVIDIA and Intel are developing hardware specifically designed to accelerate SLAM computations

- While advancements in computing power are gradually making SLAM more feasible, the perceived technical complexity and resource demands can still hinder widespread adoption, especially for smaller businesses or developers with limited computational resources

- Overcoming these challenges through continuous innovation in algorithm design, hardware optimization, and the development of more user-friendly SLAM development kits and platforms will be vital for sustained market growth

Simultaneous Localization and Mapping Market Scope

The market is segmented on the basis of type, offering, application, end-user, and region.

- By Type

On the basis of type, the simultaneous localization and mapping market is segmented into EKF SLAM, Fast SLAM, Graph-Based SLAM, and Others. The graph-based SLAM segment is anticipated to hold a significant market revenue share, driven by its robustness and ability to optimize the entire trajectory and map simultaneously, leading to highly accurate and consistent results, particularly in complex and large-scale environments. Its ability to effectively handle loop closures and reduce accumulated errors makes it a preferred choice for applications requiring high precision.

The EKF SLAM segment is expected to witness the fastest CAGR of 46.91% from 2025 to 2032, due to its long-standing presence and continued relevance in scenarios requiring real-time state estimation with well-defined motion and observation models. While facing challenges with scalability in large environments, its relatively lower computational complexity for smaller-scale applications and ability to provide uncertainty estimates continue to drive its adoption in specific robotic and autonomous systems.

- By Offering

On the basis of offering, the SLAM market is segmented into 2D SLAM and 3D SLAM. The 3D SLAM segment held the largest market revenue share in 2023, driven by the growing demand for higher fidelity spatial awareness in autonomous vehicles, drones, and advanced AR/VR applications. 3D SLAM provides a more comprehensive understanding of the environment, crucial for navigating complex, unstructured, and dynamic 3D spaces, enabling more sophisticated interactions and decision-making for autonomous systems

The 2D SLAM segment is expected to witness the fastest CAGR of 47.29% from 2025 to 2032, fueled by its widespread use in robotics for indoor navigation, warehouse automation, and domestic cleaning robots. Its simplicity, lower computational requirements, and cost-effectiveness make it a popular choice for applications operating primarily on a planar surface.

- By Application

On the basis of application, the SLAM market is segmented into Robotics, UAV, AR/VR, Automotive, and Others. The Unmanned aerial vehicles (UAVs) segment utilize SLAM technology to map and localize their surroundings for tasks like delivery, surveillance, and inspection. The global UAV market holds the second-largest share in SLAM technology, driven by rapid sector growth and extensive R&D. Developers continue advancing SLAM integration in drones, enhancing autonomous capabilities and improving navigation precision.

The Robotics segment is expected to witness the fastest CAGR of 36% from 2025 to 2032, driven by the increasing deployment of industrial and service robots across manufacturing, logistics, and healthcare sectors. SLAM is fundamental for these robots to navigate, map their surroundings, and perform tasks autonomously in dynamic environments.

- By End-User

On the basis of end user, the SLAM market is segmented into Manufacturing and Logistics, Commercial, Household, Military. The commercial end-user segment has driven rapid UAV sales growth, with increasing demand across photography, recreation, manufacturing, and defense. Numerous startups are entering the market as UAVs gain traction in assembly-line inspections and surveillance applications. The defense sector fuels expansion, leveraging drones for intelligence gathering, while households adopt UAVs for personal and creative uses.

The manufacturing and logistics segment is expected to witness the fastest CAGR of 34.70% from 2025 to 2032, driven by advancements in SLAM technology. As automation grows, industries increasingly adopt SLAM-powered robots to enhance efficiency in warehousing and logistics operations, reducing costs and time. The e-commerce sector further accelerates demand, integrating intelligent navigation systems for improved performance and productivity.

Simultaneous Localization and Mapping Market Regional Analysis

- Europe dominates the SLAM market with the largest revenue share of 49.01% in 2024, characterized by significant investment in R&D, a strong presence of leading technology companies, and early adoption of advanced robotics and autonomous vehicle technologies.

- The U.S. is experiencing substantial growth in SLAM applications, particularly in industrial automation

U.K. Simultaneous Localization and Mapping Market Insight

The U.K. simultaneous localization and mapping market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating demand for service robots for both domestic and industrial applications, as well as significant applications of SLAM in military and commercial drones. The U.K.'s robust research and development ecosystem, coupled with increasing investments in AI and emerging technologies such as augmented reality, is stimulating market growth. Concerns regarding operational efficiency, safety, and the desire for intelligent automation are encouraging various sectors to integrate SLAM solutions.

Germany Simultaneous Localization and Mapping Market Insight

The Germany simultaneous localization and mapping market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's strong industrial base and its leadership in manufacturing and automotive sectors. Germany's emphasis on Industry initiatives and the increasing adoption of industrial robots and autonomous guided vehicles are key drivers. The demand for highly precise and reliable navigation solutions in factories, warehouses, and for autonomous driving is promoting the integration of SLAM technology. Furthermore, ongoing advancements in sensor technology and AI within the German tech landscape contribute to market expansion.

North America Simultaneous Localization and Mapping Market Insight

North America is expected to be the fastest-growth rate of 48.12% in the simultaneous localization and mapping market during the forecast period due to increasing industrial automation, growing adoption of drones in various sectors, and rising government initiatives supporting the development of smart cities and autonomous technologies

U.S. Simultaneous Localization and Mapping Market Insight

The U.S. simultaneous localization and mapping market captured the largest revenue share of 39% in 2024, this growth is primarily fueled by substantial investments in artificial intelligence, the internet of thing, and digital mapping solutions, alongside the rapid advancements and adoption of autonomous vehicles and robotics. The strong presence of leading technology companies and a focus on R&D in areas such as self-driving cars and industrial automation further propels the market. Consumers and industries in the U.S. increasingly value the precision and real-time mapping capabilities offered by SLAM for various applications, including autonomous navigation and AR/VR experiences.

Asia-Pacific Simultaneous Localization and Mapping Market Insight

The Asia-Pacific simultaneous localization and mapping market is poised to grow at the fastest CAGR of 39.1% from 2023 to 2031. This rapid growth is driven by increasing industrial automation, rising disposable incomes leading to greater adoption of consumer robotics, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards smart cities and smart factories, supported by government initiatives promoting digitalization and innovation, is driving the adoption of SLAM solutions across diverse applications, including UAVs and AR/VR.

Japan Simultaneous Localization and Mapping Market Insight

The Japan simultaneous localization and mapping market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and a strong focus on robotics and automation. The Japanese market places a significant emphasis on technological precision and efficiency, and the adoption of SLAM is driven by the increasing number of industrial robots, service robots, and advancements in autonomous vehicle research. The integration of SLAM with other internet of things (IoT) security devices and smart infrastructure projects is fueling growth. Moreover, Japan's aging population to spur demand for more autonomous solutions in various sectors, including healthcare and elder care, where SLAM plays a crucial role.

China Simultaneous Localization and Mapping Market Insight

The China simultaneous localization and mapping market accounted for the largest market revenue share in Asia Pacific in 2023, attributed to the country's rapid industrialization, expanding manufacturing sector, and high rates of technological adoption in robotics and autonomous systems. China stands as one of the largest markets for industrial and service robots, and SLAM is becoming increasingly vital for these applications. The push towards smart cities, significant government investments in AI and automation, and the presence of strong domestic manufacturers and R&D capabilities are key factors propelling the market in China.

Simultaneous Localization and Mapping Market Share

The simultaneous localization and mapping industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- Google (U.S.)

- Microsoft (U.S.)

- Meta Platforms, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Intel Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Magic Leap, Inc. (U.S.)

- PTC Inc. (U.S.)

- Maxar Technologies Inc. (U.S.)

- Hexagon AB (Sweden)

- Ouster, Inc. (U.S.)

- SLAMcore Ltd. (U.K.)

- Cognex Corporation (U.S)

Latest Developments in Global Simultaneous Localization and Mapping Market

- In March 2024, ABB Robotics introduced the Flexley Tug T702, its first autonomous mobile robot (AMR) featuring AI-based Visual SLAM navigation technology and the AMR Studio software. This innovation enhances speed, accuracy, and autonomy in industrial logistics. Visual SLAM enables robots to intelligently navigate, differentiate between fixed and mobile objects, and continuously update maps across fleets, reducing commissioning time and enabling fully autonomous operation in dynamic environments. The integration of AI-driven mapping and real-time adaptability supports efficient automation

- In January 2024, Inertial Labs Inc., a leading sensor manufacturing company, introduced the RESEPI scanner, integrating Kudan's 3D Lidar SLAM engine. This advanced system enhances point cloud generation, delivering high-resolution spatial data across multiple sensing modalities. The innovation is particularly valuable for industrial inspections, construction surveying, and other dynamic mapping applications requiring precision and accuracy. The RESEPI scanner supports real-time data processing, improving efficiency in remote sensing. This development marks a significant step in sensor fusion technology, enabling more reliable and scalable mapping solutions

- In May 2023, NavVis, a global leader in reality capture and digital factory solutions, introduced the NavVis VLX 3, featuring two advanced 32-layer LiDAR sensors and powered by precision SLAM technology. This innovation enhances survey accuracy, making it ideal for architectural, engineering, and construction (AEC) industries. The device enables real-time mapping of construction sites, improving efficiency and reliability in spatial data collection. With low noise, reduced drift, and high detail at range, NavVis VLX 3 sets a new standard for dynamic scanning applications

- In March 2023, Kudan Inc. and Movel AI established a strategic partnership, launching an integrated SLAM solution for robotic navigation and fleet management. This collaboration merges Kudan's 3D Lidar 'KdLidar' and visual 'KdVisual' SLAM software into Movel AI's Seirios platform, enhancing localization and mapping accuracy. The solution enables precise positioning, supports dynamic environments, and accelerates robot adoption across industries. By offering seamless user experiences and scalable fleet management, the partnership advances autonomous mobile robotics

- In September 2022, Amazon acquired Cloostermans, a Belgium-based warehouse technology manufacturer, to enhance its automation capabilities. Cloostermans specializes in mechatronics solutions, helping move and stack heavy pallets while supporting industrial machine repairs. Amazon has integrated its expertise into Amazon Robotics, aiming to improve operational efficiency. However, reports indicate that robot-equipped warehouses experience higher injury rates than non-automated facilities. By leveraging Cloostermans’ repair and maintenance skills, Amazon seeks to optimize workplace safety and streamline warehouse operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.