Global Rubber Additive Market

Market Size in USD Million

CAGR :

%

USD

5,340.64 Million

USD

8,196.20 Million

2022

2030

USD

5,340.64 Million

USD

8,196.20 Million

2022

2030

| 2023 –2030 | |

| USD 5,340.64 Million | |

| USD 8,196.20 Million | |

|

|

|

|

Rubber Additives Market Analysis and Size

Industrial construction and household electrical insulations are the dominating factor for driving the business line of the rubber additive market globally Due to their potential attribute of insulation rubber additives are the most preferred material for tire and tubing fabrication, consumer goods, and industrial construction

The increasing rate of vehicles and the automotive industry is defining the success verticals of the global rubber additive market in the forecasted period 2023 to 2030 However, the acrimonious rules and regulations imposed by the government may act as restraints for the rubber additive market, whereas the emission of hazardous gasses and pollutants hamper the ecosystem thus the restriction on the same may curb down the market growth.

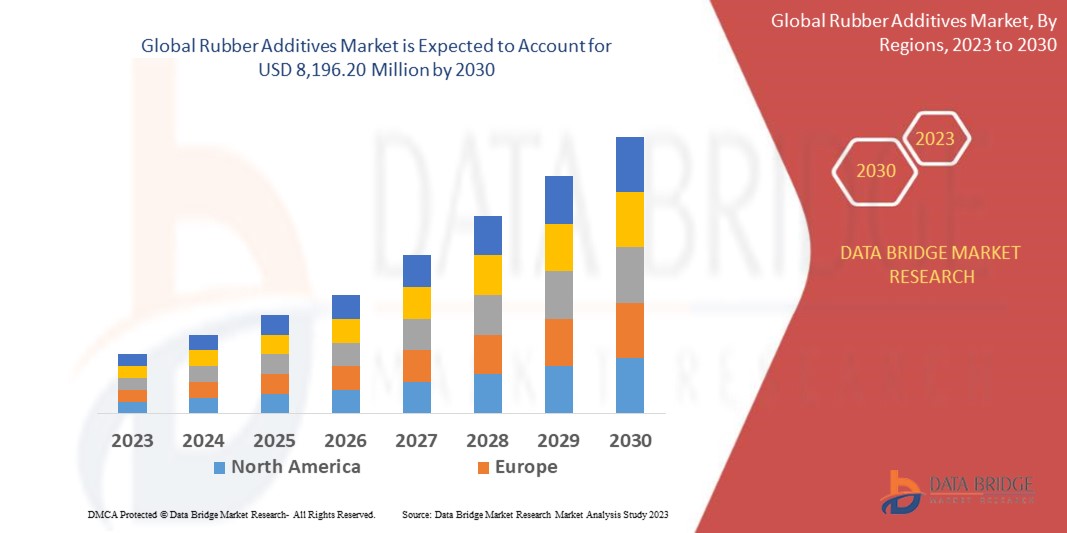

Data Bridge Market Research analyses that the rubber additives market which was USD 5,340.64 million in 2022, would rocket up to USD 8,196.20 million by 2030, and is expected to undergo a CAGR of 5.50% during the forecast period. This indicates the market value. Tire & Tubing dominates the end user segment of the rubber additives market due to the expansion of the tire and rubber industries in developing nations caused by industrialization.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Rubber Additives Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Accelerators, Activators, Peptizers, Antidegradants, Plasticizers, Tackifiers, Vulcanization Inhibitors, Rubber Antioxidant, Insoluble Sulfur, Others), Application (Adhesives, Electric Cables And Hoses, Insulation, Specialty Tapes, Tiers, Others), Coating Agents (Silicon, Teflon, Others), Materials (Fibre, Silica, Silicates, Carbon Black, Others), End User (Tire and Tubing, Consumer Goods, Construction, Electrical Insulation, Others) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Akrochem Corporation, Akzo Nobel N.V., Arkema, BEHN MEYER, Eastman Chemical Company, LANXESS, Struktol Company of America, LLC, Thomas Swan & Co. Ltd., LUMITOS AG, Wacker Chemie AG, Velox Solutions Pvt. Ltd., IMCD N.V., BASF SE, Solvay, China Petrochemical Corporation, Emery Oleochemicals, R.T. Vanderbilt Holding Company, Inc and among others. |

|

Market Opportunities |

|

Market Definition.

Rubber additives are rubber polymers processed by the amalgamation of some chemicals to increase or enhance the overall performance. Due to high viscosity and cross-linkage capability, they are tremendously adopted in industrial manufacturing and production. They represent the rubber industry through an array of portfolios such as processing agents, high-performance bladders for tires, anti-sun check waxes, and others.

Global Rubber Additives Market Dynamics

Drivers

- Increasing demand from non-tire rubber applications

Due to rubber additives strong demand in applications other than tires, it is predicted that the need for rubber additives would rise. Developing countries are rapidly industrializing, which is driving up demand for rubber goods. Additionally, the market for rubber additives that give rubber products excellent attributes is driven by the growing demand for high-quality rubber products.

- Growth in the tire and rubber industry

The demand for rubber additives is increasing due to the expansion of the tire and rubber industries. The market for rubber additives is significantly dominated by the tire industry. The automotive industry's rising need for tires, particularly in emerging markets, is anticipated to fuel market expansion. The growing customer preference for tires that last longer and are more robust is also anticipated to increase demand for rubber additives.

Opportunities

High-performance rubbers have become more common as a result of technological advancements and advances in the rubber sector. These materials offer excellent qualities such as high strength, durability, and resistance to heat, abrasion, chemicals, and ozone. To improve their processing and performance, some rubbers need unique additives. In order to increase the adhesion between rubber and fillers like silica and carbon black, silane coupling agents are utilized. Similarly, rubber compounds are stabilized and protected from burning by the application of organophosphites. The market for rubber additives in a variety of applications, including tires, hoses, belts, seals, gaskets, and medical devices, is anticipated to benefit from the development of these high-performance rubbers.

Restraints/Challenges

The price changes of raw materials like natural rubber, synthetic rubber, carbon black, zinc oxide, and others have an impact on the market for rubber additives. These raw resources come from petroleum and natural gas, whose supply and demand are unstable. The market for rubber additives is unstable as a result of fluctuations in the price of raw materials, which can have an impact on manufacturers' profitability. Therefore the fluctuation in raw materials acts as a restraint to the global rubber additives market

The significant obstacle faced by the rubber additives market is environmental laws and sustainability worries. Numerous compounds that may be harmful to the environment and human health are included in rubber compositions. Some rubber additives, including nitrosamines, polycyclic aromatic hydrocarbons (PAHs), and heavy metals, are thought to be hazardous or carcinogenic. As a result, different regulatory organizations like REACH, EPA, FDA, etc. have either restricted or outright forbidden the use of certain compounds. To lessen the negative environmental effects of rubber additives, manufacturers must adhere to these laws and use environmentally appropriate substitutes, Hence, the environmental regulations act as a challenge for the rubber additives market.

Recent Development

- In June 2022, Evonik launched POLYVEST eCO, sustainable liquid polybutadiene it can be used as raw material for adhesives and sealants or as a liquid rubber additive in tire production. This product line is said to reduce the use of fossil raw materials by up to 99.9%.

- In March 2023, According to H.M. Royal. , Bruggemann, a polymer additives company, has introduced a new technology in rubber additives that involves the combination of two additives, TP 1862 and LP21-103, to create a rubber-to-metal adhesive that eliminates the need for resorcinol and cobalt salt

Global Rubber Additives Market Scope

The rubber additives market is segmented on the basis of type, price range, application, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Accelerators

- Activators

- Peptizers

- Plasticizers

- Tackifiers

- Vulcanization Inhibitors

- Rubber Antioxidant

- Insoluble Sulfur

- Antidegradants

- Others

Application

- Adhesives

- Electric cables and Hoses

- Insulations

- Specialty tapes

- Tiers

- Others

Coating Agents

- Silicon

- Teflon

- Others

Materials

- Fibre

- Silica

- Silicates

- Carbon black

- Others

End User

- Tire and Tubing

- Consumer Goods

- Construction

- Electrical Insulation

- Others

Rubber Additives Market Regional Analysis/Insights

The rubber additives market is analysed and market size insights and trends are provided by country, type, application, coating agents, materials and end user and as referenced above.

The countries covered in the rubber additives market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

North America dominates the rubber additive market due to the large market share of the U.S. in the availability of automotive as well as other associated infrastructure in the region. Asia-Pacific region is expected to hold the largest growth rate due to the establishment of assembling facilities for the rubber additive market in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Increasing demand from tire and non-tire rubber applications

The rubber additives market also provides you with detailed market analysis for every country's growth in expenditure for capital equipment, installed base of different kinds of products for the Rubber Additives market, impact of technology using lifeline curves, and changes in regulatory scenarios and their impact on the rubber additives market. The data is available for the historic period 2010-2020.

Competitive Landscape and Rubber Additives Market Share Analysis

The rubber additives market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the rubber additives market.

Some of the major players operating in the rubber additives market are:

- Akrochem Corporation

- Akzo Nobel N.V.

- Arkema

- BEHN MEYER

- Eastman Chemical Company

- LANXESS

- Struktol Company of America, LLC

- Thomas Swan & Co. Ltd.

- LUMITOS AG

- Wacker Chemie AG

- Velox Solutions Pvt. Ltd.

- IMCD N.V.

- BASF SE

- Solvay

- China Petrochemical Corporation

- Emery Oleochemicals

- R.T. Vanderbilt Holding Company, Inc.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rubber Additive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rubber Additive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rubber Additive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.