Global Satellite Backhaul Market

Market Size in USD Billion

CAGR :

%

USD

7.53 Billion

USD

44.57 Billion

2024

2032

USD

7.53 Billion

USD

44.57 Billion

2024

2032

| 2025 –2032 | |

| USD 7.53 Billion | |

| USD 44.57 Billion | |

|

|

|

|

Satellite Backhaul Market Size

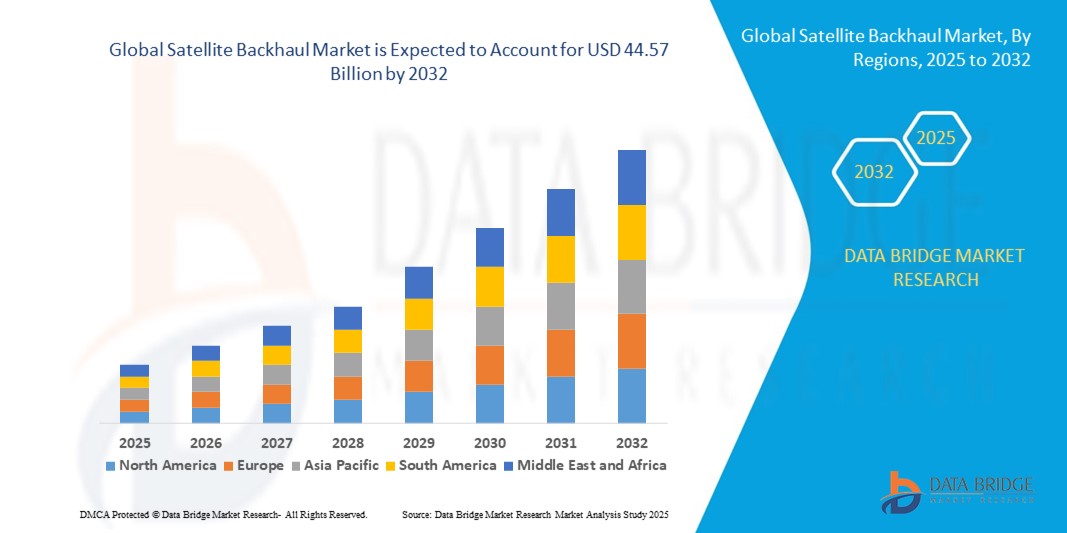

- The global satellite backhaul market size was valued at USD 7.53 billion in 2024 and is expected to reach USD 44.57 billion by 2032, at a CAGR of 24.89% during the forecast period

- The market growth is largely fueled by the increasing demand for high-speed, reliable connectivity in remote, rural, and underserved regions, along with the rapid expansion of mobile networks, broadband services, and cloud-based applications

- Furthermore, rising adoption of satellite backhaul solutions by telecommunications, broadcasting, government, and enterprise sectors is establishing them as critical infrastructure for seamless data transmission and network resilience. These converging factors are accelerating the deployment of advanced satellite systems, thereby significantly boosting the industry's growth

Satellite Backhaul Market Analysis

- Satellite backhaul solutions provide communication links between terrestrial networks and satellite systems, enabling the transmission of data, voice, and multimedia content over long distances. These solutions support both mobile and fixed networks, offering low-latency, high-capacity connectivity for commercial, government, and defense applications

- The escalating demand for satellite backhaul is primarily driven by the need to bridge connectivity gaps in remote locations, support the proliferation of IoT and cloud services, and ensure uninterrupted communication during network outages or disaster recovery scenarios. Technological advancements in MEO, LEO, and Ka-/C-band satellites further enhance performance, scalability, and reliability for global deployments

- North America dominated the satellite backhaul market with a share of 35.5% in 2024, due to extensive investments in telecommunication infrastructure, rising adoption of broadband services, and the increasing need for reliable connectivity in remote and rural areas

- Asia-Pacific is expected to be the fastest growing region in the satellite backhaul market during the forecast period due to increasing urbanization, growing broadband demand, and technological adoption in countries such as China, Japan, and India

- Hardware segment dominated the market with a market share of 62% in 2024, due to high demand for ground terminals, antennas, modems, and associated equipment required to establish reliable satellite communication links. Network operators and service providers prioritize hardware investments to ensure low latency, high bandwidth, and robust connectivity across remote and underserved areas. The segment’s dominance is also supported by continuous technological upgrades, including more efficient antennas and satellite modems that enhance overall network performance. Hardware solutions often serve as long-term infrastructure investments, creating recurring demand as operators expand coverage and upgrade existing backhaul networks

Report Scope and Satellite Backhaul Market Segmentation

|

Attributes |

Satellite Backhaul Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Satellite Backhaul Market Trends

Rising Demand for Bandwidth

- The increasing demand for high-speed connectivity and bandwidth-intensive applications is a major trend driving the satellite backhaul market. With the proliferation of digital services, video streaming, cloud computing, and IoT devices, telecom operators and enterprises require reliable bandwidth solutions to manage exponential traffic growth across underserved and remote regions

- For instance, SES S.A. has expanded its satellite backhaul services using high-throughput satellites (HTS) to provide bandwidth-efficient solutions to mobile network operators in Africa and Latin America. Similarly, Hughes Network Systems has partnered with telecom providers to offer satellite-enabled backhaul that ensures reliable broadband and mobile connectivity in areas without terrestrial infrastructure

- Satellite backhaul plays a crucial role in extending network coverage to areas where terrestrial networks are not cost-effective, such as rural communities, islands, disaster recovery zones, and military bases. The rising demand for data-intensive services in these locations is reinforcing the importance of satellite-enabled bandwidth solutions

- The deployment of advanced HTS and low-earth-orbit (LEO) constellations is also contributing to this trend by offering higher capacity, lower latency, and cost efficiency compared to older geostationary systems. Companies are leveraging these technologies to meet the growing consumption of mobile broadband and enterprise data services

- Moreover, the transition to 4G and 5G networks is significantly boosting the need for robust backhaul connectivity. As operators expand coverage, satellite backhaul provides a scalable solution to deliver consistent broadband performance in regions underserved by fiber or microwave connections

- In conclusion, the escalating global demand for bandwidth in both consumer and industrial applications is cementing the role of satellite backhaul as a critical enabler for next-generation connectivity. This trend will continue to expand as digital ecosystems evolve and service providers seek efficient ways to meet surging data traffic requirements

Satellite Backhaul Market Dynamics

Driver

Rising Government Initiatives and Funding

- Government initiatives and funding programs are serving as strong drivers for the growth of the satellite backhaul market. Policymakers are actively supporting satellite communication infrastructure to enhance connectivity in rural, remote, and underserved regions, thereby bridging the digital divide and expanding nationwide broadband access

- For instance, the U.S. Federal Communications Commission (FCC) under the Rural Digital Opportunity Fund (RDOF) has allocated billions of dollars to support satellite and terrestrial solutions aimed at rural broadband connectivity. Similarly, India’s Digital India program is leveraging partnerships with satellite service providers to improve internet reach across rural villages and underserved communities

- Governments are recognizing the importance of reliable backhaul solutions in extending 4G and 5G services across geographically challenging terrains. Funding support and policy frameworks are helping telecom operators deploy satellite-based backhaul infrastructure without facing prohibitive investment risks

- In addition, defense and security agencies are also funding satellite backhaul systems to strengthen secure communications, disaster management, and emergency responses. Such deployments further reinforce the role of satellite backhaul as an essential component of national security infrastructure

- Overall, the continuous backing from governments and public funding initiatives is accelerating the adoption of satellite backhaul solutions. This driver ensures long-term market expansion by aligning connectivity goals with public policy priorities across developed and developing economies

Restraint/Challenge

High Initial Costs

- The high initial costs associated with deploying satellite backhaul systems remain a significant restraint for market participants. Establishing ground infrastructure such as earth stations, antennas, and network gateways, along with launching and maintaining satellites, requires substantial capital expenditure that limits adoption for smaller operators and developing markets

- For instance, large-scale LEO projects such as Starlink involve multibillion-dollar investments to launch and maintain satellite constellations. While global operators can absorb such costs, regional or local players often find it difficult to justify the high upfront expenditure compared to terrestrial backhaul options such as fiber or microwave links

- The cost of deploying compatible equipment for end-users and integrating backhaul solutions with existing telecom networks further increases the overall investment burden. These expenses act as a deterrent for many smaller telecom service providers, especially in price-sensitive regions where consumer affordability is limited

- In addition, operating costs including bandwidth leasing, satellite maintenance, and upgrades for ground equipment contribute to long-term financial strain. This makes it challenging for operators to maintain competitive pricing while delivering reliable, high-capacity services

- As a result, the high capital intensity of satellite backhaul deployments continues to limit widespread adoption, particularly in emerging economies with constrained budgets. Addressing this challenge will require innovative funding models, public-private partnerships, and scalable low-cost solutions to make satellite backhaul more accessible and economically viable

Satellite Backhaul Market Scope

The market is segmented on the basis of component, type, technology, and end user.

- By Component

On the basis of component, the satellite backhaul market is segmented into hardware and services. The hardware segment dominated the market with the largest revenue share of 62% in 2024, driven by high demand for ground terminals, antennas, modems, and associated equipment required to establish reliable satellite communication links. Network operators and service providers prioritize hardware investments to ensure low latency, high bandwidth, and robust connectivity across remote and underserved areas. The segment’s dominance is also supported by continuous technological upgrades, including more efficient antennas and satellite modems that enhance overall network performance. Hardware solutions often serve as long-term infrastructure investments, creating recurring demand as operators expand coverage and upgrade existing backhaul networks.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for managed satellite backhaul, installation, maintenance, and consulting services. Operators increasingly prefer outsourcing these services to reduce operational complexity and focus on network expansion. In addition, service providers are offering scalable solutions that cater to temporary events, disaster recovery, and rapid deployment scenarios, driving adoption across multiple sectors. The growth is further accelerated by increased demand for flexible service-level agreements (SLAs) and real-time monitoring to ensure high reliability in remote or challenging environments.

- By Type

On the basis of type, the satellite backhaul market is segmented into dedicated satellite backhaul and shared satellite backhaul. The dedicated satellite backhaul segment held the largest revenue share in 2024 due to its guaranteed bandwidth, high reliability, and security, which are critical for mission-critical applications and high-priority data transmission. Telecommunications providers and enterprises often prefer dedicated backhaul for uninterrupted service delivery and minimal latency. The segment’s prominence is supported by the increasing deployment of broadband services in remote areas and strategic investments by government and defense organizations requiring private and secure communication links.

The shared satellite backhaul segment is anticipated to witness the fastest growth from 2025 to 2032, driven by cost efficiency and flexible bandwidth allocation. Shared backhaul allows multiple users or organizations to leverage the same satellite infrastructure, reducing upfront investment and operational costs. This type is gaining traction among small and medium telecommunications operators, broadcasters, and maritime enterprises seeking scalable solutions. Growing adoption of cloud-based applications and on-demand connectivity services further fuels the demand for shared satellite backhaul solutions.

- By Technology

On the basis of technology, the satellite backhaul market is segmented into C-band, Ku-band, and Ka-band. The C-band segment dominated the market in 2024, driven by its reliability in providing wide coverage with minimal signal degradation due to weather conditions. C-band frequencies are particularly favored in tropical and high-rainfall regions where rain fade can affect higher frequency bands. The segment also benefits from established global infrastructure and regulatory acceptance, making it a preferred choice for large-scale satellite backhaul deployments across telecommunications, broadcasting, and government sectors.

The Ka-band segment is expected to witness the fastest growth from 2025 to 2032, fueled by its high bandwidth capabilities and suitability for high-speed data transmission. Ka-band enables operators to support growing demand for broadband, IoT, and multimedia applications with lower latency and higher throughput. Technological advancements in spot beam satellites and frequency reuse further enhance capacity and efficiency, driving adoption in commercial, maritime, and defense applications. The Ka-band’s ability to facilitate next-generation backhaul solutions positions it as a key growth driver for the market.

- By End User

On the basis of end user, the satellite backhaul market is segmented into telecommunications, broadcasting, government and defense, maritime, and oil and gas. The telecommunications segment dominated the market in 2024, driven by the growing need for broadband expansion, rural connectivity, and network densification. Telecom operators leverage satellite backhaul to bridge connectivity gaps in underserved regions and to maintain uninterrupted service during peak traffic periods or natural disasters. The segment’s growth is further supported by 5G rollout initiatives and increasing demand for mobile data services in remote and semi-urban areas.

The maritime segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing digitalization and connectivity requirements for shipping, offshore exploration, and port operations. Ships, cruise lines, and offshore platforms rely on satellite backhaul to maintain operational efficiency, crew communication, and real-time monitoring systems. Rising demand for IoT-based navigation, predictive maintenance, and cloud-enabled maritime services further accelerates the adoption of satellite backhaul solutions in this sector.

Satellite Backhaul Market Regional Analysis

- North America dominated the satellite backhaul market with the largest revenue share of 35.5% in 2024, driven by extensive investments in telecommunication infrastructure, rising adoption of broadband services, and the increasing need for reliable connectivity in remote and rural areas

- Service providers and enterprises in the region highly value high-speed, low-latency backhaul solutions that support cloud applications, 5G rollout, and data-intensive operations

- This widespread adoption is further supported by advanced satellite infrastructure, government initiatives for digital connectivity, and a technologically adept population, establishing satellite backhaul as a critical solution across telecommunications, government, and commercial sectors

U.S. Satellite Backhaul Market Insight

The U.S. satellite backhaul market captured the largest revenue share in North America in 2024, fueled by the rapid expansion of mobile networks, growing demand for broadband connectivity, and increased reliance on cloud services. Telecommunication operators prioritize dedicated satellite backhaul for secure, uninterrupted connectivity in remote areas, while managed services and flexible solutions are gaining traction for commercial and government applications. The country’s strong satellite ecosystem, combined with favorable regulatory policies and the growing deployment of hybrid and Ka-band technologies, is driving market growth across multiple sectors.

Europe Satellite Backhaul Market Insight

The Europe satellite backhaul market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing demand for secure and resilient communication networks, and government and defense applications. Growing investments in broadcasting and maritime communication infrastructure, coupled with the push for 5G expansion, are fostering adoption across the region. European enterprises are also drawn to satellite backhaul for redundancy and network resilience, supporting operations in rural and underserved areas.

U.K. Satellite Backhaul Market Insight

The U.K. satellite backhaul market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising demand for reliable broadband, government-backed digital initiatives, and an emphasis on network security. Telecommunication operators and broadcasters increasingly rely on both dedicated and shared backhaul solutions for cost-effective, high-performance connectivity. The U.K.’s developed infrastructure, supportive regulatory environment, and growing adoption of hybrid backhaul solutions are expected to continue stimulating market growth.

Germany Satellite Backhaul Market Insight

The Germany satellite backhaul market is expected to expand at a considerable CAGR during the forecast period, driven by increasing investments in telecommunications infrastructure, government and defense applications, and broadcasting networks. Germany’s focus on innovation, technological advancement, and network resilience encourages the adoption of advanced backhaul technologies such as C-band and Ka-band. The growing need for seamless connectivity in industrial, maritime, and energy sectors further supports market expansion.

Asia-Pacific Satellite Backhaul Market Insight

The Asia-Pacific satellite backhaul market is poised to grow at the fastest CAGR during 2025–2032, driven by increasing urbanization, growing broadband demand, and technological adoption in countries such as China, Japan, and India. Government initiatives supporting digitalization, smart city projects, and expansion of telecom infrastructure are accelerating adoption. The region’s emergence as a hub for satellite manufacturing and service providers enhances the accessibility and affordability of satellite backhaul solutions, catering to both commercial and government applications.

Japan Satellite Backhaul Market Insight

The Japan satellite backhaul market is gaining momentum due to high-tech infrastructure, growing telecom and broadcasting needs, and demand for reliable connectivity in remote and maritime applications. Operators increasingly leverage satellite backhaul to support high-speed data transmission, cloud services, and IoT integration. Japan’s emphasis on technological innovation and network resilience is fueling the adoption of both dedicated and shared backhaul solutions.

China Satellite Backhaul Market Insight

The China satellite backhaul market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, increasing telecom network expansion, and the rising adoption of broadband and digital services. China’s large-scale deployment of Ka-band and C-band satellites, coupled with domestic manufacturing capabilities, is supporting cost-effective and scalable backhaul solutions. Growing investments in smart cities, maritime communication, and government connectivity projects are key factors propelling market growth across multiple end-user segments.

Satellite Backhaul Market Share

The satellite backhaul industry is primarily led by well-established companies, including:

- SES S.A. (Luxembourg)

- Intelsat S.A. (Luxembourg)

- Hughes Network Systems, LLC (U.S.)

- Eutelsat Communications S.A. (France)

- Iridium Communications Inc. (U.S.)

- Viasat Inc. (U.S.)

- Telesat Canada (Canada)

- Yahsat (U.A.E.)

- China Satcom (China)

- Inmarsat Global Limited (U.K.)

Latest Developments in Global Satellite Backhaul Market

- In July 2025, SES announced the delivery of the seventh and eighth O3b mPOWER satellites, expanding its Medium Earth Orbit (MEO) constellation. This advancement significantly enhances global connectivity, particularly for remote and underserved regions, by providing higher throughput and lower latency. The increased capacity supports telecom operators and enterprises in delivering reliable backhaul services, facilitating the growth of cloud applications and IoT deployments in challenging environments

- In February 2024, Eutelsat OneWeb and Telstra launched the largest Low Earth Orbit (LEO) satellite backhaul deployment in Australia. This initiative aims to provide high-speed connectivity to over 300 remote base stations, addressing the challenges of delivering traditional backhaul services in geographically isolated areas. The collaboration underscores the growing importance of LEO constellations in bridging connectivity gaps and supporting mobile network expansion in underserved regions

- In June 2023, OneWeb expanded its connectivity services across Europe and the majority of the United States. This rollout adds 37 new countries to its coverage, enhancing satellite backhaul options for telecom operators and enterprises. The expansion facilitates the delivery of reliable internet services to remote and rural areas, supporting the increasing demand for broadband connectivity and enabling digital inclusion efforts in previously underserved regions

- In December 2022, Intelsat's Galaxy 35 satellite was launched, providing additional capacity for satellite backhaul services across the Americas. This satellite enhances connectivity solutions for various applications, ensuring that telecom operators can effectively meet the growing demand for reliable data transmission in the region. The increased capacity supports the expansion of broadband services and the deployment of advanced communication technologies

- In September 2022, SES partnered with Microsoft to deliver satellite backhaul services for Azure Orbital, Microsoft's satellite connectivity platform. This collaboration integrates SES's O3b mPOWER system with Microsoft's cloud infrastructure, enabling seamless connectivity for enterprise applications. The partnership highlights the growing convergence of satellite and cloud technologies, offering scalable and resilient backhaul solutions to meet the evolving demands of digital transformation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Satellite Backhaul Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Satellite Backhaul Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Satellite Backhaul Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.