Global Silicon Carbide Power Semiconductors Market, By Form Factor (SFF and SFP; SFP+ and SFP28; QSFP, QSFP+, QSFP14, and QSFP28; CFP, CFP2, and CFP4; XFP; CXP), Data Rate (Less Than 10 GBPS, 10 GBPS to 40 GBPS, 41 GBPS to 100 GBPS, and More Than 100 GBPS), Distance (Less Than 1 KM, 1 to 10 KM, 11 to 100 KM, and More Than 100 KM), Wavelength (850 NM Band, 1310 NM Band, 1550 NM Band, and Others), Connector (LC Connector, SC Connector, MPO Connector, and RJ-45), Application (Telecommunication, Data Center, and Enterprise) – Industry Trends and Forecast to 2031.

Silicon Carbide Power Semiconductors Market Analysis and Size

In renewable energy systems, Silicon Carbide (SiC) power semiconductors play a crucial role in enhancing the efficiency and performance of solar inverters and wind turbine converters. SiC devices enable more efficient power conversion, reducing energy losses and improving the overall efficiency of renewable energy systems. SiC power semiconductors companies contribute to better grid integration and energy storage solutions, supporting the growth and reliability of renewable energy sources such as solar and wind power.

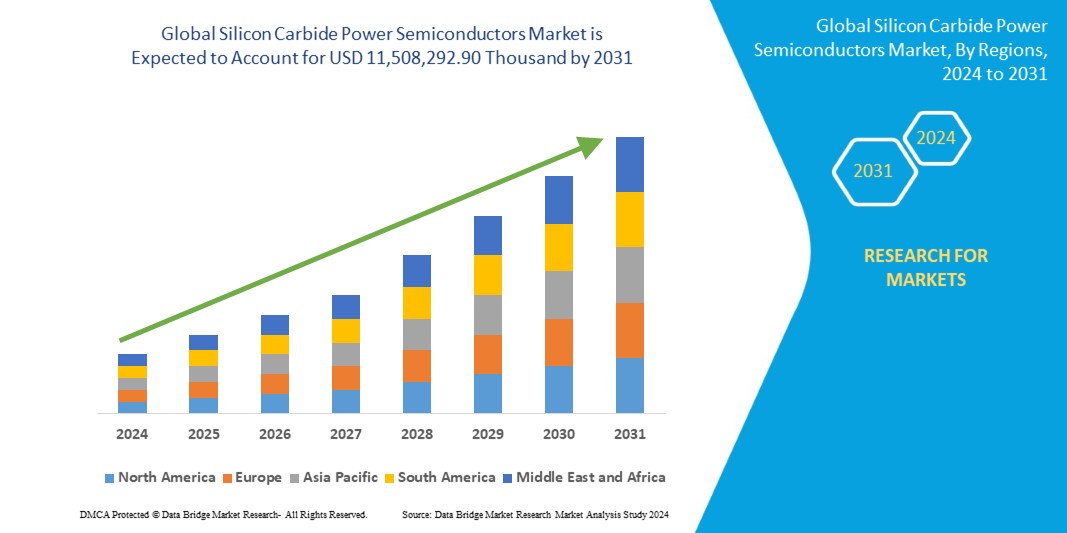

The global silicon carbide power semiconductors market size was valued at USD 1,950,156.00 thousand in 2023 and is projected to reach USD 11,508,292.90 thousand by 2031, with a CAGR of 25.1% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (MOSFETS, Schottky Barrier Diodes (SBDs), Bipolar Junction Transistor (BJT), Hybrid Modules, SiC Bare Die, Pin Diode, Junction FET, and Others), Wafer Type (SiC Epitaxial Wafers and Blank SiC Wafers), Voltage Range (301 V to 900 V, 901 V to 1700 V, 1701 V & Above, and Less than 300 V), Wafer Size (2 Inch, 3 Inch and 4 Inch, 6 Inch, and 8 & 12 Inch), Application (Electric Vehicle (EV), Inverters, Power Supplies, Photovoltaics, RF Devices, Industrial Motor Drives, and Others), Vertical (Automotive & Transportation, Data Centers, Industrial, Renewables/Grids, Consumer Electronics, Aerospace & Defense, Medical, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, U.K., France, Italy, Netherlands, Spain, Russia, Switzerland, Turkey, Belgium, Poland, Sweden, Denmark, Norway, Finland, and Rest of Europe, China, Japan, India, South Korea, Australia, Taiwan, Singapore, Thailand, Indonesia, Malaysia, Philippines, New Zealand, Vietnam, and Rest of Asia-Pacific, Brazil, Argentina, and Rest of South America, Saudi Arabia, U.A.E, Israel, South Africa, Egypt, Qatar, Kuwait, Bahrain, Oman, and Rest of Middle East and Africa

|

|

Market Players Covered

|

Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), WOLFSPEED, INC. (U.S.), Renesas Electronics Corporation (Japan), Semiconductor Components Industries, LLC (U.S.), Mitsubishi Electric Corporation (Japan), ROHM CO., LTD. (Japan), Qorvo, Inc (U.S.), Nexperia (Netherlands), TOSHIBA CORPORATION (Japan), Allegro MicroSystems, Inc. (U.S.), GeneSiC Semiconductor Inc. (U.S.), Fuji Electric Co., Ltd (Japan), Vishay Intertechnology, Inc. (U.S.), Hitachi Power Semiconductor Device, Ltd. (Japan), Littelfuse, Inc. (U.S.), Texas Instruments Incorporated (U.S.), Microchip Technology Inc. (U.S.), Semikron Danfoss (Germany), WeEn Semiconductors (China), Solitron Devices, Inc. (U.S.), SemiQ Inc. (U.S.), Xiamen Powerway Advanced Material (China), and MaxPower Semiconductor (China)

|

|

Market Opportunities

|

|

Market Definition

Silicon Carbide (SiC) power semiconductors are advanced electronic components that utilize silicon carbide as the semiconductor material instead of traditional silicon. SiC power semiconductors offer higher efficiency, lower power losses, and higher operating temperatures, enabling them to handle high voltages and currents with reduced size and weight, making them ideal for applications in electric vehicles, renewable energy systems, and industrial power electronics.

Silicon Carbide Power Semiconductors Market Dynamics

Drivers

- Growing Adoption of Electric Vehicles (EVs)

SiC devices enhance the efficiency and performance of EV powertrains by enabling faster switching speeds, lower power losses, and better thermal management compared to traditional silicon-based semiconductors. This results in longer driving ranges, shorter charging times, and overall improved vehicle performance. As the EV market expands rapidly, driven by increasing consumer demand and supportive government policies, the need for advanced power electronics such as SiC semiconductors are becoming more critical, fueling the growth of the SiC power semiconductor market.

- Growing Technological Advancements SiC Power Semiconductors

Innovations in SiC material quality and manufacturing processes have significantly improved the performance and cost-effectiveness of these semiconductors. Enhanced fabrication techniques have led to higher yields and reduced defects, making SiC devices more reliable and commercially viable. In addition, the development of new SiC power modules and packaging technologies has expanded their application range, enabling superior performance in high-temperature and high-voltage environments.

Opportunities

- Growing Government Policies

Many governments around the world are implementing regulations and providing incentives to reduce carbon emissions and transition to cleaner energy sources. Policies such as subsidies for renewable energy projects, tax incentives for electric vehicle manufacturers, and stringent energy efficiency standards encourage the use of advanced technologies such as SiC semiconductors. These initiatives stimulate demand for SiC devices and support research and development efforts, fostering innovation and growth within the market.

- Growing Industrial Automation

SiC devices offer advantages such as higher power density, faster switching speeds, and reduced losses, making them ideal for power converters, motor drives, and other industrial automation systems. These semiconductors enable improved energy efficiency, smaller form factors, and enhanced reliability in industrial equipment, contributing to cost savings and improved performance. As industries continue to automate processes for efficiency and productivity gains, the demand for SiC power semiconductors in industrial automation is expected to grow significantly.

Restraints/Challenges

- High Initial Costs

The initial investment required for SiC devices, including manufacturing equipment, materials, and development, is often higher compared to traditional silicon-based counterparts. This can deter potential adopters, particularly in cost-sensitive industries or applications. Additionally, the need for specialized expertise and infrastructure for SiC fabrication and implementation further adds to the upfront expenses. The long-term benefits of SiC, such as increased efficiency and reliability increases its costs which causes the initial financial barrier restraining the widespread adoption of SiC power semiconductors.

- Regulatory Uncertainty Limits SiC Power Semiconductors

Changes in regulations or standards related to power electronics and semiconductor materials can introduce unpredictability and complexity into the market environment. Compliance with evolving regulatory requirements may necessitate costly modifications to manufacturing processes or product designs, impacting production timelines and costs. Moreover, uncertainty surrounding future regulatory frameworks may deter investment in SiC technology development and adoption, hindering market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market, contact data bridge market research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In December 2022, STMicroelectronics and Soitec announced a cooperation on Silicon Carbide (SiC) substrates, aiming to qualify Soitec's SmartSiC technology for ST's future 200mm substrate manufacturing. This collaboration targets volume production in the midterm, intending to bolster ST's financials and contribute to the growth of the global SiC power semiconductor market

- In November 2022, Infineon Technologies signed a non-binding Memorandum of Understanding for multi-year supply cooperation of silicon carbide (SiC) semiconductors with Stellantis's direct Tier 1 suppliers. This agreement, valued at over EUR 1 billion, aims to supply CoolSiC "bare die" chips in the latter half of the decade, positively impacting Infineon's financials and fostering growth in the global SiC power semiconductor market

Silicon Carbide Power Semiconductors Market Scope

The market is segmented into six notable segments which are based on type, wafer type, voltage range, wafer size, application, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Mosfets

- Schottky Barrier Diodes (SBDs)

- Bipolar Junction Transistor (BJT)

- Hybrid Modules

- SiC Bare Die

- Pin Diode

- Junction FET

- Others

Wafer Type

- SiC Epitaxial Wafers

- Blank SiC Wafers

Voltage Range

- 301 V to 900 V

- 901 V to 1700 V

- 1701 V & Above

- Less than 300 V

Wafer Size

- 2 Inch, 3 Inch and 4 Inch

- 6 Inch

- 8 & 12 Inch

Application

- Electric Vehicle (EV)

- Inverters

- Power Supplies

- Photovoltaics

- RF Devices

- Industrial Motor Drives

- Others

Vertical

- Automotive and Transportation

- Data Centers

- Industrial

- Renewables/Grids

- Consumer Electronics

- Aerospace and Defense

- Medical

- Others

Silicon Carbide Power Semiconductors Market Analysis/Insights

The market is segmented into six notable segments which are based on type, wafer type, voltage range, wafer size, application, and vertical.

The countries covered in this market report are U.S., Canada, Mexico, Germany, U.K., France, Italy, Netherlands, Spain, Russia, Switzerland, Turkey, Belgium, Poland, Sweden, Denmark, Norway, Finland, and Rest of Europe, China, Japan, India, South Korea, Australia, Taiwan, Singapore, Thailand, Indonesia, Malaysia, Philippines, New Zealand, Vietnam, and Rest of Asia-Pacific, Brazil, Argentina, and Rest of South America, Saudi Arabia, U.A.E, Israel, South Africa, Egypt, Qatar, Kuwait, Bahrain, Oman, and Rest of Middle East and Africa.

North America is expected to dominate the market due to the increasing adoption of electric vehicles in the region. Its robust technological ecosystem, extensive research and development efforts, and a notable uptick in electric vehicle usage. With a conducive environment for innovation and a growing emphasis on sustainable transportation solutions, the U.S. is as likely to spearhead advancements in silicon carbide power semiconductor technology, further consolidating its dominance in the market.

Europe is expected to grow in the market due to its advanced technology infrastructure and robust research and development capabilities. With a strong emphasis on sustainable and efficient energy solutions, Germany is at the forefront of innovation in fields such as renewable energy, electric mobility, and industrial automation. The country's strategic investments in cutting-edge technologies, coupled with a skilled workforce and supportive regulatory environment, position it as a key player in driving technological advancements and addressing global challenges related to energy efficiency and sustainability.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Silicon Carbide Power Semiconductors Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related the market.

Some of the major players operating in the market are:

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- WOLFSPEED, INC. (U.S.)

- Renesas Electronics Corporation (Japan)

- Semiconductor Components Industries, LLC (U.S.)

- Mitsubishi Electric Corporation (Japan)

- ROHM CO., LTD. (Japan)

- Qorvo, Inc (U.S.)

- Nexperia (Netherlands)

- TOSHIBA CORPORATION (Japan)

- Allegro MicroSystems, Inc. (U.S.)

- GeneSiC Semiconductor Inc. (U.S.)

- Fuji Electric Co., Ltd (Japan)

- Vishay Intertechnology, Inc. (U.S.)

- Hitachi Power Semiconductor Device, Ltd. (Japan)

- Littelfuse, Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- Microchip Technology Inc. (U.S.)

- Semikron Danfoss (Germany)

- WeEn Semiconductors (China)

- Solitron Devices, Inc. (U.S.)

- SemiQ Inc. (U.S.)

- Xiamen Powerway Advanced Material (China)

- MaxPower Semiconductor (China)

SKU-