Global Robot Operating System Market

Market Size in USD Million

CAGR :

%

USD

607.58 Million

USD

1,201.79 Million

2024

2032

USD

607.58 Million

USD

1,201.79 Million

2024

2032

| 2025 –2032 | |

| USD 607.58 Million | |

| USD 1,201.79 Million | |

|

|

|

|

Robot Operating System Market Size

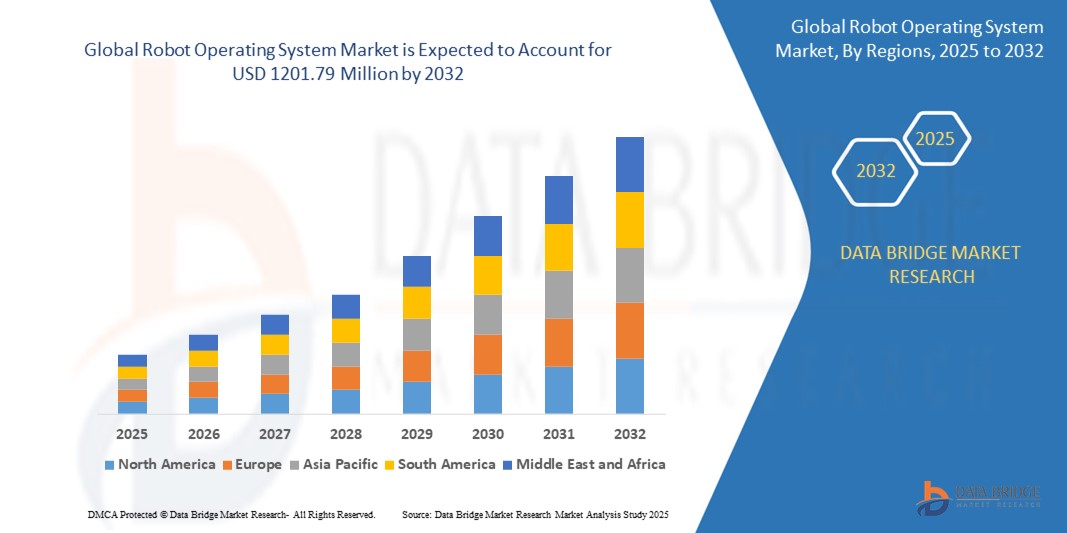

- The global robot operating system market size was valued at USD 607.58 Million in 2024 and is expected to reach USD 1201.79 Million by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation in the industrial sector and the rising adoption of ROS by manufacturers, especially in developing economies

- Furthermore, the surge in demand for collaborative modular robots is a significant factor anticipated to fuel the expansion of the robot operating system market during the forecast period

Robot Operating System Market Analysis

- Robot Operating Systems (ROS) are increasingly vital as the foundational software framework for the development and deployment of robots across a multitude of industries. They provide a standardized platform that facilitates the integration of diverse hardware and software components, enabling advanced robotic capabilities such as navigation, perception, and manipulation

- The escalating demand for robot operating systems is primarily fueled by the increasing adoption of robots in various sectors, including manufacturing, logistics, healthcare, and agriculture, to enhance efficiency, productivity, and safety. The ongoing advancements in robotics technology and the growing need for sophisticated control systems are also key factors driving the market's expansion

- North America dominates the robot operating system market with the largest revenue share of 31.61% in 2024, driven by a strong demand for automation in industries such as manufacturing and increasing investments in advanced robotics technologies

- Asia-Pacific is expected to be the fastest growing region in the robot operating system market during the forecast period due to rapid industrialization, the growth of smart manufacturing, and increased robot adoption in countries such as China, Japan, and South Korea

- SCARA robots segment is expected to dominate the robot operating system market in 2025, driven by increasing adoption across various industries such as automotive, electronics, pharmaceuticals, and consumer goods

Report Scope and Robot Operating System Market Segmentation

|

Attributes |

Robot Operating System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Robot Operating System Market Trends

“Increasing Adoption of Advanced Sensors and Perception Technologies”

- A significant and accelerating trend within the robot operating system (ROS) market is the integration of increasingly sophisticated sensors and perception technologies

- Modern robots are becoming more intelligent and capable due to advancements in sensors such as 3D cameras, LiDAR, and ultrasonic sensors, which enable them to perceive and understand their environment in greater detail. This trend is directly influencing the development and adoption of ROS, as it provides the framework to process and fuse data from these complex sensor systems

- For instance, in autonomous mobile robots (AMRs) used in logistics and warehousing, advanced sensors are crucial for navigation, obstacle avoidance, and object recognition. ROS offers a rich ecosystem of libraries and tools, such as the Point Cloud Library (PCL), which are specifically designed for processing 3D point cloud data from sensors such as LiDAR

- Companies developing robotic solutions for various applications, from industrial automation to service robots, are leveraging ROS to harness the power of these advanced perception technologies

- This trend is expected to continue, with further innovations in sensor technology leading to even more capable and adaptable robotic systems powered by ROS

Robot Operating System Market Dynamics

Driver

“Growing Demand for Automation across Industries”

- A primary driver fueling the expansion of the robot operating system (ROS) market is the burgeoning demand for automation across a diverse range of industries. Businesses are increasingly turning to robotics to enhance efficiency, improve productivity, reduce operational costs, and address labor shortages

- This demand spans sectors such as manufacturing, logistics, healthcare, agriculture, and even consumer services. ROS, as an open-source and versatile platform, is well-positioned to cater to this widespread need for automation. Its modularity and extensive library of software packages allow developers to build customized robotic solutions for specific industry requirements.

- For instance, in the manufacturing sector, ROS is used to control robots for tasks such as welding, assembly, and material handling. In healthcare, it powers robots for surgery, rehabilitation, and patient care.

- The continuous drive for automation across these and other industries is a key factor propelling the adoption of ROS as the operating system of choice for a growing number of robotic applications. As automation becomes more integral to business operations, the demand for flexible and robust platforms such as ROS will continue to rise

Restraint/Challenge

“Ensuring Interoperability and Standardization”

- A notable challenge in the robot operating system (ROS) market is the ongoing effort to ensure interoperability and standardization across different robotic platforms, hardware components, and software modules. While ROS itself is an open-source framework intended to promote standardization, the vast ecosystem of robotics involves a multitude of manufacturers, sensor types, and communication protocols

- Achieving seamless integration and interoperability between these diverse elements can be complex. Developers often face challenges in ensuring that different ROS-based robots and software components can communicate and work together effectively. This lack of complete standardization can sometimes lead to increased development time and effort

- Initiatives such as ROS 2 are aimed at addressing some of these challenges by providing a more robust and standardized framework for building complex and distributed robotic systems

- However, given the rapid pace of innovation in the robotics industry, ensuring consistent interoperability and adherence to standards remains a significant challenge for the ROS community and developers

- Overcoming this challenge will be crucial for facilitating wider adoption and fostering greater collaboration within the robotics ecosystem

Robot Operating System Market Scope

The market is segmented on the basis of robot type, application, and industry.

By Robot Type

The Robot Operating System market can be segmented by robot type into articulated robots, SCARA robots, parallel robots, Cartesian robots, and collaborative robots. In 2025, the SCARA robots segment likely holds a significant market share due to increasing adoption across various industries such as automotive, electronics, pharmaceuticals, and consumer goods.

The articulated robots segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the integration of advanced technologies such as artificial intelligence and machine learning is enhancing the capabilities of articulated robots, allowing for more adaptive and efficient operations.

By Application

Based on application, the robot operating system market is segmented into pick and place, plastic injection and blow molding, printed circuit board handling and information communication and technology (ICT), testing and quality inspection, metal sampling and press tending, computer numerical control (CNC) machine tending and co-packing, end of line packaging, mapping and navigation, inventory management, home automation and security, and personal assistance. In 2025, the mapping and navigation segment likely dominated the market due to a confluence of technological advancements and increasing demand across various industries.

The home automation and security segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for smart home solutions and robotic security systems.

By Industry

The robot operating system market can be categorized by industry into automotive, electrical and electronics, metal and machinery, plastics, rubber and chemicals, food and beverages, healthcare, and others. In 2025, the metal and machinery likely accounted for the largest market share due to the increasing demand for industrial automation and the need for more flexible, efficient manufacturing processes.

The automotive is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing demand for automation and the pursuit of more accurate and efficient manufacturing processes are key drivers of market expansion. This momentum is further accelerated by the adoption of Industry 4.0 technologies, with the robot operating system (ROS) serving as a versatile foundation for building intelligent, adaptive robotic solutions.

Robot Operating System Market Regional Analysis

- North America dominates the robot operating system market with the largest revenue share of 31.61% in 2024, driven by a strong demand for automation in industries such as manufacturing and increasing investments in advanced robotics technologies

- The presence of numerous tech companies and early adoption across sectors such as automotive, aerospace, and healthcare are key drivers. Ongoing R&D investments and government backing for robotics in defense and industry further boost ROS adoption

U.S. Robot Operating System Market Insight

The U.S. accounted for the majority of North American revenue in 2025, thanks to its robust tech sector, strong robotics research, and high automation levels in manufacturing. Key industries such as automotive, logistics, and healthcare are actively implementing robot operating systems to enhance productivity and cut costs. The rising popularity of autonomous mobile robots (AMRs) and collaborative robots (cobots), along with AI integration, is strengthening the market's growth.

Europe Robot Operating System Market Insight

The European market is expected to grow significantly, driven by strict labor laws, a rising need for operational efficiency, and a focus on Industry 4.0. Investments in smart factories and industrial automation in countries such as Germany, France, and Italy are increasing ROS deployment. The growing interest in AI-powered robots for sectors such as healthcare, agriculture, and warehousing is also boosting the market.

U.K. Robot Operating System Market Insight

The U.K. market is anticipated to experience notable growth, fueled by increasing automation in manufacturing and service sectors such as logistics and retail. Government support for digital transformation and innovation initiatives, such as the UK Robotics Growth Partnership, is accelerating ROS integration. The wider use of robotic systems in public services, warehouse automation, and healthcare is contributing to market expansion.

Germany Robot Operating System Market Insight

The German ROS market is expanding rapidly, supported by the country’s leading role in automotive manufacturing, precision engineering, and robotics innovation. German industrial players are prioritizing the integration of ROS with AI and machine learning for intelligent automation. The government's emphasis on "Industries 4.0" further promotes the deployment of ROS platforms across various sectors.

Asia-Pacific Robot Operating System Market Insight

Asia-Pacific is projected to have the fastest growth rate, driven by rapid industrialization, the growth of smart manufacturing, and increased robot adoption in countries such as China, Japan, and South Korea. Government initiatives supporting robotics, such as "Make in India," "China 2025," and Japan’s "Society 5.0," are strengthening market development. The region’s competitive manufacturing environment and a growing number of robotics startups are contributing to widespread ROS usage.

Japan Robot Operating System Market Insight

The Japanese market is advancing due to its established robotics industry and a high demand for automation in solutions for an aging population. Sectors such as healthcare, eldercare, and industrial automation are rapidly deploying ROS-powered systems to improve efficiency and safety. Strong collaborations between academia and industry, along with significant investment in robotics R&D, position Japan as a ROS innovation hub in the region.

China Robot Operating System Market Insight

China dominates the Asia-Pacific ROS market in terms of revenue share in 2025, driven by its large manufacturing sector, strong robotics industry, and government-led smart city projects. The widespread adoption of collaborative and service robots in manufacturing, logistics, and consumer sectors is a key factor in this growth. Substantial investments in domestic ROS solutions and open-source platforms are accelerating the market's development in China.

Robot Operating System Market Share

The Robot Operating System industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- OMRON Corporation (U.S.)

- Clearpath Robotics (U.S.)

- Yaskawa America, Inc. (U.S.)

- KUKA AG (Germany)

- Husarion Sp. z o.o. (Poland)

- Cyberbotics Ltd. (Switzerland)

- Rethink Robotics (Germany)

- FANUC America Corporation (Japan)

- YASKAWA ELECTRIC CORPORATION (Japan)

- DENSO CORPORATION (Japan)

- TOSHIBA CORPORATION (Japan)

- Panasonic Corporation (Japan)

- Stäubli International AG (Switzerland)

- Yamaha Robotics Holdings (Japan)

- Seiko Epson Corp. (U.S.)

- Comau S.p.A (Italy)

Latest Developments in Global Robot Operating System Market

- In June 2024, FANUC America, a global leader in robotics and automation, introduced the SR-12iA/C Food Grade SCARA robot, a high-performance solution tailored for food processing, packaging, and cleanroom environments. With a 12kg payload, compact design, corrosion-resistant build, and compliance with food safety regulations, the robot delivers fast, efficient, and hygienic operations, strengthening FANUC’s presence in the food industry

- In April 2024, Yaskawa Europe, the European arm of Japan's Yaskawa Electric, conducted a groundbreaking ceremony on April 24, 2024, in Kočevje, Slovenia, to initiate the construction of a new European Robotics Distribution Centre and an assembly hall for robotic welding systems. This facility will function as a key logistics and assembly hub for fulfilling robot orders throughout Europe, the Middle East, and Africa (EMEA), further solidifying Yaskawa’s infrastructure and regional reach

- In October 2022, ABB announced a strategic alliance with Scalable Robotics to bolster its robotic welding systems portfolio. This collaboration reinforces ABB’s commitment to delivering intuitive, accessible robotic solutions by integrating Scalable Robotics' advanced technologies. The move enhances ABB’s capabilities in user-friendly automation and supports its expansion into new customer segments

- In September 2022, KUKA AG unveiled the LBR iisy 11 kg and LBR iisy 15 kg collaborative robot models, featuring improved payload capacity, greater reach, and enhanced IP protection. These innovations broaden KUKA’s cobot lineup, addressing the needs of varied automation environments and accelerating adoption across industries through their flexibility and performance

- In March 2022, Fanuc Corporation expanded its CRX series by launching three new collaborative robots — the CRX-5iA, CRX-20iA/L, and CRX-25iA — alongside the existing CRX-10iA and CRX-10iA/L models. These additions enhance Fanuc's automation portfolio, delivering advanced features, greater efficiency, and versatility to meet the increasing demand for collaborative robotics in industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ROBOT OPERATING SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ROBOT OPERATING SYSTEM MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ROBOT OPERATING SYSTEM MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL ROBOT OPERATING SYSTEM MARKET, BY HARDWARE PLATFORM

6.1 OVERVIEW

6.2 DESKTOP COMPUTERS

6.3 EMBEDDED SYSTEMS

6.4 ROBOTS

6.5 OTHERS

7 GLOBAL ROBOT OPERATING SYSTEM MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 UBUNTU

7.2.1 BY HARDWARE PLATFORM

7.2.1.1. DESKTOP COMPUTERS

7.2.1.2. EMBEDDED SYSTEMS

7.2.1.3. ROBOTS

7.2.1.4. OTHERS

7.3 DEBIAN

7.3.1 BY HARDWARE PLATFORM

7.3.1.1. DESKTOP COMPUTERS

7.3.1.2. EMBEDDED SYSTEMS

7.3.1.3. ROBOTS

7.3.1.4. OTHERS

7.4 MAC OS

7.4.1 BY HARDWARE PLATFORM

7.4.1.1. DESKTOP COMPUTERS

7.4.1.2. EMBEDDED SYSTEMS

7.4.1.3. ROBOTS

7.4.1.4. OTHERS

7.5 WINDOWS

7.5.1 BY HARDWARE PLATFORM

7.5.1.1. DESKTOP COMPUTERS

7.5.1.2. EMBEDDED SYSTEMS

7.5.1.3. ROBOTS

7.5.1.4. OTHERS

7.6 GAZEBO

7.6.1 BY HARDWARE PLATFORM

7.6.1.1. DESKTOP COMPUTERS

7.6.1.2. EMBEDDED SYSTEMS

7.6.1.3. ROBOTS

7.6.1.4. OTHERS

7.7 OPENCV

7.7.1 BY HARDWARE PLATFORM

7.7.1.1. DESKTOP COMPUTERS

7.7.1.2. EMBEDDED SYSTEMS

7.7.1.3. ROBOTS

7.7.1.4. OTHERS

7.8 POINT CLOUD LIBRARY (PCL)

7.8.1 BY HARDWARE PLATFORM

7.8.1.1. DESKTOP COMPUTERS

7.8.1.2. EMBEDDED SYSTEMS

7.8.1.3. ROBOTS

7.8.1.4. OTHERS

7.9 MOVEIT

7.9.1 BY HARDWARE PLATFORM

7.9.1.1. DESKTOP COMPUTERS

7.9.1.2. EMBEDDED SYSTEMS

7.9.1.3. ROBOTS

7.9.1.4. OTHERS

7.1 ROS INDUSTRIAL

7.10.1 BY HARDWARE PLATFORM

7.10.1.1. DESKTOP COMPUTERS

7.10.1.2. EMBEDDED SYSTEMS

7.10.1.3. ROBOTS

7.10.1.4. OTHERS

8 GLOBAL ROBOT OPERATING SYSTEM MARKET, BY PROGRAMMING LANGUAGES

8.1 OVERVIEW

8.2 C++

8.3 PYTHON

8.4 OTHERS

9 GLOBAL ROBOT OPERATING SYSTEM MARKET, BY VERSION

9.1 OVERVIEW

9.2 ROS 1

9.3 ROS 2

10 GLOBAL ROBOT OPERATING SYSTEM MARKET, BY TYPE

10.1 OVERVIEW

10.2 ARTICULATED ROBOTS

10.3 SCARA ROBOTS

10.4 PARALLEL ROBOTS

10.5 CARTESIAN ROBOTS

10.6 COLLABORATIVE ROBOTS

10.7 OTHERS

11 GLOBAL ROBOT OPERATING SYSTEM MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 INDUSTRIAL AUTOMATION

11.2.1 INDUSTRIAL AUTOMATION, BY APPLICATION

11.2.1.1. MATERIAL HANDLING

11.2.1.2. MANUFACTURING

11.2.1.3. INSPECTION

11.2.1.4. WAREHOUSING & LOGISTICS

11.2.1.5. OTHERS

11.3 SERVICE ROBOTS

11.3.1 SERVICE ROBOTS, BY TYPE

11.3.1.1. HOME ROBOTS

11.3.1.2. PERSONAL ROBOTS

11.3.1.3. HEALTHCARE ROBOTS

11.4 AUTONOMOUS VEHICLES

11.4.1 AUTONOMOUS VEHICLES, BY TYPE

11.4.1.1. GROUND ROBOTS

11.4.1.2. AERIAL ROBOTS

11.4.1.3. UNDERWATER ROBOTS

11.5 SPACE ROBOTS

11.5.1 SPACE ROBOTS, BY TYPE

11.5.1.1. PLANETARY ROVERS

11.5.1.2. SATELLITE SERVICING ROBOTS

11.5.1.3. SPACE DEBRIS REMOVAL ROBOTS

11.6 OTHERS

12 GLOBAL ROBOT OPERATING SYSTEM MARKET, BY GEOGRAPHY

GLOBAL ROBOT OPERATING SYSTEM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 FRANCE

12.2.3 U.K.

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 TURKEY

12.2.8 BELGIUM

12.2.9 NETHERLANDS

12.2.10 NORWAY

12.2.11 FINLAND

12.2.12 SWITZERLAND

12.2.13 DENMARK

12.2.14 SWEDEN

12.2.15 POLAND

12.2.16 REST OF EUROPE

12.3 ASIA PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 NEW ZEALAND

12.3.7 SINGAPORE

12.3.8 THAILAND

12.3.9 MALAYSIA

12.3.10 INDONESIA

12.3.11 PHILIPPINES

12.3.12 TAIWAN

12.3.13 VIETNAM

12.3.14 REST OF ASIA PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 U.A.E

12.5.5 OMAN

12.5.6 BAHRAIN

12.5.7 ISRAEL

12.5.8 KUWAIT

12.5.9 QATAR

12.5.10 REST OF MIDDLE EAST AND AFRICA

12.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL ROBOT OPERATING SYSTEM MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL ROBOT OPERATING SYSTEM MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL ROBOT OPERATING SYSTEM MARKET, COMPANY PROFILE

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 OPEN SOURCE ROBOTICS FOUNDATION, INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 PICKNIK INC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 KUKA AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 WIND RIVER SYSTEMS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 HUSARION SP. Z O.O.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENT

15.7 BRAIN CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 NEOBOTIX GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENT

15.9 FANUC AMERICA CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENT

15.1 YASKAWA ELECTRIC CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENT

15.11 DENSO

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENT

15.12 OMRON CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENT

15.13 UNIVERSAL ROBOTS A/S

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENT

15.14 IROBOT CORPORATION.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENT

15.15 STANLEY ROBOTICS

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.