Global Security Cameras Market

Market Size in USD Billion

CAGR :

%

USD

3.76 Billion

USD

7.45 Billion

2024

2032

USD

3.76 Billion

USD

7.45 Billion

2024

2032

| 2025 –2032 | |

| USD 3.76 Billion | |

| USD 7.45 Billion | |

|

|

|

|

What is the Global Security Cameras Market Size and Growth Rate?

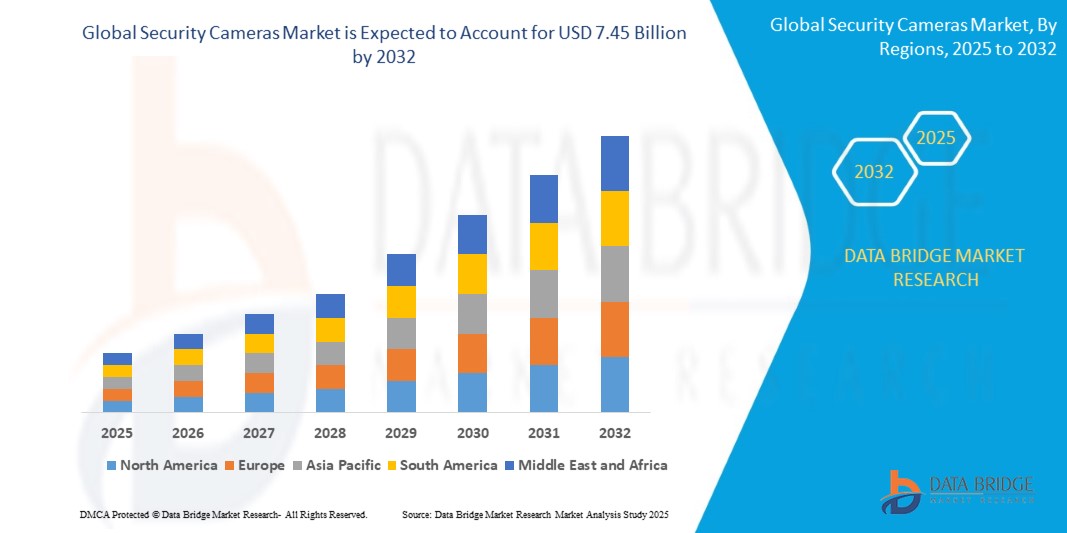

- The global security cameras market size was valued at USD 3.76 billion in 2024 and is expected to reach USD 7.45 billion by 2032, at a CAGR of 8.90% during the forecast period

- Residential security applications of the security cameras market involve safeguarding homes and properties through video surveillance. These cameras are strategically placed to monitor entry points such as doors and windows, as well as outdoor areas such as driveways and gardens

- They provide homeowners with real-time monitoring capabilities, allowing them to remotely view live footage and receive alerts on their smartphones in case of suspicious activities or intrusions. In addition, advanced features such as motion detection and night vision enhance security effectiveness, while cloud storage options ensure that recorded footage is securely stored for later review or evidence

What are the Major Takeaways of Security Cameras Market?

- Advancements such as higher resolution cameras (4K and beyond), infrared and night vision capabilities, and wide dynamic range enable clearer and more detailed footage, enhancing surveillance effectiveness in various lighting conditions. Furthermore, integration with artificial intelligence (AI) and machine learning algorithms enables advanced video analytics for real-time threat detection, object recognition, and behavior analysis

- Cloud-based storage solutions provide scalability and accessibility, allowing users to store and retrieve large amounts of data securely. These technological innovations improve security outcomes but also drive market growth by meeting evolving customer needs for smarter, more reliable surveillance solutions

- Asia-Pacific held the largest revenue share of 38.92% in the security cameras market in 2024, driven by rapid urbanization, rising security concerns, and expansive infrastructure development across countries such as China, India, and Japan

- North America is projected to grow at the fastest CAGR of 13.48% from 2025 to 2032, driven by increasing demand for advanced surveillance systems, enterprise security, and home automation

- The fixed security camera segment dominated the market with the largest revenue share of 41.3% in 2024, owing to its affordability, ease of installation, and wide applicability across commercial and residential spaces

Report Scope and Security Cameras Market Segmentation

|

Attributes |

Security Cameras Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Security Cameras Market?

“Advanced Monitoring Enabled by AI and Wireless Connectivity”

- A major trend in the security cameras market is the growing integration of artificial intelligence (AI) and wireless technologies to enable intelligent, real-time surveillance. This trend is significantly improving situational awareness, proactive threat detection, and operational efficiency in both residential and commercial sectors

- Modern security cameras now feature AI-powered facial recognition, motion detection, object tracking, and behavior analysis. These capabilities help distinguish between humans, vehicles, and animals, reducing false alerts and enhancing incident response times

- For instance, in January 2024, Axis Communications introduced its latest AI-based security camera range, featuring edge analytics and deep learning to identify abnormal activities in real-time

- Integration with wireless connectivity (Wi-Fi, 5G, and LoRaWAN) is further enabling remote access via mobile apps and cloud platforms, allowing users to view footage, receive alerts, and control systems from anywhere

- Companies such as Hikvision, Bosch, and Arlo are leading this transformation by embedding smart algorithms and wireless capabilities into compact, energy-efficient designs.

- This trend is rapidly redefining traditional surveillance by making systems smarter, more autonomous, and accessible across various verticals including retail, banking, public safety, and smart homes

What are the Key Drivers of Security Cameras Market?

- The market is primarily driven by rising concerns over safety and crime prevention, growing investments in smart city infrastructure, and the increasing adoption of cloud-based surveillance. Businesses and homeowners are increasingly turning to intelligent monitoring systems for real-time threat detection and evidence collection

- In March 2024, Honeywell International Inc. announced its expansion into AI-powered commercial security cameras for perimeter surveillance and retail loss prevention, addressing rising concerns around theft and vandalism

- The proliferation of IoT devices and remote access solutions has made surveillance systems more efficient and user-friendly. AI-enabled alerts and video analytics are helping users detect incidents before they escalate

- High-resolution imaging, night vision, and edge-based analytics are now standard features, catering to industries such as healthcare, manufacturing, and transportation where 24/7 monitoring is critical

- Furthermore, increasing demand for touchless and automated solutions post-COVID-19 has accelerated the shift toward smart surveillance systems that ensure both safety and operational continuity

Which Factor is challenging the Growth of the Security Cameras Market?

- One of the key challenges is the growing concern around privacy and data security, especially with cloud-based and AI-enabled surveillance systems. Unauthorized access or misuse of recorded footage can lead to regulatory backlash and loss of consumer trust

- For example, in late 2023, a major data leak from an unsecured camera cloud server highlighted the vulnerability of poorly protected systems and raised alarms across global markets

- Regulatory frameworks such as GDPR in Europe and CCPA in the U.S. are imposing stricter compliance demands, making it necessary for manufacturers and users to adopt privacy-first designs and secure storage solutions

- High initial setup costs, limited technical expertise, and compatibility issues with legacy systems are additional barriers, especially in small and mid-sized enterprises or emerging economies

- Moreover, cybersecurity threats, such as camera hijacking or denial-of-service attacks, are becoming more sophisticated, requiring continuous software updates and cybersecurity investments

- To overcome these issues, companies must focus on end-to-end encryption, user authentication protocols, and consumer education to build trust and ensure long-term market growth

How is the Security Cameras Market Segmented?

The market is segmented on the basis of type, usage, resolution, application, system, connectivity and distribution channel.

• By Type

On the basis of type, the security cameras market is segmented into Fixed Security Camera, Pan-Tilt-Zoom (PTZ) Security Camera, Mini Dome Security Camera, Night Vision Security Camera, Motion Detection Security Camera, and Others. The Fixed security camera segment dominated the market with the largest revenue share of 41.3% in 2024, owing to its affordability, ease of installation, and wide applicability across commercial and residential spaces. Fixed cameras offer continuous monitoring of specific areas, making them a popular choice for indoor and perimeter surveillance.

The Pan-Tilt-Zoom Security Camera segment is anticipated to grow at the fastest CAGR during the forecast period due to its advanced coverage flexibility and remote control functionality. These features are increasingly demanded in city infrastructure and high-security areas requiring dynamic surveillance.

• By Resolution

On the basis of resolution, the market is segmented into Non HD, HD, Full HD, and Ultra HD. The Full HD segment held the highest market share of 36.5% in 2024, driven by the rising demand for crisp, high-quality video footage for accurate identification and forensic analysis. Full HD cameras strike a balance between performance and storage efficiency, making them widely adopted across sectors.

The Ultra HD segment is projected to witness the fastest CAGR through 2032, fueled by technological advancements and the growing demand for highly detailed surveillance footage in critical infrastructure, airports, and industrial zones.

• By Application

On the basis of application, the market is segmented into Border Security, Commercial, City Infrastructure, Institutional, Residential, and Industrial. The Commercial segment dominated the market with a revenue share of 34.8% in 2024, driven by increasing adoption in retail stores, offices, and shopping complexes to ensure safety, deter theft, and support operational monitoring.

The City Infrastructure segment is expected to register the fastest CAGR from 2025 to 2032, supported by smart city initiatives, traffic management systems, and public surveillance efforts aimed at enhancing urban safety.

• By System

On the basis of system, the market is segmented into Analog System and IP-Based System. The IP-Based System segment captured the largest revenue share of 58.6% in 2024, as it offers high-resolution video, remote accessibility, and easy integration with other digital platforms and AI-powered tools.

The Analog System segment is expected to see slower growth, primarily in cost-sensitive markets or legacy applications where digital migration is still underway.

• By Connectivity

On the basis of connectivity, the market is segmented into Wired and Wireless. The Wired segment held the highest market share of 53.2% in 2024, owing to its stable connectivity, uninterrupted power supply, and suitability for large-scale installations in commercial and government settings.

The Wireless segment is projected to experience the fastest growth during the forecast period, driven by increasing demand for DIY installations, flexibility, and remote access in smart homes and small businesses.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment led the market with a revenue share of 61.9% in 2024, attributed to consumer preference for physical verification, installation services, and support offered by retail and wholesale outlets.

However, the Online segment is anticipated to grow at the fastest CAGR, fueled by the rapid expansion of e-commerce platforms, product comparisons, and access to a wider variety of brands at competitive prices.

Which Region Holds the Largest Share of the Security Cameras Market?

- Asia-Pacific held the largest revenue share of 38.92% in the security cameras market in 2024, driven by rapid urbanization, rising security concerns, and expansive infrastructure development across countries such as China, India, and Japan. The region’s booming construction sector and increasing smart city investments are fueling the demand for surveillance and monitoring solutions across commercial, public, and residential applications

- The widespread deployment of IP-based and wireless cameras, along with the integration of AI-powered video analytics, has further boosted the market. The presence of leading regional players such as Hikvision and Dahua enhances market accessibility and cost competitiveness

- Increasing government-led safety initiatives, including public surveillance programs and transportation security upgrades, are key contributors to the region’s market dominance

China Security Cameras Market Insight

China led the Asia-Pacific security cameras market in terms of revenue in 2024, supported by its strong manufacturing ecosystem, rapid digital transformation, and focus on smart surveillance infrastructure. Large-scale government programs such as “Skynet” and “Sharp Eyes” have led to the mass deployment of high-resolution and AI-integrated surveillance systems across cities. The availability of low-cost, high-tech security cameras further accelerates adoption in both urban and rural areas.

Japan Security Cameras Market Insight

Japan's market is witnessing steady growth due to its emphasis on high-definition imaging, automation, and public safety. Demand is rising across sectors such as retail, education, and transportation, with Japanese consumers prioritizing high-quality surveillance with strong data privacy and cybersecurity standards. Integration with smart home systems and IoT platforms is also increasing, supporting the country's broader move toward connected living environments.

India Security Cameras Market Insight

India is emerging as a high-growth market in Asia-Pacific, fueled by rising crime rates, urban development, and digitization of government services. The rollout of large infrastructure projects and increasing smart city initiatives under programs such as Digital India are driving the demand for both public and private security systems. The availability of affordable wired and wireless cameras is helping expand adoption across Tier 2 and Tier 3 cities as well.

Which Region is the Fastest Growing in the Security Cameras Market?

North America is projected to grow at the fastest CAGR of 13.48% from 2025 to 2032, driven by increasing demand for advanced surveillance systems, enterprise security, and home automation. The region’s focus on AI-driven facial recognition, predictive analytics, and cloud video surveillance platforms is fostering robust market expansion. High investments in law enforcement technologies, corporate security, and smart home installations—especially across the U.S. and Canada—are further accelerating growth. The rising threat of cybercrime and physical breaches is also pushing organizations to upgrade their monitoring infrastructure.

U.S. Security Cameras Market Insight

The U.S. dominates the North American market, supported by high adoption of intelligent surveillance systems across sectors including education, retail, and defense. The growing demand for video-as-a-service (VaaS), real-time monitoring, and smart analytics integration makes the U.S. a leader in innovation and deployment. Technological partnerships and product innovations from players such as Arlo, Cisco, and Avigilon are further enhancing security capabilities.

Canada Security Cameras Market Insight

Canada is showing promising growth, especially in residential security and commercial surveillance, backed by government investments in infrastructure and public safety. Demand for wireless and cloud-connected security cameras is rising as consumers prioritize flexibility and scalability. Privacy-compliant, AI-integrated systems are being increasingly adopted by businesses and municipalities to improve incident response and operational efficiency.

Which are the Top Companies in Security Cameras Market?

The security cameras industry is primarily led by well-established companies, including:

- Swann (Australia)

- Teledyne FLIR LLC (U.S.)

- Cisco Systems, Inc. (U.S.)

- AV Costar (U.S.)

- Axis Communications AB (Sweden)

- Honeywell International Inc. (U.S.)

- Avigilon Corporation (Canada)

- Bosch Sicherheitssysteme GmbH (Germany)

- Canon U.S.A., Inc. (U.S.)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Panasonic Corporation (Japan)

- Sony Electronics Inc. (U.S.)

- Dahua Technology Co., Ltd (China)

- Hanwha Group (South Korea)

- SAMSUNG (South Korea)

- Schneider Electric (France)

- Johnson Controls (U.S.)

- Vicon Industries Inc. (U.S.)

- JVCKENWOOD Corporation (Japan)

- Arlo (U.S.)

What are the Recent Developments in Global Security Cameras Market?

- In January 2024, Avigilon introduced its H6A and H6X series security cameras, offering enhanced privacy features such as dynamic masking for people and vehicles. These dome and bullet models, ranging from 2MP to 8MP, include IR illumination, IP66/67 weather resistance, and IK10 impact protection. The bullet version is optimized for long-range monitoring and license plate recognition. This launch underscores Avigilon’s commitment to intelligent, privacy-first surveillance solutions for enterprise and public safety

- In January 2024, CP PLUS unveiled its Solar-Powered AI-enabled 4G Cameras equipped with a 4MP PT camera, 4G LTE connectivity, and an 18,000mAh battery. These cameras support motion tracking, human detection, and solar charging, making them ideal for remote deployments. The innovation reflects CP PLUS’s leadership in sustainable, self-reliant, and AI-powered security systems

- In January 2023, IDIS showcased its latest 5MP dome and bullet cameras at Intersec 2023, featuring its proprietary deep learning engine. These cameras are built to address modern security and operational needs with scalable AI-powered software, servers, and appliances for varied business sizes. This product expansion strengthens IDIS's position in delivering AI-driven security monitoring solutions

- In May 2022, Tenda launched the CP3 smart security camera, featuring a 1080p sensor and a motorized pan/tilt mechanism that offers 360° horizontal and 155° vertical rotation. With AI-based tracking and full HD clarity, it ensures zero blind spots in surveillance coverage. This launch highlights Tenda’s focus on intelligent home security and panoramic surveillance

- In August 2021, SimpliSafe released a wireless outdoor camera designed for hassle-free installation using an adjustable magnetic mount. The device includes a rechargeable battery lasting up to six months per charge and does not require any wiring. This release demonstrates SimpliSafe’s emphasis on user-friendly, flexible outdoor security solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SECURITY CAMERAS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SECURITY CAMERAS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SECURITY CAMERAS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 PRICING ANALYSIS

6 GLOBAL SECURITY CAMERAS MARKET, BY CAMERA TYPE

6.1 OVERVIEW

6.2 BULLET

6.3 DOME

6.4 IP

6.5 SPY

6.6 CONVENTIONAL

6.7 MICRO

6.8 CUBE

7 GLOBAL SECURITY CAMERAS MARKET, BY LENS TYPE

7.1 OVERVIEW

7.2 FIXED

7.3 VARIFOCAL

8 GLOBAL SECURITY CAMERAS MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

8.3.1 WI-FI

8.3.2 ETHERNET

8.3.3 BLUETOOTH

8.3.4 CELLULAR

8.3.5 ZIGBEE

8.3.6 OTHERS

9 GLOBAL SECURITY CAMERAS MARKET, BY COMPATIBLE DEVICE

9.1 OVERVIEW

9.2 DESKTOP/LAPTOP

9.3 MOBILE

9.4 TABLET

9.5 TELEVISION

10 GLOBAL SECURITY CAMERAS MARKET, BY POWER SOURCE

10.1 OVERVIEW

10.2 BATTERY

10.2.1 BY CAMERA TYPE

10.2.1.1. BULLET

10.2.1.2. DOME

10.2.1.3. IP

10.2.1.4. SPY

10.2.1.5. CONVENTIONAL

10.2.1.6. MICRO

10.2.1.7. CUBE

10.3 SOLAR

10.3.1 BY CAMERA TYPE

10.3.1.1. BULLET

10.3.1.2. DOME

10.3.1.3. IP

10.3.1.4. SPY

10.3.1.5. CONVENTIONAL

10.3.1.6. MICRO

10.3.1.7. CUBE

10.4 POE

10.4.1 BY CAMERA TYPE

10.4.1.1. BULLET

10.4.1.2. DOME

10.4.1.3. IP

10.4.1.4. SPY

10.4.1.5. CONVENTIONAL

10.4.1.6. MICRO

10.4.1.7. CUBE

11 GLOBAL SECURITY CAMERAS MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 1.3 MP

11.3 1 MP

11.4 2 MP

11.5 3 MP

11.6 4 MP

11.7 5 MP

11.8 8 MP

11.9 HD

11.1 FULL HD

11.11 QXGA

11.12 OTHERS

12 GLOBAL SECURITY CAMERAS MARKET, BY CONTROL METHOD

12.1 OVERVIEW

12.2 APP

12.3 REMOTE

12.4 TOUCH

12.5 VOICE

13 GLOBAL SECURITY CAMERAS MARKET, BY MOUNTING TYPE

13.1 OVERVIEW

13.2 CEILING MOUNT

13.3 DOOR MOUNT

13.4 POLE MOUNT

13.5 TABLETOP MOUNT

13.6 TREE MOUNT

13.7 WALL MOUNT

13.8 WINDOW MOUNT

14 GLOBAL SECURITY CAMERAS MARKET, BY FUNCTION

14.1 OVERVIEW

14.2 NIGHT VISION

14.2.1 BY RANGE

14.2.1.1. UPTO 9 M

14.2.1.2. 10 TO 29 M

14.2.1.3. 30 TO 40 M

14.2.1.4. ABOVE 40 M

14.3 MOTION DETECTION

14.4 TWO-WAY AUDIO

14.5 LOCAL RECORDING

14.6 OTHERS

15 GLOBAL SECURITY CAMERAS MARKET, BY INSTALLATION TYPE

15.1 OVERVIEW

15.2 DIY

15.3 DO-IT-FOR-ME

16 GLOBAL SECURITY CAMERAS MARKET, BY PRICE RANGE

16.1 OVERVIEW

16.2 LOW RANGE

16.3 MID RANGE

16.4 HIGH RANGE

17 GLOBAL SECURITY CAMERAS MARKET, BY APPLICATION

17.1 OVERVIEW

17.2 INDOOR

17.2.1 BY CAMERA TYPE

17.2.1.1. BULLET

17.2.1.2. DOME

17.2.1.3. IP

17.2.1.4. SPY

17.2.1.5. CONVENTIONAL

17.2.1.6. MICRO

17.2.1.7. CUBE

17.3 OUTDOOR

17.3.1 BY CAMERA TYPE

17.3.1.1. BULLET

17.3.1.2. DOME

17.3.1.3. IP

17.3.1.4. SPY

17.3.1.5. CONVENTIONAL

17.3.1.6. MICRO

17.3.1.7. CUBE

18 GLOBAL SECURITY CAMERAS MARKET, BY SALES CHANNEL

18.1 OVERVIEW

18.2 ONLINE

18.2.1 E-COMMERCE WEBSITE

18.2.2 BRAND OWNED WEBSITE

18.3 OFFLINE

18.3.1 WHOLESELLER/DISTRIBUTOR

18.3.2 SPECIALITY STORE

18.3.3 ELECTRONICS STORE

18.3.4 OTHERS

19 GLOBAL SECURITY CAMERAS MARKET, BY END USER

19.1 OVERVIEW

19.2 BANKING

19.2.1 BY CAMERA TYPE

19.2.1.1. BULLET

19.2.1.2. DOME

19.2.1.3. IP

19.2.1.4. SPY

19.2.1.5. CONVENTIONAL

19.2.1.6. MICRO

19.2.1.7. CUBE

19.3 CAMPUS

19.3.1 BY CAMERA TYPE

19.3.1.1. BULLET

19.3.1.2. DOME

19.3.1.3. IP

19.3.1.4. SPY

19.3.1.5. CONVENTIONAL

19.3.1.6. MICRO

19.3.1.7. CUBE

19.4 HOSPITALITY

19.4.1 BY CAMERA TYPE

19.4.1.1. BULLET

19.4.1.2. DOME

19.4.1.3. IP

19.4.1.4. SPY

19.4.1.5. CONVENTIONAL

19.4.1.6. MICRO

19.4.1.7. CUBE

19.5 HEALTHCARE

19.5.1 BY CAMERA TYPE

19.5.1.1. BULLET

19.5.1.2. DOME

19.5.1.3. IP

19.5.1.4. SPY

19.5.1.5. CONVENTIONAL

19.5.1.6. MICRO

19.5.1.7. CUBE

19.6 INDUSTRIAL

19.6.1 BY CAMERA TYPE

19.6.1.1. BULLET

19.6.1.2. DOME

19.6.1.3. IP

19.6.1.4. SPY

19.6.1.5. CONVENTIONAL

19.6.1.6. MICRO

19.6.1.7. CUBE

19.7 LAW ENFORCEMENT

19.7.1 BY CAMERA TYPE

19.7.1.1. BULLET

19.7.1.2. DOME

19.7.1.3. IP

19.7.1.4. SPY

19.7.1.5. CONVENTIONAL

19.7.1.6. MICRO

19.7.1.7. CUBE

19.8 OIL & GAS

19.8.1 BY CAMERA TYPE

19.8.1.1. BULLET

19.8.1.2. DOME

19.8.1.3. IP

19.8.1.4. SPY

19.8.1.5. CONVENTIONAL

19.8.1.6. MICRO

19.8.1.7. CUBE

19.9 REAL ESTATE

19.9.1 BY CAMERA TYPE

19.9.1.1. BULLET

19.9.1.2. DOME

19.9.1.3. IP

19.9.1.4. SPY

19.9.1.5. CONVENTIONAL

19.9.1.6. MICRO

19.9.1.7. CUBE

19.1 RETAIL

19.10.1 BY CAMERA TYPE

19.10.1.1. BULLET

19.10.1.2. DOME

19.10.1.3. IP

19.10.1.4. SPY

19.10.1.5. CONVENTIONAL

19.10.1.6. MICRO

19.10.1.7. CUBE

19.11 SMART TRAFFIC

19.11.1 BY CAMERA TYPE

19.11.1.1. BULLET

19.11.1.2. DOME

19.11.1.3. IP

19.11.1.4. SPY

19.11.1.5. CONVENTIONAL

19.11.1.6. MICRO

19.11.1.7. CUBE

19.12 OTHERS

20 GLOBAL SECURITY CAMERAS MARKET, BY GEOGRAPHY, (USD MILLION)

GLOBAL SECURITY CAMERAS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 NORTH AMERICA

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

20.2 EUROPE

20.2.1 GERMANY

20.2.2 FRANCE

20.2.3 U.K.

20.2.4 ITALY

20.2.5 SPAIN

20.2.6 RUSSIA

20.2.7 TURKEY

20.2.8 BELGIUM

20.2.9 NETHERLANDS

20.2.10 SWITZERLAND

20.2.11 SWEDEN

20.2.12 POLAND

20.2.13 NORWAY

20.2.14 FINLAND

20.2.15 DENMARK

20.2.16 REST OF EUROPE

20.3 ASIA PACIFIC

20.3.1 JAPAN

20.3.2 CHINA

20.3.3 SOUTH KOREA

20.3.4 INDIA

20.3.5 AUSTRALIA

20.3.6 SINGAPORE

20.3.7 THAILAND

20.3.8 MALAYSIA

20.3.9 INDONESIA

20.3.10 PHILIPPINES

20.3.11 TAIWAN

20.3.12 NEW ZEALAND

20.3.13 VIETNAM

20.3.14 REST OF ASIA PACIFIC

20.4 SOUTH AMERICA

20.4.1 BRAZIL

20.4.2 ARGENTINA

20.4.3 REST OF SOUTH AMERICA

20.5 MIDDLE EAST AND AFRICA

20.5.1 SOUTH AFRICA

20.5.2 EGYPT

20.5.3 SAUDI ARABIA

20.5.4 U.A.E

20.5.5 ISRAEL

20.5.6 OMAN

20.5.7 KUWAIT

20.5.8 QATAR

20.5.9 BAHRAIN

20.5.10 REST OF MIDDLE EAST AND AFRICA

21 GLOBAL SECURITY CAMERAS MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

23 GLOBAL SECURITY CAMERAS MARKET - COMPANY PROFILE

23.1 KONINKLIJKE PHILIPS N.V

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT UPDATES

23.2 CP PLUS INTERNATIONAL

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT UPDATES

23.3 GODREJ & BOYCE

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT UPDATES

23.4 AIRTEL (A PART OF BHARTI ENTERPRISES)

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT UPDATES

23.5 TP-LINK CORPORATION PTE. LTD

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT UPDATES

23.6 EZVIZ INC (A PART OF HIKVISION)

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT UPDATES

23.7 LOREX CORPORATION (ACQUIRED BY ZHEJIANG DAHUA TECHNOLOGY)

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT UPDATES

23.8 MULTI GIGA ( ACQUIRED BY GRUPO MULTI)

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT UPDATES

23.9 XIAOMI

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT UPDATES

23.1 ANKER (A PART OF ANKER INNOVATIONS TECHNOLOGY)

23.10.1 COMPANY SNAPSHOT

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT UPDATES

23.11 EATON

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT UPDATES

23.12 FOSCAM (A SUBSIDIARY OF FOSCAM INTELLIGENT TECHNOLOGY CO., LTD)

23.12.1 COMPANY SNAPSHOT

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 RECENT UPDATES

23.13 QUBO (A HERO GROUP VENTURE)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT UPDATES

23.14 TRUEVIEW (A FLAGSHIP BRAND OF WARNER ELECTRONICS (I) PVT. LTD)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT UPDATES

23.15 SIMPLISAFE, INC.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT UPDATES

23.16 RING

23.16.1 COMPANY SNAPSHOT

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT UPDATES

23.17 ADT

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT UPDATES

23.18 WYZE LABS, INC.

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT UPDATES

23.19 ARLO (A PART OF NETGEAR)

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 PRODUCT PORTFOLIO

23.19.4 RECENT UPDATES

23.2 NEST LABS (ACQUIRED BY GOOGLE)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT UPDATES

23.21 BLINK (AN AMAZON COMPANY)

23.21.1 COMPANY SNAPSHOT

23.21.2 REVENUE ANALYSIS

23.21.3 PRODUCT PORTFOLIO

23.21.4 RECENT UPDATES

23.22 SWANN COMMUNICATIONS INC. (INFINOVA INTERNATIONAL LTD)

23.22.1 COMPANY SNAPSHOT

23.22.2 REVENUE ANALYSIS

23.22.3 PRODUCT PORTFOLIO

23.22.4 RECENT UPDATES

23.23 ZMODO

23.23.1 COMPANY SNAPSHOT

23.23.2 REVENUE ANALYSIS

23.23.3 PRODUCT PORTFOLIO

23.23.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 RELATED REPORTS

25 QUESTIONNAIRE

26 CONCLUSION

27 ABOUT DATA BRIDGE MARKET RESEARCH

Global Security Cameras Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Security Cameras Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Security Cameras Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.