Global Roll Your Own Tobacco Product Market

Market Size in USD Billion

CAGR :

%

USD

8.85 Billion

USD

12.40 Billion

2024

2032

USD

8.85 Billion

USD

12.40 Billion

2024

2032

| 2025 –2032 | |

| USD 8.85 Billion | |

| USD 12.40 Billion | |

|

|

|

|

Roll-Your-Own Tobacco Product Market Size

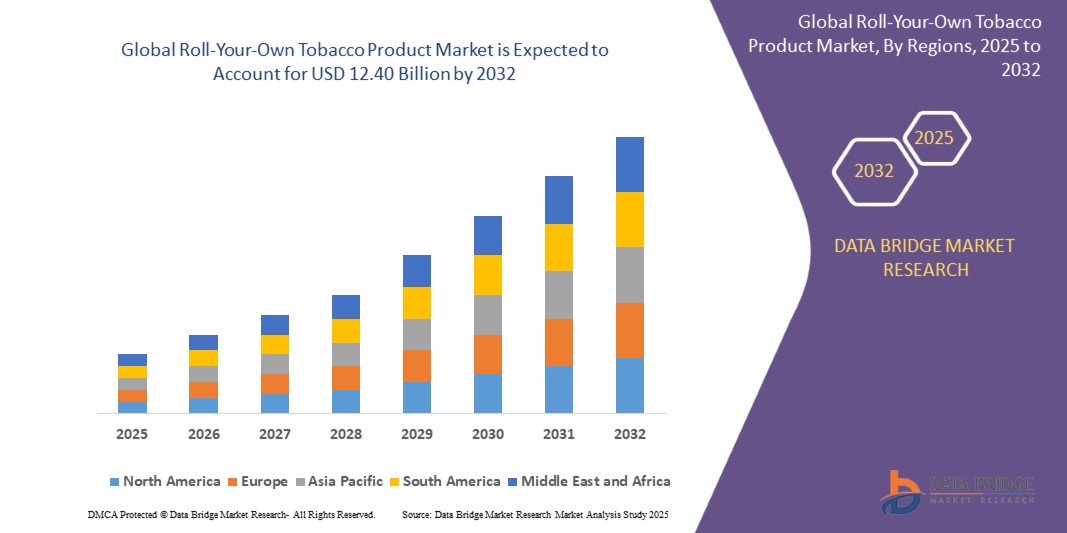

- The global roll-your-own tobacco product market size was valued at USD 8.85 billion in 2024 and is expected to reach USD 12.40 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for cost-effective smoking alternatives, increasing taxation on manufactured cigarettes, and a growing trend among younger demographics for personalized smoking experiences

Roll-Your-Own Tobacco Product Market Analysis

- Increasing awareness about the cost benefits of hand-rolled cigarettes is encouraging more consumers to switch from factory-made cigarettes to roll-your-own tobacco products

- The availability of a wide variety of rolling papers, filters, and flavored tobacco blends is enhancing user experience and driving market adoption

- Europe dominated the roll-your-own tobacco product market with the largest revenue share of 41.8% in 2024, driven by a strong cultural acceptance of hand-rolled cigarettes, increasing taxation on factory-made cigarettes, and widespread availability of rolling accessories across retail channels

- North America region is expected to witness the highest growth rate in the global roll-your-own tobacco product market, driven by increasing consumer shift toward affordable alternatives, availability of RYO kits through e-commerce and convenience stores, and evolving smoking habits among younger adults

- The roll-your-own tobacco papers and cigarette tubes segment dominated the market with the largest market revenue share of 48.7% in 2024, driven by increasing consumer preference for personalized smoking experiences and cost-effective alternatives to pre-rolled cigarettes. These products offer flexibility in tobacco choice and quantity, attracting both habitual smokers and lifestyle-oriented consumers. The widespread availability of flavored, biodegradable, and organic paper variants further supports the segment’s strong growth and continued adoption

Report Scope and Roll-Your-Own Tobacco Product Market Segmentation

|

Attributes |

Roll-Your-Own Tobacco Product Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Roll-Your-Own Tobacco Product Market Trends

“Shift Toward Customization and Premium Blends”

- Consumers are increasingly drawn to customizable smoking experiences, preferring to choose their own tobacco quantity, paper type, and filter style for a more tailored experience

- Premium tobacco blends, including organic and additive-free varieties, are gaining popularity among health-conscious smokers who want more control over ingredients

- The demand for aesthetically pleasing and eco-friendly rolling accessories—such as biodegradable papers and reusable metal tins—continues to grow as smoking becomes more of a lifestyle expression

- E-commerce platforms and specialty tobacco stores are helping consumers explore niche brands, limited-edition flavors, and international tobacco products with greater convenience

- For instance, RAW has capitalized on this trend by offering organic hemp rolling papers, artisan filters, and customizable rolling trays, which are especially popular among younger consumers in the U.S. and Europe

Roll-Your-Own Tobacco Product Market Dynamics

Driver

“Cost-Effectiveness Compared To Manufactured Cigarettes”

- Roll-your-own tobacco is significantly cheaper per unit than manufactured cigarettes, making it a preferred option for frequent smokers seeking economic value

- Loose tobacco and rolling papers are available in bulk, reducing packaging costs and enabling smokers to customize the size of their cigarettes, which helps control consumption and spending

- Economic pressure and rising inflation in various regions have pushed many consumers to shift from premium cigarette brands to roll-your-own alternatives

- In many countries, roll-your-own tobacco is still taxed at a lower rate than manufactured cigarettes, although this gap is narrowing, it still presents cost savings in several regions

- For instance, in Germany, high excise taxes on ready-made cigarettes have contributed to a steady increase in RYO tobacco use, especially among middle-income and budget-conscious smokers

Restraint/Challenge

“Rising Government Regulations And Taxation Policies”

- Many governments are introducing uniform taxation policies for all tobacco products, including roll-your-own, which reduces the price advantage once offered by loose tobacco

- Regulations mandating plain packaging and large health warnings limit brand identity and reduce the visual appeal of RYO products, especially among new or casual users

- Flavor restrictions and bans on menthol and other additives have led to a decrease in product variety, making RYO tobacco less appealing for consumers seeking diverse experiences

- Anti-smoking campaigns, public bans on smoking, and stricter control over tobacco advertising are creating a hostile regulatory environment for all tobacco formats, including roll-your-own

- For instance, in Australia, the government has implemented high excise taxes and strict plain packaging laws for roll-your-own tobacco, which has significantly decreased sales volume in recent years

Roll-Your-Own Tobacco Product Market Scope

The market is segmented on the basis of type and application.

• By Type

On the basis of type, the roll-your-own tobacco product market is segmented into roll-your-own tobacco papers and cigarette tubes, roll-your-own tobacco injector, and roll-your-own tobacco filter & paper tip. The roll-your-own tobacco papers and cigarette tubes segment dominated the market with the largest market revenue share of 48.7% in 2024, driven by increasing consumer preference for personalized smoking experiences and cost-effective alternatives to pre-rolled cigarettes. These products offer flexibility in tobacco choice and quantity, attracting both habitual smokers and lifestyle-oriented consumers. The widespread availability of flavored, biodegradable, and organic paper variants further supports the segment’s strong growth and continued adoption.

The roll-your-own tobacco injector segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising demand for convenience in manual cigarette making. These devices enable users to prepare uniform, well-packed cigarettes with less effort, appealing to both new users and experienced rollers. Enhanced product designs, compact formats, and compatibility with various cigarette tubes are contributing to their increasing popularity, particularly in Europe and North America where DIY tobacco practices are prevalent.

• By Application

On the basis of application, the market is segmented into specialty store, supermarket, and others. The specialty store segment accounted for the largest market revenue share in 2024, primarily due to their extensive range of roll-your-own tobacco accessories and product personalization options. These stores cater to dedicated tobacco users by offering expert recommendations, exclusive blends, and a wide variety of rolling accessories, establishing themselves as the go-to option for enthusiasts.

The supermarket segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing accessibility and convenience of purchasing roll-your-own tobacco products alongside daily essentials. With rising shelf presence of branded RYO products and growing partnerships between tobacco brands and retail chains, supermarkets are becoming an important distribution channel for casual and budget-conscious consumers.

Roll-Your-Own Tobacco Product Market Regional Analysis

- Europe dominated the roll-your-own tobacco product market with the largest revenue share of 41.8% in 2024, driven by a strong cultural acceptance of hand-rolled cigarettes, increasing taxation on factory-made cigarettes, and widespread availability of rolling accessories across retail channels

- Consumers in the region prefer roll-your-own products for their affordability, personalization, and perceived authenticity compared to ready-made alternatives

- The market’s expansion is further supported by the presence of established tobacco brands, rising demand for organic and additive-free tobacco, and evolving consumer habits that emphasize control over tobacco usage

Germany Roll-Your-Own Tobacco Product Market Insight

The Germany roll-your-own tobacco product market captured the largest revenue share of 36% in 2024 within Europe, fueled by growing consumer interest in economical smoking options and stricter regulation on manufactured cigarettes. The demand is reinforced by the availability of premium papers, filters, and rolling machines in both supermarkets and specialty tobacco shops. Germany’s mature retail infrastructure and consumer preference for customizable tobacco solutions continue to boost the market’s long-term potential.

U.K. Roll-Your-Own Tobacco Product Market Insight

The U.K. roll-your-own tobacco product market is expected to witness the fastest growth rate from 2025 to 2032, driven by high tobacco taxes and a growing preference for more economical smoking alternatives. Consumers are turning to roll-your-own products as a cost-effective option amidst rising prices of manufactured cigarettes. In addition, the availability of high-quality rolling papers, flavored filters, and accessories in both convenience stores and specialist outlets supports demand. Public awareness around health risks has also encouraged users to choose additive-free and organic RYO options. Government regulations may shape future growth, but consumer interest in affordability and customization remains strong.

North America Roll-Your-Own Tobacco Product Market Insight

The North America roll-your-own tobacco product market is expected to witness the fastest growth rate from 2025 to 2032, largely driven by rising cigarette prices and growing consumer awareness of cost-saving alternatives. Increasing availability of RYO kits and accessories through online platforms and convenience stores is enhancing accessibility. The U.S. and Canada are also seeing increased adoption among younger adults who are drawn to the DIY aspect and aesthetic value of hand-rolled cigarettes.

U.S. Roll-Your-Own Tobacco Product Market Insight

The U.S. roll-your-own tobacco product market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising popularity of personalized smoking solutions and a shift toward natural, minimally processed tobacco products. The country’s strong e-commerce infrastructure, combined with the appeal of customizable products and evolving consumer tastes, continues to attract a growing base of RYO users. In addition, increasing regulatory restrictions on manufactured cigarettes have pushed many users to explore alternative formats.

Asia-Pacific Roll-Your-Own Tobacco Product Market Insight

The Asia-Pacific roll-your-own tobacco product market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising tobacco consumption, urbanization, and increasing disposable incomes in key countries such as India, Indonesia, and the Philippines. Cultural acceptance of hand-rolled cigarettes, especially in rural areas, continues to sustain demand. Furthermore, the region is experiencing growth in local production and distribution of RYO materials, making the products more accessible and affordable.

China Roll-Your-Own Tobacco Product Market Insight

The China roll-your-own tobacco product market accounted for a substantial share of the Asia-Pacific revenue in 2024, driven by a growing middle class, increased awareness of alternative smoking formats, and a rising trend of smoking personalization. While manufactured cigarettes remain dominant, roll-your-own tobacco is increasingly seen as a cost-effective and customizable alternative. Government efforts to reduce tobacco-related health issues may further influence a shift toward more controlled usage formats such as RYO products.

Japan Roll-Your-Own Tobacco Product Market Insight

The Japan roll-your-own tobacco product market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing interest in lifestyle-driven smoking habits and compact, discreet consumption formats. Japanese consumers, known for valuing quality and precision, are increasingly drawn to premium rolling papers, filter tips, and sleek RYO accessories. The market is also benefiting from the presence of specialized tobacco shops offering curated RYO kits. As concerns around health and wellness rise, there is growing demand for organic and low-additive loose tobacco products. Japan’s urban population, particularly younger adults, is contributing to the emerging popularity of roll-your-own formats as a personalized smoking alternative.

Roll-Your-Own Tobacco Product Market Share

The Roll-Your-Own Tobacco Product industry is primarily led by well-established companies, including:

- Altria Group, Inc. (U.S.)

- Imperial Brands (U.K.)

- British American Tobacco (U.K.)

- JT International SA (Switzerland)

- Scandinavian Tobacco Group A/S (Denmark)

- Philip Morris Products S.A. (Switzerland)

Latest Developments in Global Roll-Your-Own Tobacco Product Market

- In October 2023, Imperial Tobacco announced the expansion of its product portfolio with the launch of a new roll-your-own (RYO) tobacco variety under the Embassy Signature range. This development follows the success of the existing blend, recognized as the company’s fastest-selling tobacco product. The new variety aims to strengthen Imperial’s position in the RYO market by offering consumers a premium yet affordable option. It is expected to attract both loyal and new customers seeking quality and value. This move is likely to enhance brand visibility and stimulate growth within the competitive RYO tobacco segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.