Global Security Analytics Market

Market Size in USD Billion

CAGR :

%

USD

15.17 Billion

USD

52.19 Billion

2024

2032

USD

15.17 Billion

USD

52.19 Billion

2024

2032

| 2025 –2032 | |

| USD 15.17 Billion | |

| USD 52.19 Billion | |

|

|

|

|

Security Analytics Market Analysis

The security analytics Market is experiencing rapid growth, driven by the increasing sophistication of cyber threats, the expansion of cloud computing, and the rise of AI and machine learning in security operations. Organizations across industries are leveraging security analytics solutions to enhance threat detection, automate incident response, and ensure compliance with evolving regulatory standards such as GDPR and CCPA. Advancements in AI-driven analytics allow security teams to analyze vast amounts of data in real-time, identify anomalies, and mitigate potential threats before they escalate. In addition, the integration of big data analytics and behavioral analytics in security frameworks has strengthened proactive threat intelligence, enabling organizations to anticipate and counter cyber risks more effectively. The adoption of cloud-based security analytics solutions is also increasing due to their scalability, cost-efficiency, and ability to provide continuous monitoring across distributed networks. As businesses embrace zero-trust security architectures and automated security orchestration, the market is expected to witness sustained growth. With cyberattacks becoming more frequent and complex, security analytics is becoming a critical component of enterprise cybersecurity strategies, ensuring resilience against ever-evolving digital threats.

Security Analytics Market Size

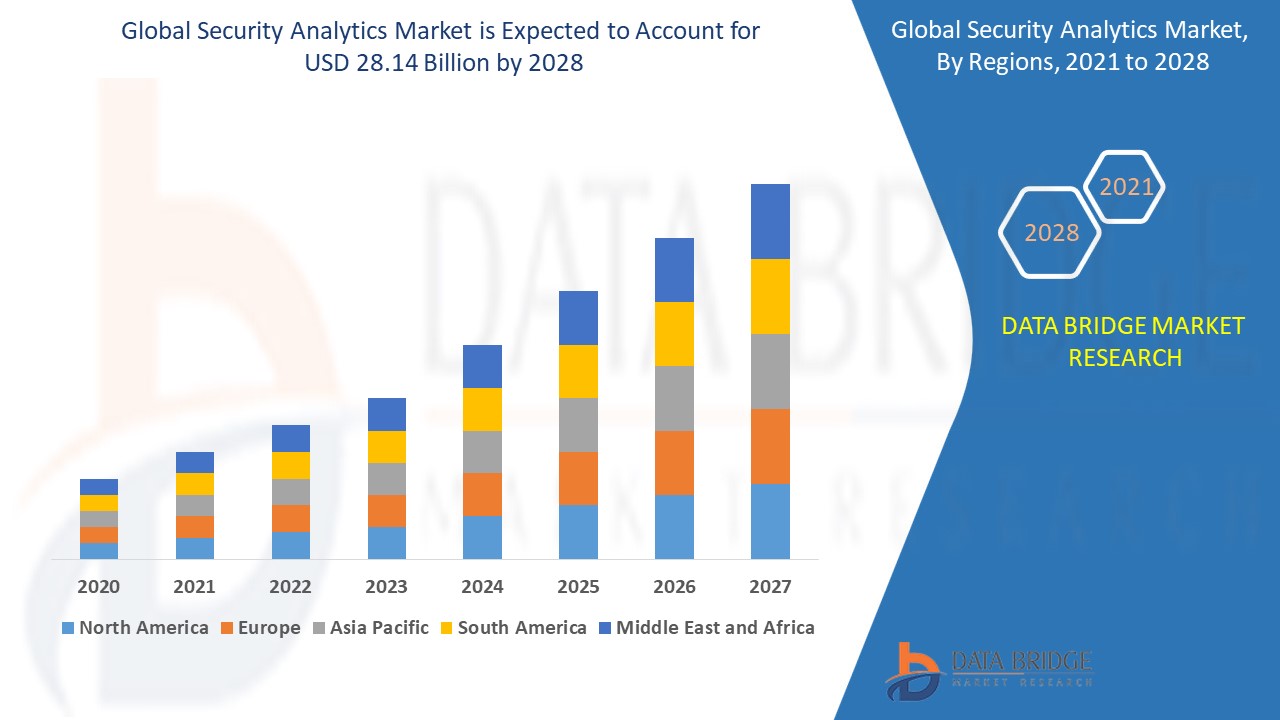

The global security analytics market size was valued at USD 15.17 billion in 2024 and is projected to reach USD 52.19 billion by 2032, with a CAGR of 16.70% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Security Analytics Market Trends

“Increasing Adoption of AI-Driven Threat Intelligence”

One major trend shaping the security analytics market is the increasing adoption of AI-driven threat intelligence for real-time threat detection and automated response. As cyberattacks grow more sophisticated, traditional security solutions struggle to keep up, driving organizations to deploy AI and machine learning-powered security analytics. These technologies enhance behavioral analysis, detect anomalies, and predict cyber threats before they escalate. For instance, IBM’s QRadar Security Analytics Platform leverages AI-driven analytics to identify potential breaches and automate security workflows, reducing response time and minimizing human intervention. In addition, AI-powered User and Entity Behavior Analytics (UEBA) is helping businesses detect insider threats and advanced persistent threats (APTs) more effectively. The growing integration of AI and predictive analytics in cloud security, endpoint protection, and network monitoring is transforming cybersecurity operations. As enterprises continue to adopt zero-trust security models and automated security orchestration, AI-driven security analytics is expected to dominate the market, ensuring proactive cyber defense.

Report Scope and Security Analytics Market Segmentation

|

Attributes |

Security Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

IBM (U.S.), Cisco Systems, Inc. (U.S.), Splunk LLC (U.S.), RSA Security LLC (U.S.), Musarubra US LLC (U.S.), Hewlett Packard Enterprise Development LP (U.S.), McAfee, LLC (U.S.), Broadcom (U.S.), Exabeam (U.S.), Fortinet, Inc. (U.S.), Huntsman (Australia), Securonix, Inc. (U.S.), Gurucul (U.S.), Juniper Networks, Inc. (U.S.), Hillstone Networks (China), Rapid7 (U.S.), Fortra, LLC (U.S.), Forcepoint (U.S.), and Secure Passage (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Security Analytics Market Definition

Security Analytics refers to the process of collecting, analyzing, and interpreting security-related data to detect, prevent, and respond to cyber threats and vulnerabilities. It combines big data analytics, machine learning, behavioral analysis, and threat intelligence to identify suspicious activities, uncover anomalies, and mitigate risks in real time.

Security Analytics Market Dynamics

Drivers

- Rising Cyber Threats and Sophisticated Attacks

The increasing frequency and complexity of cyber threats, such as ransomware, phishing, and Advanced Persistent Threats (APTs), are significantly driving the demand for security analytics solutions. Cybercriminals are constantly evolving their attack strategies, making it challenging for traditional security measures to detect and mitigate threats effectively. Security analytics plays a crucial role in real-time threat detection, incident response, and risk assessment by leveraging behavioral analytics and anomaly detection. For instance, in 2023, a major financial institution faced a large-scale ransomware attack that was successfully mitigated using an AI-driven security analytics platform, which detected unusual network behavior and flagged the intrusion before data was compromised. With increasing cyberattacks targeting critical infrastructure, enterprises and governments are investing heavily in security analytics solutions to strengthen their cybersecurity posture, making this a key driver of market growth.

- Growing Adoption of AI and Machine Learning in Cybersecurity

The integration of AI and machine learning (ML) in security analytics is revolutionizing how organizations detect and respond to cyber threats. AI-powered security analytics solutions analyze vast amounts of data, identify attack patterns, and automate threat mitigation, reducing the need for manual intervention. Machine learning algorithms can adapt to new cyber threats, improving predictive threat intelligence and proactive security measures. For instance, IBM’s Watson for Cyber Security leverages AI to analyze millions of security documents, helping security teams identify hidden threats and respond faster to incidents. Similarly, Splunk’s AI-driven security analytics solutions provide real-time monitoring and automated threat response, reducing detection times and preventing data breaches. As cyber threats continue to evolve, businesses are prioritizing AI-driven security analytics solutions to enhance cyber resilience, streamline security operations, and comply with stringent regulatory frameworks, making AI adoption a major market driver.

Opportunities

- Increasing Cloud Adoption and Remote Workforce

The growing reliance on cloud computing and remote work models has significantly expanded the cyberattack surface, making security analytics solutions a crucial component for enterprises. With more businesses migrating workloads to cloud environments and employees accessing sensitive data from various locations, cybercriminals are targeting cloud infrastructure with data breaches, account takeovers, and insider threats. Cloud-based security analytics solutions provide organizations with real-time threat detection, automated response mechanisms, and enhanced visibility into cloud and remote endpoints. For instance, Microsoft Defender for Cloud uses AI-powered security analytics to identify suspicious activities in hybrid and multi-cloud environments, ensuring proactive protection. As companies continue to invest in cloud transformation, the demand for scalable, AI-driven security analytics solutions will rise, presenting a major market opportunity for cybersecurity vendors to develop cloud-native analytics platforms tailored for modern work environments.

- Increasing Regulatory Compliance and Data Protection Requirements

With the increasing emphasis on data privacy and protection, governments and regulatory bodies worldwide are enforcing stringent compliance mandates such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and Health Insurance Portability and Accountability Act (HIPAA). Organizations face significant penalties for non-compliance, leading to a surge in demand for security analytics solutions that offer continuous compliance monitoring, risk assessment, and automated reporting. Businesses are adopting log management, forensic analysis, and AI-driven real-time monitoring to meet regulatory requirements and enhance data governance. For instance, Splunk's Security Analytics for GDPR Compliance provides organizations with a centralized security intelligence platform, enabling them to monitor access logs, detect anomalies, and generate compliance reports effortlessly. As regulatory frameworks become more stringent globally, cybersecurity companies have a major market opportunity to develop customized compliance-focused security analytics solutions, catering to diverse industry requirements.

Restraints/Challenges

- High Implementation and Maintenance Costs

The adoption of security analytics platforms requires substantial financial investment, making it a significant barrier for many organizations. These platforms rely on advanced AI-driven threat detection, real-time data processing, and cloud-based infrastructure, all of which demand high-performance hardware and software. In addition, companies must invest in skilled cybersecurity professionals to configure, monitor, and maintain these systems effectively. For instance, a large multinational corporation implementing a security analytics solution needs to integrate it with multiple data sources such as SIEM systems, endpoint security tools, and threat intelligence feeds. This integration increases costs and requires continuous maintenance, updates, and fine-tuning to ensure effectiveness. As a result, many small and mid-sized enterprises (SMEs) struggle to afford these solutions, limiting market expansion and slowing overall adoption.

- Data Privacy Concerns

Security analytics platforms process vast amounts of sensitive and personally identifiable information (PII), making data privacy a major concern. Organizations must comply with strict regulations such as GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and HIPAA (Health Insurance Portability and Accountability Act) to avoid legal and financial penalties. The challenge lies in balancing threat detection with privacy protection, ensuring that security analytics solutions do not violate data protection laws while identifying potential cyber threats. For instance, a healthcare organization using a security analytics platform to detect cyber threats must analyze patient records and other confidential data. If the platform fails to anonymize or securely store sensitive information, it could lead to data breaches or regulatory violations, resulting in hefty fines and reputational damage. This concern discourages organizations from fully leveraging security analytics, impacting market growth and adoption rates.

Beyond legal compliance, organizations must also securely store and process voice data, which is a significant market challenge. Voice recordings often contain personally identifiable information (PII), sensitive health data, or financial details, making them prime targets for cyberattacks. The risk of data breaches discourages businesses from fully adopting Security Analytics solutions. For instance, a major telecom provider faced a data leak in which thousands of customer support call recordings were exposed due to improper encryption. Ensuring end-to-end security, encryption, and access control is costly and adds technical complexity to implementation, limiting market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Security Analytics Market Scope

The market is segmented on the basis of component, organization size, deployment type, application, and industry vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solutions

- Services

Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Deployment Type

- Cloud

- On-Premises

Application

- Web Security Analytics

- Network Security Analytics

- Endpoint Security Analytics

- Application Security Analytics

- Others

Industry Vertical

- BFSI

- Government and Defence

- Consumer Goods and Retail

- IT and Telecom

- Healthcare

- Energy and Utilities

- Manufacturing

- Other Industry Verticals

Security Analytics Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, component, organization size, deployment type, application, and industry vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the security analytics market, driven by the presence of major cybersecurity vendors and advanced IT infrastructure. The rising frequency of cyber threats, data breaches, and sophisticated attacks has increased the adoption of AI-driven security analytics solutions across various industries. In addition, the region’s strong focus on regulatory compliance and data protection laws, such as CISA and GDPR, is pushing enterprises to invest in proactive threat detection technologies. With continuous advancements in cloud security, machine learning, and behavioral analytics, North America remains at the forefront of security analytics market growth.

Asia-Pacific is projected to witness fastest growth in the forecast period of 2025-2032, driven by the rising adoption of Bring Your Own Device (BYOD) policies and the rapid expansion of the Internet of Things (IoT) ecosystem. The increasing number of connected devices and remote work trends has heightened the need for advanced security and data management solutions. In addition, growing awareness about the devastating impact of advanced targeted threats, such as cyberattacks and data breaches, is pushing organizations to invest in robust cybersecurity frameworks. These factors collectively contribute to the region’s accelerated market expansion and technological advancements.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Security Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Security Analytics Market Leaders Operating in the Market Are:

- IBM (U.S.)

- Cisco Systems, Inc. (U.S.)

- Splunk LLC (U.S.)

- RSA Security LLC (U.S.)

- Musarubra US LLC (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- McAfee, LLC (U.S.)

- Broadcom (U.S.)

- Exabeam (U.S.)

- Fortinet, Inc. (U.S.)

- Huntsman (Australia)

- Securonix, Inc. (U.S.)

- Gurucul (U.S.)

- Juniper Networks, Inc. (U.S.)

- Hillstone Networks (China)

- Rapid7 (U.S.)

- Fortra, LLC (U.S.)

- Forcepoint (U.S.)

- Secure Passage (U.S.)

Latest Developments in Security Analytics Market

- In August 2024, Fortinet, Inc., a leading cybersecurity company, announced the acquisition of Next DLP, a firm specializing in insider risk and data protection. This strategic move aims to strengthen Fortinet’s presence in both the integrated DLP and standalone enterprise data loss prevention (DLP) market

- In January 2024, McAfee, LLC, a key player in the online protection industry, introduced its latest innovation, ‘Project Mockingbird’, an advanced AI-powered detection capability designed to identify maliciously altered audio in videos. McAfee has integrated AI-driven behavioral, categorical, and contextual detection models to address growing concerns regarding deepfake threats

- In July 2022, CrowdStrike launched Falcon OverWatch Cloud Threat Hunting, a new cloud threat hunting service designed to help security teams continuously identify sophisticated and hidden threats within cloud environments. This solution enables onsite analysts to detect vulnerabilities that may expose sensitive data to cyber risks

- In June 2022, Ensono announced a partnership with ATPCO to provide continuous monitoring, threat detection, Mainframe-as-a-Service, disaster recovery, and private cloud services. This collaboration ensures high operational efficiency while offering ATPCO flexibility in both technical and commercial aspects to meet its current and future business requirements

- In July 2021, LogRhythm introduced a new automation module to assist organizations in rapidly complying with Qatar’s National Cybersecurity Framework. This enhancement aims to streamline compliance processes and improve cybersecurity resilience across various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.