Global Robotic Arm Market

Market Size in USD Billion

CAGR :

%

USD

34.04 Billion

USD

96.44 Billion

2024

2032

USD

34.04 Billion

USD

96.44 Billion

2024

2032

| 2025 –2032 | |

| USD 34.04 Billion | |

| USD 96.44 Billion | |

|

|

|

|

Robotic Arm Market Size

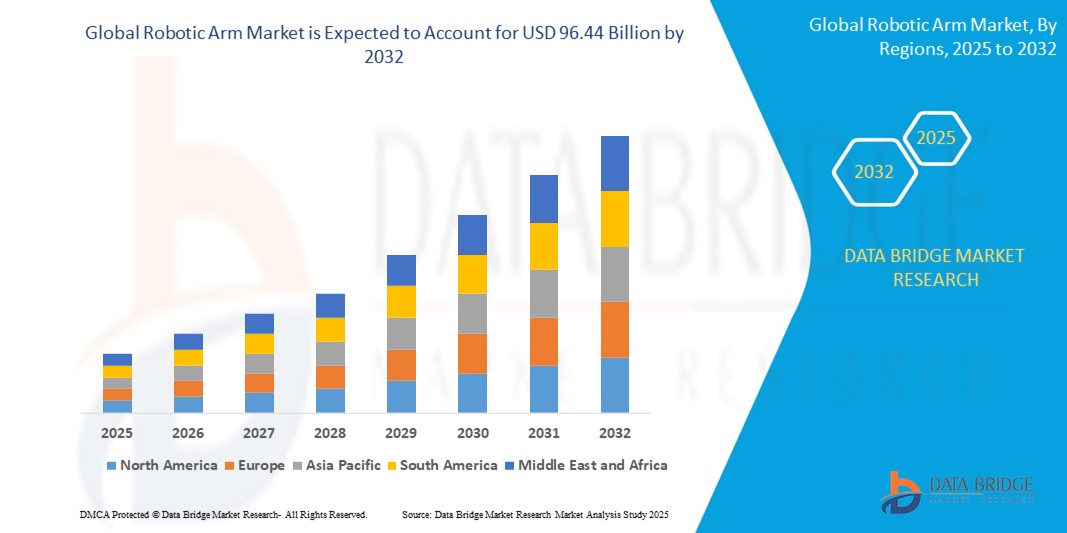

- The robotic arm film market size was valued at USD 34.04 billion in 2024 and is expected to reach USD 96.44 billion by 2032, at a CAGR of 13.90% during the forecast period

- The Market growth is driven by increasing automation across industries, rising demand for precision manufacturing, and advancements in robotic technologies such as AI integration and collaborative robots

- Growing adoption in small and medium enterprises (SMEs) and the push for Industry 4.0 solutions are further accelerating demand for robotic arms in diverse applications

Robotic Arm Market Analysis

- The robotic arm market is experiencing robust growth due to the rising need for automation in manufacturing, logistics, and assembly lines, enhancing productivity and reducing operational costs

- The automotive and electronics sectors are key contributors, with increasing demand for high-precision robotic arms for tasks such as welding, assembling, and material handling

- North America held the largest market share of 35.7% in 2024, driven by a strong manufacturing base, technological advancements, and widespread adoption of automation in the U.S. and Canada

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fueled by rapid industrialization, expanding manufacturing sectors, and government initiatives promoting automation in countries such as China, Japan, and India

- The articulated robotic arm segment dominated the market with a revenue share of 43% in 2024, attributed to its versatility, high payload capacity, and suitability for complex tasks such as welding and material handling

Report Scope and Robotic Arm Market Segmentation

|

Attributes |

Robotic Arm Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Robotic Arm Market Trends

“Rising Adoption of Collaborative Robots (Cobots)”

- Collaborative robots, or cobots, are gaining significant traction in the robotic arm market due to their ability to work safely alongside human operators without the need for extensive safety guarding

- Cobots are designed for ease of programming and deployment, making them highly attractive to small and medium-sized enterprises (SMEs) that may lack dedicated robotics expertise

- These robots are particularly suited for tasks requiring human-robot interaction, such as assembly, quality inspection, and material handling, where flexibility and adaptability are key

- For instance, Universal Robots, a leading cobot manufacturer, has seen significant growth in various industries, including electronics, automotive, and food and beverage, as businesses seek to automate tasks without completely replacing human workers

- The growing emphasis on flexible manufacturing and personalized production is further driving the demand for cobots, as they can be easily reconfigured for different tasks and production runs

Robotic Arm Market Dynamics

Driver

“Increasing Demand for Automation and Industry 4.0 Integration”

- The accelerating global push towards automation across diverse industries is a primary driver for the robotic arm market, as businesses seek to enhance operational efficiency, reduce labor costs, and improve product quality

- The principles of Industry 4.0, including interconnected smart factories, real-time data analysis, and autonomous systems, heavily rely on advanced robotic arms for seamless execution of manufacturing processes

- Robotic arms contribute significantly to higher production yields, reduced waste, and faster time-to-market by performing repetitive and precise tasks with consistent accuracy

- For instance, in the automotive sector, robotic arms are integral to assembly lines, welding, and painting, enabling mass production with high precision and customization capabilities

- The rise of smart factories and the adoption of digital manufacturing technologies are creating a robust demand for robotic arms that can integrate seamlessly with IoT platforms and other automated systems

Restraint/Challenge

“High Initial Investment and Integration Complexities”

- The substantial upfront cost associated with purchasing robotic arms, including the robot itself, end-effectors, software, and necessary safety infrastructure, can be a significant barrier to adoption, particularly for smaller businesses

- Integrating robotic arms into existing production lines often involves complex programming, reconfiguring layouts, and ensuring compatibility with other machinery, leading to additional costs and downtime

- The need for skilled personnel to operate, program, and maintain robotic systems can be a challenge for companies that lack in-house expertise, requiring investments in training or outsourcing

- For instances, a small manufacturing company might find the initial capital expenditure and the subsequent integration process for even a single robotic arm to be financially prohibitive and technically daunting

- Concerns about return on investment (ROI) and the long-term cost of ownership, including maintenance and potential software upgrades, can deter potential buyers, especially in industries with tight margins

Robotic arm Market Scope

The market is segmented on the basis of payload capacity, type, axes, end user industry, and application.

- By Payload Capacity

On the basis of payload capacity, the global robotic arm market is segmented into less than 500kg, 500-3000kg, and 300kg and above. The 500-3000kg segment held the largest market revenue share of 45.8% in 2024, driven by its widespread use in automotive and heavy machinery industries for tasks such as welding, material handling, and assembly. These robotic arms offer a balance of strength and precision, making them ideal for medium to large-scale manufacturing.

The Less than 500kg segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in small and medium enterprises (SMEs) and industries such as electronics and food and beverages, where lightweight, flexible robotic arms, such as collaborative robots (cobots), are preferred for tasks requiring high precision and human-robot collaboration.

- By Type

On the basis of type, the global robotic arm market is segmented into articulated, Cartesian, SCARA, spherical or polar, cylindrical, and others. The articulated robotic arm segment dominated the market with a revenue share of 43% in 2024, attributed to its versatility, high payload capacity, and suitability for complex tasks such as welding and material handling.

The SCARA segment is projected to grow at the fastest rate during the forecast period, driven by its high-speed and precision capabilities, making it ideal for pick-and-place and assembly tasks in electronics and consumer goods manufacturing.

- By Axes

On the basis of axes, the global robotic arm market is segmented into 1-Axis, 2-Axis, 3-Axis, 4-Axis, 5-Axis, 6-Axis, and 7-Axis. The 6-Axis segment led with a revenue share of 38.9% in 2024, owing to its flexibility and ability to perform complex, multi-directional tasks in automotive and aerospace applications.

The 7-Axis segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for advanced robotic arms with enhanced dexterity for intricate tasks in industries such as healthcare and precision manufacturing.

- End User Industry

On the basis of end user industry, the global robotic arm market is segmented into automotive, electrical and electronics, metals and machinery, plastics and chemicals, food and beverages, and others. The automotive segment accounted for the largest revenue share of 40.6% in 2024, driven by the high adoption of robotic arms for welding, assembly, and material handling in vehicle manufacturing.

The electrical and electronics segment is anticipated to grow at the fastest rate during the forecast period, propelled by the rising demand for precision robotic arms in semiconductor production and consumer electronics assembly.

- By Application

On the basis of application, the global robotic arm market is segmented into Materials Handling, Cutting and Processing, Soldering and Welding, Assembling and Disassembling, and Others. The materials handling segment dominated with a revenue share of 36.1% in 2024, supported by its extensive use in logistics, automotive, and e-commerce industries for efficient handling and transportation of goods.

The assembling and disassembling segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing automation of assembly lines in electronics and automotive sectors, where precision and speed are critical.

Robotic arm Market Regional Analysis

- North America held the largest market share of 35.7% in 2024, driven by a strong manufacturing base, technological advancements, and widespread adoption of automation in the U.S. and Canada

- The region benefits from technological advancements, such as AI-integrated robotic systems, and strong demand for automation to improve productivity and reduce labor costs

- Growth is further supported by the presence of key market players and government initiatives promoting Industry 4.0 adoption

U.S. Robotic Arm Market Insight

The U.S. holds the largest share in the North American robotic arm market in 2024, fueled by strong demand from automotive and aerospace industries, as well as growing adoption in logistics and e-commerce for material handling. The trend toward smart manufacturing and the integration of collaborative robots in SMEs further drive market growth. Companies such as Tesla and General Motors increasingly rely on robotic arms for automated production, enhancing efficiency and product quality.

Europe Robotic Arm Market Insight

The European robotic arm market is expected to witness significant growth, driven by a strong emphasis on automation and Industry 4.0 initiatives in countries such as Germany, France, and Italy. The region’s focus on precision manufacturing and sustainability encourages the adoption of advanced robotic arms in automotive and electronics sectors. Collaborative robots are gaining traction for their ability to enhance flexibility in production lines.

U.K. Robotic Arm Market Insight

The U.K. market is projected to witness rapid growth, driven by increasing automation in manufacturing and logistics, particularly in the automotive and food and beverage sectors. Growing awareness of robotic arms’ ability to improve productivity and reduce operational costs is boosting demand. Government support for smart manufacturing and the adoption of cobots in SMEs further accelerate market expansion.

Germany Robotic Arm Market Insight

Germany is expected to witness the fastest growth rate in the European robotic arm market, attributed to its advanced manufacturing ecosystem and leadership in automotive and machinery industries. German manufacturers prioritize robotic arms with AI and IoT integration for smart factories, enhancing efficiency and precision. The adoption of high-payload articulated robots and cobots in automotive assembly lines supports sustained market growth.

Asia-Pacific Robotic Arm Market Insight

The Asia-Pacific region is anticipated to witness the fastest growth rate, driven by rapid industrialization, increasing automation in manufacturing, and rising investments in countries such as China, Japan, and India. Growing demand for consumer electronics and automotive production, coupled with government initiatives promoting automation, boosts the adoption of robotic arms. The region’s competitive manufacturing landscape and low labor costs further enhance market accessibility.

Japan Robotic Arm Market Insight

Japan’s robotic arm market is expected to witness rapid growth, driven by its leadership in robotics technology and strong presence of key players such as FANUC and Yaskawa. The country’s focus on precision manufacturing in electronics and automotive sectors fuels demand for advanced robotic arms. High adoption of 6-axis and SCARA robots for assembly and material handling, along with growing interest in cobots, supports market penetration.

China Robotic Arm Market Insight

China holds the largest share of the Asia-Pacific robotic arm market, propelled by rapid industrialization, expanding manufacturing sectors, and government policies promoting automation. The country’s growing electronics and automotive industries drive demand for robotic arms for tasks such as welding, assembly, and material handling. Strong domestic manufacturing capabilities and competitive pricing enhance market growth, with increasing adoption of cobots in SMEs.

Robotic Arm Market Share

The robotic arm industry is primarily led by well-established companies, including:

- FANUC CORPORATION (Japan)

- YASKAWA ELECTRIC CORPORATION (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- ABB (Sweden)

- Mitsubishi Electric India Pvt. Ltd. (Japan)

- DENSO WAVE INCORPORATED (Japan)

- Rockwell Automation, Inc. (U.S.)

- NACHI-FUJIKOSHI CORP. (Japan)

- Universal Robots A/S (Denmark)

- Omron Corporation (Japan)

- Seiko Epson Corporation (Japan)

- Flexiv (U.S.)

- Asimov Robotics (India)

- Gridbots Technologies Private Limited (India)

- Dobot (China)

Latest Developments in Global Robotic Arm Market

- In January 2024, KUKA expanded its LBR iisy collaborative robot series, introducing new models with enhanced payload capacities and AI-driven safety features. Designed for safe human-robot interaction, these cobots target applications in electronics assembly and logistics. The LBR iisy series offers simplified programming and greater flexibility, making it ideal for SMEs and large manufacturers. This launch strengthens KUKA’s leadership in the collaborative robotic arm market, particularly in Europe and Asia-Pacific

- In October 2023, Mecademic Robotics introduced the Meca500 R4, an upgraded version of its ultra-compact industrial robotic arm designed for precision tasks in electronics and medical device manufacturing. The Meca500 R4 features enhanced AI-driven control systems and improved repeatability, ensuring superior accuracy for applications such as micro-assembly and inspection. This launch addresses the growing demand for small, high-precision robotic arms, reinforcing Mecademic’s position in the global market, particularly in North America and Europe

- In May 2023, Amber Robotics launched Lucid-1, a compact AI-powered robotic arm designed for manufacturing, healthcare, and service industries. Weighing under 3 kilograms, Lucid-1 offers exceptional agility and flexibility, ensuring seamless workflow integration. Its AI-driven intuitive movement enhances precision, making it ideal for tasks such as assembly and material handling. This innovation reflects the growing demand for lightweight, AI-enabled robotics, improving efficiency and adaptability across sectors

- In February 2023, Flexiv, a U.S.-based robotic arm manufacturer, partnered with Singapore’s Handplus Robotics to develop customized smart automation solutions. This collaboration aims to tackle labor shortages and boost return on investment using advanced robotic arm technologies. By integrating Flexiv’s adaptive robotic arms with Handplus Robotics’ expertise, the partnership enhances automation efficiency in industries such as electronics and logistics. Targeting the Asia-Pacific market, this alliance strengthens their competitive edge in collaborative robotics

- In January 2022, Yaskawa Electric Corporation acquired additional shares of Doolim-Yaskawa Electric Corporation Co., Ltd., a leading Korean manufacturer specializing in painting and sealing robotic systems. This strategic move enhances Yaskawa’s presence in the robotic arm market, particularly in automotive and industrial applications. By leveraging Doolim-Yaskawa’s expertise and market share, Yaskawa strengthens its global footprint, especially in Asia-Pacific, while expanding its portfolio of high-precision robotic arms for specialized tasks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Robotic Arm Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Robotic Arm Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Robotic Arm Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.