Global Secure Logistics Market

Market Size in USD Billion

CAGR :

%

USD

78.19 Billion

USD

196.39 Billion

2024

2032

USD

78.19 Billion

USD

196.39 Billion

2024

2032

| 2025 –2032 | |

| USD 78.19 Billion | |

| USD 196.39 Billion | |

|

|

|

Secure Logistics Market Analysis

The secure logistics market is witnessing substantial growth, driven by increasing global trade, rising cash circulation, and advancements in security technologies. The demand for secure transportation of cash, valuables, and high-risk goods such as pharmaceuticals and confidential documents has surged, prompting logistics providers to adopt advanced security measures. Companies are integrating AI-powered surveillance, GPS tracking, biometric authentication, and blockchain technology to enhance the safety and transparency of their supply chains. In addition, the expansion of e-commerce and financial institutions has heightened the need for cash management services and secure vault storage. The rise of digital payments has also influenced the market, with logistics providers offering hybrid solutions that cater to both physical and digital asset security. Key players such as Brink’s Incorporated, G4S, and Securitas AB are investing in automation and armored vehicle innovations to strengthen their services. As regulatory compliance becomes stricter across regions, businesses are focusing on integrating real-time monitoring and risk assessment technologies, ensuring robust and resilient security solutions for clients across diverse industries.

Secure Logistics Market Size

The global secure logistics market size was valued at USD 78.19 billion in 2024 and is projected to reach USD 196.39 billion by 2032, with a CAGR of 12.20% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Secure Logistics Market Trends

“Increasing Adoption of AI-Powered Surveillance and Automation”

One major trend in the secure logistics market is the increasing adoption of AI-powered surveillance and automation to enhance security and operational efficiency. As threats such as cargo theft, cyberattacks, and fraud become more sophisticated, companies are leveraging artificial intelligence, machine learning, and predictive analytics to monitor and safeguard high-value shipments in real-time. For instance, Brink’s Incorporated has integrated AI-driven threat detection and GPS-enabled tracking into its armored transport services, allowing instant alerts and route optimization to prevent security breaches. In addition, biometric authentication and blockchain technology are being employed for secure access control and tamper-proof transaction records. The growing digital transformation in banking and retail sectors has further propelled demand for automated cash management and AI-driven risk assessment solutions. With companies focusing on end-to-end security solutions that blend physical and digital asset protection, AI and automation are reshaping the secure logistics industry, ensuring enhanced reliability and transparency across global supply chains.

Report Scope and Secure Logistics Market Segmentation

|

Attributes |

Secure Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Brink's Incorporated (U.S.), G4S Limited (U.K.), Loomis Armored US, LLC (U.S.), Securitas AB (Sweden), GardaWorld (Canada), Prosegur (Spain), Allied Universal (U.S.), Amentum Services, Inc. (U.S.), ADT (U.S.), TBForte (Brazil), Cash Logistik Security AG (Germany), Linfox Armaguard Pty Ltd (Australia), GSL (U.K.), Logicall Trusted Logistics (South Africa), Alert 360 (U.S.), Lee & Muirhead Pvt. Ltd. (India), and CEVA Logistics (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Secure Logistics Market Definition

Secure logistics refers to the specialized transportation, handling, and storage of high-value goods, sensitive documents, and cash under stringent security measures to prevent theft, fraud, and unauthorized access. This sector involves advanced risk management strategies, real-time tracking, armored transportation, and surveillance technologies to ensure the safe and efficient movement of assets.

Secure Logistics Market Dynamics

Drivers

- Rising Cash Circulation & ATM Deployments

Even with the increasing adoption of digital payment solutions, cash transactions continue to hold significant importance, especially in developing economies. The rising circulation of cash fuels the need for secure cash logistics services, including cash-in-transit (CIT), cash vault management, and ATM replenishment solutions. Emerging markets such as India and Brazil are expanding their ATM networks to enhance financial inclusion, requiring robust security solutions to prevent theft and fraud. For instance, Brink’s and Loomis Armored US provide end-to-end cash management services to banks and retailers, ensuring secure cash movement. This growing reliance on secure cash handling services positions CIT providers as key players in the financial ecosystem, driving overall market growth.

- Growth of E-Commerce & High-Value Goods Transportation

The booming e-commerce sector has intensified the demand for secure logistics solutions, particularly for transporting high-value goods such as electronics, luxury products, and pharmaceutical supplies. Rising concerns over theft, counterfeiting, and supply chain vulnerabilities have pushed logistics providers to implement advanced security measures, including real-time GPS tracking, biometric authentication, and tamper-proof packaging. For instance, companies such as DHL and FedEx partner with e-commerce giants such as Amazon and Alibaba to offer high-security logistics solutions, ensuring the safe delivery of sensitive and expensive goods. This heightened emphasis on secure transportation is driving the growth of the secure logistics market, as businesses prioritize risk mitigation and regulatory compliance.

Opportunities

- Increasing Focus on Regulatory Compliance and Security Standards

The increasing emphasis on regulatory compliance in secure logistics presents a significant market opportunity as governments and regulatory agencies worldwide implement stricter security protocols for cash handling, confidential data transport, and high-risk goods movement. Adhering to regulations such as the EU Cash Services Directive, PCI DSS (Payment Card Industry Data Security Standard), and various banking security standards is driving financial institutions, retailers, and logistics providers to adopt advanced security solutions. This has led to increased investments in armored transportation, AI-driven surveillance, and biometric authentication to enhance security while ensuring compliance. For instance, leading secure logistics firms such as G4S and Prosegur have integrated AI-powered risk assessment tools and real-time tracking systems to mitigate risks and maintain regulatory adherence. As compliance requirements become more stringent, businesses are prioritizing security-driven innovations, creating lucrative growth opportunities for secure logistics providers while strengthening global supply chain integrity.

- Increasing Advancements in Security and Asset Tracking Technologies

The rapid advancements in security and asset tracking technologies are transforming the secure logistics market, presenting significant opportunities for growth and innovation. GPS tracking systems provide real-time location updates, ensuring enhanced visibility and control over high-value asset transportation. Blockchain technology is being increasingly adopted to create tamper-proof digital records, reducing fraud risks and ensuring transparency in supply chain operations. AI-driven surveillance enables predictive threat detection, helping logistics providers preemptively address security risks. In addition, biometric authentication, such as facial recognition and fingerprint scanning, is strengthening access control in secure warehouses and transport vehicles. For instance, Brink’s Incorporated has integrated AI-powered risk assessment tools to optimize secure transportation routes, minimizing vulnerabilities and ensuring the safe delivery of cash and valuable goods. As businesses and financial institutions prioritize data-driven security solutions, the adoption of these cutting-edge technologies is expected to rise, offering secure logistics providers a competitive edge and fostering.

Restraints/Challenges

- High Operational Costs

The secure logistics industry requires significant investment in advanced security infrastructure, highly trained personnel, and armored transport vehicles, leading to high operational costs. To ensure safe transportation of cash, high-value goods, and sensitive materials, companies must deploy GPS tracking, biometric authentication, surveillance systems, and AI-driven risk assessment tools. In addition, hiring and retaining security-trained personnel and maintaining specialized armored fleets add to the overall expenditure. For instance, cash-in-transit (CIT) companies operating in regions with high crime rates must continuously upgrade security protocols, train staff in threat response, and enhance vehicle protection to minimize risks. These costs make secure logistics services expensive, limiting their affordability for small businesses and emerging markets, thereby restricting market expansion.

- Rising Threat of Theft and Fraud

High-value shipments, including cash, pharmaceuticals, electronics, and luxury goods, are prime targets for organized crime, cargo theft, and cyber fraud. Criminal groups use sophisticated tactics, such as hijacking armored trucks, cyberattacks on tracking systems, and insider threats, to steal goods. The rise of e-commerce and global supply chains has further increased vulnerabilities, as more valuable shipments move through multiple transit points, increasing exposure to risk. For instance, in North America, cargo theft incidents targeting electronics and pharmaceuticals have risen, with criminals exploiting weak security measures in warehouses and transportation networks. Similarly, cybercriminals have begun hacking logistics tracking systems to reroute valuable shipments. These persistent security threats increase insurance costs, disrupt supply chains, and force companies to invest more in security measures, impacting profitability and growth in the secure logistics market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Secure Logistics Market Scope

The market is segmented on the basis of type, service type, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Static

- Mobile

Service Type

- Cash Services

- Security Services

Application

- Cash Management

- Diamonds, Jewellery, and Precious Metal

- Manufacturing

- Others

End User

- Financial Institutions

- Retailers

- Government

- Others

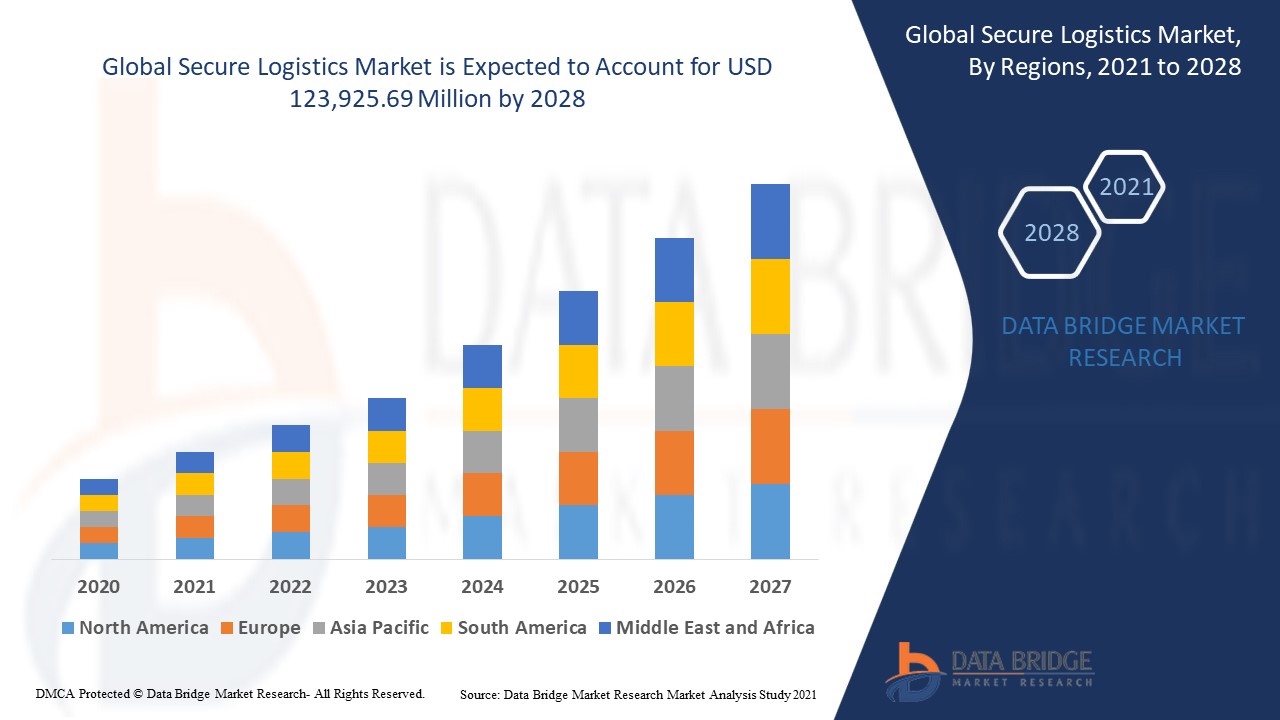

Secure Logistics Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, service type, application, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe is the dominating regon in the secure logistics market from the outset. This dominance is expected to continue throughout the forecast period due to the increasing circulation of cash and rising trade investments across European nations. In addition, the well-established retail sector plays a crucial role in driving market expansion by requiring secure transportation and handling of valuable goods. The region’s strong financial infrastructure and growing demand for efficient security services further contribute to the market’s steady growth.

Asia-Pacific is projected to experience a fastest growth rate during the forecast period. The rapid expansion of banking and financial institutions across the region is a key factor driving the demand for secure logistics services. In addition, the continuous development of the logistics industry is creating lucrative opportunities for market growth, as businesses seek efficient and secure transportation solutions. The increasing adoption of digital banking, cash management services, and trade activities further strengthens the region’s position in the secure logistics market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Secure Logistics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Secure Logistics Market Leaders Operating in the Market Are:

- Brink's Incorporated (U.S.)

- G4S Limited (U.K.)

- Loomis Armored US, LLC (U.S.)

- Securitas AB (Sweden)

- GardaWorld (Canada)

- Prosegur (Spain)

- Allied Universal (U.S.)

- Amentum Services, Inc. (U.S.)

- ADT (U.S.)

- TBForte (Brazil)

- Cash Logistik Security AG (Germany)

- Linfox Armaguard Pty Ltd (Australia)

- GSL (U.K.)

- Logicall Trusted Logistics (South Africa)

- Alert 360 (U.S.)

- Lee & Muirhead Pvt. Ltd. (India)

- CEVA Logistics (France)

Latest Developments in Secure Logistics Market

- In July 2023, Securitas signed an expanded five-year agreement with Microsoft to deliver data center security across 31 countries, strengthening their long-term partnership in safeguarding critical infrastructure

- In July 2023, Artificial Intelligence Technology Solutions Inc. and its subsidiary, Robotic Assistance Devices Inc. (RAD), partnered with GardaWorld Security Systems to supply RAD products to customers in Canada, reflecting GardaWorld’s commitment to integrating advanced security technologies

- In June 2023, Prosegur Cash and Linfox Armaguard, a financial logistics company in Australia, announced a merger of Prosegur Australia, aiming to create a financially sustainable provider of CIT services by consolidating cash management and ATM capabilities

- In July 2022, Securitas AB acquired Stanley Security for USD 3.2 billion, reinforcing its presence in the electronic security services market and enhancing its technology-driven security solutions in collaboration with STANLEY Security and Healthcare

- In May 2022, Brink's Incorporated partnered with METACO to enhance institutional digital asset custody by integrating METACO’s services with Brink’s global vault network and secure logistics expertise, offering financial institutions a robust disaster recovery solution for private key backups

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.