Global Self Monitoring Of Blood Glucose Smbg Market

Market Size in USD Billion

CAGR :

%

USD

21.70 Billion

USD

32.62 Billion

2025

2033

USD

21.70 Billion

USD

32.62 Billion

2025

2033

| 2026 –2033 | |

| USD 21.70 Billion | |

| USD 32.62 Billion | |

|

|

|

|

Self-Monitoring of Blood Glucose (SMBG) Market Size

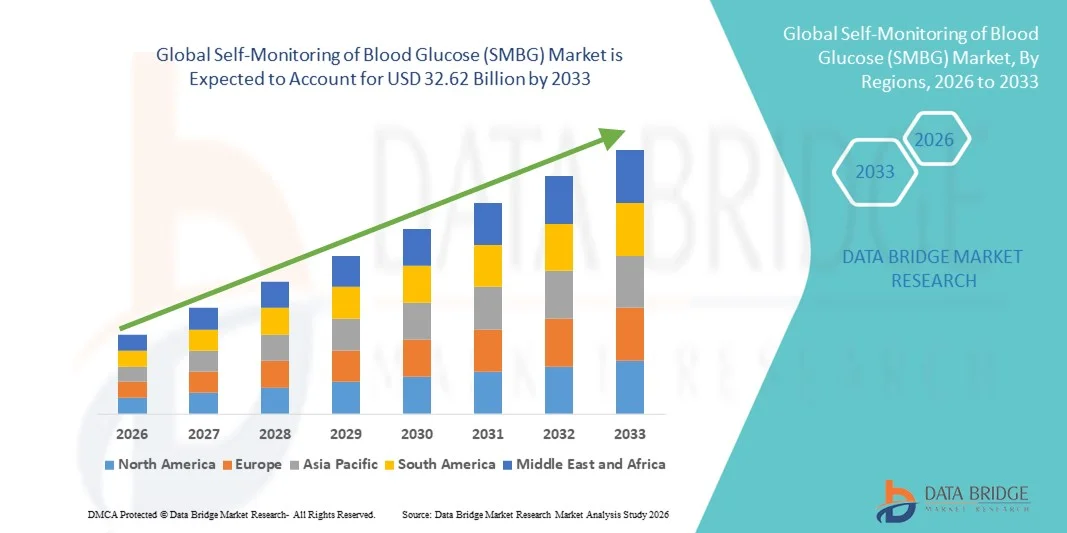

- The global self-monitoring of blood glucose (SMBG) market size was valued at USD 21.70 billion in 2025 and is expected to reach USD 32.62 billion by 2033, at a CAGR of 5.23% during the forecast period

- The market growth is largely driven by the rising prevalence of diabetes worldwide, increasing awareness of proactive disease management, and continuous technological advancements in blood glucose meters and test strips, leading to improved accuracy, ease of use, and greater patient compliance in both homecare and clinical settings

- Furthermore, growing demand for convenient, reliable, and minimally invasive glucose monitoring solutions—along with the integration of digital features such as Bluetooth connectivity, mobile health apps, and data analytics—is accelerating the adoption of Self-Monitoring of Blood Glucose (SMBG) solutions, thereby significantly boosting overall market growth

Self-Monitoring of Blood Glucose (SMBG) Market Analysis

- Self-Monitoring of Blood Glucose (SMBG) devices, which enable individuals with diabetes to regularly track their blood glucose levels, are essential components of modern diabetes management across homecare and clinical settings due to their role in improving glycemic control, treatment adherence, and patient outcomes

- The escalating demand for SMBG solutions is primarily driven by the rising global prevalence of diabetes, growing awareness of early disease management, and technological advancements in glucose meters and test strips that enhance accuracy, portability, and ease of use

- North America dominated the self-monitoring of blood glucose (SMBG) market with the largest revenue share of approximately 37.4% in 2025, supported by high diabetes prevalence, favorable reimbursement policies, strong adoption of home-based monitoring devices, and the presence of leading industry players, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the Self-Monitoring of Blood Glucose (SMBG) market during the forecast period, driven by a rapidly expanding diabetic population, improving healthcare access, rising disposable incomes, and increasing awareness of self-care and preventive healthcare

- The Type 2 Diabetes segment accounted for the largest market revenue share of 63.5% in 2025, driven by the high global prevalence of Type 2 diabetes

Report Scope and Self-Monitoring of Blood Glucose (SMBG) Market Segmentation

|

Attributes |

Self-Monitoring of Blood Glucose (SMBG) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Self-Monitoring of Blood Glucose (SMBG) Market Trends

Advancements in Digital Connectivity and Data Management

- A major and accelerating trend in the global self-monitoring of blood glucose (SMBG) market is the increasing integration of digital connectivity features, enabling seamless data transfer between glucose meters, mobile applications, and cloud-based platforms. This evolution is enhancing patient engagement, real-time monitoring, and long-term diabetes management

- For instance, several leading SMBG device manufacturers now offer Bluetooth-enabled glucose meters that automatically sync blood glucose readings to smartphone applications, allowing users to track trends, generate reports, and share data with healthcare professionals for improved clinical decision-making

- Enhanced data analytics capabilities are further improving the effectiveness of SMBG systems by providing insights into glucose patterns, helping patients identify fluctuations related to diet, physical activity, or medication adherence. These features support personalized diabetes care and better glycemic control

- The integration of SMBG devices with digital health ecosystems, including electronic health records (EHRs) and telemedicine platforms, is enabling remote patient monitoring and facilitating timely medical interventions, particularly for patients managing chronic diabetes conditions

- This trend toward connected and data-driven glucose monitoring solutions is reshaping user expectations, encouraging manufacturers to focus on accuracy, ease of use, and interoperability with digital healthcare platforms

- As a result, demand for advanced SMBG systems that offer reliable connectivity and comprehensive data management solutions continues to grow across both home-care and clinical settings

Self-Monitoring of Blood Glucose (SMBG) Market Dynamics

Driver

Rising Prevalence of Diabetes and Increasing Focus on Self-Care

- The growing global prevalence of diabetes, including both Type 1 and Type 2 diabetes, is a primary driver of demand for SMBG devices, as regular glucose monitoring is essential for effective disease management and the prevention of long-term complications

- For instance, according to data published by the International Diabetes Federation (IDF), the global diabetic population surpassed 530 million adults in the early 2020s, significantly increasing the need for routine blood glucose testing solutions in both developed and emerging economies. This expanding patient base directly supports sustained demand for SMBG products

- Increasing awareness among patients and healthcare providers regarding the importance of frequent blood glucose testing is driving adoption, particularly for insulin-dependent patients and individuals undergoing intensive glycemic control therapies

- The shift toward home-based healthcare and self-management of chronic conditions is further propelling SMBG market growth, as patients seek convenient and reliable monitoring solutions outside hospital settings

- Technological improvements in test strip accuracy, reduced blood sample requirements, and faster result delivery are enhancing user compliance and encouraging broader adoption of SMBG devices

- In addition, supportive government initiatives, reimbursement policies, and diabetes management programs are improving access to SMBG systems, especially in regions with established healthcare infrastructure

Restraint/Challenge

High Ongoing Costs and User Compliance Challenges

- The recurring cost associated with SMBG consumables, particularly test strips and lancets, remains a significant challenge for widespread adoption, especially in cost-sensitive markets and among uninsured populations

- For instance, patients using branded SMBG systems from leading manufacturers often require multiple test strips per day, resulting in substantial monthly expenses. In regions with limited reimbursement coverage, this ongoing cost burden has been reported as a key reason for reduced testing frequency among diabetic patients

- Inconsistent reimbursement policies across countries and healthcare systems further limit patient access to SMBG supplies, negatively affecting adherence to recommended testing routines

- User compliance challenges, including discomfort from frequent finger-pricking and the inconvenience of repeated daily testing, can discourage consistent usage, particularly among elderly patients and newly diagnosed individuals

- Variability in measurement accuracy due to improper usage or environmental factors can also impact patient confidence in SMBG readings, affecting long-term engagement

- Addressing these challenges through affordable product offerings, improved reimbursement frameworks, patient education, and simplified testing procedures will be critical for sustaining SMBG market growth

Self-Monitoring of Blood Glucose (SMBG) Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the Global Self-Monitoring of Blood Glucose (SMBG) market is segmented into Test Strips, Lancets, Blood Glucose Meters, Self-Monitoring Blood Glucose Meters, and Continuous Glucose Monitors. The Test Strips segment dominated the largest market revenue share of 44.7% in 2025, driven by their recurring and indispensable use in routine blood glucose monitoring. Test strips are required for every SMBG test, resulting in consistent repeat purchases. The growing global diabetic population significantly boosts demand. High adoption in home-care settings supports dominance. Test strips are compatible with a wide range of glucose meters, increasing usability. Their relatively low cost compared to devices enhances accessibility. Increasing awareness about frequent glucose testing contributes to demand. Reimbursement support in developed markets strengthens uptake. Rising prevalence of Type 2 diabetes further drives usage. Continuous monitoring needs ensure sustained consumption. Manufacturers’ focus on accuracy and reduced sample volume supports growth. Emerging economies contribute to volume sales due to expanding diabetes screening programs.

The Continuous Glucose Monitors (CGMs) segment is expected to witness the fastest CAGR of 12.9% from 2026 to 2033, driven by increasing adoption of advanced diabetes management technologies. CGMs provide real-time glucose readings, reducing the need for frequent finger-prick testing. Rising demand for continuous and remote monitoring supports growth. Growing awareness of improved glycemic control drives adoption. Technological advancements such as wearable sensors enhance user comfort. Increasing use among Type 1 diabetes patients accelerates demand. Integration with smartphones and digital health platforms supports expansion. Favorable reimbursement policies in developed regions boost uptake. Rising pediatric diabetes cases contribute to growth. Strong investment in digital healthcare accelerates innovation. Expanding availability in emerging markets further supports CAGR. These factors collectively drive rapid CGM adoption.

- By Application

On the basis of application, the Global Self-Monitoring of Blood Glucose (SMBG) market is segmented into Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes. The Type 2 Diabetes segment accounted for the largest market revenue share of 63.5% in 2025, driven by the high global prevalence of Type 2 diabetes. Lifestyle changes, obesity, and aging populations contribute to rising incidence. Patients with Type 2 diabetes require frequent glucose monitoring to manage blood sugar levels. SMBG devices are widely recommended for medication and lifestyle adjustment. Large patient pool ensures sustained demand for test strips and meters. Increasing awareness programs support early diagnosis and monitoring. Adoption of home-based glucose monitoring boosts segment growth. Growing healthcare expenditure supports device accessibility. Strong presence in both developed and developing regions reinforces dominance. Primary care physicians increasingly recommend SMBG for disease management. Government diabetes control initiatives support adoption. These factors firmly establish Type 2 diabetes as the dominant application segment.

The Gestational Diabetes segment is expected to grow at the fastest CAGR of 11.6% from 2026 to 2033, driven by rising pregnancy-related diabetes cases globally. Increasing maternal age and obesity rates contribute to higher incidence. Early diagnosis and strict glucose monitoring are critical during pregnancy. SMBG is widely preferred for frequent monitoring in home settings. Growing awareness among healthcare providers supports adoption. Improved prenatal care infrastructure enhances testing rates. Portable and easy-to-use devices boost patient compliance. Increasing screening programs in emerging markets drive growth. Technological improvements improve accuracy and convenience. Growing emphasis on maternal and fetal health supports demand. Rising healthcare access in developing countries accelerates adoption. These factors contribute to strong growth momentum.

- By End User

On the basis of end user, the Global Self-Monitoring of Blood Glucose (SMBG) market is segmented into Hospitals, Home Settings, and Diagnostic Centres. The Home Settings segment dominated the largest market revenue share of 52.4% in 2025, driven by the increasing preference for self-care and home-based disease management. SMBG devices are specifically designed for easy use by patients at home. Rising prevalence of diabetes encourages regular self-monitoring. Home settings reduce the burden on healthcare facilities. Technological advancements improve device usability and accuracy. Increasing elderly population supports home monitoring adoption. Cost savings associated with home care drive demand. Availability of portable and compact devices enhances convenience. Growing digital health integration supports remote monitoring. Strong adoption in both urban and rural regions reinforces dominance. Patient empowerment trends boost usage. Favorable reimbursement for home glucose monitoring supports growth.

The Diagnostic Centres segment is projected to register the fastest CAGR of 10.8% from 2026 to 2033, driven by the expansion of standalone diagnostic facilities. Increasing diabetes screening programs boost patient inflow. Diagnostic centers offer reliable and standardized testing services. Rising awareness of preventive healthcare supports growth. Expansion in emerging economies fuels demand. Improved laboratory infrastructure enhances testing capacity. Diagnostic centers serve as referral hubs for diabetes management. Growing collaboration with hospitals supports expansion. Technological upgrades improve testing efficiency. Increasing health check-up packages drive SMBG-related services. Rising urbanization supports diagnostic center growth. These factors collectively drive the segment’s rapid CAGR.

Self-Monitoring of Blood Glucose (SMBG) Market Regional Analysis

- North America dominated the self-monitoring of blood glucose (SMBG) market with the largest revenue share of approximately 37.4% in 2025, supported by a high prevalence of diabetes, favorable reimbursement policies, and strong adoption of home-based glucose monitoring devices. The region benefits from well-established healthcare infrastructure, widespread patient awareness regarding routine glucose testing, and the presence of leading SMBG manufacturers

- Consumers and healthcare providers in North America place strong emphasis on accurate, reliable, and easy-to-use glucose monitoring solutions, driving sustained demand for SMBG devices across homecare and clinical settings

- This widespread adoption is further supported by high healthcare expenditure, a technologically aware patient population, and growing emphasis on self-management of chronic diseases, positioning SMBG as a cornerstone of diabetes care across both outpatient and home environments

U.S. Self-Monitoring of Blood Glucose (SMBG) Market Insight

The U.S. self-monitoring of blood glucose (SMBG) market accounted for the largest revenue share within North America in 2025, driven by a substantial diabetic population and strong penetration of home-based glucose monitoring solutions. The presence of major industry players, extensive insurance coverage for SMBG supplies, and continuous technological advancements in glucose meters and test strips support market leadership. Increasing emphasis on preventive healthcare, routine glycemic control, and patient education programs further contributes to sustained demand for SMBG devices across hospitals, clinics, and homecare settings.

Europe Self-Monitoring of Blood Glucose (SMBG) Market Insight

The Europe self-monitoring of blood glucose (SMBG) market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising diabetes prevalence, growing awareness of early disease management, and strong regulatory emphasis on diagnostic accuracy. Increasing adoption of SMBG devices across public healthcare systems and private clinics, along with government-supported diabetes screening programs, is contributing to market growth. The region is witnessing steady demand across hospitals, diagnostic laboratories, and homecare environments, with SMBG playing a critical role in long-term diabetes management.

U.K. Self-Monitoring of Blood Glucose (SMBG) Market Insight

The U.K self-monitoring of blood glucose (SMBG) market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by a well-established public healthcare system and increasing focus on chronic disease management. Rising adoption of SMBG devices within the National Health Service (NHS), along with growing awareness of self-monitoring among diabetic patients, is driving demand. Government-backed diabetes management initiatives and expanding access to glucose monitoring supplies are further strengthening market growth across both clinical and homecare settings.

Germany Self-Monitoring of Blood Glucose (SMBG) Market Insight

The Germany self-monitoring of blood glucose (SMBG) market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing healthcare expenditure, strong emphasis on preventive care, and growing adoption of advanced diagnostic and monitoring solutions. Germany’s robust healthcare infrastructure and high awareness of diabetes-related complications support consistent use of SMBG devices. The rising focus on precision medicine, patient-centric care, and early intervention strategies is further driving SMBG adoption across hospitals, outpatient clinics, and homecare environments.

Asia-Pacific Self-Monitoring of Blood Glucose (SMBG) Market Insight

The Asia-Pacific self-monitoring of blood glucose (SMBG) market is expected to grow at the fastest CAGR during the forecast period, driven by a rapidly expanding diabetic population, improving healthcare access, rising disposable incomes, and increasing awareness of self-care and preventive healthcare. Countries such as China, Japan, and India are witnessing strong demand for SMBG devices due to lifestyle changes, urbanization, and growing diagnosis rates of diabetes. Government initiatives aimed at improving chronic disease management and expanding healthcare coverage are further accelerating market growth across the region.

Japan Self-Monitoring of Blood Glucose (SMBG) Market Insight

The Japan self-monitoring of blood glucose (SMBG) market is gaining momentum due to the country’s aging population, high prevalence of age-related metabolic disorders, and strong focus on routine health monitoring. The widespread adoption of SMBG devices is supported by advanced healthcare infrastructure and strong patient compliance with prescribed monitoring regimens. Increasing demand for accurate and user-friendly glucose monitoring solutions is driving market growth across both clinical and homecare settings.

China Self-Monitoring of Blood Glucose (SMBG) Market Insight

The China self-monitoring of blood glucose (SMBG) market ccounted for the largest revenue share within Asia Pacific in 2025, driven by a rapidly growing diabetic population, expanding middle class, and increasing healthcare awareness. Strong government initiatives aimed at improving chronic disease management, along with rising availability of affordable SMBG devices from domestic manufacturers, are supporting widespread adoption. The expansion of healthcare infrastructure and growing emphasis on early diagnosis and regular glucose monitoring are key factors propelling market growth in China.

Self-Monitoring of Blood Glucose (SMBG) Market Share

The Self-Monitoring of Blood Glucose (SMBG) industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Roche Diagnostics (Switzerland)

- Ascensia Diabetes Care (Switzerland)

- LifeScan, Inc. (U.S.)

- Dexcom, Inc. (U.S.)

- Medtronic plc (Ireland)

- Becton, Dickinson and Company (U.S.)

- Terumo Corporation (Japan)

- ARKRAY, Inc. (Japan)

- Nipro Corporation (Japan)

- Ypsomed Holding AG (Switzerland)

- Sinocare Inc. (China)

- AgaMatrix, Inc. (U.S.)

- i-SENS, Inc. (South Korea)

- Trividia Health, Inc. (U.S.)

- PHC Holdings Corporation (Japan)

- Bio-Rad Laboratories (U.S.)

- Omron Healthcare (Japan)

- Medisana GmbH (Germany)

- Nova Biomedical (U.S.)

Latest Developments in Global Self-Monitoring of Blood Glucose (SMBG) Market

- In March 2021, Roche announced the launch of the Accu-Chek Instant system, a Bluetooth enabled blood glucose monitoring device designed to connect with the mySugr app to support personalized diabetes management by enabling easy data transfer between the meter and a patient’s smartphone. This launch reinforced Roche’s emphasis on digital integration and user-friendly SMBG solutions to improve self-monitoring compliance and trend tracking

- In March 2024, Nova Biomedical launched the New Generation StatStrip Glucose Hospital Meter System in the U.S., featuring enhanced usability and improved cybersecurity safeguards, receiving FDA clearance for use with critically ill patients. This development highlights ongoing innovation in SMBG devices for both home and clinical settings, particularly for patients requiring precise glucose management

- In August 2024, Dexcom introduced “Stelo,” an over-the-counter continuous glucose monitor (CGM) in the United States, expanding access to real-time glucose tracking without a prescription. As an accessible CGM option distinct from traditional prescription monitoring, Stelo marked a key innovation bridging SMBG and continuous glucose monitoring technologies

- In June 2024, Abbott Laboratories secured U.S. FDA clearance for two new over-the-counter CGM systems — Lingo and Libre Rio — based on FreeStyle Libre technology, expanding direct-to-consumer access to glucose monitoring and improving patient convenience outside traditional prescription channels

- In July 2024, Roche received CE Mark approval for the Accu-Chek SmartGuide CGM solution, marking a significant regulatory milestone for its integrated glucose monitoring technologies in Europe and supporting broader global adoption of advanced SMBG-related devices

- In April 2025, DexCom, Inc. announced that the U.S. FDA approved its Dexcom G7 15-Day Continuous Glucose Monitoring System for use by adults aged 18 and older, offering extended wear time (up to 15 days) and high accuracy for diabetes management. This approval represents a major milestone in glucose monitoring, enhancing the usability and convenience of next-generation glucose tracking technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.