Global Simulation Software Market

Market Size in USD Billion

CAGR :

%

USD

20.84 Billion

USD

57.76 Billion

2024

2032

USD

20.84 Billion

USD

57.76 Billion

2024

2032

| 2025 –2032 | |

| USD 20.84 Billion | |

| USD 57.76 Billion | |

|

|

|

Simulation Software Market Analysis

The simulation software market is experiencing significant growth, driven by advancements in artificial intelligence (AI), cloud computing, and digital twin technologies. Simulation software is widely used across industries such as automotive, aerospace, healthcare, industrial manufacturing, and electronics to optimize designs, enhance operational efficiency, and reduce costs. The increasing adoption of cloud-based simulation solutions has enabled businesses to perform complex simulations without requiring high-end on-premises hardware, making the technology more accessible to small and medium enterprises (SMEs). In addition, the integration of AI and machine learning (ML) algorithms is improving the accuracy and speed of simulations, leading to more efficient product development cycles. Industry 4.0 adoption and the rise of smart manufacturing are further fueling market demand, as companies seek to enhance automation, predictive maintenance, and real-time monitoring. The growing use of digital twins, which create virtual replicas of physical assets, is also revolutionizing sectors such as automotive and aerospace by enabling real-time testing and performance optimization. With continuous technological advancements and increasing industry reliance on simulation tools, the market is poised for substantial expansion in the coming years.

Simulation Software Market Size

The global simulation software market size was valued at USD 20.84 billion in 2024 and is projected to reach USD 57.76 billion by 2032, with a CAGR of 13.59% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Simulation Software Market Trends

“Growing Adoption of Cloud-Based Simulation Solutions”

One of the key trends in the simulation software market is the growing adoption of cloud-based simulation solutions, driven by the need for scalability, cost-effectiveness, and remote accessibility. Traditional on-premises simulation tools often require high computational power and expensive hardware, making them less accessible to small and medium enterprises (SMEs). Cloud-based simulation software eliminates these challenges by offering on-demand computing resources, pay-as-you-go pricing models, and real-time collaboration features. For instance, Siemens’ Simcenter X, launched in May 2024, provides engineers with browser-based access to high-performance simulation tools, enabling them to run complex simulations without investing in costly infrastructure. In addition, cloud-based platforms integrate seamlessly with AI and digital twin technologies, allowing industries such as automotive, aerospace, and industrial manufacturing to perform real-time performance testing and predictive analysis. As more companies shift toward cloud-based deployment, this trend is expected to accelerate the market's growth and transformation.

Report Scope and Simulation Software Market Segmentation

|

Attributes |

Simulation Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Siemens (Germany), Rockwell Automation (U.S.), Schneider Electric (France), Autodesk Inc. (U.S.), ANSYS, Inc. (U.S.), Bentley Systems, Incorporated (U.S.), Altair Engineering, Inc. (U.S.), PTC (U.S.), CPFD Software (U.S.), Cybernet Systems Corporation (Japan), Dassault Systèmes (France), Design Simulation Technologies, Inc. (U.S.), Synopsys, Inc. (U.S.), The MathWorks, Inc. (U.S.), GSE Systems, Inc. (U.S.), Simulations Plus (U.S.), ESI Group (France), The AnyLogic Company (U.S.), FlexSim Software Products, Inc. (U.S.), and Simio (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Simulation Software Market Definition

Simulation software is a computer-based tool that enables users to create virtual models of real-world systems, processes, or products to analyze their behavior under different conditions. It allows industries such as automotive, aerospace, healthcare, industrial manufacturing, and electronics to test designs, optimize performance, and predict outcomes without the need for physical prototypes.

Simulation Software Market Dynamics

Drivers

- Growing Adoption of Industry 4.0 and Smart Manufacturing

The rise of Industry 4.0 and smart manufacturing is a major driver of the simulation software market, as businesses increasingly rely on digital twins, AI-powered simulations, and real-time data analytics to improve production efficiency, reduce operational downtime, and enhance predictive maintenance. With advanced automation, robotics, and IoT-enabled systems, industries can simulate complex production workflows, test various manufacturing scenarios, and optimize resource allocation. For instance, BMW uses digital twin technology to create virtual replicas of its factories, allowing engineers to analyze production lines, detect inefficiencies, and implement real-time improvements. Similarly, General Electric (GE) employs AI-driven simulation models to predict maintenance needs for industrial equipment, significantly reducing unexpected breakdowns. As smart manufacturing continues to expand, simulation software adoption will surge, enabling manufacturers to make data-driven decisions, lower costs, and achieve higher operational efficiency.

- Rising Demand for Cloud-Based Simulation Solutions

The transition to cloud computing is revolutionizing the simulation software market, offering businesses scalability, flexibility, and cost savings. Traditional on-premises simulation tools require significant hardware investments, making them less accessible to small and medium enterprises (SMEs). In contrast, cloud-based simulation solutions allow organizations to perform high-performance simulations on-demand, eliminating the need for expensive IT infrastructure. For instance, Siemens’ Simcenter X, launched in May 2024, provides engineers with pay-as-you-go access to advanced simulation tools, enabling them to collaborate remotely and optimize product designs without heavy upfront costs. Similarly, ANSYS Cloud offers real-time simulation capabilities, allowing aerospace and automotive companies to test flight dynamics, crash simulations, and structural integrity models directly through cloud platforms. As industries continue to prioritize digital transformation, the adoption of cloud-based simulation software will accelerate, making advanced simulation tools more accessible and cost-effective for businesses of all sizes.

Opportunities

- Increasing Use of Simulation in Aerospace and Automotive Industries

The automotive and aerospace industries are witnessing a surge in the adoption of simulation software, presenting a significant market opportunity. Simulation tools are extensively used for design validation, crash testing, aerodynamics analysis, and predictive maintenance, enabling manufacturers to reduce costs and improve product safety. With the rise of electric vehicles (EVs) and autonomous driving technologies, the need for simulation-driven development has intensified. For instance, Tesla leverages simulation software to test battery performance, vehicle aerodynamics, and self-driving algorithms before real-world deployment, ensuring efficiency and regulatory compliance. Similarly, Boeing and Airbus use simulation models to analyze aircraft structural integrity, fuel efficiency, and flight safety, reducing the need for expensive physical testing. As the EV and aerospace sectors continue to expand, the demand for high-performance simulation software will grow, creating lucrative opportunities for technology providers.

- Increasing Advancements in AI, Machine Learning, and Digital Twin Technology

The integration of artificial intelligence (AI), machine learning (ML), and digital twin technology is revolutionizing simulation software, offering businesses a competitive edge through enhanced predictive capabilities. AI-powered simulations can analyze vast datasets, identify patterns, and optimize system performance in real time, making them indispensable in industries such as healthcare, logistics, and industrial manufacturing. For instance, Siemens’ Digital Twin technology allows manufacturers to create virtual replicas of production systems, enabling them to test efficiency, detect potential failures, and refine processes before physical implementation. In healthcare, GE Healthcare utilizes AI-driven simulations to predict patient outcomes and optimize medical imaging equipment. With businesses prioritizing cost reduction, efficiency, and real-time decision-making, the advancements in AI and digital twin technology present a major growth opportunity for the simulation software market.

Restraints/Challenges

- High Initial Investment and Licensing Costs

One of the biggest challenges in the Simulation Software Market is the high initial investment and licensing costs, which create a barrier to adoption, especially for small and medium-sized enterprises (SMEs) and startups. Simulation software requires powerful computing infrastructure, high-end graphics processing units (GPUs), and cloud-based or on-premise deployment, all of which demand significant upfront capital. In addition, leading simulation tools such as ANSYS, Simulink, and Dassault Systèmes’ SIMULIA often come with expensive licensing fees and subscription-based pricing models, making it difficult for cost-sensitive businesses to invest in them. For instance, aerospace and automotive companies heavily rely on simulation software for product testing and virtual prototyping, but the high costs limit access for smaller players. Furthermore, maintaining and upgrading simulation platforms adds to operational expenses, forcing companies to carefully balance their budget between software investments and other R&D initiatives.

- Cybersecurity and Data Privacy Risks

With the increasing shift toward cloud-based simulation software, cybersecurity and data privacy risks have become a major market challenge. Simulation models often contain sensitive intellectual property (IP), proprietary engineering designs, and confidential data, making them prime targets for cyberattacks and data breaches. Industries such as defense, healthcare, and automotive manufacturing face heightened security concerns, as cyber threats could lead to stolen trade secrets, production delays, or compromised safety standards. For instance, aerospace companies using cloud-based simulations for aircraft design need robust encryption, access controls, and compliance measures to prevent unauthorized access. In addition, different countries have varying data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the Cybersecurity Maturity Model Certification (CMMC) in the U.S., making global compliance even more complex. As businesses increasingly rely on remote collaboration and cloud-based simulation, addressing cybersecurity risks will be crucial to maintaining trust and data integrity in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Simulation Software Market Scope

The market is segmented on the basis of component, application, deployment type, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Software

- Services

Application

- E-Learning and Training

- Research and Development

Deployment Type

- Cloud

- On-Premises

Vertical

- Automotive

- Aerospace and Defence

- Electrical and Electronics

- Industrial Manufacturing

- Healthcare

- Education and Research

- Others

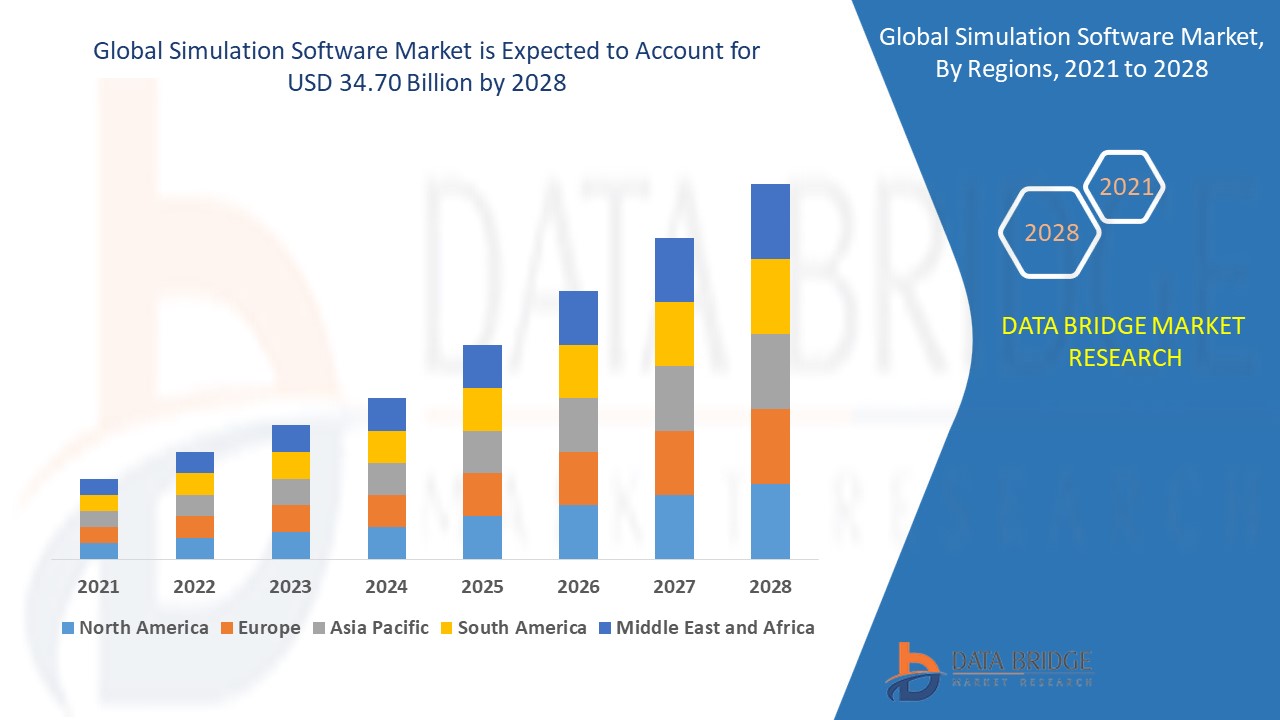

Simulation Software Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, component, application, deployment type, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the simulation software market and is expected to maintain its dominance throughout the forecast period due to its strong industrial presence and technological leadership. The region benefits from the early adoption of simulation technologies in aerospace and defense, where precision and advanced testing are critical. In addition, the presence of a large number of key market players fosters continuous innovation and drives market expansion. Growing investments in R&D, artificial intelligence (AI), and digital twin technologies further strengthen North America's position in the global simulation software industry.

Asia-Pacific is projected to witness the fastest CAGR in the simulation software market during the forecast period, driven by rapid industrialization and increasing manufacturing activities. The region is experiencing a surge in small and medium-sized enterprises (SMEs), which are increasingly adopting simulation technologies to enhance productivity and efficiency. In addition, government initiatives supporting digital transformation and the integration of Industry 4.0 technologies are accelerating market growth. The expanding presence of automotive, aerospace, and electronics industries in countries such as China, India, and Japan further boosts demand for advanced simulation solutions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Simulation Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Simulation Software Market Leaders Operating in the Market Are:

- Siemens (Germany)

- Rockwell Automation (U.S.)

- Schneider Electric (France)

- Autodesk Inc. (U.S.)

- ANSYS, Inc. (U.S.)

- Bentley Systems, Incorporated (U.S.)

- Altair Engineering, Inc. (U.S.)

- PTC (U.S.)

- CPFD Software (U.S.)

- Cybernet Systems Corporation (Japan)

- Dassault Systèmes (France)

- Design Simulation Technologies, Inc. (U.S.)

- Synopsys, Inc. (U.S.)

- The MathWorks, Inc. (U.S.)

- GSE Systems, Inc. (U.S.)

- Simulations Plus (U.S.)

- ESI Group (France)

- The AnyLogic Company (U.S.)

- FlexSim Software Products, Inc. (U.S.)

- Simio (U.S.)

Latest Developments in Simulation Software Market

- In May 2024, Siemens announced Simcenter X, a SaaS solution that provides cloud-based access to Simcenter's simulation tools, starting with Simcenter STAR-CCM+. Offering pay-as-you-go pricing, scalability, and remote access via a browser, it enables engineers to accelerate simulations, improve flexibility, and enhance collaboration without requiring upfront hardware or licensing costs

- In March 2024, General Atomics Aeronautical Systems, Inc. (GA-ASI) adopted Siemens' Simcenter STAR-CCM+ for its aircraft development process to meet evolving simulation needs. Following a comprehensive evaluation, GA-ASI transitioned to Simcenter to achieve improved workflow efficiency, faster solver speeds, and seamless integration with Siemens' PLM platform

- In February 2024, Siemens and AVL collaborated to integrate Siemens' Simcenter solutions with AVL's simulation tools, aiming to enhance the development of electric vehicles by optimizing key performance metrics

- In January 2024, Ansys partnered with Materialise in a strategic collaboration to improve metal additive manufacturing processes by enhancing product quality and reducing costs through better risk management

- In January 2024, AVL introduced the AVL Scenario Simulator, a tool designed to enable automated large-scale ADAS/AD testing while extending off-road simulation capabilities for passenger cars and commercial vehicles

- In June 2023, Keysight unveiled PathWave ADS 2024, an advanced EDA software designed to enhance 5G/6G wireless semiconductor design. It features accelerated simulations, improved electromagnetic solvers, and Python APIs for superior circuit design and validation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SIMULATION SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SIMULATION SOFTWARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SIMULATION SOFTWARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CASE STUDIES

5.2 REGULATORY FRAMEWORK

5.3 TECHNOLOGICAL TRENDS

5.4 PRICING ANALYSIS

5.5 VALUE CHAIN ANALYSIS

6 GLOBAL SIMULATION SOFTWARE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 FINITE ELEMENT ANALYSIS

6.2.2 ELECTROMAGNETIC SIMULATION

6.2.3 COMPUTATIONAL FLUID DYNAMICS

6.3 SERVICES

6.3.1 CONSULTING

6.3.2 INTEGRATION & IMPLEMENTATION

6.3.3 SUPPORT & MAINTENANCE

7 GLOBAL SIMULATION SOFTWARE MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 ON-PREMISES

7.3 CLOUD

8 GLOBAL SIMULATION SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 PRODUCT ENGINEERING

8.3 GAMIFICATION

8.4 RESEARCH & DEVELOPMENT

9 GLOBAL SIMULATION SOFTWARE MARKET, BY END-USE

9.1 OVERVIEW

9.2 AUTOMOTIVE

9.2.1 BY OFFERING

9.2.1.1. SOFTWARE

9.2.1.1.1. FINITE ELEMENT ANALYSIS

9.2.1.1.2. ELECTROMAGNETIC SIMULATION

9.2.1.1.3. COMPUTATION FLUID DYNAMICS

9.2.1.2. SOFTWARE

9.2.1.2.1. CONSULTING

9.2.1.2.2. INTEGRATION & IMPLEMENTATION

9.2.1.2.3. SUPPORT & MAINTENANCE

9.3 AEROSPACE & DEFENSE

9.3.1 BY OFFERING

9.3.1.1. SOFTWARE

9.3.1.1.1. FINITE ELEMENT ANALYSIS

9.3.1.1.2. ELECTROMAGNETIC SIMULATION

9.3.1.1.3. COMPUTATION FLUID DYNAMICS

9.3.1.2. SOFTWARE

9.3.1.2.1. CONSULTING

9.3.1.2.2. INTEGRATION & IMPLEMENTATION

9.3.1.2.3. SUPPORT & MAINTENANCE

9.4 HEALTHCARE & PHARMACEUTICALS

9.4.1 BY OFFERING

9.4.1.1. SOFTWARE

9.4.1.1.1. FINITE ELEMENT ANALYSIS

9.4.1.1.2. ELECTROMAGNETIC SIMULATION

9.4.1.1.3. COMPUTATION FLUID DYNAMICS

9.4.1.2. SOFTWARE

9.4.1.2.1. CONSULTING

9.4.1.2.2. INTEGRATION & IMPLEMENTATION

9.4.1.2.3. SUPPORT & MAINTENANCE

9.5 ELECTRICAL & ELECTRONICS

9.5.1 BY OFFERING

9.5.1.1. SOFTWARE

9.5.1.1.1. FINITE ELEMENT ANALYSIS

9.5.1.1.2. ELECTROMAGNETIC SIMULATION

9.5.1.1.3. COMPUTATION FLUID DYNAMICS

9.5.1.2. SOFTWARE

9.5.1.2.1. CONSULTING

9.5.1.2.2. INTEGRATION & IMPLEMENTATION

9.5.1.2.3. SUPPORT & MAINTENANCE

9.6 CONSTRUCTION

9.6.1 BY OFFERING

9.6.1.1. SOFTWARE

9.6.1.1.1. FINITE ELEMENT ANALYSIS

9.6.1.1.2. ELECTROMAGNETIC SIMULATION

9.6.1.1.3. COMPUTATION FLUID DYNAMICS

9.6.1.2. SOFTWARE

9.6.1.2.1. CONSULTING

9.6.1.2.2. INTEGRATION & IMPLEMENTATION

9.6.1.2.3. SUPPORT & MAINTENANCE

9.7 MARINE

9.7.1 BY OFFERING

9.7.1.1. SOFTWARE

9.7.1.1.1. FINITE ELEMENT ANALYSIS

9.7.1.1.2. ELECTROMAGNETIC SIMULATION

9.7.1.1.3. COMPUTATION FLUID DYNAMICS

9.7.1.2. SOFTWARE

9.7.1.2.1. CONSULTING

9.7.1.2.2. INTEGRATION & IMPLEMENTATION

9.7.1.2.3. SUPPORT & MAINTENANCE

9.8 CHEMICALS

9.8.1 BY OFFERING

9.8.1.1. SOFTWARE

9.8.1.1.1. FINITE ELEMENT ANALYSIS

9.8.1.1.2. ELECTROMAGNETIC SIMULATION

9.8.1.1.3. COMPUTATION FLUID DYNAMICS

9.8.1.2. SOFTWARE

9.8.1.2.1. CONSULTING

9.8.1.2.2. INTEGRATION & IMPLEMENTATION

9.8.1.2.3. SUPPORT & MAINTENANCE

9.9 OTHERS

9.9.1 BY OFFERING

9.9.1.1. SOFTWARE

9.9.1.1.1. FINITE ELEMENT ANALYSIS

9.9.1.1.2. ELECTROMAGNETIC SIMULATION

9.9.1.1.3. COMPUTATION FLUID DYNAMICS

9.9.1.2. SOFTWARE

9.9.1.2.1. CONSULTING

9.9.1.2.2. INTEGRATION & IMPLEMENTATION

9.9.1.2.3. SUPPORT & MAINTENANCE

10 GLOBAL SIMULATION SOFTWARE MARKET, BY REGION

Global SIMULATION SOFTWARE Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

10.2 EUROPE

10.2.1 GERMANY

10.2.2 FRANCE

10.2.3 U.K.

10.2.4 ITALY

10.2.5 SPAIN

10.2.6 RUSSIA

10.2.7 TURKEY

10.2.8 BELGIUM

10.2.9 NETHERLANDS

10.2.10 SWITZERLAND

10.2.11 REST OF EUROPE

10.3 ASIA PACIFIC

10.3.1 JAPAN

10.3.2 CHINA

10.3.3 SOUTH KOREA

10.3.4 INDIA

10.3.5 AUSTRALIA

10.3.6 SINGAPORE

10.3.7 THAILAND

10.3.8 MALAYSIA

10.3.9 INDONESIA

10.3.10 PHILIPPINES

10.3.11 REST OF ASIA PACIFIC

10.4 SOUTH AMERICA

10.4.1 BRAZIL

10.4.2 ARGENTINA

10.4.3 REST OF SOUTH AMERICA

10.5 MIDDLE EAST AND AFRICA

10.5.1 SOUTH AFRICA

10.5.2 EGYPT

10.5.3 SAUDI ARABIA

10.5.4 U.A.E

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

11 GLOBAL SIMULATION SOFTWARE MARKET,COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS & ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 GLOBAL SIMULATION SOFTWARE MARKET, SWOT AND DBMR ANALYSIS

13 GLOBAL SIMULATION SOFTWARE MARKET, COMPANY PROFILE

13.1 DASSAULT SYSTEMS

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 GEOGRAPHIC PRESENCE

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 HONEYWELL INTERNATIONAL, INC

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 GEOGRAPHIC PRESENCE

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MSC SOFTWARE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 GEOGRAPHIC PRESENCE

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 ALTAIR ENGINEERING

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 GEOGRAPHIC PRESENCE

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 BENTLEY SYSTEMS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 GEOGRAPHIC PRESENCE

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 COMSOL

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 GEOGRAPHIC PRESENCE

13.6.4 PRODUCT PORTFOLIO

13.6.5 RECENT DEVELOPMENTS

13.7 SPIRENT COMMUNICATIONS

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 GEOGRAPHIC PRESENCE

13.7.4 PRODUCT PORTFOLIO

13.7.5 RECENT DEVELOPMENTS

13.8 SYNOPSYS

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 GEOGRAPHIC PRESENCE

13.8.4 PRODUCT PORTFOLIO

13.8.5 RECENT DEVELOPMENTS

13.9 AVEVA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 GEOGRAPHIC PRESENCE

13.9.4 PRODUCT PORTFOLIO

13.9.5 RECENT DEVELOPMENTS

13.1 SIEMENS AG

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 GEOGRAPHIC PRESENCE

13.10.4 PRODUCT PORTFOLIO

13.10.5 RECENT DEVELOPMENTS

13.11 AUTODESK

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 GEOGRAPHIC PRESENCE

13.11.4 PRODUCT PORTFOLIO

13.11.5 RECENT DEVELOPMENTS

13.12 ANSYS

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 GEOGRAPHIC PRESENCE

13.12.4 PRODUCT PORTFOLIO

13.12.5 RECENT DEVELOPMENTS

13.13 PTC

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 GEOGRAPHIC PRESENCE

13.13.4 PRODUCT PORTFOLIO

13.13.5 RECENT DEVELOPMENTS

13.14 PRESAGIS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 GEOGRAPHIC PRESENCE

13.14.4 PRODUCT PORTFOLIO

13.14.5 RECENT DEVELOPMENTS

13.15 ANYLOGIC

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 GEOGRAPHIC PRESENCE

13.15.4 PRODUCT PORTFOLIO

13.15.5 RECENT DEVELOPMENTS

13.16 PTC GROUP

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 GEOGRAPHIC PRESENCE

13.16.4 PRODUCT PORTFOLIO

13.16.5 RECENT DEVELOPMENTS

13.17 SIMSCALE

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 GEOGRAPHIC PRESENCE

13.17.4 PRODUCT PORTFOLIO

13.17.5 RECENT DEVELOPMENTS

13.18 SCALABLE NETWORKS

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 GEOGRAPHIC PRESENCE

13.18.4 PRODUCT PORTFOLIO

13.18.5 RECENT DEVELOPMENTS

13.19 SIMUL8 CORPORATION

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 GEOGRAPHIC PRESENCE

13.19.4 PRODUCT PORTFOLIO

13.19.5 RECENT DEVELOPMENTS

13.2 FLEXISIM

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 GEOGRAPHIC PRESENCE

13.20.4 PRODUCT PORTFOLIO

13.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.