Global Rolling Stock Market

Market Size in USD Billion

CAGR :

%

USD

67.79 Billion

USD

95.67 Billion

2024

2032

USD

67.79 Billion

USD

95.67 Billion

2024

2032

| 2025 –2032 | |

| USD 67.79 Billion | |

| USD 95.67 Billion | |

|

|

|

|

Rolling Stock Market Size

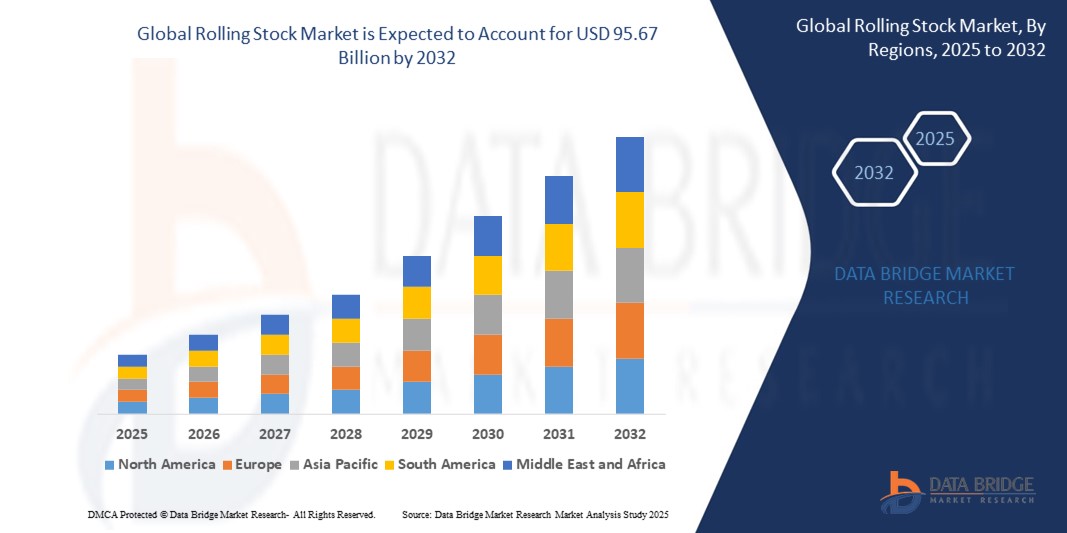

- The global rolling stock market size was valued at USD 67.79 billion in 2024 and is expected to reach USD 95.67 billion by 2032, at a CAGR of 4.40% during the forecast period

- Market growth is primarily driven by the rising demand for urban rail transport, ongoing rail infrastructure modernization, and the adoption of energy-efficient and high-speed trains worldwide

- In addition, government investments in electrified and sustainable transportation solutions, particularly across Asia-Pacific and Europe, are accelerating the deployment of advanced Rolling Stock, significantly fueling market expansion

Rolling Stock Market Analysis

- Rolling stock, which includes passenger coaches, freight wagons, and locomotives, plays a critical role in enhancing public transit capacity, reducing carbon emissions, and improving freight logistics efficiency across both developing and developed regions

- The increasing shift toward electrification, digitization, and automation of rail systems is a key driver of market demand, supported by the integration of smart sensors, real-time monitoring, and predictive maintenance technologies

- The market is also benefiting from urbanization trends, population growth, and a renewed global focus on sustainable mobility, positioning rolling stock as a cornerstone of future-ready transportation infrastructure

- Asia-Pacific dominated the rolling stock market with the largest revenue share of 46.23% in 2024, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The Middle East and Africa rolling stock market is projected to register the fastest CAGR of 26.33% during the forecast period of 2025 to 2032. This growth is driven by massive investments in rail infrastructure, particularly in the U.A.E., Saudi Arabia, Egypt, and South Africa

- The Wagons segment accounted for the largest market revenue share of 35.55% in 2024, driven by rising demand for efficient freight transportation and the expansion of industrial sectors requiring bulk goods movement

Report Scope and Rolling Stock Market Segmentation

|

Attributes |

Rolling Stock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rolling Stock Market Trends

“Integration of Advanced Technologies and Sustainable Mobility Solutions”

- A key trend shaping the global rolling stock market is the rapid integration of advanced digital technologies and the increasing focus on sustainability. Railway operators are investing in AI-driven maintenance, smart sensors, and real-time data analytics to improve operational efficiency, reduce downtime, and enhance safety

- For instance, Siemens Mobility and Deutsche Bahn launched a project in 2023 to implement predictive maintenance for trains using cloud-based data platforms and AI, improving reliability and reducing maintenance costs

- The industry is also witnessing a surge in the development of battery-powered and hydrogen-fueled trains as alternatives to diesel locomotives, particularly in regions lacking complete electrification. These eco-friendly options are gaining traction amid rising environmental regulations

- In addition, automated and driverless trains are emerging as a futuristic innovation, with metro systems in cities such as Paris, Dubai, and Singapore implementing such technologies to streamline urban mobility

- The shift toward smart railways and green transportation is expected to redefine the Rolling Stock landscape, supporting long-term growth through digital and environmental transformation

Rolling Stock Market Dynamics

Driver

“Rising Urbanization and Demand for Efficient Public Transport”

- The global increase in urban population and congestion in metropolitan areas is driving the need for efficient, safe, and high-capacity public transportation systems, spurring investments in rolling stock

- For Instance, in July 2024, Alstom secured a major contract in India to supply 200 metro train sets under the Smart Cities initiative, aiming to improve urban mobility across major cities

- Governments worldwide are prioritizing rail infrastructure development, allocating significant budgets for high-speed rail, metro systems, and light rail networks to reduce carbon footprints and manage growing commuter populations

- Furthermore, the shift from road to rail as a preferred mode of freight transportation, due to its cost-efficiency and lower emissions, is enhancing the demand for new freight wagons and locomotives

- These developments, combined with public-private partnerships (PPPs) and favorable regulatory policies, are driving the global rolling stock market forward

Restraint/Challenge

“High Capital Investment and Infrastructure Limitations”

- The rolling stock industry faces challenges due to high upfront investment requirements for manufacturing, upgrading, and maintaining trains and supporting infrastructure such as tracks and electrification

- For instance, new-generation electric multiple units (EMUs) and high-speed trains can cost up to USD 30 million per train set, limiting adoption in budget-constrained regions or countries with underdeveloped rail systems

- In addition, infrastructure bottlenecks in developing regions, including outdated signaling systems and inadequate track networks, hinder the smooth deployment of modern Rolling Stock

- Delays in regulatory approvals and complex procurement processes further slow market penetration

- Overcoming these barriers will require collaborative government-industry efforts, improved financing models, and phased modernization plans to encourage broader adoption and long-term investment

Rolling Stock Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Type

On the basis of type, the rolling stock market is segmented into Wagons, Coaches, Locomotives, and Rapid Transit. The Wagons segment accounted for the largest market revenue share of 35.55% in 2024, driven by rising demand for efficient freight transportation and the expansion of industrial sectors requiring bulk goods movement. The ability of wagons to transport heavy materials over long distances at reduced costs continues to bolster their demand globally.

The Rapid Transit segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing urbanization and government investments in metro rail projects. Rapid transit systems provide high-capacity, eco-friendly urban mobility solutions, making them a vital component of smart city development plans worldwide.

• By Locomotive Technology

On the basis of locomotive technology, the rolling stock market is segmented into Turbocharged Locomotives, Conventional Locomotives, and Maglev. The Turbocharged Locomotives segment held the largest market revenue share in 2024, driven by their improved fuel efficiency, higher power output, and operational effectiveness on long-haul routes. They are particularly valued in freight applications where high power-to-weight ratios are essential.

The Maglev (magnetic levitation) segment is anticipated to grow at the fastest rate from 2025 to 2032, supported by ongoing high-speed rail infrastructure projects in countries such as Japan and China. Maglev technology offers unmatched speed and energy efficiency, attracting investments in next-gen mobility projects.

• By Components

On the basis of components, the rolling stock market is segmented into Train Control Systems, Passenger Information Systems, Brakes, Air Conditioning Systems, Auxiliary Power Systems, Pantographs, Mechanical Components, Axles, Wheelsets, Traction Motors, Gearboxes, Baffle Gear, and Coupler. The Traction Motors segment accounted for the largest revenue share in 2024 due to their critical role in locomotive propulsion and efficiency. Electrification of railway lines and the rising adoption of electric locomotives are further boosting demand for advanced traction motors.

The Passenger Information Systems segment is expected to register the fastest CAGR from 2025 to 2032, driven by the demand for real-time travel updates, improved passenger convenience, and digital transformation initiatives across public transport systems.

• By Application

On the basis of application, the rolling stock market is segmented into Passenger Transportation and Freight Transportation. The Freight Transportation segment dominated the market revenue share in 2024, driven by the cost-effectiveness, fuel efficiency, and reliability of rail transport for long-distance cargo delivery. Logistics firms are increasingly turning to rail networks to minimize emissions and optimize delivery timelines.

The Passenger Transportation segment is projected to grow at the fastest CAGR from 2025 to 2032, due to rising urban population, increasing demand for comfortable and fast mobility, and sustained investments in high-speed rail and metro transit systems aimed at reducing road congestion and pollution.

Rolling Stock Market Regional Analysis

- Asia-Pacific dominated the rolling stock market with the largest revenue share of 46.23% in 2024, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- The region's growing inclination towards smart homes, supported by government initiatives promoting digitalization, is driving the adoption of Rolling Stocks

- Furthermore, as APAC emerges as a manufacturing hub for Rolling Stock components and systems, the affordability and accessibility of Rolling Stocks are expanding to a wider consumer base

Japan rolling stock Market Insight

The Japan rolling stock market is gaining momentum due to the country's high-tech culture, rapid urbanization, and demand for convenience. The Japanese market places a significant emphasis on security, and the adoption of rolling stocks is driven by the increasing number of smart homes and connected buildings. The integration of Rolling Stocks with other IoT devices, such as home security cameras and lighting systems, is fueling growth. Moreover, Japan's aging population is such asly to spur demand for easier-to-use, secure access solutions in both residential and commercial sectors.

China Rolling Stock Market Insight

The China rolling stock market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption. China stands as one of the largest markets for smart home devices, and Rolling Stocks are becoming increasingly popular in residential, commercial, and rental properties. The push towards smart cities and the availability of affordable rolling stock options, alongside strong domestic manufacturers, are key factors propelling the market in China.

Europe Rolling Stock Market Insight

The Europe rolling stock market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent security regulations and the escalating need for enhanced security in homes and offices. The increase in urbanization, coupled with the demand for connected devices, is fostering the adoption of rolling stocks. European consumers are also drawn to the convenience and energy efficiency these devices offer. The region is experiencing significant growth across residential, commercial, and multi-family housing applications, with Rolling Stocks being incorporated into both new constructions and renovation projects.

U.K. Rolling Stock Market Insight

The U.K. rolling stock market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of home automation and a desire for heightened security and convenience. In addition, concerns regarding burglary and safety are encouraging both homeowners and businesses to choose keyless entry solutions. The UK's embrace of connected devices, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth.

Germany Rolling Stock Market Insight

The Germany rolling stock market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digital security and the demand for technologically advanced, eco-conscious solutions. Germany's well-developed infrastructure, combined with its emphasis on innovation and sustainability, promotes the adoption of Rolling Stocks, particularly in residential and commercial buildings. The integration of rolling stocks with home automation systems is also becoming increasingly prevalent, with a strong preference for secure, privacy-focused solutions aligning with local consumer expectations.

Middle East & Africa (MEA) Rolling Stock Market Insight

MEA rolling stock market is projected to register the fastest CAGR of 26.33% during the forecast period of 2025 to 2032. This growth is driven by massive investments in rail infrastructure, particularly in the U.A.E., Saudi Arabia, Egypt, and South Africa. These nations are increasingly focusing on diversifying transportation systems, boosting logistics efficiency, and building smart mobility networks. Rising demand for urban connectivity, cross-border freight corridors, and tourism-related rail projects are creating new opportunities for rolling stock suppliers in the region.

U.A.E. Rolling Stock Market Insight

The U.A.E. rolling stock market is rapidly growing due to large-scale initiatives such as Etihad Rail, aiming to develop a national freight and passenger railway network. The project’s vision of linking major cities and ports is creating substantial demand for modern locomotives, wagons, and signaling systems, making the U.A.E. a focal point for rail development in the Middle East.

Rolling Stock Market Share

The rolling stock industry is primarily led by well-established companies, including:

- ABB (Sweden)

- Alstom SA (France)

- American Industrial Transport, Inc. (U.S.)

- Bombardier (Canada)

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain)

- Caterpillar (U.S.)

- CRRC Corporation Limited (China)

- Hitachi, Ltd. (Japan)

- Hyundai Motor India (South Korea)

- Japan Transport Engineering Company (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- National Steel Car Limited (Canada)

- Niigata Transys Co., Ltd. (Japan)

- Talgo (Spain)

- Siemens (Germany)

- Stadler Rail AG (Switzerland)

- Toshiba Infrastructure Systems & Solutions Corporation (Japan)

- Wabtec Corporation (U.S.)

Latest Developments in Global Rolling Stock Market

- In February 2023, Stadler Rail AG collaborated with ASPIRE Engineering Research Centre and Utah State University to develop a battery-powered passenger train based on the FLIRT Akku concept. The project includes the design, construction, and testing of a two-car battery-operated multiple unit. Test runs will help generate valuable insights for the decarbonization of U.S. passenger transit through battery technology. This partnership highlights the growing commitment to sustainable rail transportation solutions in North America

- In February 2023, Stadler Rail AG announced its acquisition of BBR Verkehrstechnik GmbH and its affiliated companies to expand its capabilities in digitalization and railway signaling. This strategic move aims to enhance the delivery of advanced signaling technologies and support the ongoing digital transformation within the rail sector. The acquisition strengthens Stadler’s market position in intelligent rail infrastructure systems

- In January 2023, Siemens Mobility secured a landmark contract with Indian Railways for the supply of 1,200 high-powered locomotives rated at 9,000 HP—marking the largest locomotive order in Siemens India and Siemens Mobility history. The deal includes full-service maintenance for 35 years, with production and testing to take place at Indian Railways' Gujarat facility over an 11-year period. This deal underscores Siemens’ long-term commitment to Indian railway modernization

- In November 2022, Siemens Mobility revealed plans to establish a train bogie manufacturing plant in Aurangabad, India. The factory, based on the SF30 Combino Plus design platform, has the capacity to fulfill large export orders, producing over 200 bogies, and is equipped to serve both domestic and international rolling stock demand. This facility strengthens Siemens’ local manufacturing footprint while supporting global rail supply chains

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.