Global Robotic Vacuum Cleaner Market

Market Size in USD Billion

CAGR :

%

USD

5.09 Billion

USD

20.05 Billion

2023

2031

USD

5.09 Billion

USD

20.05 Billion

2023

2031

| 2024 –2031 | |

| USD 5.09 Billion | |

| USD 20.05 Billion | |

|

|

|

Robotic Vacuum Cleaner Market Analysis

The robotic vacuum cleaner market is experiencing significant growth, driven by advancements in technology and innovative methodologies. Recent developments include the integration of artificial intelligence (AI) and machine learning, enabling devices to learn household layouts and optimize cleaning routes. For instance, advanced mapping technologies such as LiDAR help robotic vacuums create detailed floor plans, enhancing efficiency and cleaning effectiveness.

Moreover, the incorporation of smart home connectivity through IoT has transformed user experience. Consumers can now control their devices remotely via smartphone apps, schedule cleanings, and receive real-time updates. This has led to increased user engagement and satisfaction.

Battery technology advancements, such as lithium-ion batteries, have extended operational times and improved charging efficiencies, allowing robotic vacuums to clean larger areas without frequent interruptions.

The market is also witnessing a surge in demand for specialized models, including those designed for pet owners or allergy sufferers. These innovations not only improve cleaning performance but also cater to diverse consumer needs, fostering substantial growth in the robotic vacuum cleaner market.

Robotic Vacuum Cleaner Market Size

The global robotic vacuum cleaner market size was valued at USD 5.09 billion in 2023 and is projected to reach USD 20.05 billion by 2031, with a CAGR of 18.70% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Robotic Vacuum Cleaner Market Trends

“Integration of Smart Home Technology”

A significant trend in the robotic vacuum cleaner market is the increasing integration of smart home technology. Consumers now seek devices that can seamlessly connect with their home ecosystems, enhancing convenience and automation. For instance, in May 2023, Dyson launched the Dyson 360 Vis Nav robot vacuum cleaner, elevating the standards for home cleaning technology. This innovative vacuum boasts six times the suction power of its competitors and utilizes 360-degree vision for intelligent navigation and cleaning. The advanced technology in Dyson robot vacuum cleaner ensures thorough cleaning across different surfaces while optimizing performance. Dyson's entry into the robot vacuum market showcases its commitment to enhancing household cleaning experiences.

Report Scope and Robotic Vacuum Cleaner Market Segmentation

|

Attributes |

Robotic Vacuum Cleaner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ECOVACS (China), Dyson (U.K.), LG Electronics (South Korea), iRobot Corporation (U.S.), Proscenic (China), Samsung (South Korea), Neato Robotics, Inc., (California), Matsutek Co. Ltd. (Taiwan), Robert Bosch GmbH (Germany), Koninklijke Philips N.V. (Netherlands), Panasonic Corporation (Japan), Hayward Industries, Inc, (U.S.), BLACK+DECKER (U.S.), SharkNinja Operating LLC (U.S.), bObsweep (Canada), Maytronics (Israel), Taurus Group (Spain), Miele & Cie. KG (Germany) and AB Electrolux (Sweden) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Robotic Vacuum Cleaner Market Definition

A robotic vacuum cleaner is an automated device designed to clean floors with minimal human intervention. Equipped with sensors and navigation technology, it can maneuver around obstacles, detect dirt, and cover various surfaces such as carpets and hard floors. Most models feature programmable schedules and remote control capabilities, allowing users to set cleaning times and monitor performance via smartphone apps. Advanced models include mapping technology, which creates a virtual layout of the home for more efficient cleaning patterns. The convenience and efficiency of robotic vacuum cleaners make them popular among busy households, offering a hands-free solution to daily cleaning tasks.

Robotic Vacuum Cleaner Market Dynamics

Drivers

- Increasing Product Range

The expanding product range in the robotic vacuum cleaner market significantly drives growth by catering to diverse consumer needs and budgets. Brands such as iRobot and Roborock offer various models, from budget-friendly options under USD 200 to high-end models exceeding USD 1,000, each equipped with unique features. For instance, in May 2022, Haier launched its first smart vacuum cleaner technology in India, unveiling the 2-in-1 dry and wet mop Robot Vacuum Cleaner. This innovative device features 2.4 GHz WI-Fi connectivity, allowing users to control it through the Haier smart app, Google Home Assistant, and voice commands. The robot vacuum's intelligent management capabilities offer convenience and efficiency, catering to the growing demand for smart home solutions in the Indian market.

- Increasing Demand for Convenience and Time-Saving

The rising demand for convenience and time-saving solutions significantly drives the robotic vacuum cleaner market. These devices automate the cleaning process, enabling users to focus on other important tasks while the vacuum operates independently. For instance, in August 2020, ECOVACS expanded its T8 series of robotic vacuum cleaners by launching the DEEBOT OZMO T8, equipped with advanced object detection technology. This model features innovative accessories such as the OZMO Pro Mopping System and an Auto-Empty Station, ensuring hassle-free cleaning experiences. The introduction of the DEEBOT OZMO T8 underscores ECOVACS' commitment to providing cutting-edge solutions for home maintenance, enhancing the convenience of robotic cleaning technology.

Opportunities

- Rise of E-commerce

The rise of e-commerce has significantly expanded opportunities in the robotic vacuum cleaner market. Online shopping platforms such as Amazon and Walmart now offer an extensive range of robotic vacuums, enhancing consumer access and choice. This convenience allows consumers to compare models, read reviews, and benefit from competitive pricing. For instance, Amazon's Prime Day promotions often feature substantial discounts on popular brands such as iRobot and Ecovacs, boosting sales and visibility. In addition, e-commerce facilitates targeted marketing through social media ads, increasing consumer awareness. As more consumers prefer the convenience of online shopping, this trend is expected to drive further growth and innovation in the robotic vacuum sector.

- Advancements in Technology

Advancements in technology present significant opportunities in the robotic vacuum cleaner market. Innovations such as enhanced navigation algorithms and sophisticated mapping capabilities improve cleaning efficiency by allowing devices to cover larger areas without missing spots. Smart features, such as app control and voice activation, cater to consumer demands for convenience and integration with smart home systems. For instance, in September 2020, Neato introduced a new line of robotic vacuum cleaners, featuring the Neato D8, D9, and D10 models. These vacuums are designed to enhance home cleaning efficiency through advanced navigation and powerful suction capabilities. In addition, iRobot Corporation launched new Roomba series products in India, including the i3 and i33+. This dual-launch highlights the competitive landscape of robotic vacuum cleaners and the growing consumer interest in smart home technology.

Restraints/Challenges

- Limited Battery Life and Charging Time

Limited battery life and long charging times pose significant challenges for the robotic vacuum cleaner market. Many models can operate only for 60 to 120 minutes on a single charge, which is often insufficient for larger homes or extensive cleaning tasks. This limitation forces users to interrupt the cleaning process for recharging, resulting in incomplete cleaning cycles and diminished user satisfaction. As a result, consumers may prefer traditional vacuum cleaners that offer uninterrupted cleaning power. In addition, the inconvenience of managing battery life can deter potential buyers, ultimately hindering the market's growth and adoption rate among consumers seeking efficient cleaning solutions.

- High Initial Costs

The high initial costs of robotic vacuum cleaners present a significant barrier to market growth. These devices often carry a price tag that exceeds that of traditional vacuum cleaners, making them less accessible to price-sensitive consumers. The upfront investment required for advanced models with smart features, such as app connectivity and advanced navigation, further exacerbates this issue. As a result, many potential buyers may opt for more affordable options, limiting the market penetration of robotic vacuums. This price sensitivity can hinder widespread adoption and reduce overall sales, particularly among budget-conscious consumers who prioritize cost over convenience and technology.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Robotic Vacuum Cleaner Market Scope

The market is segmented on the basis of type, operation mode, charging type, price, distribution channel and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Floor Vacuum Cleaner

- Window Vacuum Cleaner

- Pool Vacuum Cleaner

- Others

Operation Mode

- Self-Drive

- Remote Control

Charging Type

- Manual Charging

- Automatic Charging

Distribution Channel

- Electronic Stores

- E-Commerce

- Retail Stores

- Supermarket/Hypermarkets

- Others

Price

- Below USD 150

- USD 150 – 300

- USD 300 – 500

- Above USD 500

End User

- Residential

- Commercial

- Institutional

- Industrial

Robotic Vacuum Cleaner Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, operation mode, charging type, price, distribution channel and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

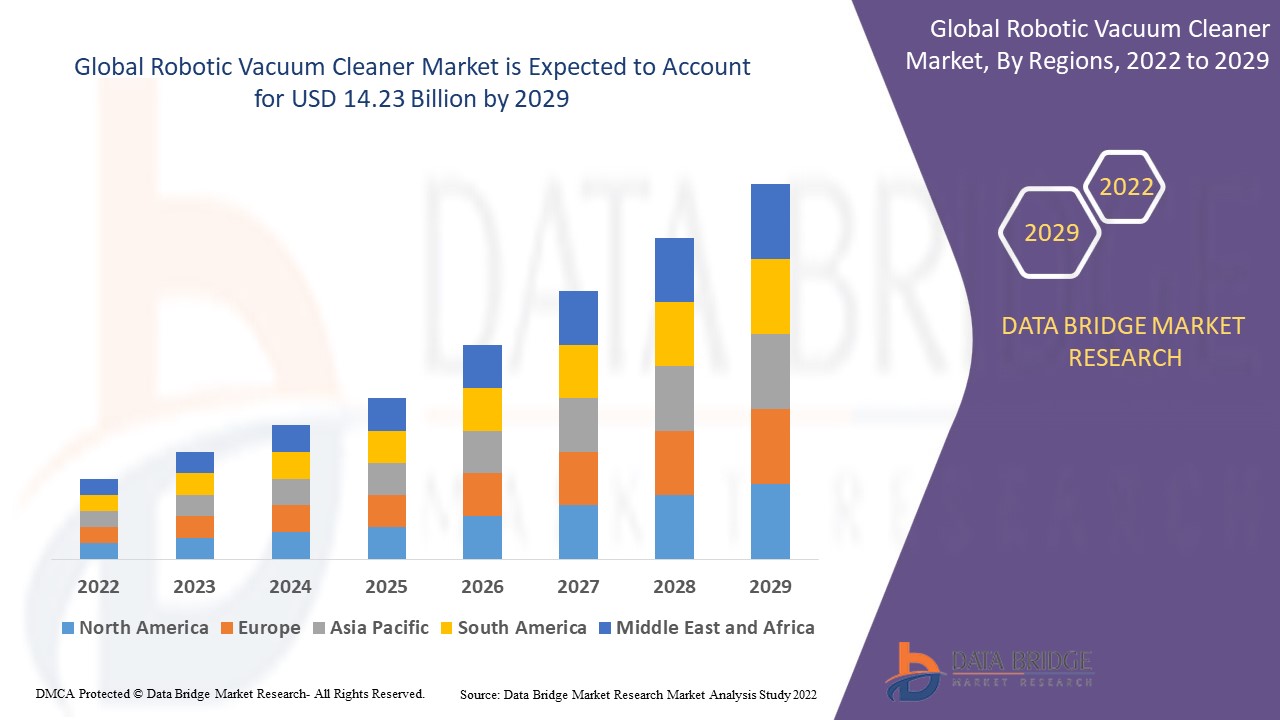

Asia-Pacific is expected to dominate the robotic vacuum cleaner market, driven by decreased product costs and increased consumer purchasing power. This region's growing urbanization and demand for smart home solutions further enhance its leadership in the market, contributing to substantial revenue growth.

Europe is estimated to show lucrative growth in the robotic vacuum cleaner market, driven by innovative product offerings and consumers' willingness to invest in added value. The increasing demand for advanced cleaning solutions is further propelling market expansion across the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Robotic Vacuum Cleaner Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Robotic Vacuum Cleaner Market Leaders Operating in the Market Are:

- ECOVACS (China)

- Dyson (U.K.)

- LG Electronics (South Korea)

- iRobot Corporation (U.S.)

- Proscenic (China)

- Samsung (South Korea)

- Neato Robotics, Inc., (California)

- Matsutek Co. Ltd. (Taiwan)

- Robert Bosch GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Panasonic Corporation (Japan)

- Hayward Industries, Inc, (U.S.)

- BLACK+DECKER (U.S.)

- SharkNinja Operating LLC (U.S.)

- bObsweep (Canada)

- Maytronics (Israel)

- Taurus Group (Spain)

- Miele & Cie. KG (Germany)

- AB Electrolux (Sweden)

Latest Developments in Robotic Vacuum Cleaner Market

- In January 2024, iRobot Corporation and Amazon jointly announced their decision to terminate the acquisition agreement initially signed on August 4, 2022. This mutual decision comes amid evolving business strategies and market conditions, reflecting both companies' reassessment of their strategic priorities. The termination marks a significant shift in the landscape of consumer robotics, as both companies navigate their independent paths forward

- In January 2024, ECOVACS ROBOTICS introduced groundbreaking whole home robotics, showcasing revolutionary robots designed for various household tasks. These innovations include specialized robots for floor care, air purification, ceiling maintenance, window cleaning, and lawn care. This comprehensive approach emphasizes ECOVACS' commitment to enhancing the efficiency of home cleaning through advanced technology. The unveiling positions ECOVACS as a leader in the rapidly evolving robotics market

- In March 2023, Samsung expanded its product lineup in India with the introduction of the Bespoke Jet and Robotic Jet Bot+ premium vacuum cleaners. This marked Samsung's inaugural foray into robotic vacuum technology in the region. The Bespoke Jet features a clean station that charges the vacuum and automatically empties the dustbin. With a powerful digital inverter motor and extended battery life, the product reflects Samsung's innovation in smart home appliances

- In May 2022, Haier launched its first smart vacuum cleaner technology in India, unveiling the 2-in-1 dry and wet mop Robot Vacuum Cleaner. This innovative device features 2.4 GHz WI-Fi connectivity, allowing users to control it through the Haier smart app, Google Home Assistant, and voice commands. The robot vacuum's intelligent management capabilities offer convenience and efficiency, catering to the growing demand for smart home solutions in the Indian market

- In July 2021, Ecovacs Robotics announced the launch of several advanced robotic vacuum cleaners in India, including models such as the DEEBOT 500, DEEBOT U2 PRO, DEEBOT OZMO 950, and DEEBOT OZMO T8. This launch represents Ecovacs' efforts to enhance its presence in the Indian market by offering a diverse range of products that cater to varying customer needs, focusing on automation and user-friendly features for modern households

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.