Global Self Service Bi Market

Market Size in USD Billion

CAGR :

%

USD

10.66 Billion

USD

33.53 Billion

2024

2032

USD

10.66 Billion

USD

33.53 Billion

2024

2032

| 2025 –2032 | |

| USD 10.66 Billion | |

| USD 33.53 Billion | |

|

|

|

|

Self-Service Business Intelligence (BI) Market Size

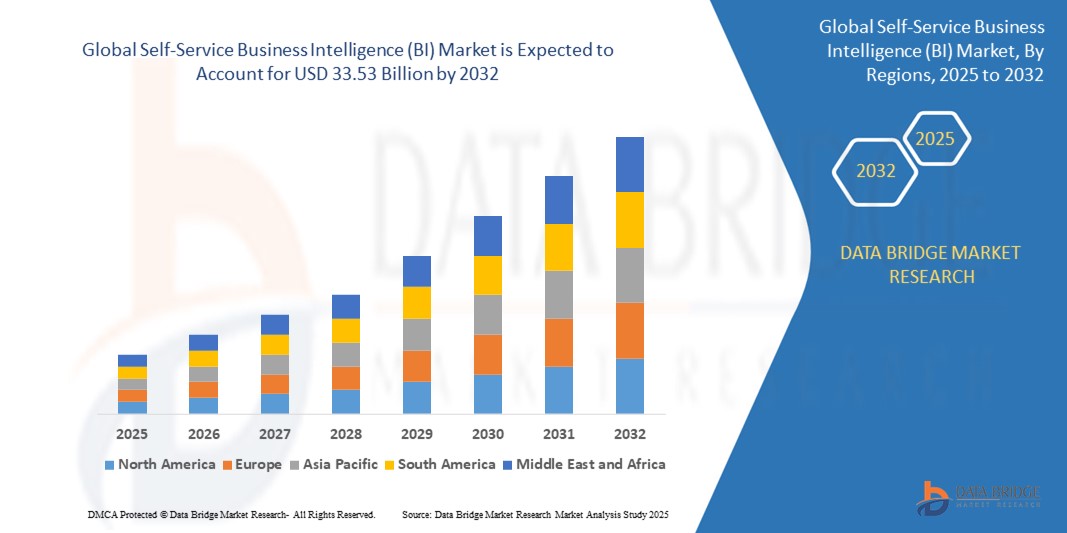

- The global self-service business intelligence (BI) market size was valued at USD 10.66 billion in 2024 and is expected to reach USD 33.53 billion by 2032, at a CAGR of 15.40% during the forecast period

- This growth is driven by factors such as the rising demand for data-driven decision-making, increased adoption of cloud-based solutions, and the growing need for personalized dashboards and real-time analytics across various industry verticals

Self-Service Business Intelligence (BI) Market Analysis

- Self-service BI tools empower business users to generate reports, visualize data, and uncover insights without relying heavily on IT departments, driving broader data democratization across enterprises

- The demand for self-service BI is significantly driven by the need for real-time decision-making, data literacy initiatives, and integration of BI tools with cloud platforms, AI, and ML technologies

- North America dominates the self-service BI market, capturing approximately 47% of the global market share in 2023. This leadership is attributed to the region's robust digital infrastructure, early adoption of advanced analytics platforms, and a high concentration of leading BI vendors such as Microsoft, Tableau (Salesforce), Qlik, and IBM

- Asia-Pacific is expected to be the fastest-growing region in the self-service BI market during the forecast period, owing to increased digital transformation efforts, rising cloud adoption, and growing number of SMEs utilizing BI for competitive advantage

- The Fraud and Security Management segment is projected to dominate the global Self-Service Business Intelligence (BI) market, accounting for approximately 35.12% of the application segment share. This dominance is driven by the increasing need for real-time anomaly detection, compliance monitoring, and risk assessment across critical sectors such as banking, insurance, transportation, and logistics

Report Scope and Self-Service Business Intelligence (BI) Market Segmentation

|

Attributes |

Self-Service Business Intelligence (BI) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Self-Service Business Intelligence (BI) Market Trends

“Integration of AI and Natural Language Processing (NLP) in Self-Service BI Platforms”

- One prominent trend in the self-service BI market is the growing integration of artificial intelligence (AI) and natural language processing (NLP) capabilities to enhance data exploration and decision-making for non-technical users

- These technologies simplify data interaction by allowing users to ask queries in natural language and receive actionable insights, eliminating the need for complex coding or SQL knowledge

- For instance, In February 2024, Microsoft Power BI integrated deeper Copilot (AI assistant) capabilities, enabling users to generate reports and analyze data using conversational prompts, improving productivity and user adoption

- These advancements are transforming how organizations consume and act on data, enabling faster, more intuitive decision-making and expanding the reach of BI tools across departments

Self-Service Business Intelligence (BI) Market Dynamics

Driver

“Rising Demand for Data-Driven Decision Making Across Industries”

- The growing need for data-driven decision-making is significantly contributing to the increased demand for self-service BI platforms, as businesses strive to harness the full potential of their data.

- As the amount of data generated by organizations continues to grow, businesses require user-friendly, intuitive tools that allow non-technical users to create reports, dashboards, and analyses without relying on IT teams.

- As companies prioritize data-driven strategies to enhance operational efficiency, improve customer experiences, and reduce costs, the demand for self-service BI solutions has surged across industries like retail, healthcare, finance, and manufacturing

For instance,

- In October 2023, Tableau launched its AI-powered self-service analytics tool that allows users to automatically generate insights from large datasets, making decision-making faster and more accessible for business users

- As a result, the need for self-service BI platforms that enable users to analyze and act on data independently is growing rapidly, further accelerating market growth

Opportunity

“Leveraging AI and Machine Learning for Enhanced Data Insights and Automation”

- AI and machine learning (ML) technologies are transforming the self-service BI landscape by enhancing the ability to uncover hidden patterns, automate data processing, and generate real-time actionable insights for businesses across various sectors.

- AI algorithms can analyze large datasets, uncover trends, and provide recommendations that help users make more informed decisions, all while reducing the need for manual analysis and intervention.

- Moreover, AI-powered self-service BI tools can improve forecasting, anomaly detection, and predictive analytics, allowing businesses to anticipate market trends and customer behaviors more accurately

For instance,

- In January 2025, Qlik launched an AI-driven analytics feature within its self-service BI platform, enabling users to quickly uncover insights from large datasets using natural language queries and AI-based visualizations. The integration of AI has helped organizations automate key BI functions like data preparation, predictive modeling, and trend analysis, resulting in increased operational efficiency and faster decision-making

- The integration of AI and ML in self-service BI tools is leading to improved business agility, more accurate forecasts, and greater efficiency in generating reports, which is propelling market growth

Restraint/Challenge

“High Costs and Complexity of Implementation Hindering Adoption”

- The high costs and complexity of implementing self-service BI platforms pose a significant challenge for many organizations, particularly in smaller companies or industries with limited IT budgets

- Although self-service BI tools are designed to be user-friendly, the initial setup costs—including software, training, and integration with existing systems—can be substantial, especially for companies without a dedicated data team

- The complexity of ensuring data quality, governance, and integration with other business systems also adds to the challenge, leading to slower adoption in some regions or industries

For instance,

- In December 2024, a report by Gartner highlighted that the total cost of ownership (TCO) for self-service BI solutions often exceeds initial expectations, with many organizations facing challenges in managing data silos, integrating diverse datasets, and ensuring data accuracy. This has led to concerns over the ROI of these platforms, particularly in industries with tight margins or legacy systems

- Consequently, these financial and technical barriers can limit the widespread adoption of self-service BI, particularly in smaller enterprises or developing regions, affecting the overall market growth potential

Self-Service Business Intelligence (BI) Market Scope

The market is segmented on the basis type, business function, application, deployment model, and industry vertical

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Business Function |

|

|

By Application |

|

|

By Deployment Model |

|

|

By Industry Vertical |

|

In 2025, the fraud and security management segment is projected to dominate the market with the largest share in the application segment

In 2025, the Fraud and Security Management segment is projected to dominate the global self-service business intelligence (BI) market, accounting for approximately 35.12% of the application segment share. This dominance is driven by the increasing need for real-time anomaly detection, compliance monitoring, and risk assessment across critical sectors such as banking, insurance, transportation, and logistics. As organizations handle growing volumes of sensitive data, self-service BI tools are being deployed to identify fraudulent activities, detect data breaches, and ensure regulatory compliance without delays caused by IT bottlenecks. The integration of AI and machine learning within self-service BI platforms has further enhanced fraud detection capabilities, enabling users to analyze patterns, flag irregular transactions, and implement automated alerts

The banking, financial services, and insurance is expected to account for the largest share during the forecast period in Industry Vertical segments

In 2025, the Banking, Financial Services, and Insurance (BFSI) sector is projected to dominate the global self-service business intelligence (BI) market, accounting for the largest market share of 30-35%. This dominance is driven by the sector's growing reliance on data for fraud detection, regulatory compliance, risk management, and customer behavior analytics. With a strong need for real-time insights, financial institutions are rapidly adopting self-service BI tools that enable non-technical teams to independently explore data, generate reports, and make informed decisions without IT dependencies. The integration of AI and machine learning into BI platforms enhances capabilities such as predictive analytics and anomaly detection, further boosting adoption in BFSI.

Self-Service Business Intelligence (BI) Market Regional Analysis

“North America Holds the Largest Share in the Self-Service Business Intelligence (BI) Market”

- North America dominates the self-service BI market, capturing approximately 47% of the global market share in 2023. This leadership is attributed to the region's robust digital infrastructure, early adoption of advanced analytics platforms, and a high concentration of leading BI vendors such as Microsoft, Tableau (Salesforce), Qlik, and IBM

- The U.S. significantly contributes to this dominance, driven by widespread deployment of data-driven decision-making tools across sectors including healthcare, finance, retail, and manufacturing. The increasing demand for democratized data access and real-time analytics further propels the market

- The presence of a strong cloud computing ecosystem, substantial investments in AI-powered analytics, and seamless integration of BI tools with existing enterprise applications enhance the region's market position

- In addition, the growing emphasis on intuitive dashboards, the surge in remote and hybrid work models, and the need for agile business operations are accelerating the adoption of self-service BI solutions across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Self-Service Business Intelligence (BI) Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the global self-service BI market, driven by rapid digital transformation, increasing adoption of cloud computing, and the expanding demand for data-driven decision-making across various industries such as healthcare, finance, retail, and manufacturing

- Countries like China, India, and Japan are emerging as key markets due to the rapid expansion of digital infrastructure, rising investments in AI and data analytics, and increasing focus on automation in business operations

- China, with its large population and growing adoption of technology in sectors such as e-commerce, finance, and manufacturing, is seeing strong growth in the adoption of self-service BI tools. The country is also experiencing significant advancements in big data analytics and cloud technologies, further driving market expansion

- India is witnessing an increasing shift toward digital transformation in both private and public sectors, fueled by government initiatives like "Digital India," and the growing demand for AI-powered analytics tools in industries such as banking, healthcare, and retail

- Japan, with its advanced technology ecosystem, is also witnessing growing demand for self-service BI solutions, especially in sectors such as automotive, finance, and manufacturing, where data-driven decision-making plays a crucial role in optimizing operations

Self-Service Business Intelligence (BI) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco Systems, Inc. (U.S.)

- IBM (U.S.)

- Microsoft (U.S.)

- Oracle (U.S.)

- SAP (Germany)

- MapR Technologies, Inc. (U.S.)

- RapidMiner, Inc. (U.S.)

- Birst, Inc. (U.S.)

- ALTERYX, INC. (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- Cloud Software Group, Inc. (U.S.)

- QlikTech International AB (Sweden)

- MicroStrategy Incorporated (U.S.)

- Salesforce, Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- Sisense Ltd. (U.S.)

- Domo, Inc. (U.S.)

- Logi Analytics (U.S.)

- TARGIT (Denmark)

- Hitachi Vantara LLC (U.S.)

Latest Developments in Global Self-Service Business Intelligence (BI) Market

- In October 2023, MicroStrategy introduced MicroStrategy AI, a groundbreaking solution designed to integrate generative AI into business intelligence (BI) applications. Built on trusted data, this platform enables organizations to refine AI-driven experiences, enhancing data analysis, automation, and interaction with insights. MicroStrategy AI simplifies self-service analytics, allowing users to engage with data through natural language queries and predictive forecasting. By accelerating decision-making and fostering innovation, it strengthens enterprise-wide intelligence. The solution includes Auto Answers, Auto Dashboard, and Auto SQL for seamless AI-powered analytics

- In September 2023, Collibra acquired Husprey, an integrated SQL data notebook platform, to strengthen its Data Intelligence Cloud and BI tools. This acquisition enhances data collaboration, allowing analysts to create SQL notebooks for streamlined insights and decision-making. Husprey’s platform integrates intelligent automation, a fluid text editor, and query history, improving workflow efficiency. The integration enriches Collibra Data Catalog and Marketplace, ensuring trusted data access across enterprises. Collibra aims to simplify data democratization and foster a collaborative data culture

- In August 2023, Smollan partnered with Pyramid Analytics to enhance data-driven solutions for businesses. Through its DatOrbis Business, Smollan now sells and implements Pyramid Analytics software, expanding its service offerings. This collaboration aims to provide clients with superior BI functionality, enabling faster decision-making and improved performance in competitive industries. The partnership also allows DataOrbis to extend its footprint beyond fast-moving consumer goods (FMCG) into new verticals. Pyramid Analytics continues to lead in business intelligence, earning top rankings from Gartner

- In June 2023, xnPOS introduced xnPOS BI, a cloud-based F&B business analytics platform designed for hotel owners, operators, and management. This solution transforms POS transaction data into actionable KPIs, providing detailed insights into F&B operations. Accessible remotely, xnPOS BI enhances decision-making, efficiency, and revenue optimization. The platform integrates real-time analytics, automated reporting, and AI-driven forecasting, ensuring businesses can adapt to market trends. xnPOS BI was unveiled at HITEC Toronto, showcasing its ability to streamline hospitality operations

- In March 2023, AtScale achieved Snowflake Ready Technology Validation, strengthening its partnership with Snowflake to enhance business intelligence and analytics. This collaboration optimizes self-service analytics, allowing users to interact with live data seamlessly. AtScale’s semantic layer ensures high-performance analytics, eliminating mass data extracts and enabling governed, real-time insights. The integration supports BI tools like Power BI, Tableau, and Excel, modernizing legacy OLAP workloads. By improving data accessibility and reliability, AtScale empowers enterprises to make faster, data-driven decisions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.