Global Shrink Drum Liner Market

Market Size in USD Billion

CAGR :

%

USD

1.02 Billion

USD

1.31 Billion

2024

2032

USD

1.02 Billion

USD

1.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.02 Billion | |

| USD 1.31 Billion | |

|

|

|

|

Shrink Drum Liner Market Size

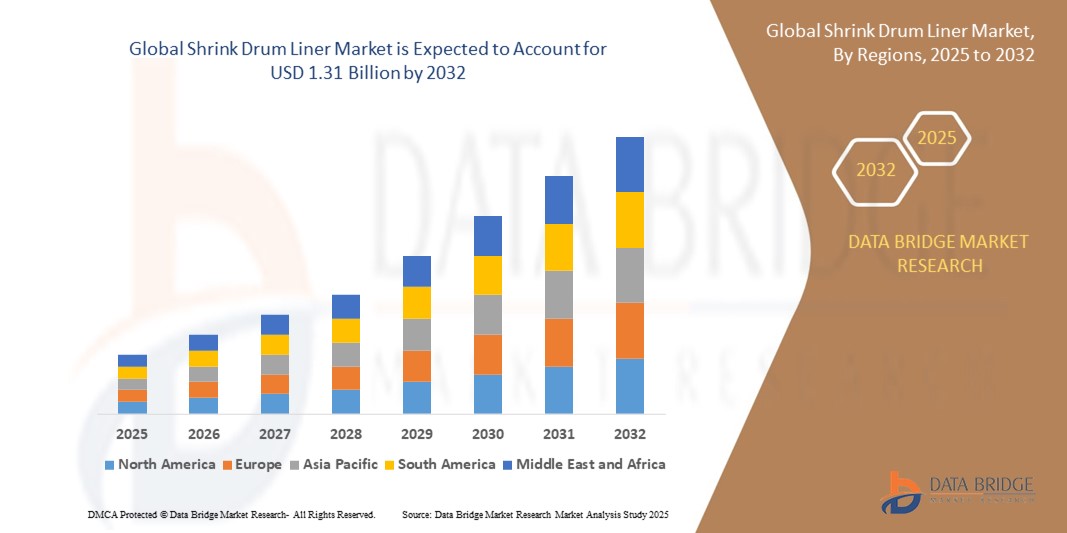

- The global shrink drum liner market size was valued at USD 1.02 billion in 2024 and is expected to reach USD 1.31 billion by 2032, at a CAGR of 3.20% during the forecast period

- The market growth is primarily driven by the increasing demand for cost-effective and contamination-free packaging solutions across chemical, pharmaceutical, and food industries, which require safe drum storage and transport

- Moreover, rising regulatory emphasis on hygienic and leak-proof packaging, along with the rising preference for environmentally sustainable and disposable drum liners, is fostering strong demand. These converging factors are enhancing the market’s adoption, thus fueling robust growth across global end-use industries

Shrink Drum Liner Market Analysis

- Shrink drum liners, designed to fit securely within industrial drums and shrink tightly to their walls upon heating, are becoming critical packaging components in sectors such as chemicals, food, and pharmaceuticals due to their leak prevention, contamination control, and cost-effective disposal benefits

- The rising demand for shrink drum liners is primarily driven by the growing need for hygienic, safe, and regulatory-compliant packaging solutions, especially for transporting hazardous or sensitive materials

- North America dominated the shrink drum liner market with the largest revenue share of 38.81% in 2024, supported by stringent packaging safety regulations, increased chemical exports, and high adoption of cleanroom-compatible packaging within pharmaceutical manufacturing

- Asia-Pacific is expected to be the fastest growing region in the shrink drum liner market during the forecast period due to rapid industrial expansion, rising cross-border trade, and a growing focus on efficient bulk packaging solutions

- The polyethylene segment dominated the shrink drum liner market with a market share of 47% in 2024, owing to its chemical resistance, durability, and suitability for shrink applications across various industrial environments

Report Scope and Shrink Drum Liner Market Segmentation

|

Attributes |

Shrink Drum Liner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shrink Drum Liner Market Trends

Sustainability and Regulatory-Driven Innovation in Industrial Packaging

- A prominent and evolving trend in the global shrink drum liner market is the shift toward sustainable and regulatory-compliant packaging solutions, especially in industries dealing with hazardous, sterile, or contaminant-sensitive materials such as chemicals, food, and pharmaceuticals

- For instance, companies such as CDF Corporation and Berry Global are developing shrink drum liners made from recyclable and BPA-free materials that comply with FDA and EU packaging standards, appealing to both environmental and safety-conscious buyers

- Manufacturers are innovating with multilayer shrink liner films that provide enhanced chemical resistance, better sealing performance, and improved durability under thermal conditions, helping reduce product waste and potential cross-contamination

- In addition, some newer drum liners incorporate anti-static and UV-resistant properties, supporting safer handling and extended shelf life of sensitive contents. These technological advancements are particularly important in pharmaceutical manufacturing and cleanroom settings

- Automation compatibility is also rising as liners are being designed for seamless integration into automated drum filling and sealing systems, minimizing labor costs and improving operational efficiency

- The trend towards sustainable, compliant, and performance-enhancing shrink drum liners is fundamentally reshaping procurement priorities in bulk packaging. Consequently, companies such as Clariant and Grief, Inc. are focusing on product innovation, recyclable materials, and liner customization to meet diverse industrial demands

- The demand for high-barrier, sustainable shrink drum liners is growing significantly across regions with strict regulatory frameworks and in industries prioritizing hygiene, traceability, and efficient waste management

Shrink Drum Liner Market Dynamics

Driver

Rising Demand for Contamination-Free, Efficient Packaging in Hazardous Material Handling

- The increasing need for contamination prevention, coupled with heightened safety requirements in handling hazardous or sensitive materials, is a major factor driving the demand for shrink drum liners

- For instance, in February 2024, CDF Corporation announced the launch of a new line of heat-shrinkable drum liners designed for pharmaceutical-grade applications, offering reduced contamination risk and full compliance with international safety standards

- Shrink drum liners provide an inner barrier that protects both the drum and its contents, reducing cleaning needs and lowering the risk of cross-contamination essential benefits in the food, chemical, and life sciences sectors

- The growing push towards operational efficiency and cleaner manufacturing practices is prompting industrial users to adopt shrink drum liners that reduce manual labor, streamline drum reusability, and improve workplace safety

- In addition, their ability to reduce drum residue and enable easy disposal is increasingly valued in industries aiming to meet waste minimization and sustainability targets

Restraint/Challenge

Material Compatibility Issues and Cost-Sensitive Adoption

- A significant challenge in the shrink drum liner market lies in the compatibility of liner materials with specific industrial substances. Not all liner materials such as polyethylene or polyamide can safely contain aggressive solvents or high-temperature substances, which limits application flexibility

- For instance, in high-purity applications such as pharmaceutical production, even minor chemical reactions between liners and contents can lead to product quality concerns, necessitating advanced liner solutions

- Furthermore, the cost associated with specialized shrink drum liners, particularly those made from high-barrier or multi-layer films, may deter adoption among price-sensitive industries or smaller businesses using drums for non-critical materials

- The upfront cost of heat application equipment for shrinking liners onto drums also presents a barrier for operations lacking automation or capital investment capabilities

- Addressing these challenges requires ongoing innovation in liner materials that offer broader chemical compatibility at lower costs and expanding liner offerings that fit diverse drum dimensions and applications. Education around the long-term cost savings from reduced cleaning and contamination risks may also help increase adoption across more cost-conscious sectors

Shrink Drum Liner Market Scope

The market is segmented on the basis of material, packaging type, and end user.

- By Material

On the basis of material, the shrink drum liner market is segmented into polyethylene, high-density polyethylene (HDPE), polypropylene, polyvinylchloride (PVC), polyester, and others. The polyethylene segment dominated the market with the largest revenue share of 47% in 2024, attributed to its cost-effectiveness, excellent shrink performance, and chemical resistance. Polyethylene liners are widely preferred for general-purpose applications in industries such as food, chemicals, and coatings due to their durability, flexibility, and compatibility with heat-shrinking equipment.

The High-Density Polyethylene (HDPE) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for heavy-duty, puncture-resistant liners in industrial and hazardous material handling. HDPE offers improved mechanical strength, environmental stress crack resistance, and suitability for long-term containment, especially in flammable and corrosive substance applications.

- By Packaging Type

On the basis of packaging type, the shrink drum liner market is segmented into flexible, rigid, and semi-rigid. The flexible segment held the largest market revenue share in 2024 due to its lightweight, cost-efficient, and easy-to-apply nature, making it ideal for high-volume usage in chemical and food industries. Flexible shrink drum liners are valued for their space-saving benefits during transportation and their ability to conform tightly to drum interiors for secure sealing.

The semi-rigid segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by its blend of structural integrity and adaptability. These liners offer better protection against punctures and leaks while maintaining ease of installation, particularly appealing for handling adhesives, coatings, and viscous substances.

- By End User

On the basis of end user, the shrink drum liner market is segmented into chemicals and flammables, adhesives, inks and coatings, food products, cosmetic materials, and others. The chemicals and flammables segment dominated the market in 2024, driven by stringent regulatory requirements for contamination prevention, safe disposal, and secure transportation of hazardous materials. Shrink drum liners in this segment help ensure compliance with international standards while reducing cleanup costs and increasing drum reuse rates.

The food products segment is projected to experience the fastest growth from 2025 to 2032, fueled by the rising demand for hygienic and contamination-free packaging in the food processing and export industries. Shrink drum liners help maintain product integrity, support cleanroom operations, and align with growing food safety regulations across emerging markets.

Shrink Drum Liner Market Regional Analysis

- North America dominated the shrink drum liner market with the largest revenue share of 38.81% in 2024, supported by stringent packaging safety regulations, increased chemical exports, and high adoption of cleanroom-compatible packaging within pharmaceutical manufacturing

- Industries in the region prioritize compliance with FDA, EPA, and OSHA standards, leading to widespread adoption of high-performance shrink drum liners that ensure leak prevention, hygiene, and operational efficiency

- This strong market presence is further supported by well-established manufacturing infrastructure, rising demand for cleanroom-compatible packaging, and increased awareness of sustainable, disposable drum liner solutions that reduce environmental impact and lower operational costs

U.S. Shrink Drum Liner Market Insight

The U.S. shrink drum liner market captured the largest revenue share of 79.2% in 2024 within North America, driven by strict environmental and safety regulations governing chemical, pharmaceutical, and food-grade packaging. Industries are increasingly turning to shrink drum liners for contamination control, efficient waste reduction, and drum reuse. The presence of major manufacturing hubs, widespread adoption of cleanroom practices, and demand for cost-effective hazardous material handling contribute significantly to market growth. Furthermore, rising awareness of sustainable packaging and compatibility with automation in drum-filling processes fuels continuous demand.

Europe Shrink Drum Liner Market Insight

The Europe shrink drum liner market is projected to grow at a steady CAGR throughout the forecast period, primarily fueled by stringent EU packaging regulations and growing industrial demand for secure, compliant containment solutions. As industries across the region—especially in Germany, France, and Italy emphasize clean production and traceability, shrink drum liners are increasingly used for safely transporting chemicals, food ingredients, and high-purity materials. The shift toward recyclable and low-residue packaging options is further stimulating market growth in both established and emerging European economies.

U.K. Shrink Drum Liner Market Insight

The U.K. shrink drum liner market is anticipated to grow at a notable CAGR during the forecast period, driven by the rising demand for contamination-free, regulatory-compliant packaging across pharmaceuticals, cosmetics, and chemical sectors. With increased scrutiny on hazardous material handling and rising preference for cleaner, sustainable packaging solutions, the U.K. industry is adopting shrink drum liners for improved operational hygiene and reduced cleaning requirements. Advancements in liner materials and growing automation in packaging are also contributing to the market's expansion.

Germany Shrink Drum Liner Market Insight

The Germany shrink drum liner market is expected to expand at a healthy CAGR during the forecast period, supported by the country's advanced manufacturing base and strong focus on sustainability and industrial safety. German industries, particularly in chemicals, automotive, and life sciences, are adopting high-performance drum liners that reduce waste and support closed-loop packaging systems. Increased integration of shrink liners into automated production lines and demand for anti-static and high-barrier film technologies are key drivers supporting market momentum.

Asia-Pacific Shrink Drum Liner Market Insight

The Asia-Pacific shrink drum liner market is set to grow at the fastest CAGR of 23.6% from 2025 to 2032, driven by expanding industrialization, infrastructure development, and export-oriented manufacturing in countries such as China, India, and Japan. Rising awareness about hygiene and safety in material handling, along with increasing regulations for packaging of chemicals and food products, are boosting adoption. The availability of cost-effective raw materials and labor in the region also makes APAC a key manufacturing hub for drum liners, enhancing market accessibility.

Japan Shrink Drum Liner Market Insight

The Japan shrink drum liner market is gaining traction due to its high standards for hygiene, quality, and industrial efficiency. Japanese companies in pharmaceuticals, food, and chemicals increasingly adopt drum liners for contamination prevention and streamlined logistics. The market benefits from the nation’s emphasis on automation, space-saving solutions, and advanced material sciences. Innovations in recyclable and heat-shrink materials aligned with Japan’s environmental goals are also spurring steady market demand.

India Shrink Drum Liner Market Insight

The India shrink drum liner market accounted for the largest market revenue share in Asia Pacific in 2024, fueled by rapid growth in the chemical, pharmaceutical, and food processing industries. The government's push for industrial safety, combined with growing awareness around efficient and sustainable packaging, is encouraging widespread adoption. India’s expanding manufacturing base and cost-effective production capabilities support local availability and affordability of shrink drum liners, while strong domestic demand is driving further innovation in liner design and material use.

Shrink Drum Liner Market Share

The shrink drum liner industry is primarily led by well-established companies, including:

- CDF Corporation (U.S.)

- Grief, Inc. (U.S.)

- Amcor plc (U.S.)

- Clariant AG (Switzerland)

- Eceplast S.r.l. (Italy)

- The Cary Company (U.S.)

- International Plastics Inc. (U.S.)

- Protective Lining Corp. (U.S.)

- Welch Fluorocarbon Inc. (U.S.)

- Snyder Industries, LLC (U.S.)

- Bulk-Pack, Inc. (U.S.)

- Taral Plastics (Turkey)

- Greif Flexibles USA, Inc. (U.S.)

- PPG Industries, Inc. (U.S.)

- Scholle IPN Corporation (U.S.)

- Plastopil Hazorea Company Ltd. (Israel)

- Huhtamaki PPL Ltd. (India)

- Technoflex (France)

- Nittel GmbH & Co. KG (Germany)

What are the Recent Developments in Global Shrink Drum Liner Market?

- In April 2023, CDF Corporation, a leading manufacturer of drum and pail liners, launched a new line of cleanroom-compatible shrink drum liners aimed at pharmaceutical and biotech industries. These liners are designed to meet stringent contamination control standards and are manufactured in ISO-certified facilities. The launch reinforces CDF’s commitment to offering high-purity packaging solutions tailored to the specific needs of sensitive applications, aligning with the growing demand for sterile and compliant containment methods across critical sectors

- In March 2023, Grief, Inc., a global leader in industrial packaging, introduced an eco-friendly shrink drum liner line made from post-consumer recycled content to support sustainability goals across its global supply chain. These new liners aim to reduce plastic waste and meet regulatory and corporate sustainability targets. Grief’s innovation showcases its focus on balancing performance with environmental responsibility, addressing the growing market preference for green packaging alternatives

- In February 2023, Berry Global Group, Inc. announced the expansion of its shrink drum liner production capacity in its Asia-Pacific facilities to meet the rising regional demand for high-performance packaging in chemical and food industries. This expansion includes the integration of advanced multilayer extrusion technology that enhances liner durability and barrier properties. The investment reflects Berry’s strategy to strengthen its global footprint and better serve high-growth markets with tailored, high-quality solutions

- In February 2023, Clariant AG launched a range of specialty additives for shrink liner films used in industrial drum packaging. These additives improve liner strength, shrink performance, and anti-static properties, enhancing safety and functionality in chemical transport. This product innovation aligns with the industry's shift toward performance-optimized materials and underlines Clariant’s role in advancing material science for packaging applications

- In January 2023, Eceplast Srl, an Italian packaging solutions provider, unveiled a fully recyclable shrink drum liner targeting the food and beverage industry. Designed to minimize residual waste and simplify disposal, the liner complies with EU food contact regulations and circular economy goals. This launch emphasizes the company’s focus on eco-design and innovation, meeting the rising consumer and regulatory demands for sustainable and efficient industrial packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Shrink Drum Liner Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Shrink Drum Liner Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Shrink Drum Liner Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.