Global Rumminant Feed Additives Market

Market Size in USD Million

CAGR :

%

USD

12.65 Million

USD

21.25 Million

2021

2029

USD

12.65 Million

USD

21.25 Million

2021

2029

| 2022 –2029 | |

| USD 12.65 Million | |

| USD 21.25 Million | |

|

|

|

|

Global Ruminant Feed Additives Market Analysis and Size

The global animal feed additives market is seeing an increase in demand for feed phytogenics, organic feed additives, mergers and acquisitions, value chain integration, and animal feed additives combinations. The sector contributes significantly to the economic and nutritional well-being of millions of people throughout the world. Moreover, the high awareness regarding the feed additives will also result in the expansion of the ruminant feed additives market.

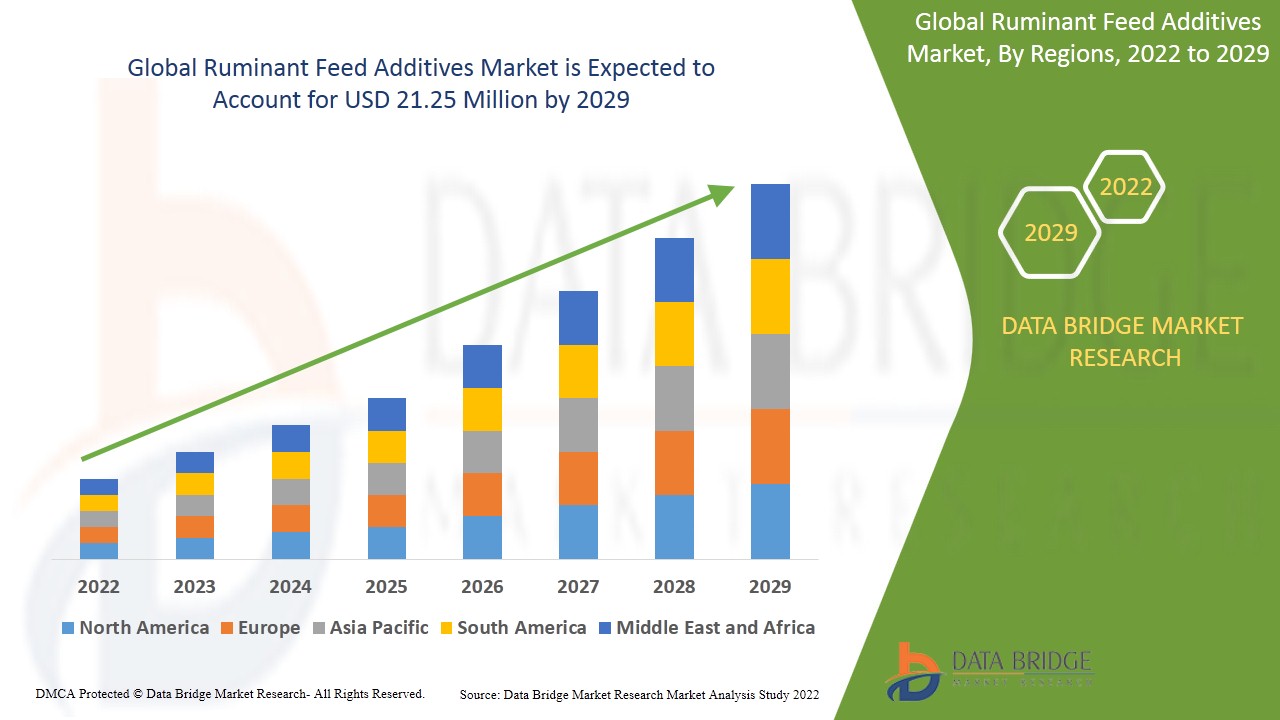

- Global ruminant feed additives market was valued at USD 12.65 million in 2021 and is expected to reach USD 21.25 million by 2029, registering a CAGR of 6.70% during the forecast period of 2022-2029. “Preservatives” dominates the product segment owing to the rising focus of the feed manufacturer on extending the shelf life of the feed within the market in the above mentioned forecasted period.

Global Ruminant Feed Additives Market Definition

Feed additives are nutritional supplements that are added to animal-derived goods to improve their quality. They normally include vitamins, minerals, amino acids, and other critical elements that help animals stay healthy and disease-free. Sensory additives that stimulate the animal's appetite, nutritional additives that provide a specific nutrient to the animal, zootechnical additives that maintain the overall nutritional balance in the animal's diet, and coccidiostats that release antibiotics that kill any bacteria in the animal's system are the most common types of feed additives used in animal feed. The ruminant feed additives are the feed additives for the ruminants. The main feed additives used in ruminant animals are ethoxyquin, terbutyl hydroxyquinone, propyl gallate, butylated hudroxytoluene, metal chelators and reducing agents like ascorbates and sulfites.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Form (Dry, Liquid), Type (Synthetic, Natural), Source (Plant, Animal, Microorganisms), Product (Amino Acids, Phosphates, Vitamins, Acidifiers, Carotenoids, Enzymes, Mycotoxin Detoxifiers, Flavors and Sweeteners, Minerals, Antioxidants, Antibiotics, Non-protein nitrogen, Phytogenics, Preservatives, Probiotics), Function (Single Function, Multifunction), End-User (Dairy Farm, Veterinary Hospitals, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Poland, Ireland, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Chile, Rest of South America, UAE, Saudi Arabia, Egypt, Kuwait, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

Cargill Incorporated (US), ADM (US), Dupont (US), Corporate.Evonik (Germany), BASF SE(Germany), DSM (Netherlands), Ajinomoto Co., Inc. (Japan), Novozymes (Denmark), Chr. Hansen Holding A/S (Denmark), TEGASA (Spain), Nutreco (Netherlands), Kemin Industries Inc. (US), Adisseo (France), Alltech (US), Palital Feed Additives B.V. (Netherlands), Global Nutrition International (France), Centafarm SRL (Italy), Bentoli (US), NUQO Feed Additives (France), and Novus International (US) |

Ruminant Feed Additives Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Increased Consumption of Animal Based Products

The growth in consumption of animal-based products, growth in feed production, standardization of meat products owing to disease outbreaks have led to the increased consumption of feed additives.

- Increased Awareness for Food Nutrients

The rising awareness about the role and dynamics of food nutrients (most importantly protein) will bolster the growth of the market in the above mentioned forecasted period. The overall physical and mental growth and development through essential nutrients are also projected to cushion the market’s growth. In addition to this, the growing trends associated with nutrients intake also drives the market’s growth.

- Growing Developments

Furthermore, the investments in research and developments and promotion of the feed additives products generate profitable opportunities to the market players in the forecast period of 2022 to 2029. The implementation of innovative animal husbandry practices to improve meat quality and technological advancements in meat processing are also carving the growth for the market.

Others

The growth determinants such as the increase in the number of feed mills and feed production across the globe are also projected to accelerate the growth of the market. Moreover, growth in rise in disposable incomes and urbanization are expected to further fuel growth of the market over the above mentioned forecasted period.

Restraints/Challenges Global Ruminant Feed Additives Market

- High Cost of Feed Additives

On the flip side, the increase in raw material prices because of rising cost of extraction from these sources, will create hindrances for the growth of the ruminant feed additives market in the above mentioned forecasted period.

- Stringent Guidelines

The stringent regulatory guidelines for feed additives is estimated to restrict the market’s growth. Moreover, the stringent lockdown regulations due to COVID-19 led to the disrupted supply chain, which will challenge the ruminant feed additives market in the above mentioned forecasted period.

This ruminant feed additives market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ruminant feed additives market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Post COVID-19 Impact on Ruminant Feed Additives Market

The recent outbreak of COVID-19 has largely impacted the industries across the globe. Due to the growing COVID-19 pandemic epidemic in multiple regions/countries, the worldwide market is expected to contract in 2020 as a result of country-specific lockdowns, international border closures, and delays in cross-border transit, all of which have hampered supply chains. Regional governments' social separation and other policies limit the number of persons who may work together in limited regions. Various lockdown and social distancing restrictions, international border closures, and delays in cross-border transit across the globe led to the contraction of the worldwide market which have hampered supply chains, which is expected to contract the market growth. The supply chain disruptions, stifling business growth, technology event cancellations, halt in new developments and has affected the overall production and sales of ruminant feed additives market.

On the brighter side, the restrictions of the government measures are likely to relax which will help the market to witness a slight increment in the upcoming years.

Recent Developments

- In February 202 1, Global animal nutrition experts Alltech and DLG Group (DLG) are teaming together with the goal of improving profitability and efficiency for livestock farmers in Scandinavia. Alltech and DLG are nearing completion on the acquisition of Kärki-Agri, a Finnish firm that will help them supply innovative, field-proven animal nutrition. This relationship follows Alltech and DLG's successful 2017 joint venture of AV Nutrismart Holdings, a premix company situated in Orenburg, Russia. In the Kärki-Agri joint venture in Seinäjoki, Finland, each company will own a 50 percent stake.

- In July 2020, ADM, a global leader in animal nutrition, announced the launch of NutriPass L, an encapsulated lysine supplement that is rumen-stable and intestinally available to cows. Lysine is an important amino acid that cows do not make naturally and must be supplemented with feedstuffs. Lysine is a biological building element that aids in lean tissue growth, milk component composition, and milk volume production. When compared to comparable products, NutriPass L has been demonstrated to meet or surpass net delivery of metabolizable lysine per 100 grammes of product. Producers can provide a balanced, cost-effective diet by reducing the use of higher-cost protein components in the ration by encapsulating lysine.

Global Ruminant Feed Additives Market Scope

The ruminant feed additives market is segmented on the basis of form, type, source, product, function and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Form

- Dry

- Liquid

On the basis of form, the ruminant feed additives market has been segmented into dry and liquid.

Type

- Synthetic

- Natural

On the basis of type, the ruminant feed additives market has been segmented into synthetic and natural.

Source

- Plant

- Animal

- Microorganisms

On the basis of source, the ruminant feed additives market has been segmented into plant, animal and microorganisms.

Product

- Amino Acids

- Phosphates

- Vitamins

- Acidifiers

- Carotenoids

- Enzymes

- Mycotoxin Detoxifiers

- Flavors and Sweeteners

- Minerals

- Antioxidants

- Antibiotics

- Non-protein nitrogen

- Phytogenics

- Preservatives

- Probiotics

On the basis of product, the ruminant feed additives market has been segmented into amino acids, phosphates, vitamins, acidifiers, carotenoids, enzymes, mycotoxin detoxifiers, flavors and sweeteners, minerals, antioxidants, antibiotics, non-protein nitrogen, phytogenics, preservatives and probiotics. The preservatives is estimated to register highest CAGR over the forecast period owing to the demand for feed preservatives has increased due to the rising focus of the feed manufacturers on extending the shelf life of the feed.

Function

- Single Function

- Multifunction

On the basis of function, the ruminant feed additives market has been segmented into single function and multifunction.

End-User

- Dairy Farm

- Veterinary Hospitals

- Others

On the basis of end-user, the ruminant feed additives market is segmented into dairy farm, veterinary hospitals and others.

Ruminant Feed Additives Market Regional Analysis/Insights

The ruminant feed additives market is analyzed and market size insights and trends are provided by country, form, type, source, product, function and end-user as referenced above.

The countries covered in the ruminant feed additives market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the ruminant feed additives market because of the owing to the rising population, rising per capita consumption of meat all over the globe and the rising adoption of intensive farming methods in the above mentioned forecasted period. Asia-Pacific, on the other hand, is estimated to register a significant growth owing to the presence of a large livestock population and an increase in the number of feed mills and feed production especially in countries such as India and Japan within the region in forecasted period from 2021 to 2029.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Ruminant Feed Additives Market Share Analysis

The ruminant feed additives market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ruminant feed additives market.

Some of the major players operating in the ruminant feed additives market are Cargill Incorporated (US), ADM (US), Dupont (US), Corporate.Evonik (Germany), BASF SE(Germany), DSM (Netherlands), Ajinomoto Co., Inc. (Japan), Novozymes (Denmark), Chr. Hansen Holding A/S (Denmark), TEGASA (Spain), Nutreco (Netherlands), Kemin Industries Inc. (US), Adisseo (France), Alltech (US), Palital Feed Additives B.V. (Netherlands), Global Nutrition International (France), Centafarm SRL (Italy), Bentoli (US), NUQO Feed Additives (France), and Novus International (US) among others.

Research Methodology : Global Ruminant Feed Additives Market

Data collection and base year analysis is done using data collection modules with large sample sizes. The stage includes the obtainment of market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analyzed and estimated using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis.

To know more about the research methodology, drop in an inquiry to speak to our industry experts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL RUMINANTS FEED ADDITIVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL RUMINANTS FEED ADDITIVES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL RUMINANTS FEED ADDITIVES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY TYPE

* (ASP, VALUE AND VOLUME WILL BE GIVEN FOR ALL SEGMENTS)

11.1 OVERVIEW

11.2 AMINO ACIDS

11.2.1 AMINO ACIDS, BY TYPE

11.2.1.1. LYSINE

11.2.1.2. METHIONINE

11.2.1.3. THREONINE

11.2.1.4. TRYPTOPHAN

11.2.1.5. VALINE

11.2.1.6. OTHERS

11.3 FIBER

11.3.1 FIBER, BY TYPE

11.3.1.1. PEA FIBER

11.3.1.2. WHEAT FIBER

11.3.1.3. BAMBOO FIBER

11.3.1.4. SOY FIBER

11.3.1.5. POTATO FIBER

11.3.1.6. CITRUS FIBER

11.3.1.7. CELLULOSE

11.3.1.8. OAT FIBER

11.3.1.9. APPLE FIBER

11.3.1.10. COCOA FIBER

11.3.1.11. ACACIA FIBER

11.3.1.12. SUGAR CANE FIBER

11.3.1.13. CORN FIBER

11.3.1.14. CARROT FIBER

11.3.1.15. SUGAR BEET FIBER

11.3.1.16. OTHERS

11.4 ANTIOXIDANTS

11.4.1 ANTIOXIDANTS, BY TYPE

11.4.1.1. BUTYLATED HYDROXYANISOLE (BHA)

11.4.1.2. BUTYLATED HYDROXYTOLUENE (BHT)

11.4.1.3. OTHERS

11.5 VITAMINS

11.5.1 VITAMINS, BY TYPE

11.5.1.1. WATER SOLUBLE

11.5.1.1.1. VITAMIN B

11.5.1.1.2. VITAMIN C

11.5.1.2. FAT SOLUBLE

11.5.1.2.1. VITAMIN A

11.5.1.2.2. VITAMIN D

11.5.1.2.3. VITAMIN E

11.5.1.2.4. VITAMIN K

11.6 MINERALS

11.6.1 MINERALS, BY TYPE

11.6.1.1. CALCIUM

11.6.1.2. CHLORIDE

11.6.1.3. CHROMIUM

11.6.1.4. COBALT

11.6.1.5. COPPER

11.6.1.6. IODINE

11.6.1.7. IRON

11.6.1.8. MAGNESIUM

11.6.1.9. MANGANESE

11.6.1.10. PHOSPHORUS

11.6.1.11. POTASSIUM

11.6.1.12. SELENIUM

11.6.1.13. SODIUM

11.6.1.14. ZINC

11.6.1.15. OTHERS

11.7 ENZYMES

11.7.1 ENZYMES, BY TYPE

11.7.1.1. CARBOHYDRASES

11.7.1.1.1. AMYLASES

11.7.1.1.2. CELLULASES

11.7.1.1.3. OTHERS

11.7.1.2. OXIDOREDUCTASES

11.7.1.2.1. GLUCOSE OXIDASE

11.7.1.2.2. LACCASES

11.7.1.2.3. LIPOXYGENASE

11.7.1.3. TRANSFERASES

11.7.1.3.1. CYCLODEXTRIN

11.7.1.3.2. GLYCOSYLTRANSFERASE

11.7.1.3.3. FRUCTOSYLTRANSFERASE

11.7.1.3.4. TRANSGLUTAMINASE

11.7.1.4. HYDROLASES

11.7.1.4.1. AMYLASES

11.7.1.4.2. INVERTASE

11.7.1.4.3. LACTASE

11.7.1.4.4. LIPASE

11.7.1.4.5. PROTEASES

11.7.1.4.6. PECTINASE

11.7.1.4.7. PEPTIDASE

11.7.1.4.8. PHOSPHOLIPASE

11.7.1.4.9. PHYTASES

11.7.1.4.10. XYLANASES

11.7.1.5. LYASES

11.7.1.6. ISOMERASES

11.7.1.7. POLYMERASE

11.7.1.8. NUCLEASES

11.7.1.9. OTHERS

11.8 NUTRITION LIPIDS

11.8.1 NUTRITION LIPIDS , BY TYPE

11.8.1.1. TRIGLYCERIDES (FATS AND OILS)

11.8.1.2. DIGLYCERIDES (PHOSPHOLIPIDS)

11.8.1.3. STEROIDS.

11.9 EUBIOTICS

11.9.1 EUBIOTICS, BY TYPE

11.9.1.1. ORGANIC ACIDS

11.9.1.2. PROBIOTICS

11.9.1.3. PREBIOTICS

11.9.1.4. PHYTOGENICS OR ESSENTIAL OILS

11.9.1.5. GUT HEALTH ENZYMES

11.1 CAROTENOIDS

11.10.1 CAROTENOIDS, BY TYPE

11.10.1.1. BETA-CAROTENE

11.10.1.2. LUTEIN

11.10.1.3. LYCOPENE

11.10.1.4. ASTAXANTHIN

11.10.1.5. ZEAXANTHIN

11.10.1.6. CANTHAXANTHIN

11.10.1.7. OTHERS

11.11 OTHERS

12 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY FEED TYPE

12.1 OVERVIEW

12.2 CATTLE

12.2.1 CATTLE, BY NUTRITION TYPE

12.2.1.1. AMINO ACIDS

12.2.1.2. FIBER

12.2.1.3. ANTIOXIDANTS

12.2.1.4. VITAMINS

12.2.1.5. MINERALS

12.2.1.6. ENZYMES

12.2.1.7. FISH OIL

12.2.1.8. NUTRITION LIPIDS

12.2.1.9. EUBIOTICS

12.2.1.10. CARTENOIDS

12.2.1.11. OTHERS

12.3 SHEEP

12.3.1 SHEEP, BY NUTRITION TYPE

12.3.1.1. AMINO ACIDS

12.3.1.2. FIBER

12.3.1.3. ANTIOXIDANTS

12.3.1.4. VITAMINS

12.3.1.5. MINERALS

12.3.1.6. ENZYMES

12.3.1.7. FISH OIL

12.3.1.8. NUTRITION LIPIDS

12.3.1.9. EUBIOTICS

12.3.1.10. CARTENOIDS

12.3.1.11. OTHERS

12.4 BUFFALO

12.4.1 BUFFALO, BY NUTRITION TYPE

12.4.1.1. AMINO ACIDS

12.4.1.2. FIBER

12.4.1.3. ANTIOXIDANTS

12.4.1.4. VITAMINS

12.4.1.5. MINERALS

12.4.1.6. ENZYMES

12.4.1.7. FISH OIL

12.4.1.8. NUTRITION LIPIDS

12.4.1.9. EUBIOTICS

12.4.1.10. CARTENOIDS

12.4.1.11. OTHER

12.5 GOAT

12.5.1 GOAT, BY NUTRITION TYPE

12.5.1.1. AMINO ACIDS

12.5.1.2. FIBER

12.5.1.3. ANTIOXIDANTS

12.5.1.4. VITAMINS

12.5.1.5. MINERALS

12.5.1.6. ENZYMES

12.5.1.7. FISH OIL

12.5.1.8. NUTRITION LIPIDS

12.5.1.9. EUBIOTICS

12.5.1.10. CARTENOIDS

12.5.1.11. OTHERS

12.6 CALVES

12.6.1 CALVES, BY NUTRITION TYPE

12.6.1.1. AMINO ACIDS

12.6.1.2. FIBER

12.6.1.3. ANTIOXIDANTS

12.6.1.4. VITAMINS

12.6.1.5. MINERALS

12.6.1.6. ENZYMES

12.6.1.7. FISH OIL

12.6.1.8. NUTRITION LIPIDS

12.6.1.9. EUBIOTICS

12.6.1.10. CARTENOIDS

12.6.1.11. OTHERS

13 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY PRODUCT FORM

13.1 OVERVIEW

13.2 DRY

13.3 LIQUID

14 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY SOURCE

14.1 OVERVIEW

14.2 SYNTHETIC

14.3 NATURAL

15 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY END USER

15.1 OVERVIEW

15.2 FEED MANUFACTUERERS

15.3 VETERINARIANS

15.4 PET FOOD MANUFACTUERERS

15.5 LIVESTOCK FARMERS

15.6 OTHERS

16 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY APPLICATION

16.1 OVERVIEW

16.2 JOINT-HEALTH

16.3 SKIN AND COAT

16.4 GASTROINTESTINAL TRACT

16.5 LIVER AND KIDNEY

16.6 HEART

16.7 OTHERS

17 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 HYPERMARKETS AND SUPERMARKETS

17.3 CONVENIENCE STORES

17.4 ONLINE STORES

17.5 OTHERS

18 GLOBAL RUMINANTS FEED ADDITIVES MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS & PARTNERSHIP

18.8 REGULATORY CHANGES

19 GLOBAL RUMINANTS FEED ADDITIVES MARKET, BY GEOGRAPHY

19.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

19.2 NORTH AMERICA

19.2.1 U.S.

19.2.2 CANADA

19.2.3 MEXICO

19.3 EUROPE

19.3.1 GERMANY

19.3.2 U.K.

19.3.3 ITALY

19.3.4 FRANCE

19.3.5 SPAIN

19.3.6 SWITZERLAND

19.3.7 NETHERLANDS

19.3.8 BELGIUM

19.3.9 RUSSIA

19.3.10 TURKEY

19.3.11 REST OF EUROPE

19.4 ASIA-PACIFIC

19.4.1 JAPAN

19.4.2 CHINA

19.4.3 SOUTH KOREA

19.4.4 INDIA

19.4.5 AUSTRALIA

19.4.6 SINGAPORE

19.4.7 THAILAND

19.4.8 INDONESIA

19.4.9 MALAYSIA

19.4.10 PHILIPPINES

19.4.11 REST OF ASIA-PACIFIC

19.5 SOUTH AMERICA

19.5.1 BRAZIL

19.5.2 ARGENTINA

19.5.3 REST OF SOUTH AMERICA

19.6 MIDDLE EAST AND AFRICA

19.6.1 SOUTH AFRICA

19.6.2 UAE

19.6.3 SAUDI ARABIA

19.6.4 KUWAIT

19.6.5 REST OF MIDDLE EAST AND AFRICA

20 GLOBAL RUMINANTS FEED ADDITIVES MARKET, SWOT & DBMR ANALYSIS

21 GLOBAL RUMINANTS FEED ADDITIVES MARKET, COMPANY PROFILE

21.1 CARGILL INCORPORATED

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 GEOGRAPHICAL PRESENCE

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 ADM

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 GEOGRAPHICAL PRESENCE

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENTS

21.3 DUPONT

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 GEOGRAPHICAL PRESENCE

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 CORPORATE.EVONIK

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 GEOGRAPHICAL PRESENCE

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 BASF SE

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 GEOGRAPHICAL PRESENCE

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 DSM

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 GEOGRAPHICAL PRESENCE

21.6.4 PRODUCT PORTFOLIO

21.6.5 RECENT DEVELOPMENTS

21.7 AJINOMOTO CO., INC.

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 GEOGRAPHICAL PRESENCE

21.7.4 PRODUCT PORTFOLIO

21.7.5 RECENT DEVELOPMENTS

21.8 NOVOZYMES

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 GEOGRAPHICAL PRESENCE

21.8.4 PRODUCT PORTFOLIO

21.8.5 RECENT DEVELOPMENTS

21.9 CHR. HANSEN HOLDING A/S

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 GEOGRAPHICAL PRESENCE

21.9.4 PRODUCT PORTFOLIO

21.9.5 RECENT DEVELOPMENTS

21.1 TEGASA

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 GEOGRAPHICAL PRESENCE

21.10.4 PRODUCT PORTFOLIO

21.10.5 RECENT DEVELOPMENTS

21.11 NUTRECO

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 GEOGRAPHICAL PRESENCE

21.11.4 PRODUCT PORTFOLIO

21.11.5 RECENT DEVELOPMENTS

21.12 KEMIN INDUSTRIES INC.

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 GEOGRAPHICAL PRESENCE

21.12.4 PRODUCT PORTFOLIO

21.12.5 RECENT DEVELOPMENTS

21.13 ADISSEO

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 GEOGRAPHICAL PRESENCE

21.13.4 PRODUCT PORTFOLIO

21.13.5 RECENT DEVELOPMENTS

21.14 ALLTECH

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 GEOGRAPHICAL PRESENCE

21.14.4 PRODUCT PORTFOLIO

21.14.5 RECENT DEVELOPMENTS

21.15 PALITAL FEED ADDITIVES B.V.

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 GEOGRAPHICAL PRESENCE

21.15.4 PRODUCT PORTFOLIO

21.15.5 RECENT DEVELOPMENTS

21.16 GLOBAL NUTRITION INTERNATIONAL

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 GEOGRAPHICAL PRESENCE

21.16.4 PRODUCT PORTFOLIO

21.16.5 RECENT DEVELOPMENTS

21.17 CENTAFARM SRL

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 GEOGRAPHICAL PRESENCE

21.17.4 PRODUCT PORTFOLIO

21.17.5 RECENT DEVELOPMENTS

21.17.6 COMPANY OVERVIEW

21.17.7 REVENUE ANALYSIS

21.17.8 GEOGRAPHICAL PRESENCE

21.17.9 PRODUCT PORTFOLIO

21.17.10 RECENT DEVELOPMENTS

21.18 BENTOLI

21.18.1 COMPANY OVERVIEW

21.18.2 REVENUE ANALYSIS

21.18.3 GEOGRAPHICAL PRESENCE

21.18.4 PRODUCT PORTFOLIO

21.18.5 RECENT DEVELOPMENTS

21.19 NUQO FEED ADDITIVES

21.19.1 COMPANY OVERVIEW

21.19.2 REVENUE ANALYSIS

21.19.3 GEOGRAPHICAL PRESENCE

21.19.4 PRODUCT PORTFOLIO

21.19.5 RECENT DEVELOPMENTS

21.2 NOVUS INTERNATIONAL

21.20.1 KEMIN INDUSTRI COMPANY OVERVIEW

21.20.2 REVENUE ANALYSIS

21.20.3 GEOGRAPHICAL PRESENCE

21.20.4 PRODUCT PORTFOLIO

21.20.5 RECENT DEVELOPMENTS

Note: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.