Global Sales Force Automation Software Market, By Application (Lead Management, Sales Forecasting, Order and Invoices Management, Opportunity Management, Others), Deployment Type (Cloud, On- Premises), Industry Vertical (Automotive, Media and Entertainments, Healthcare, Retail, Telecom, Food and Beverage, BFSI, Others), Organization Type (Small-Medium Scale Size Enterprise, Large Scale Enterprises), Software (On-Premise Salesforce Automation System, Software-As-A-Service (SaaS) Salesforce automation System, Cloud-Based Salesforce Automation System) – Industry Trends and Forecast to 2031.

Sales Force Automation Software Market Analysis and Size

Sales performance management (SPM) is a key application within the global sales force automation software market. It enables organizations to optimize sales processes by automating tasks such as lead management, opportunity tracking, and performance analytics. SPM solutions enhance sales team efficiency, align sales goals with business objectives, and provide real-time insights to drive informed decision-making.

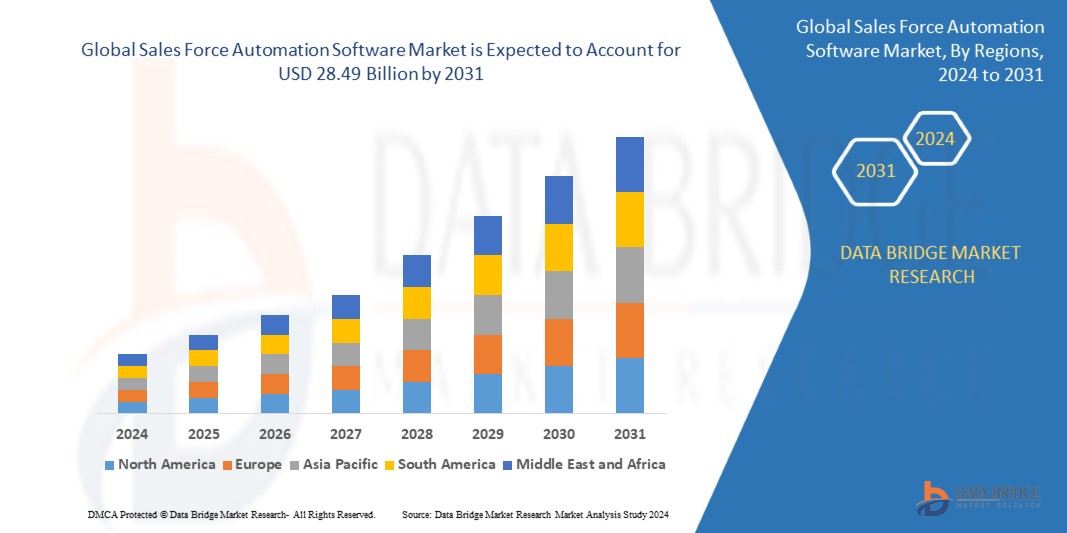

Data Bridge Market Research analyses the global sales force automation software market, which was USD 11.42 billion in 2023, is expected to reach USD 28.49 billion by 2031, at a CAGR of 12.1% during the forecast period 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Application (Lead Management, Sales Forecasting, Order and Invoices Management, Opportunity Management, Others), Deployment Type (Cloud, On- Premises), Industry Vertical (Automotive, Media and Entertainments, Healthcare, Retail, Telecom, Food and Beverage, BFSI, Others), Organization Type (Small-Medium Scale Size Enterprise, Large Scale Enterprises), Software (On-Premise Salesforce Automation System, Software-As-A-Service (SaaS) Salesforce automation System, Cloud-Based Salesforce Automation System)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa

|

|

Market Players Covered

|

SugarCRM Inc. (U.S.), Aptean (U.S.), Creatio (U.S.), Infor (U.S.), Oracle (U.S.), Pegasystems Inc. (U.S.), SAP SE (Germany), Salesforce, Inc. (U.S.), Zoho Corporation Pvt. Ltd. (India), Bullhorn, Inc. (U.S.), Microsoft (U.S.), Technology Group International (U.S.), ACG Infotech Ltd. (India), Ayoka, L.L.C (U.S.), Consensus Sales, Inc. (U.S.), eLeader (Poland), TechManyata Software Solutions Pvt. Ltd. (India), Sage Group plc (U.K.), IBM (U.S.), Adobe (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Sales force automation software is a technology solution designed to streamline and automate various aspects of the sales process. It encompasses tools for lead management, opportunity tracking, contact management, and sales forecasting. This software enhances sales team efficiency by automating repetitive tasks, improving communication, and providing a centralized platform for managing customer interactions. With features such as workflow automation and analytics, sales force automation software aims to optimize the sales cycle and boost overall productivity.

Global Sales Force Automation Software Market Dynamics

Drivers

- Rising Preference for Cloud-Based Solutions Increases the Adoption of Sales Force Automation Software

Organizations are increasingly recognizing the inherent advantages of cloud technology, such as flexibility, scalability, and accessibility. Cloud-based SFA solutions offer businesses the ability to streamline their sales processes, improve collaboration, and enhance overall efficiency. This trend is driven by the desire for real-time data access and the ability to empower sales teams with tools that facilitate remote work. The cost-effectiveness and ease of implementation associated with cloud solutions further contribute to their popularity, making them a key driver in shaping the trajectory of the sales force automation software market.

- Rise in Smartphone Penetration Expands the Potential User Base Among the Consumers

As more consumers and businesses adopt smartphones globally, the mobile platform becomes an integral channel for sales activities. Sales force automation software, designed to enhance sales processes, benefits immensely from the ubiquity of smartphones. The widespread accessibility allows sales teams to access critical information, communicate with clients, and manage tasks on the go, leading to increased efficiency and responsiveness. This trend expands the potential user base for such software and underscores the industry's evolution towards mobile-centric solutions, meeting the demands of an increasingly mobile-dependent business environment.

Opportunities

- Expansion of Sales Force Automation Software with the Rising Demand of BFSI

As the BFSI industry experiences a surge in digital transformation initiatives, SFA solutions become crucial for optimizing sales processes, managing customer relationships, and enhancing operational efficiency. The dynamic nature of the BFSI landscape, coupled with the need for advanced analytics and streamlined workflows, positions SFA software as an indispensable tool for financial institutions. The software's ability to automate sales tasks, provide real-time insights, and improve customer engagement aligns perfectly with the evolving needs of the BFSI sector, making it a key driver for the continued expansion of the sales force automation software market.

- Increasing Emphasis on Efficiency Among Different Businesses

Organizations are increasingly recognizing the pivotal role of automation in optimizing sales processes, reducing manual workload, and enhancing overall productivity. As companies strive to streamline their operations and gain a competitive edge, the demand for sales force automation software is poised to surge. This trend is driven by the software's ability to automate repetitive tasks, improve data accuracy, and provide valuable insights, thereby allowing sales teams to allocate their time more strategically and focus on high-value activities.

Restraints/Challenges

- Limited Availability of Technical Support Affects the Seamless Integration

Limited availability hampers the seamless integration, troubleshooting, and overall functionality of the software for businesses. Companies may face challenges in resolving issues promptly, leading to potential disruptions in their sales processes. This limitation can result in increased downtime, decreased user satisfaction, and hindered adoption rates. Moreover, the absence of accessible and efficient technical support may discourage potential customers from investing in SFA solutions, impacting market growth.

- High Implementation Costs Limits the Market Penetration

Many organizations, particularly small and medium-sized enterprises, may find the initial investment in SFA systems prohibitive. The expenses involve not only software licensing but also customization, training, and integration with existing infrastructure. These financial barriers can dissuade potential adopters, limiting the market penetration of SFA solutions. Ongoing maintenance and support costs contribute to the financial burden, potentially making it challenging for some businesses to justify the adoption of SFA technology.

This global sales force automation software market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global sales force automation software market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In March 2023, HubSpot CRM launched innovative tools, ChatSpot.ai and content assistance, powered by artificial intelligence. These tools aim to enhance customer efficiency by saving time in network building. HubSpot's strategic investment in AI encompasses predictive capabilities, content optimization, data quality tools, conversation intelligence, and data enrichment, reflecting their commitment to cutting-edge CRM solutions

- In July 2020, Salesforce launched Salesforce Anywhere, a cloud-based collaboration platform. This platform facilitates seamless collaboration among teams, enabling real-time communication and data sharing. The launch exemplifies Salesforce's dedication to providing advanced cloud solutions to enhance teamwork and productivity for its users

- In August 2020, Oracle collaborated with Adobe to deliver a comprehensive customer experience platform. This collaboration aimed to integrate Oracle's technology with Adobe's expertise, providing businesses with a powerful solution for managing and optimizing customer experiences across various touchpoints

- In September 2020, Microsoft launched Microsoft Dynamics 365, a cloud-based customer relationship management (CRM) solution. This platform offers businesses a versatile and scalable CRM tool, leveraging cloud technology to streamline processes and enhance customer interactions. Microsoft's introduction of Dynamics 365 underscores its commitment to delivering advanced and integrated CRM solutions to the market

Global Sales Force Automation Software Market Scope

The global sales force automation software market is segmented on the basis of application, deployment type, industry vertical, organization type, and software. The growth amongst the different segments helps you in attaining the knowledge related to the different growth factors expected to be prevalent throughout the market and formulate different strategies to help identify core application areas and the difference in your target market.

Application

- Lead Management

- Sales Forecasting

- Order and Invoices Management

- Opportunity Management

- Others

Deployment Type

- Cloud

- On- Premises

Industry Vertical

- Automotive

- Media and Entertainments

- Healthcare

- Retail

- Telecom

- Food and Beverage

- BFSI

- Others

Organization Type

- Small-Medium Scale Size Enterprise

- Large Scale Enterprises

Software

- On-Premise Salesforce Automation System

- Software-As-A-Service (SaaS) Salesforce Automation System

- Cloud-Based Salesforce Automation System

Global Sales Force Automation Software Market Region Analysis/Insights

The global sales force automation software market is analysed and market size, volume information is provided by country, application, deployment type, industry vertical, organization type, and software as referenced above.

The countries covered in the global sales force automation software market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The Asia-Pacific domnates the global sales force automation software market, driven by a surge in startup investments and advancements in mobile technology. This dominance is expected to persist as the region remains a key hub for innovation and growth in the sales automation sector.

The country section of the global sales force automation software market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Sales Force Automation Software Market Share Analysis

The global sales force automation software market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global sales force automation software market.

Some of the major players operating in the global sales force automation software market are

- SugarCRM Inc. (U.S.)

- Aptean (U.S.)

- Creatio (U.S.)

- Infor (U.S.)

- Oracle (U.S.)

- Pegasystems Inc. (U.S.)

- SAP SE (Germany)

- Salesforce, Inc. (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- Bullhorn, Inc. (U.S.)

- Microsoft (U.S.)

- Technology Group International (U.S.)

- ACG Infotech Ltd. (India)

- Ayoka, L.L.C (U.S.)

- Consensus Sales, Inc. (U.S.)

- eLeader (Poland)

- TechManyata Software Solutions Pvt. Ltd. (India)

- Sage Group plc (U.K.)

- IBM (U.S.)

- Adobe (U.S.)

SKU-