Global Sales Force Automation Software Market

Market Size in USD Billion

CAGR :

%

USD

12.80 Billion

USD

31.92 Billion

2024

2032

USD

12.80 Billion

USD

31.92 Billion

2024

2032

| 2025 –2032 | |

| USD 12.80 Billion | |

| USD 31.92 Billion | |

|

|

|

|

Sales Force Automation Software Market Size

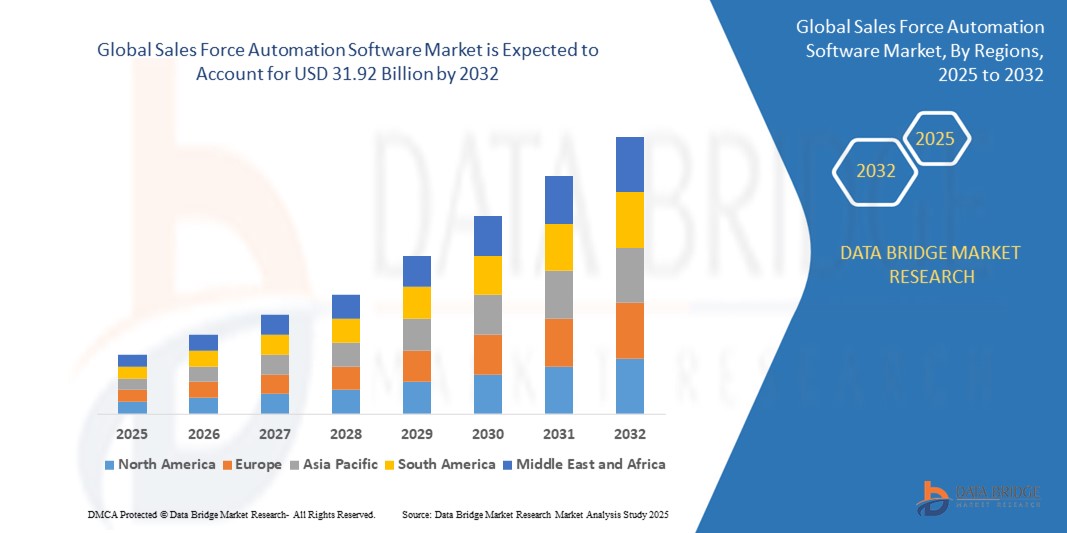

- The global sales force automation software market size was valued at USD 12.80 billion in 2024 and is expected to reach USD 31.92 billion by 2032, at a CAGR of 12.10% during the forecast period

- The market growth is primarily driven by the increasing adoption of digital transformation strategies across industries, coupled with the need for streamlined sales processes and enhanced customer relationship management

- Growing demand for data-driven decision-making, real-time analytics, and seamless integration with CRM platforms is positioning sales force automation software as a critical tool for businesses aiming to optimize sales performance.

Sales Force Automation Software Market Analysis

- Sales force automation (SFA) software enables businesses to automate sales processes, manage customer interactions, and improve operational efficiency through tools for lead tracking, sales forecasting, and opportunity management

- The surge in demand for SFA software is fueled by the need for improved productivity, enhanced customer engagement, and the growing adoption of cloud-based solutions for scalability and accessibility

- Asia-Pacific dominated the sales force automation software market with the largest revenue share of 38.5% in 2024, driven by rapid digitalization, increasing adoption of cloud technologies, and a strong presence of technology-driven enterprises in countries like China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period, propelled by advanced technological infrastructure, high investments in automation, and the presence of key market players in the U.S. and Canada

- The lead management segment holds the largest market revenue share of 32.3% in 2024, driven by its critical role in streamlining the sales process by effectively capturing, nurturing, and tracking leads. This enables businesses to maximize conversion rates and optimize sales efforts

Report Scope and Sales Force Automation Software Market Segmentation

|

Attributes |

Sales Force Automation Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Sales Force Automation Software Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The Global Sales Force Automation (SFA) software market is witnessing a significant trend of integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into sales performance, customer behavior, and predictive sales outcomes

- AI-powered SFA solutions allow for more proactive problem-solving, identifying potential issues in the sales pipeline or predicting customer churn before they lead to lost revenue

- For instance, several companies are developing AI-driven platforms that analyze customer interactions and historical sales data to offer personalized product recommendations or optimize sales strategies based on real-time market trends

- This trend is enhancing the value proposition of SFA systems, making them more attractive to both individual sales professionals and large enterprises

- AI algorithms can analyze a vast array of sales activities, including lead conversion rates, deal closure probabilities, customer engagement metrics, and even sales rep performance

Sales Force Automation Software Market Dynamics

Driver

“Rising Demand for Enhanced Sales Productivity and Customer Relationship Management”

- The increasing demand for improved sales productivity, streamlined workflows, and effective customer relationship management (CRM) is a major driver for the Sales Force Automation software market

- SFA systems enhance sales efficiency by automating repetitive tasks such as lead management, order processing, and sales forecasting, allowing sales teams to focus on higher-value activities

- The growing adoption of cloud-based solutions for scalable sales automation and the rising need for real-time analytics and data-driven decision-making are further contributing to the widespread adoption of SFA

- The proliferation of mobile technology and the development of 5G technology are further enabling the expansion of SFA applications, offering faster data transmission and lower latency for more sophisticated field sales services

- Businesses are increasingly recognizing the pivotal role of automation in optimizing sales processes, reducing manual workload, and enhancing overall productivity

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The substantial initial investment required for software licenses, integration with existing systems, and training for SFA solutions can be a significant barrier to adoption for many small and medium-sized enterprises (SMEs), especially in emerging markets

- Integrating SFA software into existing CRM or ERP systems can be complex and costly, requiring specialized IT expertise

- In addition, data security and privacy concerns pose a major challenge. SFA systems collect and transmit vast amounts of sensitive customer and sales data, raising concerns about potential breaches, misuse of information, and compliance with data protection regulations

- The fragmented regulatory landscape across different countries regarding data collection, storage, and usage further complicates operations for international software providers

- These factors can deter potential buyers and limit market expansion, particularly in regions where awareness of data privacy is high or where cost sensitivity is a significant factor

Sales Force Automation Software market Scope

The market is segmented on the basis of application, deployment type, industry vertical, organization type, and software.

- By Application

On the basis of application, the global sales force automation software market is segmented into lead management, sales forecasting, order and invoices management, opportunity management, and others. The lead management segment holds the largest market revenue share of 32.3% in 2024, driven by its critical role in streamlining the sales process by effectively capturing, nurturing, and tracking leads. This enables businesses to maximize conversion rates and optimize sales efforts.

The sales forecasting segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing need for accurate sales predictions to optimize resource allocation, inventory management, and strategic planning. Advanced analytics and AI integration are further enhancing the precision and adoption of sales forecasting tools.

- By Deployment Type

On the basis of deployment type, the global sales force automation software market is segmented into cloud and on-premises. The cloud deployment type is expected to hold the largest market revenue share of 46% in 2024, primarily driven by its flexibility, scalability, and lower upfront costs. Cloud-based solutions offer accessibility from anywhere, enabling remote sales teams and real-time data synchronization, which are crucial for modern businesses.

The on-premises deployment type is expected to witness significant growth, driven by organizations with specific security and compliance requirements or those preferring greater control over their data and infrastructure.

- By Industry Vertical

On the basis of industry vertical, the global sales force automation software market is segmented into automotive, media and entertainments, healthcare, retail, telecom, food and beverage, BFSI, and others. The BFSI segment is expected to hold the largest market revenue share of 52% in 2024, driven by the sector's high volume of customer interactions and the critical need for efficient lead management, customer relationship tracking, and regulatory compliance. Sales force automation helps streamline complex sales processes and enhance customer service in financial institutions.

The retail segment is anticipated to experience robust growth from 2025 to 2032, fueled by the increasing adoption of SFA to manage diverse customer bases, track sales performance across multiple channels, and personalize customer experiences. The competitive retail landscape necessitates efficient sales operations to drive revenue and customer loyalty.

- By Organization Type

On the basis of organization type, the global sales force automation software market is segmented into small-medium scale size enterprise and large scale enterprises. The large scale enterprises segment is expected to hold the largest market revenue share in 2024, primarily driven by their complex sales structures, extensive customer bases, and the need for comprehensive SFA solutions to manage vast amounts of data, automate workflows, and ensure consistent sales processes across diverse teams and regions.

The small-medium scale size enterprise segment is anticipated to witness rapid growth from 2025 to 2032, fueled by the increasing awareness of SFA benefits for improving efficiency, scalability, and competitiveness, along with the availability of affordable and user-friendly cloud-based solutions tailored to their needs.

- By Software

On the basis of software, the global sales force automation software market is segmented into on-premise salesforce automation system, software-as-a-service (SaaS) salesforce automation system, and cloud-based salesforce automation system. The software-As-A-Service (SaaS) salesforce automation System is expected to hold the largest market revenue share in 2024, driven by its subscription-based model, ease of deployment, automatic updates, and scalability. SaaS offers businesses a cost-effective and flexible way to access powerful SFA functionalities without significant IT infrastructure investments.

The cloud-based salesforce automation system is expected to witness the fastest growth from 2025 to 2032, driven by the increasing demand for remote accessibility, real-time collaboration, and seamless integration with other cloud-based business applications. The agility and cost-effectiveness of cloud solutions are accelerating their adoption

Sales Force Automation Software Market Regional Analysis

- Asia-Pacific dominated the sales force automation software market with the largest revenue share of 38.5% in 2024, driven by rapid digitalization, increasing adoption of cloud technologies, and a strong presence of technology-driven enterprises in countries like China, Japan, and India

- The region benefits from expanding automotive, healthcare, retail, and BFSI sectors, which are increasingly leveraging SFA for enhanced sales efficiency and customer relationship management

- Growth is supported by government initiatives promoting digitalization and the rising awareness among businesses about the benefits of sales process optimization

U.S. Sales Force Automation Software Market Insight

The U.S. sales force automation software market fastest-growing region during the forecast period, fueled by a mature technology landscape, high adoption of cloud-based solutions, and a strong focus on improving sales productivity across various industry verticals. The trend towards integrating AI and machine learning into SFA platforms further boosts market expansion, particularly in large-scale enterprises. Growing investment in digital infrastructure and the presence of key market players also contribute to its significant share.

Europe Sales Force Automation Software Market Insight

The Europe sales force automation software market is expected to witness significant growth, supported by increasing regulatory emphasis on data privacy and security, and a growing demand for customized sales solutions. Businesses across Germany, France, and the UK are actively seeking SFA tools to streamline lead management, sales forecasting, and order processing. The focus on digital transformation initiatives and the need for improved customer engagement drive the adoption of SFA software in both new installations and existing system upgrades.

U.K. Sales Force Automation Software Market Insight

The U.K. market for sales force automation software is expected to witness substantial growth, driven by a strong demand for enhanced sales efficiency and improved customer relationship management in urban and suburban settings. Increased interest in cloud-based SFA solutions and rising awareness of their benefits in lead management and sales forecasting encourage adoption. In addition, evolving business needs and the push for digital transformation influence consumer choices, balancing feature richness with compliance.

Germany Sales Force Automation Software Market Insight

Germany is expected to witness significant growth in Sales Force automation software, attributed to its advanced industrial sector and high consumer focus on efficiency and data security. German businesses prefer technologically advanced SFA solutions that optimize sales processes, improve lead conversion rates, and provide accurate sales forecasting. The integration of these solutions in the automotive, manufacturing, and retail sectors, alongside strong aftermarket options, supports sustained market growth.

Asia-Pacific Sales Force Automation Software Market Insight

The Asia-Pacific region is the dominated the global sales force automation software market share of 77.7% in 2024, driven by expanding digital infrastructure, rising disposable incomes, and a rapidly growing SME sector in countries such as China, India, and Japan. Increasing awareness of the benefits of lead management, sales forecasting, and opportunity management is boosting demand. Government initiatives promoting digitalization and business automation further encourage the use of advanced SFA solutions.

Japan Sales Force Automation Software Market Insight

Japan's Sales Force automation software market is expected to witness substantial growth due to a strong consumer preference for high-quality, technologically advanced SFA solutions that enhance sales efficiency and improve customer satisfaction. The presence of major automotive manufacturers, electronics companies, and a focus on smart business solutions accelerate market penetration. Rising interest in cloud-based SFA and SaaS models also contributes to growth.

China Sales Force Automation Software Market Insight

China holds the largest share of the Asia-Pacific sales force automation software market, propelled by rapid urbanization, rising business ownership, and increasing demand for efficient sales and customer management solutions. The country's growing middle class and focus on smart mobility and digital transformation support the adoption of advanced SFA software. Strong domestic software manufacturing capabilities and competitive pricing enhance market accessibility.

Sales Force Automation Software Market Share

The sales force automation software industry is primarily led by well-established companies, including:

- SugarCRM Inc. (U.S.)

- Aptean (U.S.)

- Creatio (U.S.)

- Infor (U.S.)

- Oracle (U.S.)

- Pegasystems Inc. (U.S.)

- SAP SE (Germany)

- Salesforce, Inc. (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- Bullhorn, Inc. (U.S.)

- Microsoft (U.S.)

- Technology Group International (U.S.)

- ACG Infotech Ltd. (India)

- Ayoka, L.L.C (U.S.)

- Consensus Sales, Inc. (U.S.)

What are the Recent Developments in Global Sales Force Automation Software Market?

- In May 2025, Salesforce acquired Convergence.ai, an AI agent company specializing in advanced systems that perform complex, human-such as tasks in digital environments. This strategic move aims to enhance Salesforce’s AI capabilities, particularly within Agentforce, a key pillar of its AI strategy. By integrating Convergence’s adaptive AI technology, Salesforce seeks to accelerate the development of next-generation agents capable of navigating dynamic interfaces, managing multi-step workflows, and improving automation efficiency. The acquisition reinforces Salesforce’s commitment to AI-driven business automation

- In April 2025, SAP continued integrating its Business AI copilot, Joule, across sales, services, marketing, and commerce applications. Joule is now generally available in SAP S/4HANA Cloud Public Edition, enabling users to interact with SAP solutions using natural language. This advancement enhances productivity, streamlines workflows, and provides intelligent recommendations for sales teams, significantly improving search efficiency. Joule is also integrated with Microsoft 365 Copilot, allowing seamless two-way access

- In March 2025, Zoho CRM rolled out several enhancements to improve speed, efficiency, and customization in communication workflows. Updates include faster inbox and conversation views, support for pooled numbers in workflow SMS, and nested merge fields for personalized messaging. In addition, bulk SMS capabilities now allow notifications for selected CRM users and customized campaign names. The Zoho CRM Inbox has been upgraded with contextual information, while SMS templates now support configurable date formats for greater flexibility

- In March 2023, HubSpot CRM introduced ChatSpot.ai and Content Assistant, two AI-powered tools designed to enhance customer efficiency and streamline network building. These innovations leverage predictive AI, content optimization, data quality tools, conversation intelligence, and data enrichment, reinforcing HubSpot’s commitment to cutting-edge CRM solutions. ChatSpot.ai enables users to add contacts, generate reports, and draft sales emails, while Content Assistant helps marketing and sales teams create high-quality content efficiently

- In July 2020, Salesforce introduced Salesforce Anywhere, a cloud-based collaboration platform designed to enable real-time communication and data sharing among teams. This solution integrates chat, alerts, comments, and video directly into the Salesforce CRM, ensuring seamless team collaboration without switching between multiple tools. The platform enhances productivity by allowing users to sell, service, market, and collaborate from anywhere, reinforcing Salesforce’s commitment to advanced cloud solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.