Global Same Day Delivery Market

Market Size in USD Billion

CAGR :

%

USD

9.58 Billion

USD

42.32 Billion

2024

2032

USD

9.58 Billion

USD

42.32 Billion

2024

2032

| 2025 –2032 | |

| USD 9.58 Billion | |

| USD 42.32 Billion | |

|

|

|

|

Same Day Delivery Market Size

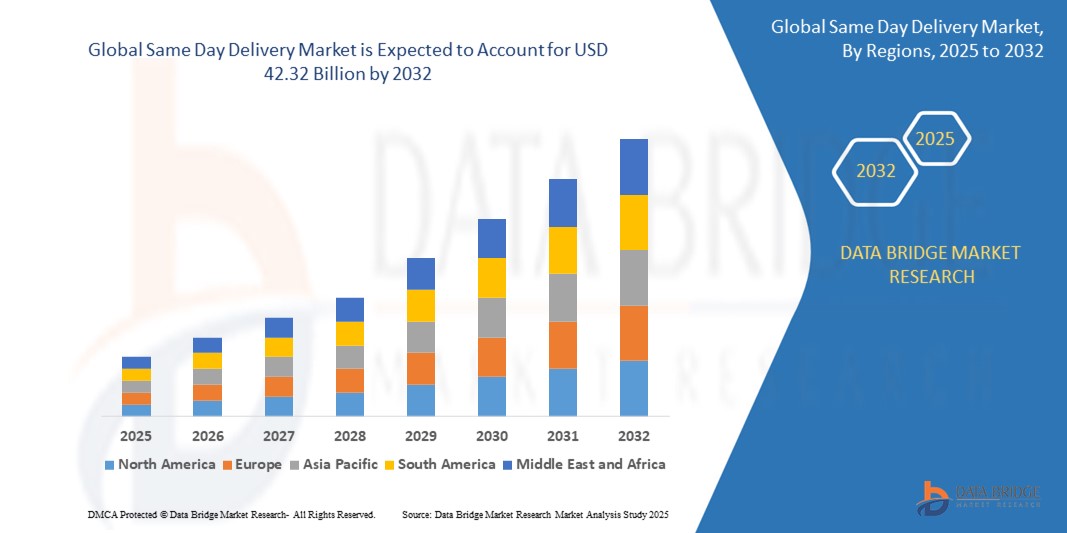

- The global same day delivery market size was valued at USD 9.58 billion in 2024 and is expected to reach USD 42.32 billion by 2032, at a CAGR of 20.40% during the forecast period

- The market growth is largely fueled by the rapid expansion of e-commerce platforms and technological advancements in logistics and last-mile delivery solutions, enabling faster, more efficient fulfillment across various sectors

- Furthermore, rising consumer expectations for instant and flexible delivery options are compelling retailers and service providers to adopt same day delivery models, thereby significantly boosting the industry's growth

Same Day Delivery Market Analysis

- Same day delivery services ensure that goods are picked up and delivered to the end customer within the same calendar day, leveraging advanced route optimization, real-time tracking, and localized fulfillment centers to meet high-speed delivery demands

- The increasing demand for same day delivery is primarily driven by the surge in online shopping, heightened competition among e-commerce players, and a growing emphasis on customer satisfaction through ultra-fast, reliable logistics solutions

- North America dominated the same day delivery market with a share of 39.1% in 2024, due to high e-commerce penetration, strong logistics infrastructure, and growing consumer preference for rapid fulfillment

- Asia-Pacific is expected to be the fastest growing region in the same day delivery market during the forecast period due to rapid urbanization, rising disposable incomes, and an accelerating shift toward online shopping in key markets such as China, Japan, and India

- Business to Business (B2B) segment dominated the market with a market share of 62% in 2024, due to the high volume of time-sensitive deliveries between suppliers, manufacturers, and distributors across sectors such as healthcare, automotive, and electronics. Businesses rely on same day delivery to maintain operational continuity, meet just-in-time inventory requirements, and reduce downtime, especially for critical components and documents. The segment also benefits from established contractual relationships and recurring demand patterns, ensuring consistent shipment volumes and higher margins for service providers

Report Scope and Same Day Delivery Market Segmentation

|

Attributes |

Same Day Delivery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Same Day Delivery Market Trends

“Advanced Route Optimization Technologies”

- The same day delivery market is experiencing rapid growth as logistics providers leverage advanced route optimization technologies—such as AI algorithms, real-time traffic analytics, and predictive demand planning—to enable faster and more reliable deliveries across increasingly complex urban environments

- For instance, leaders such as Amazon, FedEx, UPS, and technology solution providers such as Bringg and Onfleet are deploying dynamic routing platforms and automated dispatch tools to minimize delivery times, optimize driver networks, and support scalable, on-demand fulfillment for e-commerce and retail sectors

- Adoption of IoT-enabled sensors, smart package tracking, and automated warehousing increases transparency and enables continuous monitoring, reducing the risk of delays and lost shipments

- The emergence of autonomous delivery solutions—ranging from delivery drones to self-driving vehicles—is transforming last-mile logistics and expanding the potential service area for ultra-fast delivery

- Urbanization, rising consumer expectations for instant fulfillment, and the need for differentiated customer experience drive continuous investment in advanced logistics infrastructure and micro-fulfillment centers

- Sustainable delivery models—such as EV-powered fleets and carbon-neutral delivery options—are gaining momentum, with route optimization playing a key role in reducing emissions and total delivery miles traveled

Same Day Delivery Market Dynamics

Driver

“Increased Investment in Last-Mile Delivery”

- Escalating competition in e-commerce and retail is prompting substantial investment in last-mile delivery systems, enabling companies to offer rapid delivery times and meet rising consumer expectations for convenience and speed

- For instance, market leaders including Amazon, DHL, JD.com, and SF Express continue to invest in dedicated same-day delivery fleets, localized fulfillment centers, and proprietary logistics software—positioning themselves to maximize delivery efficiency for both urban and suburban customers

- Retailers and third-party logistics providers are forming strategic partnerships with tech companies and local courier networks to expand geographic reach, reduce delivery windows, and manage surge order volumes efficiently

- The proliferation of dark stores, urban distribution hubs, and flexible gig-economy driver platforms facilitates instant inventory access and shortens the last-mile leg of the supply chain

- Increased availability of mobile apps and real-time order tracking enhances customer engagement, encourages repeat purchases, and drives further platform adoption

Restraint/Challenge

“High Operational Costs”

- The high operating costs associated with same day delivery—including vehicle fleets, technology investments, labor, warehousing, and route optimization infrastructure—pose a significant barrier, particularly for smaller players and in less densely populated areas

- For instance, industry giants such as FedEx, UPS, and Amazon allocate major capital outlays to operate advanced same-day delivery networks, while smaller and emerging firms may struggle to bear these costs without significant scale or technology partnerships

- Rising fuel and labor costs, combined with strict service-level requirements for ultra-fast deliveries, compress profit margins and make cost control a critical challenge

- The requirement for efficient reverse logistics (handling returns and failed deliveries) further increases operating expenses, particularly in sectors with high return rates such as fashion and electronics

- Seasonal demand spikes and unpredictable order surges make capacity planning and cost management more complex, requiring agile resource allocation and advanced analytics to sustain profitability

Same Day Delivery Market Scope

The market is segmented on the basis of application, mode of transportation, end-user, and service.

- By Application

On the basis of application, the same day delivery market is segmented into retail, e-commerce, healthcare, manufacturing, documents and letters, and others. The e-commerce segment dominated the largest market revenue share in 2024, primarily driven by growing consumer expectations for rapid delivery and the surge in online shopping across urban and semi-urban regions. Major online retailers and marketplaces have invested heavily in fulfillment infrastructure and logistics partnerships to ensure quicker turnaround times, reinforcing the dominance of this segment. The demand for express delivery in e-commerce is further supported by last-mile delivery innovations and real-time tracking capabilities that enhance customer satisfaction.

The healthcare segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the critical need for timely delivery of medical supplies, prescription drugs, lab samples, and equipment. Same day delivery in healthcare ensures minimal disruption to treatment schedules and enhances patient outcomes, particularly in emergency and chronic care cases. The rising adoption of home healthcare services and telemedicine is also driving the need for rapid, reliable delivery solutions within this segment.

- By Mode of Transportation

On the basis of mode of transportation, the market is segmented into airways, roadways, railways, and intermodal. The roadways segment held the largest market revenue share in 2024 due to the extensive road networks and flexibility in routing and scheduling for last-mile delivery. Road transport allows logistics providers to service both densely populated urban zones and suburban areas, making it highly cost-effective and adaptable. The growing deployment of electric delivery vehicles and AI-based route optimization technologies has further enhanced the efficiency of roadway delivery networks.

The airways segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rising cross-border e-commerce demand and the need for ultra-fast delivery of high-value or time-sensitive goods. Airways enable long-distance same day shipping, especially for international service routes and express parcel requirements. The adoption of cargo drones and air freight automation is also expected to enhance the capabilities of this segment in the coming years.

- By End User

On the basis of end user, the market is segmented into business to business (B2B), business to customer (B2C), and customer to customer (C2C). The B2B segment held the largest market revenue share of 62% in 2024, driven by the high volume of time-sensitive deliveries between suppliers, manufacturers, and distributors across sectors such as healthcare, automotive, and electronics. Businesses rely on same day delivery to maintain operational continuity, meet just-in-time inventory requirements, and reduce downtime, especially for critical components and documents. The segment also benefits from established contractual relationships and recurring demand patterns, ensuring consistent shipment volumes and higher margins for service providers.

The C2C segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the expansion of peer-to-peer platforms and personal courier services. Consumers are increasingly engaging in secondhand goods exchange, gifting, and freelance logistics, requiring same day delivery capabilities for localized and hyper-personalized shipping. The rise of on-demand delivery apps and crowd-sourced courier networks is helping scale this segment rapidly across urban centers.

- By Service

On the basis of service, the market is segmented into international service and domestic service. The domestic service segment captured the largest revenue share in 2024, owing to its dominance in urban logistics ecosystems, where retailers and logistics firms collaborate to fulfill intracity deliveries within a few hours. Growing urbanization, rising consumer demand for immediacy, and robust intra-country transport infrastructure are key enablers of domestic same day service.

The international service segment is expected to witness the fastest CAGR from 2025 to 2032 as globalization of commerce and international marketplace transactions continue to increase. Businesses are seeking competitive advantages by reducing international delivery lead times, particularly for time-critical shipments such as legal documents, high-value goods, and perishables. Technological advancements in customs clearance, integrated logistics platforms, and global air freight networks are fostering growth in this segment.

Same Day Delivery Market Regional Analysis

- North America dominated the same day delivery market with the largest revenue share of 39.1% in 2024, driven by high e-commerce penetration, strong logistics infrastructure, and growing consumer preference for rapid fulfillment

- Consumers in the region expect fast, flexible delivery options, prompting retailers and logistics providers to invest in last-mile delivery innovations and real-time tracking systems

- The expansion of urban delivery networks, coupled with high internet usage and mobile commerce adoption, is reinforcing the demand for same day services across both B2B and B2C channels

U.S. Same Day Delivery Market Insight

The U.S. accounted for the largest revenue share within the North American same day delivery market in 2024. This growth is driven by the widespread expansion of e-commerce platforms and the increasing preference for ultra-fast delivery among consumers. Key sectors such as healthcare, food, and fashion are seeing rapid adoption of same day logistics, fueled by competitive pressure to meet customer expectations. The U.S. market benefits from an expansive transportation network, a mature warehousing ecosystem, and the proliferation of gig economy-based delivery models. Investments in automation, robotics, and smart logistics hubs continue to support the scalability and efficiency of same day delivery services nationwide.

Europe Same Day Delivery Market Insight

The Europe same day delivery market is projected to grow at a steady CAGR during the forecast period, supported by increasing urbanization, rising demand for quick commerce, and robust retail digitization. Countries across the region are witnessing higher consumer expectations for fast, convenient deliveries—especially in metro areas. Businesses are responding by deploying micro-fulfillment centers, sustainable delivery vehicles, and hybrid last-mile solutions. In addition, environmental regulations encouraging the use of low-emission transport methods and growing emphasis on circular logistics are shaping the evolution of the market. The integration of click-and-collect and local courier services is also gaining traction, particularly in the retail and grocery segments.

U.K. Same Day Delivery Market Insight

The U.K. same day delivery market is expected to grow at a notable CAGR through 2032, driven by the country’s advanced retail infrastructure and growing demand for same day and scheduled deliveries. E-commerce penetration is high, and consumer expectations for delivery speed continue to rise, particularly in densely populated urban centers. Businesses are leveraging same day delivery to enhance customer satisfaction and reduce cart abandonment. The increasing use of technology such as AI-based route optimization, contactless delivery, and real-time order tracking is helping companies improve delivery performance and manage operational costs efficiently.

Germany Same Day Delivery Market Insight

The Germany same day delivery market is anticipated to witness substantial growth over the forecast period, underpinned by the country’s robust industrial base and emphasis on precision logistics. Businesses in healthcare, automotive, and electronics sectors are increasingly relying on same day delivery to meet urgent operational needs. Germany’s efficient road and rail infrastructure, along with continued investments in logistics digitization and warehouse automation, supports reliable same day operations. Furthermore, growing environmental awareness is prompting the use of electric vehicles and bike couriers in urban deliveries, aligning with both consumer preferences and regulatory goals.

Asia-Pacific Same Day Delivery Market Insight

The Asia-Pacific region is poised to register the fastest CAGR from 2025 to 2032 in the same day delivery market. This growth is driven by rapid urbanization, rising disposable incomes, and an accelerating shift toward online shopping in key markets such as China, Japan, and India. Government-backed initiatives to digitize supply chains and modernize transport infrastructure are enabling logistics companies to offer faster and more efficient delivery services. In addition, the emergence of tech-savvy consumers, coupled with high smartphone penetration and mobile commerce usage, is boosting demand for instant delivery options across retail, food, and healthcare sectors. The availability of low-cost labor and an expanding network of third-party logistics providers are also fueling service scalability.

Japan Same Day Delivery Market Insight

Japan’s same day delivery market is gaining traction due to a strong emphasis on punctuality, service quality, and consumer convenience. With growing demand for express delivery in retail and C2C segments, Japanese logistics providers are implementing high-tech solutions, including robotics and automated warehousing, to meet rising service expectations. The country’s aging population is also contributing to the need for easy-to-use and reliable delivery systems, particularly for pharmaceuticals and essential goods. Smart city initiatives and integration of IoT-enabled delivery tracking are further enhancing the appeal of same day services in both urban and suburban environments.

China Same Day Delivery Market Insight

China accounted for the largest market share in Asia-Pacific’s same day delivery segment in 2024, supported by its expansive urban population, advanced digital infrastructure, and dominance of domestic e-commerce giants. Platforms such as JD.com and Alibaba have pioneered same day delivery through investments in intelligent logistics networks and AI-powered fulfillment centers. Strong consumer appetite for convenience, paired with widespread use of mobile wallets and shopping apps, is driving demand for instant delivery across retail, food, and electronics categories. In addition, the country’s rapid adoption of smart city technologies and the growing presence of domestic delivery startups are accelerating innovation and market expansion.

Same Day Delivery Market Share

The same day delivery industry is primarily led by well-established companies, including:

- A1 Express Delivery Company (U.S.)

- Aramex (U.A.E)

- DHL International GmbH (Germany)

- Dropoff, Inc. (U.S.)

- FedEx (U.S.)

- Jet Delivery, Inc. (U.S.)

- Power Link Expedite (U.S.)

- USACouriers (U.S.)

- XPO Logistics, Inc. (U.S.)

- 1-800Courier (U.S.)

- Aztec Couriers LLC (U.S.)

- RDS Same-Day Delivery (U.S.)

- American Expediting (U.S.)

- Tailwind Delivery - Take Out LLC (U.S.)

- D.C. Express, Inc. (U.S.)

- BKS SameDay Courier, LLC (U.S.)

- Econo-Courier (U.S.)

Latest Developments in Global Same Day Delivery Market

- In January 2024, Flipkart announced the launch of same-day delivery services at no additional cost, starting February 2024. By initially rolling out the service in 20 Indian cities including Bengaluru, Mumbai, Delhi, and Chennai, this move is expected to significantly strengthen Flipkart’s competitive position in India’s fast-growing e-commerce market by meeting rising consumer expectations for ultra-fast delivery

- In May 2023, FedEx Express, a subsidiary of FedEx Corp, expanded its same-day delivery service to enhance user experience beyond Seoul and the Greater Seoul area. This new service now includes inbound shipments from Asia and Europe, allowing customers to receive non-dutiable shipments on the same day as flight arrivals. This move aims to improve delivery efficiency and reach more customers

- In April 2023, Ecom Express Limited introduced a suite of express logistics solutions—Same Day Delivery+ (SDD+), Same Day Delivery (SDD), and Next Day Delivery (NDD)—targeted at enhancing service levels for e-commerce businesses in India. These offerings are poised to improve delivery speed and customer satisfaction, thereby positioning the company as a key enabler of rapid fulfillment in India’s evolving digital retail landscape

- In June 2021, FedEx partnered with Nuro to integrate autonomous vehicles into its last-mile delivery system. This collaboration focuses on incorporating autonomous technology for same-day and specialty deliveries. By leveraging Nuro's expertise in autonomous vehicles, FedEx aims to innovate its delivery services, enhancing efficiency and potentially reducing delivery times while expanding its delivery capabilities

- In December 2020, Drop-off Inc completed the acquisition of QCS Logistics, expanding its geographical reach. This strategic acquisition allows Drop-off Inc to enhance its same-day delivery services and extend its market presence. By integrating QCS Logistics’ operations, Drop-off Inc aims to improve its logistical capabilities and service coverage, reinforcing its position in the logistics and delivery sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.