Global Scale Nas Market

Market Size in USD Billion

CAGR :

%

USD

8.50 Billion

USD

14.60 Billion

2024

2032

USD

8.50 Billion

USD

14.60 Billion

2024

2032

| 2025 –2032 | |

| USD 8.50 Billion | |

| USD 14.60 Billion | |

|

|

|

|

Scale-Out Network Attached Storage (NAS) Market Size

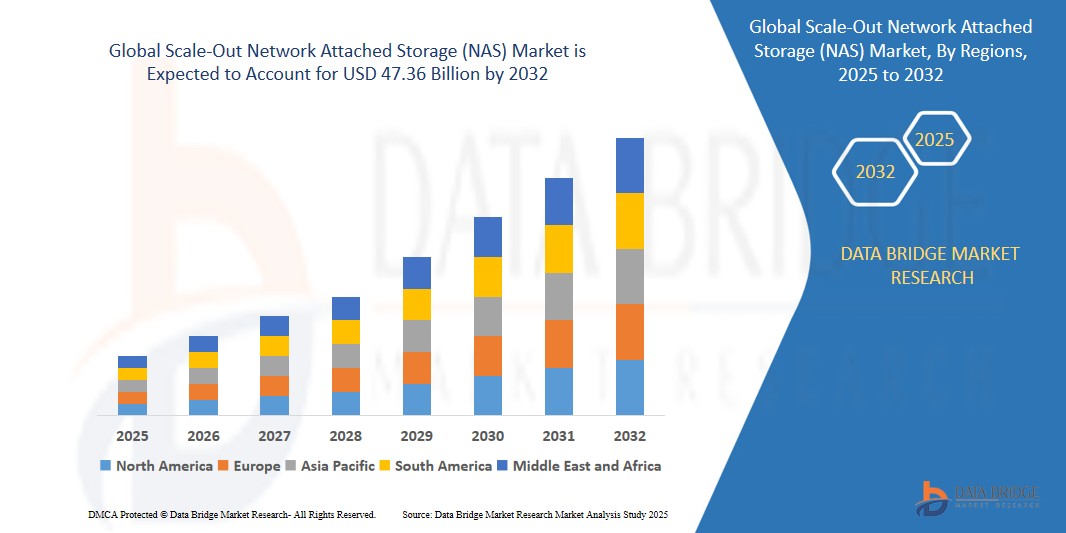

- The global Scale-Out Network Attached Storage (NAS) market size was valued at USD 15.98 billion in 2024 and is expected to reach USD 47.36 billion by 2032, at a CAGR of 18.5% during the forecast period

- This growth is driven by the increasing demand for scalable storage solutions, rapid data generation from IoT and AI applications, and the adoption of hybrid cloud storage across enterprises

Scale-Out Network Attached Storage (NAS) Market Analysis

- The Scale-Out Network Attached Storage (NAS) market encompasses advanced storage solutions that allow seamless expansion of storage capacity and performance through clustered architectures, enabling enterprises to manage large volumes of unstructured data efficiently.

- The demand for scale-out NAS is significantly driven by the exponential growth of data, with global data generation expected to reach 175 zettabytes by 2025, and the need for high-performance storage for AI, IoT, and 5G applications, with 60% of enterprises adopting scale-out NAS for data-intensive workloads by 2024.

- North America is expected to dominate the Scale-Out NAS market due to its advanced IT infrastructure and presence of key vendors like Dell Technologies and NetApp, holding a 35.0% market share in 2024.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid digitalization, smart city initiatives, and increasing investments in IT infrastructure in countries like China and India.

- The Hybrid deployment segment is expected to dominate the market with a market share of 45.0% in 2025 due to its ability to combine on-premises control with cloud scalability, supporting disaster recovery and data management

Report Scope and Scale-Out Network Attached Storage (NAS) Market Segmentation

|

Attributes |

Scale-Out Network Attached Storage (NAS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Scale-Out Network Attached Storage (NAS) Market Trends

“Adoption of AI-Driven Storage Solutions in Scale-Out NAS”

- A prominent trend in the Scale-Out NAS market is the integration of artificial intelligence (AI) and machine learning (ML) into storage solutions, enabling automated data management and predictive analytics, with 50% of scale-out NAS systems incorporating AI features by 2024.

- Cloud-based scale-out NAS solutions are gaining traction due to their scalability and cost-effectiveness, with the cloud segment projected to grow at a CAGR of 20.0% during the forecast period.

- For instance, in May 2024, Huawei launched the OceanStor A800, an exabyte-scale NAS solution designed for AI workloads, supporting over 1 exabyte of storage.

- This trend is driving demand for advanced, scalable storage solutions that address the needs of data-intensive applications

Scale-Out Network Attached Storage (NAS) Market Dynamics

Driver

“Exponential Growth of Unstructured Data and AI Workloads”

- The rapid increase in unstructured data, projected to reach 175 zettabytes globally by 2025, and the growing adoption of AI and IoT applications, with 70% of enterprises requiring scalable storage for AI workloads by 2024, are significantly contributing to the Scale-Out NAS market growth.

- Scale-out NAS solutions provide linear scalability and high performance, reducing data bottlenecks by 25% in enterprises adopting these systems.

- For instance, in 2024, a major telecom provider implemented scale-out NAS to manage 5G network data, improving data access speeds by 30%.

- As organizations prioritize scalable and efficient storage, the demand for scale-out NAS continues to rise, ensuring robust data management

Opportunity

“Expansion of Scale-Out NAS in Smart City and IoT Applications”

- The growing adoption of scale-out NAS in smart city projects and IoT applications, with 65% of global smart cities investing in scalable storage by 2025, offers significant opportunities for market growth by supporting real-time data processing and storage.

- These solutions manage data from IoT devices, such as smart sensors and surveillance systems, with deployments projected to reduce data latency by 20% in smart city applications by 2025.

- For instance, in 2024, Singapore integrated scale-out NAS into its smart city infrastructure to manage traffic and public safety data, enhancing operational efficiency.

- This opportunity drives market expansion by enabling scalable and reliable storage for connected ecosystems.

Restraint/Challenge

“Performance Limitations and Protocol Constraints”

- Performance limitations, with 35% of enterprises reporting latency issues in scale-out NAS due to protocols like SMB and NFS in 2024, and challenges in scaling high-performance applications, affecting 40% of deployments, pose significant barriers to the Scale-Out NAS market.

- These challenges require substantial investments in advanced hardware and protocol optimization, increasing deployment costs for organizations.

- For instance, in 2024, 30% of SMEs cited high latency as a barrier to adopting scale-out NAS for real-time analytics.

- These issues can hinder market growth, necessitating high-performance and cost-effective solutions

Scale-Out Network Attached Storage (NAS) Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Deployment Type |

|

|

By End-User |

|

In 2025, the Cloud Segment is Projected to Dominate the Market with the Largest Share in the Deployment Segment

The cloud segment is expected to lead the Scale-Out Network Attached Storage (NAS) market in 2025, capturing approximately 64% of the market share. This dominance is driven by the increasing adoption of cloud-native applications and the growing need for flexible, scalable, and cost-effective storage solutions. Organizations across sectors are shifting toward hybrid and multi-cloud environments to manage explosive data growth, enhance disaster recovery capabilities, and support remote workforces. The proliferation of edge computing and real-time analytics is further accelerating demand for cloud-based NAS solutions capable of seamless data access and centralized control.

The IT & Telecom Segment is Expected to Account for the Largest Share During the Forecast Period in the End-User Market

In 2025, the IT & telecom segment is anticipated to hold the largest market share in the Scale-Out NAS market. This is primarily due to the vast volumes of structured and unstructured data generated by telecom operators, including customer records, billing systems, and network analytics. The need for high-performance, scalable storage infrastructure that ensures low-latency data retrieval and continuous availability is driving the adoption of scale-out NAS in this sector. Additionally, the integration of 5G technologies and IoT applications requires robust back-end storage systems capable of handling high throughput and dynamic data workflows, further fueling market demand.

Scale-Out Network Attached Storage (NAS) Market Regional Analysis

“North America Holds the Largest Share in the Scale-Out Network Attached Storage (NAS) Market”

- North America dominates the Scale-Out NAS market, driven by the rapid digital transformation of enterprises, high penetration of cloud-based services, and the growing need for scalable storage solutions across data-intensive industries such as media, BFSI, and healthcare.

- The U.S. holds a significant share due to widespread adoption of big data analytics, artificial intelligence (AI), and machine learning (ML) technologies that require seamless, high-capacity, and scalable storage infrastructure.

- The strong presence of major technology vendors such as Dell Technologies, NetApp, Hewlett Packard Enterprise (HPE), and IBM further fuels regional growth through consistent innovation and product development.

- Additionally, enterprises in the U.S. are investing heavily in hybrid and multi-cloud environments, which is boosting demand for scale-out NAS systems capable of integrating with diverse cloud platforms and providing unified data access.

“Asia-Pacific is Projected to Register the Highest CAGR in the Scale-Out Network Attached Storage (NAS) Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Scale-Out NAS market, driven by accelerating digital infrastructure development, rising internet penetration, and the surge in enterprise data generation across sectors such as manufacturing, telecommunications, and e-commerce.

- Countries like China, India, Japan, and South Korea are emerging as major contributors due to increasing adoption of cloud services, expanding IT services industry, and a growing focus on data localization and sovereignty.

- Japan, known for its technological innovation, is investing heavily in high-performance computing and AI research, thereby driving demand for advanced NAS solutions to support massive data workloads.

- In China and India, government-led digital transformation initiatives like “Digital China” and “Digital India,” along with rising investments in smart city projects and industrial automation, are further propelling the growth of scalable NAS infrastructure

Scale-Out Network Attached Storage (NAS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dell Technologies Inc. (U.S.)

- NetApp, Inc. (U.S.)

- Synology Inc. (Taiwan)

- QNAP Systems, Inc. (Taiwan)

- Hewlett Packard Enterprise Company (U.S.)

- Hitachi, Ltd. (Japan)

- Western Digital Corporation (U.S.)

- Seagate Technology PLC (U.S.)

- Buffalo Americas, Inc. (U.S.)

- IBM Corporation (U.S.)

Latest Developments in Global Scale-Out Network Attached Storage (NAS) Market

- In September 2022, QNAP Systems introduced the QTS 5.0.1 NAS operating system, offering enhanced security, improved convenience, and increased performance for data protection. Key features include secure RAID disk replacement, compatibility with Enterprise Self-Encrypting Drives (SED), and support for the Windows Search Protocol for NAS shared folders

- In April 2023, Seagate partnered with QNAP Systems Inc. to deliver an all-encompassing portfolio of edge-to-cloud enterprise storage options. This collaboration features QNAP's high-capacity NAS solutions, Seagate Lyve Cloud, and IronWolf Pro Hard Drives, catering to small to medium businesses and content creators

- In September 2023, Huawei launched the OceanStor Pacific 9920, an all-flash NAS array designed to meet application performance requirements for several virtual machines. This system offers high capacity and performance, aiming to qualify for various virtual machine applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.